Author: Frank, PANews

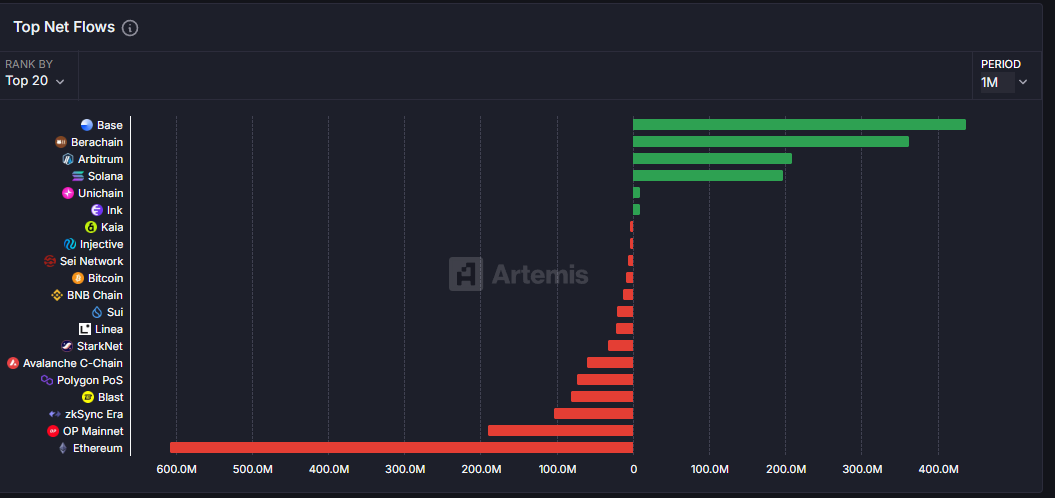

In the context of the recent overall downturn in the cryptocurrency market, Berachain ranks second in the public chain sector with a net inflow of $360 million over the past month, becoming one of the few Layer 1 projects to grow against the trend. After the mainnet launch, its Total Value Locked (TVL) stabilized at $2.9 billion, placing it sixth across all networks, validating the attractiveness of its Proof of Liquidity (PoL) mechanism for staked funds.

However, the ecosystem also faces some controversies, including the volatile price of the BERA token, disparities in airdrop distribution raising questions about fairness, and public reflections from co-founders on the token economic model. After the airdrop concludes, whether Berachain can regain community trust through the liquidity narrative of the PoL mechanism and transform from a new force into an Ivy League project remains to be seen.

Second in Net Inflow This Month, TVL Ranks Sixth

The funding inflow situation is the most impressive data point for Berachain. As of March 18, Berachain's net inflow over the past month was approximately $360 million, second only to Base. In a phase where the market is declining and various public chain ecosystems are in a slump, Berachain's funding inflow is indeed remarkable.

However, a closer analysis reveals that the concentrated inflow of funds into Berachain mainly occurred between February 16 and March 3. This period coincided with the launch of Berachain's mainnet, the introduction of the testnet, and the airdrop claiming phase. Therefore, a surge of funds flowing in seems somewhat expected.

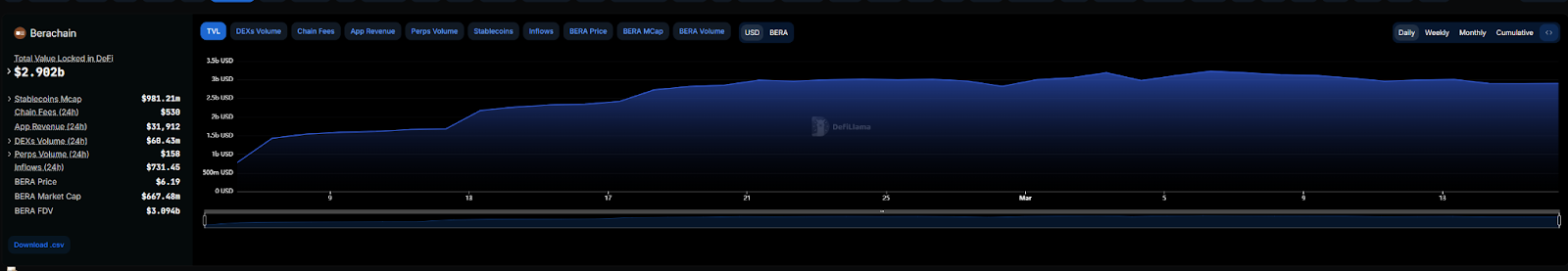

In addition to the net inflow of funds, Berachain's TVL has also remained relatively stable since the mainnet launch, without experiencing explosive growth or significant declines due to market changes. As of March 18, Berachain's TVL was approximately $2.9 billion. In terms of overall data comparison, Berachain's TVL ranks sixth among all networks, with only Bitcoin, Ethereum, Solana, BSC, and Tron having higher TVL. From this perspective, Berachain's PoL consensus mechanism does have a certain inherent advantage in attracting staked funds.

Among these, the most funds are staked in Infrared Finance, which is the main application of Berachain's liquidity consensus mechanism.

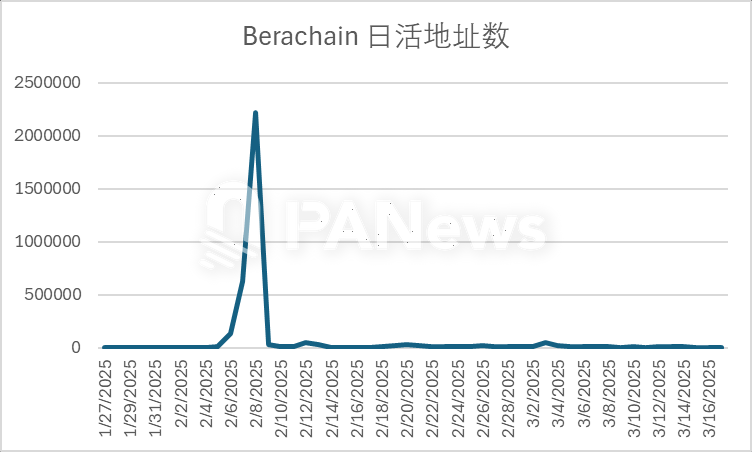

In addition to the effective inflow of funds, network activity is also a measure of a new public chain's actual health index. According to Berachain's official data, the number of daily active users experienced significant fluctuations, peaking at over 2 million daily active addresses between February 4 and February 10, before stabilizing around 10,000 addresses. In the past month, the average number of daily active addresses for Berachain was approximately 13,400. Compared to several other mainstream public chains, this figure still shows a considerable gap, but it is relatively stable for now; further activity will require a larger time sample to clarify the situation.

On the data front, the most attention-grabbing aspect is the performance of the token. The BERA token has also been a major source of controversy for Berachain recently.

From the chart, the BERA token surged to $15.5 shortly after its launch before starting to decline, a performance that is generally similar to that of many large airdrop projects. However, in the subsequent market, BERA exhibited significant volatility, oscillating between $5 and $9. It often surged nearly 90% within a few days, then dropped 40% back to its original point. Due to the limited supply of tokens in the early market, such drastic fluctuations are relatively easy to occur.

From Airdrop Frenzy to Trust Crisis

The doubts surrounding BERA mainly focus on the airdrop and the token economic model. Previously, PANews had summarized the airdrop situation of Berachain (Related reading: Berachain Airdrop "Wealth Disparity": NFT Holders Earn Up to $55.77 Million, Testnet Users Only $60), highlighting the stark contrast in benefits between NFT holders and ordinary test users, leading to a significant wealth gap.

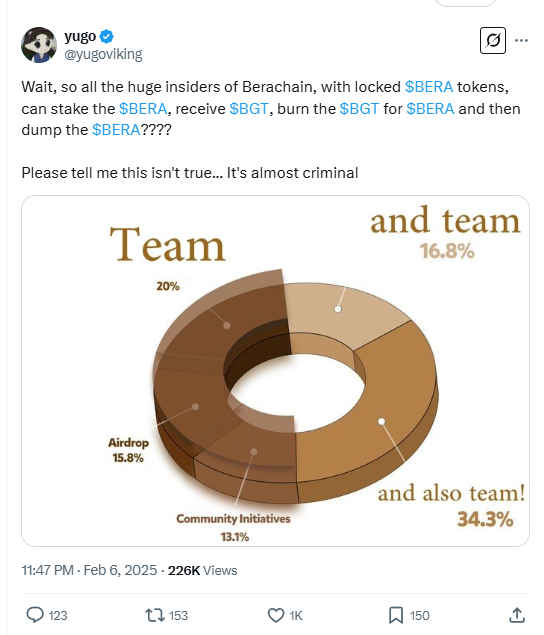

Moreover, although early VCs did not unlock their tokens, they could stake locked tokens to earn returns, which many users found unfair. Over 35% of the BERA tokens were allocated to private investors, raising concerns about centralization and fairness.

In hindsight, Berachain's anonymous co-founder Smokey the Bera stated in an interview with Un Chained: "I don't think the criticism is entirely wrong. If we could do it all over again, and the team could start from scratch, we might not sell so much supply to VCs."

Additionally, a blogger named Ericonomic discovered that one of Berachain's co-founders sold 200,000 tokens obtained from the airdrop. The Berachain team did not respond to this.

As the excitement around the airdrop wanes and the token price experiences significant fluctuations, Berachain's recent popularity on social media has also gradually diminished. The next major attention was drawn by news of a security incident involving an ecosystem project.

On March 15, Berachain's ecosystem platform Berally, which uses AI agents for social trading, announced a security issue, stating, "Some information from the deployer's key was leaked, leading to all vesting tokens being sold off and withdrawn from the liquidity pool." Fortunately, Berally acted quickly, announcing a token compensation plan of up to 120% a day later and claiming to have locked the hacker through centralized exchanges.

Airdrop Claiming Ending Soon, Liquidity Experiment Begins

The airdrop claiming period for Berachain is set to end on March 20. Once the airdrop activity is completely over, whether Berachain can continue to attract users through its PoL or create a new growth curve through the rise of other ecosystem projects may be a key issue Berachain faces.

Recently, several key partners of Berachain have also made progress. Infrared, as the application with the most staked funds on Berachain, welcomed another $14 million in Series A funding on March 4, bringing the total financing amount to $18.75 million. From a product perspective, Infrared's staking product offers a maximum APR of 95.45%, which is indeed quite eye-catching.

However, given that this high-yield trading pair is WBERA-HONEY, and considering the significant ups and downs of BERA, this yield is more meaningful in terms of resisting the fluctuations of the BERA token.

Additionally, several ecosystem partners like Orderly, XrossRoad, and Moby have also had some new developments. However, in terms of importance, these new developments do not represent significant progress. Berachain's official focus still seems to be on governance and establishing the PoL mechanism. As of March 18, Berachain had 60 validators, and the PoL mechanism has not yet officially launched.

From the official statements, there seems to be confidence in the performance of the PoL after its launch. However, with former NFT holders receiving massive airdrops and VCs able to stake locked tokens, the trust left for Berachain from the community may be running low, and the only thing Berachain can do is to prove itself through the PoL.

In the future, whether it can transform the PoL mechanism into a true ecological moat and find a balance between decentralized governance and user value distribution will determine whether it can evolve from a "dark horse" into a "evergreen tree." After the airdrop ends on March 20, this liquidity experiment may truly begin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。