Original Author: KarenZ, Foresight News

With the Abu Dhabi sovereign fund MGX investing $2 billion in Binance and the resonance of Zhao Changpeng's influence, combined with the integration of the Alpha section on Binance's main site, the Meme ecosystem on BSC has exploded. While the market's attention is focused on the "Middle East concept" and the movements of Zhao Changpeng and He Yi, savvy investors have begun to use systematic tools to try to capture the next phenomenal opportunity amidst the chaos.

It should be clarified that the investment strategies and tools summarized and reviewed in this article are only applicable for assisting in identifying trends in capital flow.

Four Major Coin Hunting Strategy Frameworks

Capturing Zhao Changpeng and He Yi Narratives

Tool Combination: Twitter pop-ups, DeBot, chain.fm

Operational Idea: Currently, the Meme hype on BSC mainly revolves around the Middle East concept, as well as the content or images interacted with, retweeted, or commented on by Zhao Changpeng and He Yi. Therefore, closely monitoring the Twitter dynamics of Zhao Changpeng and He Yi is undoubtedly the best way to seize investment opportunities. Based on the popularity of the interactive content, one can assess the token's popularity, expectations for going on Alpha, contract expectations, and even spot expectations, and can also extract ambush interaction expectations, although the risk is higher. When investing, prioritize entering Memes with strong narratives, and within the same narrative or content, prioritize selecting tokens with the highest market capitalization.

KOL Signal Enhancement Strategy

Tool Combination: GMGN KOL/VC monitoring, DeBot AI signals, chain.fm KOL channel

Operational Idea: Establish a KOL influence matrix, focusing on KOLs that meet the criteria of "high fan stickiness + narrative ability + real market validation," and consider Meme popularity comprehensively.

Data-Driven Sniping

Tool Combination: GMGN, chain.fm, DeBot, ave.ai

Operational Idea: Identify anomalous projects through the 5-minute popularity list → Search for contract addresses on Twitter (focusing on monitoring narrative integrity and KOL interaction density) → Combine developer holding ratios and social media activity for comprehensive judgment.

Address Monitoring and Following

Tool Combination: GMGN, chain.fm, DeBot, ave.ai

Operational Idea: Track market-validated "diamond hands" addresses. For promising targets, hold until the market cap breaks through key milestones and then gradually reduce holdings; for short-term speculative targets, use a "double outlay + gradual reduction" dual insurance mechanism.

Tool Inventory

GMGN

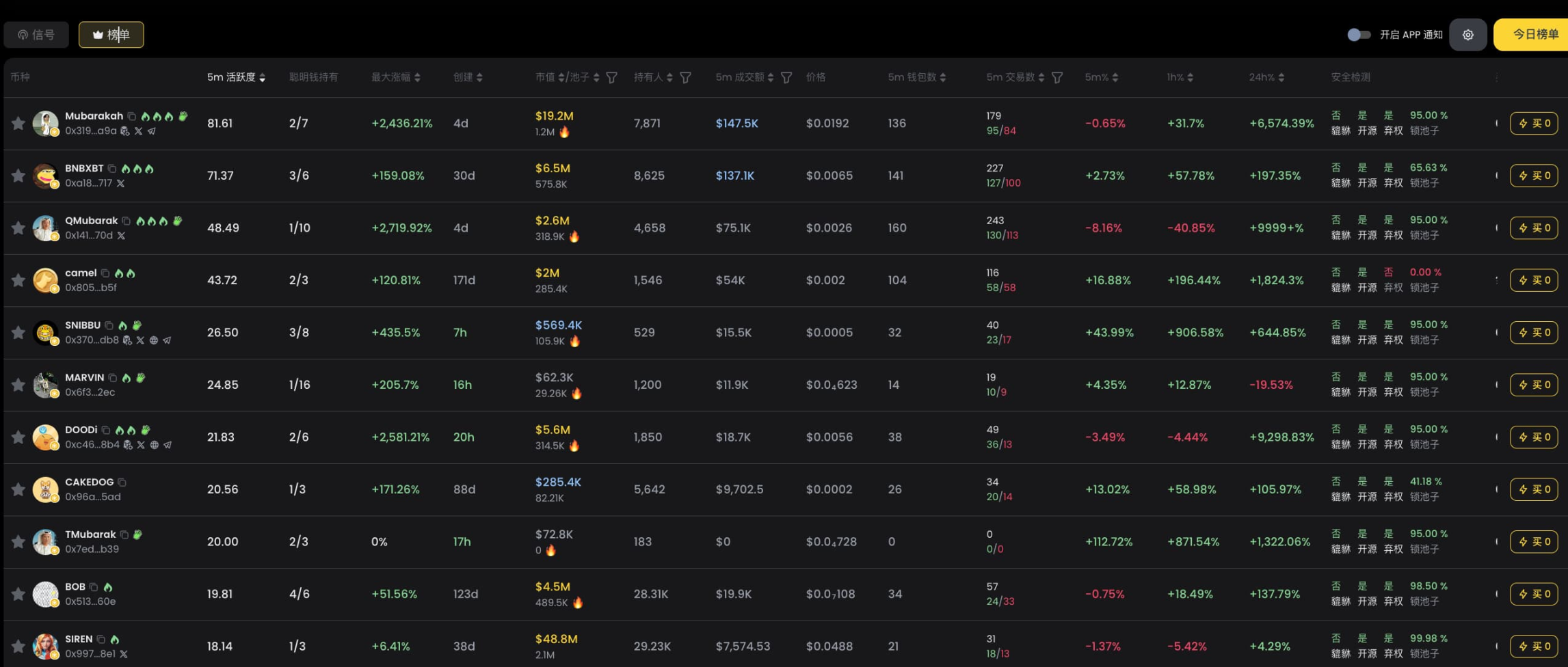

As a multi-chain "dog-hunting" tool, GMGN allows users to view token popularity on BSC's popular markets across time dimensions of 1 minute, 5 minutes, 1 hour, 6 hours, and 24 hours, and marks the number of smart money addresses that bought in, blue-chip indices, etc., and supports one-click buying. If you want to quickly discover potential tokens, prioritize the 5-minute popularity list. The 1-minute popularity list can filter out hot Memes faster, but the risk is higher.

Additionally, GMGN's Meme section supports monitoring Meme tokens issued on Four.Meme and can filter based on conditions such as social media presence, whether the DEV has liquidated, top ten holdings, progress, market cap, 1-hour transaction volume, number of holders, and transaction amount. By only viewing Four.Meme tokens, it can somewhat avoid Rug events caused by liquidity withdrawal.

However, Four.Meme has encountered a liquidity pool manipulation bug again today. Specifically, attackers made large purchases when the internal progress was close to being filled and preemptively added these chips directly to the pool, waiting to withdraw them after migrating to the external market. In response, Four.Meme stated today that it is under attack, has suspended activation functions, and has begun an emergency investigation, promising compensation to affected users.

In terms of address monitoring, GMGN supports batch importing and exporting multiple addresses and allows for one-click following based on monitored addresses.

https://gmgn.ai/?chain=bsc

chain.fm

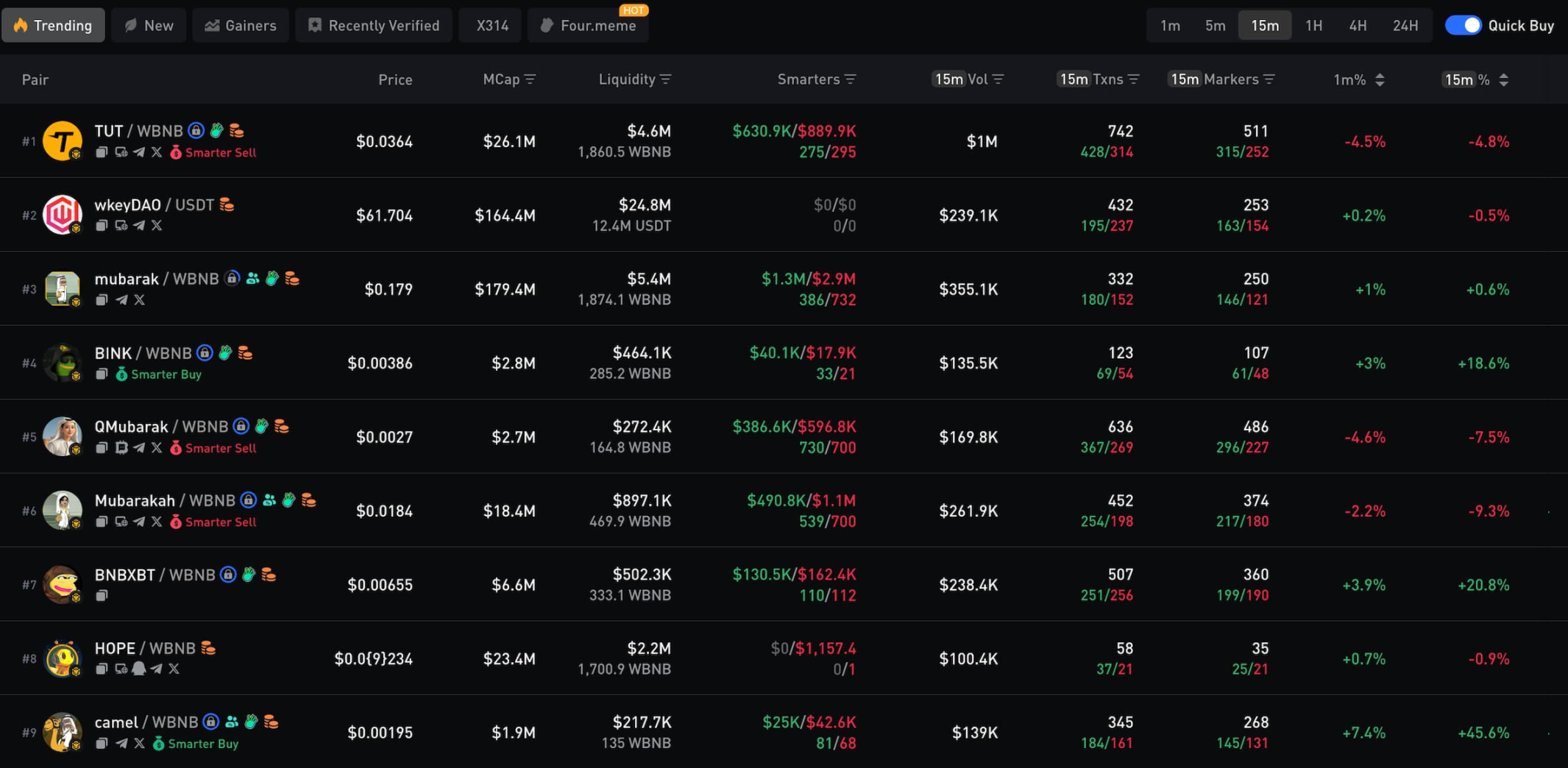

chain.fm allows users to view Meme popularity across 5 minutes, 1 hour, 6 hours, and 24 hours. Its uniqueness lies in the channel feature, allowing users to follow different types of channels, monitoring KOL wallets from both domestic and foreign markets, aggregating top narrative smart money wallets, focusing on players and addresses heavily invested in major tokens, and channels targeting BSC's main focus on major tokens.

chain.fm also supports viewing smart money movements across BSC, Solana, and Base chains on the same page.

https://chain.fm/trending?chains=bsc

DeBot

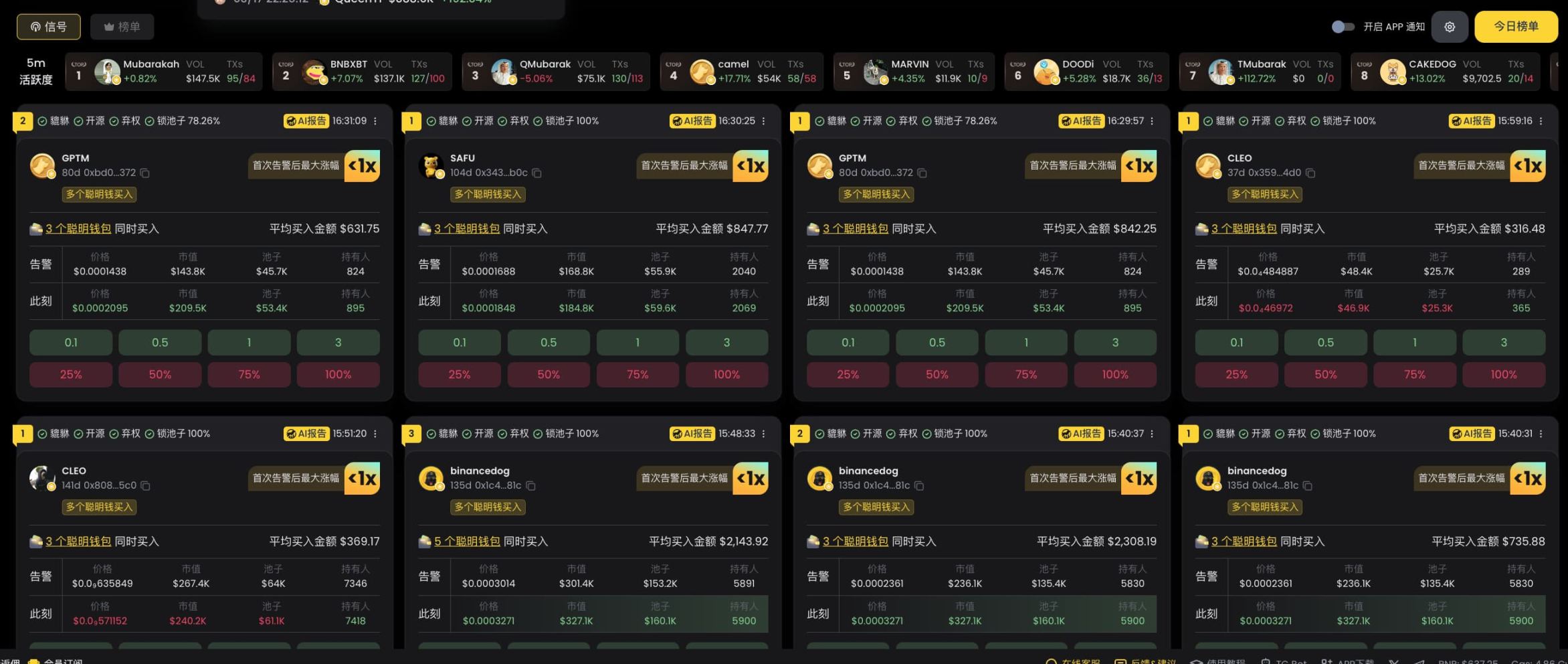

DeBot allows users to view token popularity across 1 minute, 5 minutes, 1 hour, 12 hours, and 24 hours, enabling multi-dimensional evaluation of token popularity based on transaction volume, number of trades, and price increase. DeBot also supports viewing only Memes issued on the Four.Meme platform.

The DeBot AI signal section can display Memes that smart money is concentrating on buying in real-time, marking relevant narratives, the number of Twitter name changes, and the proportion of developer zeroed tokens, as well as supporting one-click following operations. Currently, DeBot supports limit order bottom fishing and double outlay functions, with plans to introduce multi-wallet following and AI signal following features in the future.

Additionally, DeBot offers custom monitoring features, including token monitoring, Twitter monitoring, and wallet monitoring. Among them, Twitter monitoring can track tweets, retweets, name changes, profile picture changes, bio changes, and website changes; wallet monitoring supports setting trigger conditions for buying, selling, and first purchases, meeting users' personalized needs.

https://debot.ai/hot?chain=bsc

ave.ai

ave.ai integrates features such as smart money collection, address monitoring, Four.Meme chain scanning + internal market purchases, MEV attack prevention, following, market price orders, and liquidity pool monitoring.

https://ave.ai/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。