4 Alpha Core Insights

I. Macroeconomic Review of the Week

- Market Corrects Expectations, Defensive Sentiment Dominates

• U.S. stocks generally retreated, while the utilities sector rose against the trend, with funds flowing into defensive assets.

• VIX remains above 20, indicating that market sentiment is still in a cautious adjustment phase.

2. Commodity Market Divergence, Risk Aversion Intensifies

• Gold broke through $3000 per ounce to reach a new high, and copper prices rose by 3.9%, indicating continued demand support in manufacturing.

• Oil prices stabilized, but net futures positions decreased, reflecting market concerns over global demand growth.

3. Cryptocurrency Market Adjusts in Sync, BTC Still Holds Long-term Allocation Value

• BTC's short-term selling pressure has eased, supported by the long-term liquidity environment.

• Altcoins showed weak performance, with market risk appetite declining and stablecoin inflows slowing.

4. Tariff Impacts Emerge, Global Supply Chains Accelerate Adjustment

• The BDI index rose, indicating increased manufacturing activity in the Asia-Europe region, while the U.S. transportation index declined, showing weak domestic demand.

• The trend of supply chain restructuring is evident, putting pressure on the U.S. domestic economy.

5. Inflation Data Cools, but Inflation Expectations Diverge

• CPI and PPI were below expectations, reinforcing market expectations for interest rate cuts, but consumer inflation expectations rose, showing clear partisan divides.

• The divergence between actual data and expectations increases market uncertainty.

6. Marginal Liquidity Eases, but Credit Market Risks Intensify

• TGA account outflows and decreased use of the Fed's discount window indicate temporary liquidity stability.

• Credit spreads widened, and CDS rose, reflecting heightened market concerns over corporate and government debt, which may suppress risk asset performance.

II. Macroeconomic Outlook for Next Week

1. Key Market Variables Next Week: FOMC Meeting, Retail Data, Global Central Bank Dynamics

• Focus on the Fed's dot plot for interest rate cut guidance (expectation of 2-3 cuts).

• Whether QT pauses will become a market focal point, potentially affecting market risk appetite.

2. Strategy Recommendations

U.S. Stocks: Reduce high-beta assets, increase holdings in defensive sectors, and look for mispriced opportunities.

Cryptocurrency Market: Hold BTC for the long term, reduce altcoin allocations, and monitor stablecoin liquidity.

Credit Market: Reduce high-leverage corporate bonds, increase holdings in high-rated bonds, and be wary of U.S. debt deficit risks.

Core Turning Point Signals: Repair in the credit market or clearer easing signals from the FOMC.

4 Alpha Macro Weekly Report: When Will the Turning Point Arrive? How to Interpret Signals from the Credit Market?

I. Macroeconomic Review of the Week

1. Market Overview

As pointed out in last week's market report, the current market is still in a phase of multiple expectation games. This week, based on the specific performance of U.S. stocks, cryptocurrencies, and the commodity market, the core trading logic remains centered around adjustments to Fed rate cut expectations and slowing U.S. economic growth, leading to a phase adjustment in the pricing of risk assets.

U.S. Stocks: Defensive Assets Favored, Market Corrects Previous Optimism. This week, the three major U.S. stock indices showed significant declines, including:

• Dow Jones Industrial Average (-3.1%),

• Nasdaq Index (-2.6%),

• Russell 2000 Index (-1.8%)

showing a general downturn, indicating a retreat in overall market risk appetite. Notably, the utilities sector (+1.4%) was the only industry to rise, reflecting a shift of funds towards defensive assets. Additionally, the VIX volatility index remains above 20 but has not entered extreme panic territory, indicating that market sentiment is more about correcting previous excessive optimism rather than an accelerated release of pessimism.

Commodity Market: Gold Hits Historical High, Copper Prices Rise, Energy Market Divergence.

This week, gold broke through $3000 per ounce, reaching a new historical high, reflecting a sustained demand for safe-haven assets. Meanwhile, copper prices rose by 3.9%, indicating some support from manufacturing demand. However, the energy market showed divergence:

• Oil prices stabilized around $67, but CFTC net futures positions decreased by over 9.6%, suggesting weak expectations for global demand growth.

• Natural gas prices continued to decline, primarily influenced by oversupply and weak industrial demand.

Cryptocurrency Market: Volatility Converges, Risk Appetite Declines.

The cryptocurrency market remains in sync with the adjustments in U.S. stocks. Although Bitcoin's weekly trend continues to show a downward trajectory, the volatility has narrowed, indicating a easing of short-term selling pressure. However, in the altcoin space, ETH, SOL, and others still show weak performance, reflecting a decline in market risk appetite. Additionally, the market capitalization of stablecoins continues to grow, but net inflows are slowing, suggesting a cautious trend in market liquidity and a slowdown in the pace of new capital entering the market.

Recent data indicates that tariff impacts are gradually emerging, accompanied by adjustments in global supply chains and cooling U.S. demand.

Trump's new round of tariff policies not only impacts the pricing expectations of risk assets but is also beginning to play a role in the real economy. This week's transportation market data further confirms this trend:

• The Baltic Dry Index (BDI) continues to soar, indicating strong shipping demand in the Asia-Europe region, with manufacturing capacity potentially accelerating its shift overseas.

• The U.S. transportation index (-6.5%) has shown a significant decline, suggesting weak domestic demand and a decrease in local logistics demand.

This divergence reflects that under the influence of tariff policies, global supply chains are undergoing regional restructuring—with U.S. domestic demand slowing while manufacturing and export activities in the Asia-Europe region may be relatively active. Meanwhile, the rise in copper prices and the stability of oil prices further illustrate that the market's pricing of economic recession remains divided. Although macroeconomic data has not clearly supported recession judgments, uncertainty about future demand prospects remains high.

2. Economic Data Analysis

Several key data points from last week included CPI, PPI, and inflation expectation data. Specifically:

The NFIB small business confidence index for February, released on Tuesday, has declined for three consecutive months, indicating that U.S. small and medium enterprises' concerns over trade policy uncertainty continue to worsen.

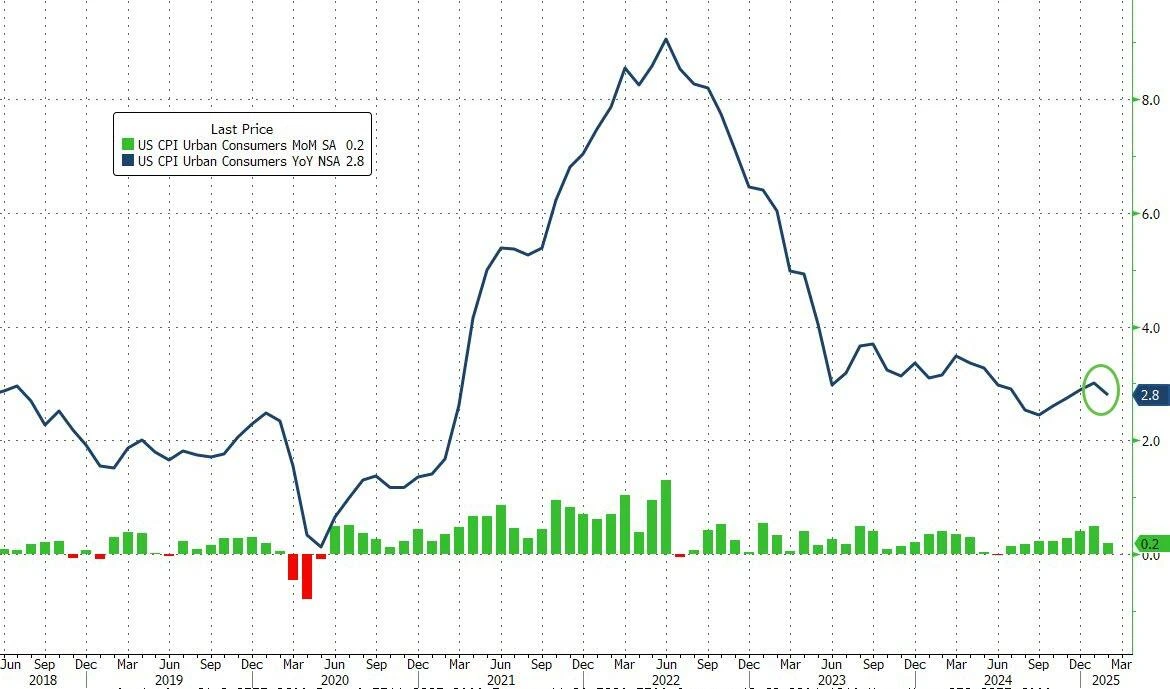

The CPI data released on Wednesday was better than market expectations, with seasonally adjusted overall CPI and core CPI both at 0.2%, below the expected 0.3%; as a result, the overall CPI annual rate fell to 2.8%, providing a brief boost to market risk appetite.

Chart 1: U.S. CPI Annual Rate Changes Source: Bloomberg

From the detailed data, although commodity inflation has rebounded, service inflation continues to decline, with service inflation excluding housing dropping to its lowest level since October 2023.

The PPI data released on Thursday continued the downward trend, with core PPI showing the largest month-on-month decline since April 2021, decreasing by 0.1% against an expected increase of 0.3%. Transportation services were the core contributors to the PPI decline.

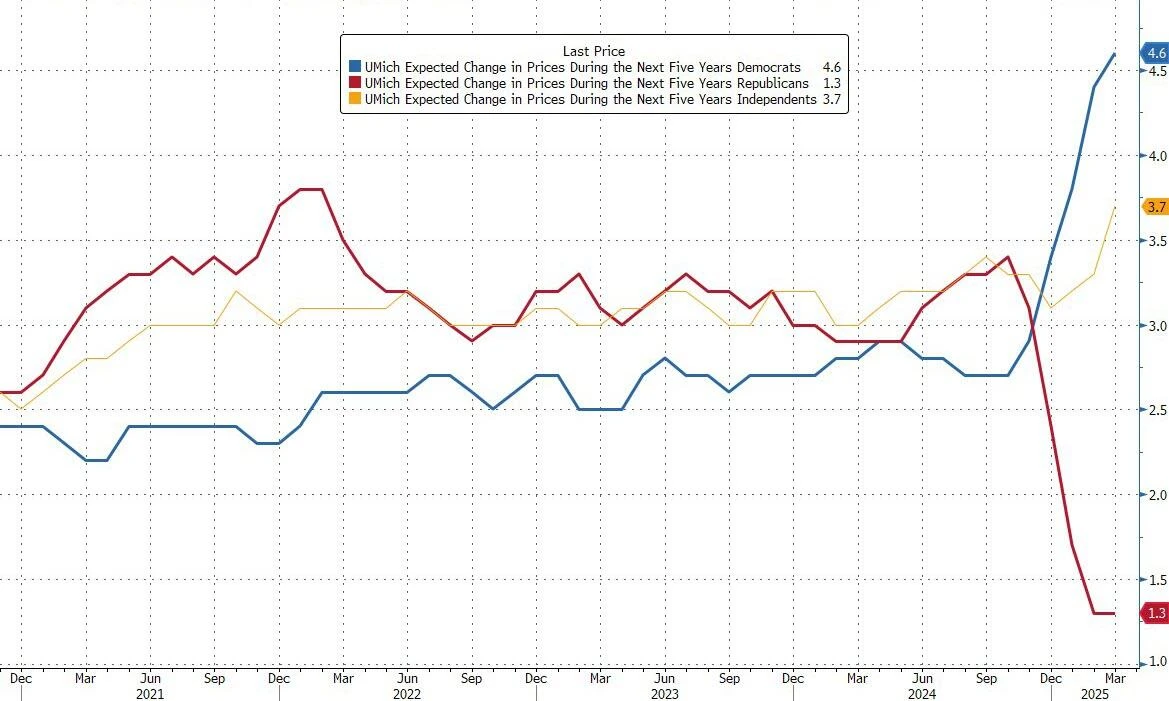

The University of Michigan consumer confidence index and one-year inflation expectations released on Friday provided a direction opposite to the actual data, with one-year and five-to-ten-year inflation expectations initial values (+3.9%, expected 3.4%) continuing to surge. However, the data continued to reflect previous partisan divides, with significant differences in expectations based on party affiliation, and the surge in inflation expectations primarily coming from Democratic respondents. In fact, this clear partisan data difference has turned this data into market noise.

Chart 2: University of Michigan Inflation Expectations Survey Shows Clear Partisan Differences Source: Bloomberg

The CPI, PPI, and inflation expectation data released this week exhibit a dual signal of "real inflation cooling" and "divergent inflation expectations," producing a complex impact on market sentiment.

Overall, the decline in actual inflation data reinforces market expectations for Fed rate cuts within the year, but the volatility in inflation expectations increases market uncertainty, intensifying short-term market adjustment pressures.

3. Changes in Liquidity and Interest Rate Markets

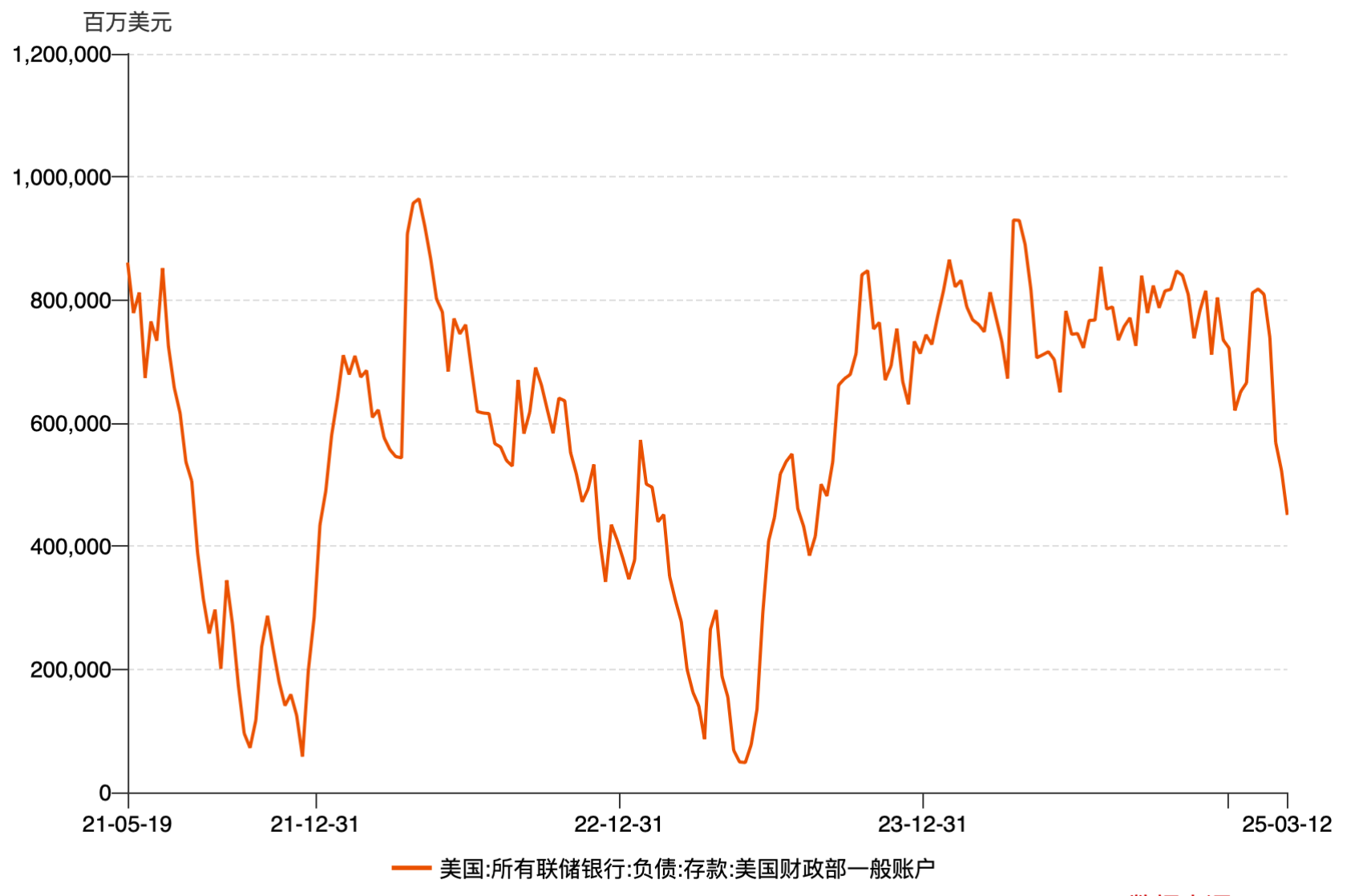

From a broad liquidity perspective (viewed through the Fed's balance sheet), the trend of marginal liquidity recovery has become clear over the past two weeks, maintaining above $6 trillion this week, primarily due to outflows from the U.S. Treasury's TGA account; additionally, the use of the Fed's discount window continued to decline this week, indicating that current macro liquidity is generally stabilizing.

Chart 3: Changes in U.S. Treasury General Account Balance Source: Wind

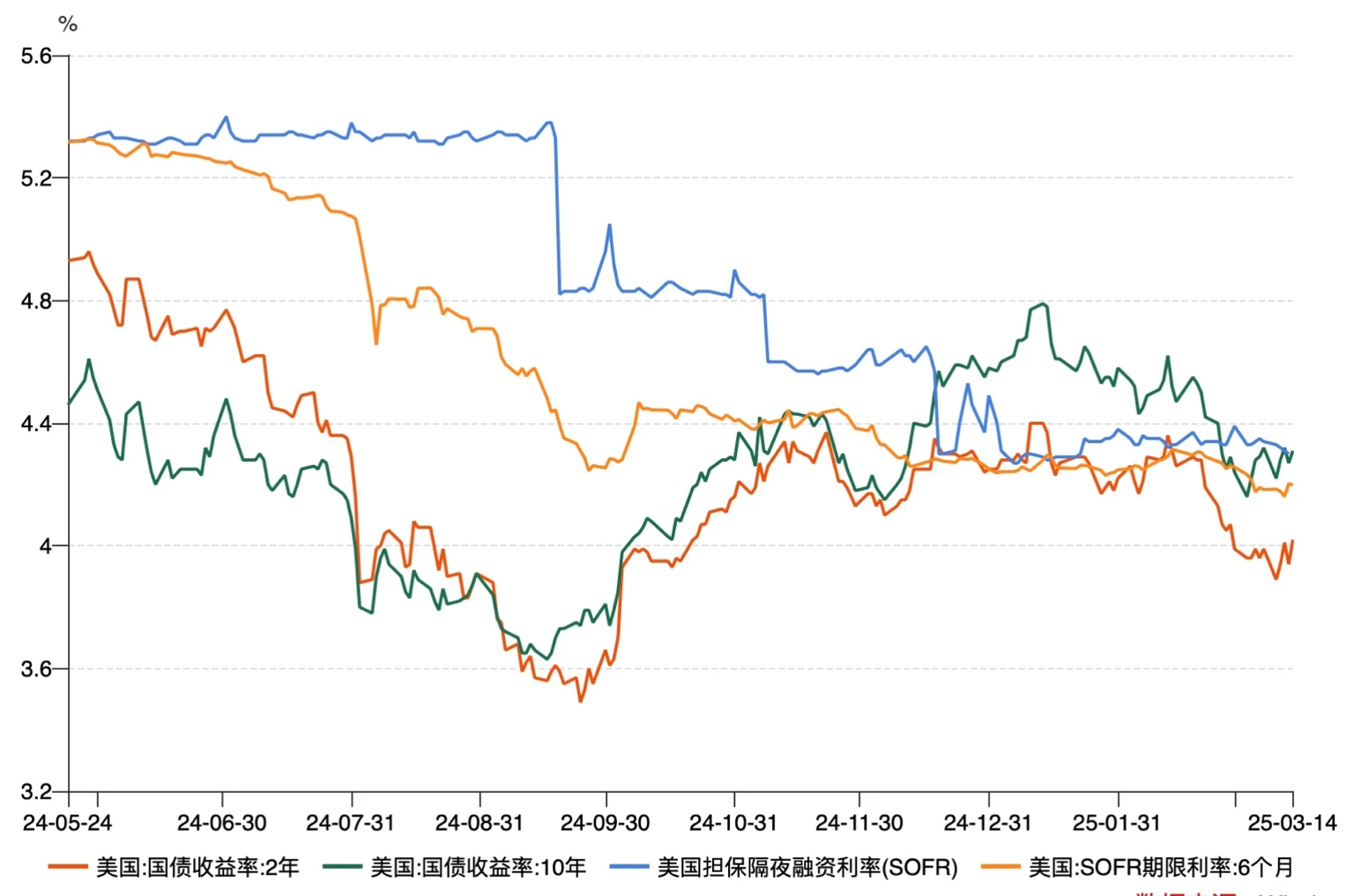

From the interest rate market perspective, the federal funds futures market is almost pricing in a negligible probability of a rate cut in March, essentially indicating that the interest rate market does not expect the Fed to take rate cut actions in March.

Chart 4: Federal Funds Rate Futures Source: MacroMicro

However, the six-month term interest rates and the yield curve for government bonds suggest that rate cuts this year are still expected to be around 2-3 times. Over the past period, short-term yields have significantly declined while long-term yields have remained relatively stable, indicating that the market is gradually pricing in future Fed rate cuts.

Chart 5: Government Bond Yields and SOFR Rates Source: Wind

Another noteworthy change is in the U.S. credit market, where corporate credit spreads have been widening over the past two weeks. The North American investment-grade credit default swap (CDX IG) reading was 55.28 by Friday, up over 7% during the week. Meanwhile, U.S. sovereign CDS and high-yield bond credit default swaps have also shown varying degrees of increase.

The widening of sovereign and corporate credit default swap spreads indicates that, on one hand, market concerns about the sustainability of U.S. debt, including the fiscal deficit, have increased, while concerns about corporate credit risk have also risen simultaneously. These factors will gradually transmit to the capital markets, further suppressing market upward movement.

II. Macroeconomic Outlook for Next Week

The current market is in a triple contradiction phase of "cooling inflation but rising expectations," "increasing credit risk but no economic recession yet," and "marginal liquidity easing but policy constraints." Market sentiment has not yet escaped the panic zone, and the uncertainty surrounding Trump's tariffs continues to exert significant pressure on the formation of stable market expectations. Additionally, in this week's report, we particularly remind investors to pay attention to the credit market, which is an important leading indicator for risk assets. It directly reflects market confidence in the debt repayment ability of corporations and governments, and changes in the credit market often precede movements in the stock market or other risk asset markets, with turning points often signaling changes in risk appetite.

Based on the aforementioned analysis, our overall view is:

1) Global Stock Markets: Focus on Defense, Look for Mispriced Opportunities.

In the U.S. stock market, the market is still in an expectation adjustment phase, necessitating a reduction in high-beta asset allocations and an increase in defensive sectors (such as utilities, healthcare, and consumer staples) to cope with market volatility. Meanwhile, the high VIX index indicates that the market remains in a cautious sentiment, so in the short term, it is advisable to avoid excessive bets on high-growth, high-volatility sectors like technology and small-cap stocks.

Look for mispriced opportunities: A decline in market sentiment often leads to irrational sell-offs. It is recommended to focus on blue-chip stocks with high dividends and stable cash flows, especially leading companies with global competitiveness that have seen valuation declines. These assets may be among the first to recover once market sentiment stabilizes.

Appropriately increase allocations in the Asia-Europe markets: As the effects of tariff policies gradually become apparent, global supply chain adjustments are accelerating. The export and manufacturing activities in the Asia-Europe markets are relatively more active, so it is advisable to increase asset allocations in the Asia-Pacific region (especially China, India, and Southeast Asia) and European markets to hedge against uncertainties in the U.S. market.

2) Cryptocurrency Market: BTC Still Holds Long-term Allocation Value, Reduce Altcoin Risks

Bitcoin (BTC) has seen a reduction in short-term selling pressure, with long-term support remaining intact. Although BTC showed a downward trend last week, the narrowing volatility indicates that panic selling in the market has weakened. From a macro perspective, the marginal recovery in liquidity and unchanged capital inflow trends provide long-term support for BTC, so it can be continued to be held or accumulated on dips.

Reduce altcoin allocations, as market risk appetite is declining, with funds still primarily concentrated in BTC. Other crypto assets may continue to face pressure in the short term, so it is advisable to reduce risk exposure and maintain a wait-and-see attitude.

Pay attention to the flow of stablecoin funds. The slowing growth of stablecoin market capitalization indicates that the pace of new capital entering the market is slowing, necessitating further observation of market liquidity conditions to determine the direction of the cryptocurrency market in the next phase.

3) Credit Market: Beware of Widening Credit Spreads, Debt Risks May Intensify

The expansion of credit spreads indicates a decline in market risk appetite. The North American investment-grade credit default swap (CDX IG) rose over 7% last week, while U.S. sovereign CDS and high-yield bond credit default swaps also expanded, reflecting rising market concerns about corporate and government debt.

Avoid high-leverage corporate bonds and increase allocations in high-rated bonds. As credit risks rise, high-leverage companies may face greater repayment pressure. It is advisable to reduce allocations in low-rated corporate bonds and shift towards investment-grade bonds or U.S. medium- to long-term government bonds to lower credit risk exposure.

Be cautious of the impact of U.S. debt deficit issues. The rise in sovereign credit default swaps (CDS) indicates that market concerns about the sustainability of U.S. debt are intensifying. If the deficit issue continues to worsen, it may further heighten market risk aversion, thereby affecting the performance of overall risk assets.

Overall, the market is still seeking a new balance, and investors need to remain cautious while seizing potential mispriced opportunities for quality assets during market overreactions.

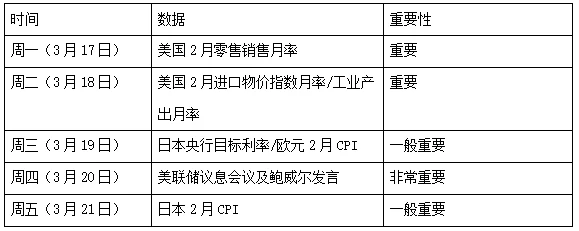

Key macroeconomic data for next week is as follows:

Notably, the key points of contention in the upcoming FOMC meeting will revolve around whether the dot plot indicates expectations for 2-3 rate cuts and the inclination of Powell's remarks. Additionally, another point of interest is whether the Fed will announce a pause in QT during this meeting. Given the current liquidity situation in the market and the reserves in the banking system, a pause in QT may be anticipated, which could provide significant support to the current market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。