Source: Cointelegraph Original: "{title}"

Ethereum's native token, Ether (ETH), continues to consolidate below $2,000, with some traders viewing this price level as a psychological barrier. On March 10, the price of Ether fell below this range, and the current trading price of this altcoin remains at its lowest level since October 2023.

Ethereum 4-hour chart. Source: Cointelegraph/TradingView

Ether has also seen a decrease in market capitalization relative to other major altcoins. On March 15, the price of Ripple (XRP) against Ether reached its highest level in five years.

The real question for investors is whether Ether has the ability to recover some of its recent losses, or if traders will choose to capitulate if the price falls below $1,900.

If the price falls below $1,900, Ethereum traders may sell off

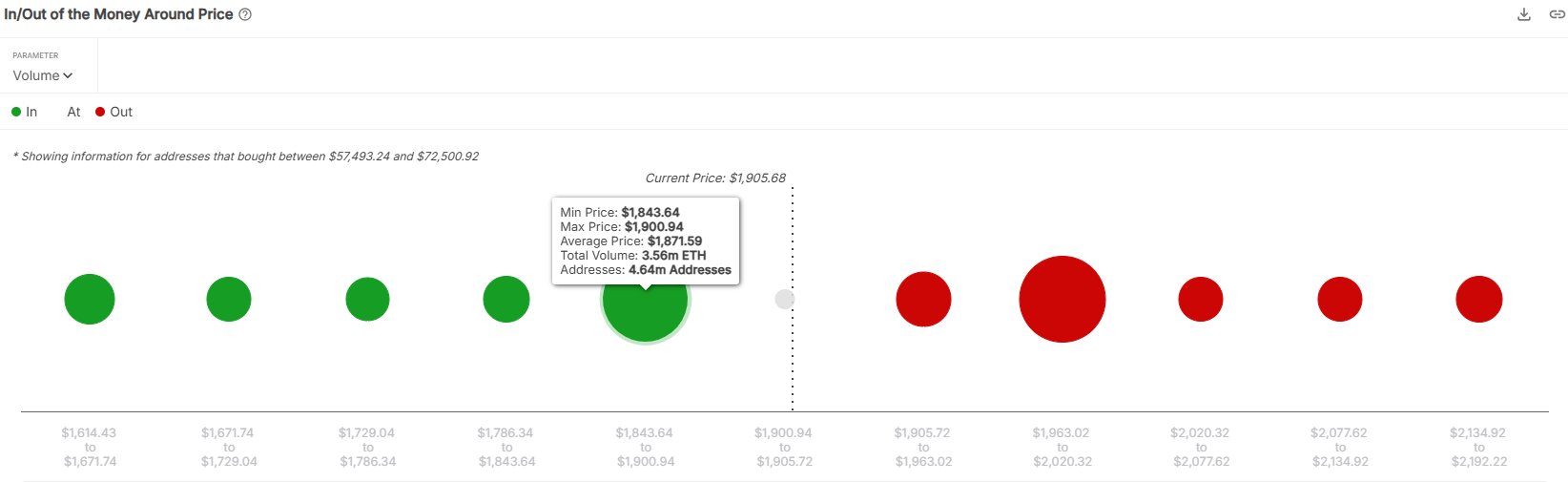

According to data analysis platform IntoTheBlock, Ethereum holders accumulated 3.56 million Ether between $1,900 and $1,843, with an average accumulation price of $1,871. Therefore, the total value of the current accumulation is $6.65 billion. This indicates that there is a strong support level for Ether's price between $1,900 and $1,843, which could potentially become a range for a bullish reversal.

Ethereum holding profit and loss chart. Source: X.com

However, if the price of Ether falls below $1,843, data shows that investors may become increasingly worried and choose to capitulate. Capitulation is a market sentiment where investors often panic and sell their holdings at a loss during significant market corrections. If Ether consolidates below $1,843 for an extended period, the likelihood of a deeper correction will increase exponentially.

Below $1,843, the scale and number of Ether accumulations significantly decrease, further highlighting the importance of the support range between $1,900 and $1,843.

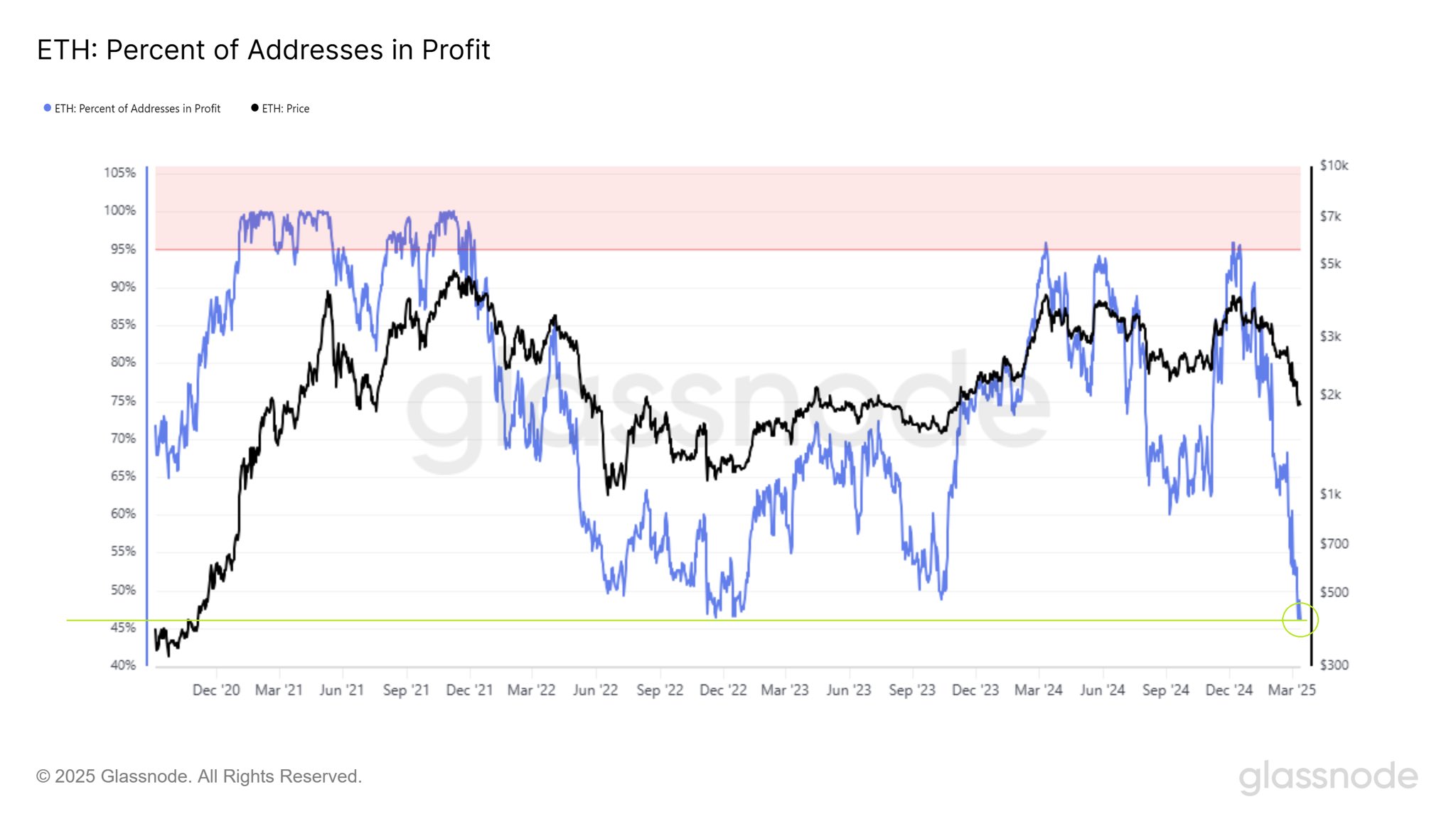

Similarly, the proportion of profitable Ethereum addresses has dropped to its lowest level since the beginning of this year. This is the lowest value since December 2022, slightly below 46%.

Ether: Proportion of profitable addresses. Source: X platform

Historically, a low proportion of profitable addresses often indicates that Ethereum prices are bottoming out. Given the high accumulation of Ether and the fewer profitable addresses, these factors may be bullish signals. Therefore, the likelihood of Ethereum prices consolidating below $1,843 is decreasing.

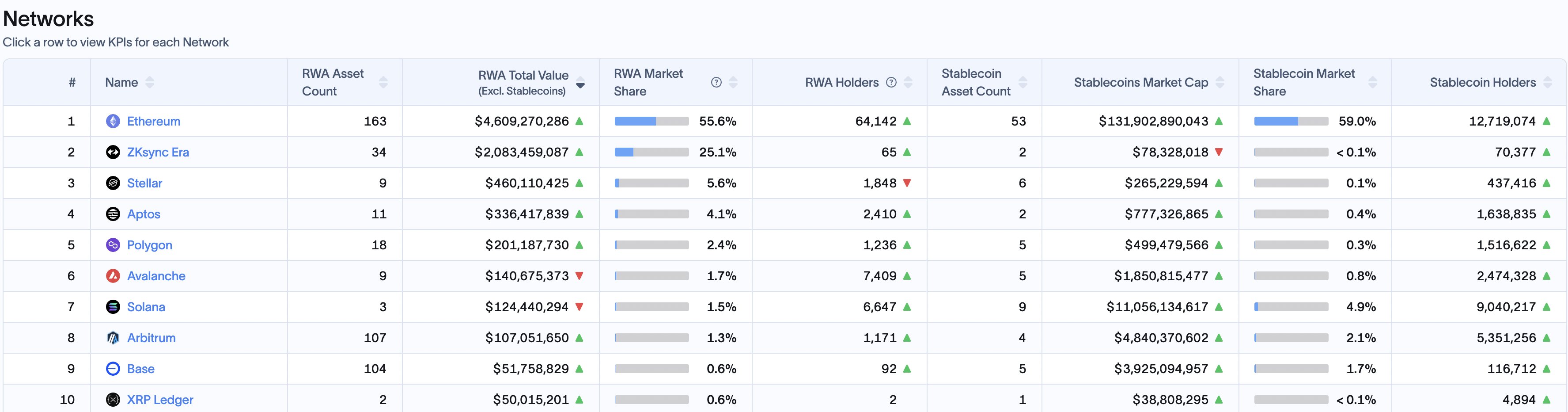

Hitesh Malviya, founder of the cryptocurrency research firm DYOR crypto, stated that now is not a "good time to be bearish on Ether." Malviya emphasized the recent growth of real-world assets (RWA) in the industry, which has increased by 50.9% in the past 30 days, with an annual growth rate of 850%. Ethereum and ZKsync account for over 80% of the total market share.

Market share of real-world assets on Layer 1 blockchains. Source: X platform

Ethereum long-short ratio shows a neutral market

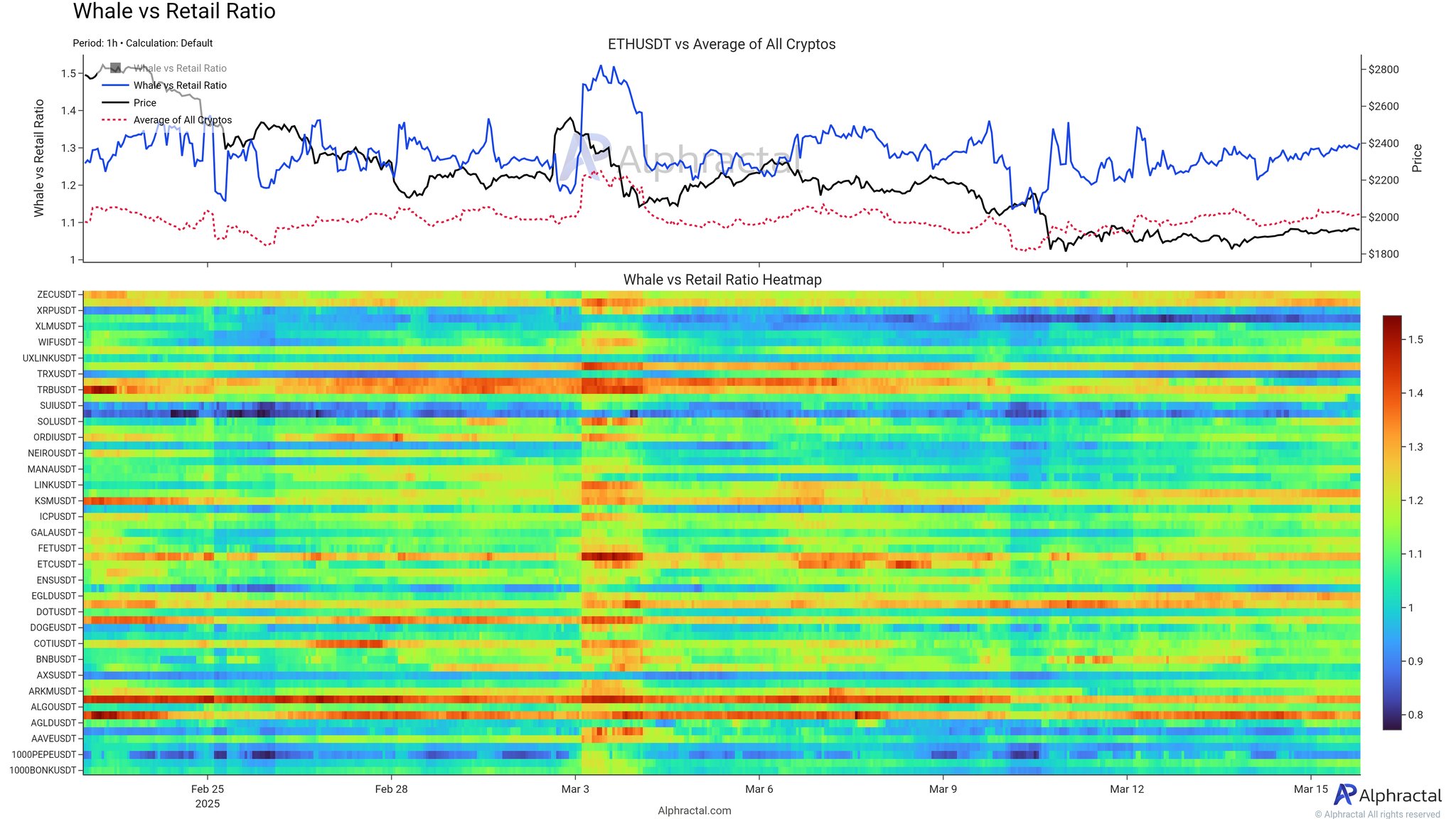

Cryptocurrency data analysis site Alphractal assessed the current market sentiment for Ether based on the long-short ratio, which is an indicator used to measure the proportion of bullish (long) and bearish (short) positions among futures traders.

Heatmap of holdings ratio between whale investors and retail investors. Source: X platform

According to the chart above, large investors tend to hold long positions, while small investors are deleveraging. Deleveraging means closing out risky positions established with borrowed funds, which reduces market volatility and interest in leveraged trading.

The current long-short ratio is 1.3, indicating that the market is in a balanced but cautious state. Alphractal added:

"This suggests that, in the short term, Ethereum market volatility is low, and interest in leveraged trading is also not high, which may leave many traders feeling fatigued and impatient."

Related: Analysts closely monitor the sell-off, as Ethereum prices may fall below the "strong" demand range of $1,900

This article does not contain investment advice or recommendations. Every investment and trading operation carries risks, and readers should conduct their own research when making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。