Source: Cointelegraph Original: "{title}"

Since March 2, the price of Bitcoin (BTC) has dropped by 12%, while on March 2, its price nearly reached $94,000. Interestingly, during the same period, the dollar weakened against a basket of foreign currencies, which is typically seen as a positive signal for scarce assets like Bitcoin.

Investors are now confused, not understanding why Bitcoin has not responded positively to the decline in the dollar index, and what factors might prompt Bitcoin to break free from this trend.

Dollar Index (DXY, left) vs. Bitcoin to Dollar Exchange Rate (right). Source: TradingView/Cointelegraph

As of mid-2024, the dollar index and Bitcoin price have shown an inverse relationship, meaning that when the dollar weakens, this cryptocurrency typically rises. During that time, Bitcoin was widely regarded as an inflation-hedging asset, similar to digital gold, due to its lack of correlation with the stock market and its fixed monetary policy.

However, correlation does not imply causation, and the situation over the past eight months suggests that the reasons for investing in Bitcoin evolve over time. For instance, some analysts claim that Bitcoin's price is related to the global money supply as central banks adjust their economic policies; while others emphasize Bitcoin's role as an uncensorable currency, allowing both governments and individuals to engage in free trade.

The benefits of Bitcoin from a weakening dollar may take months or even years to materialize.

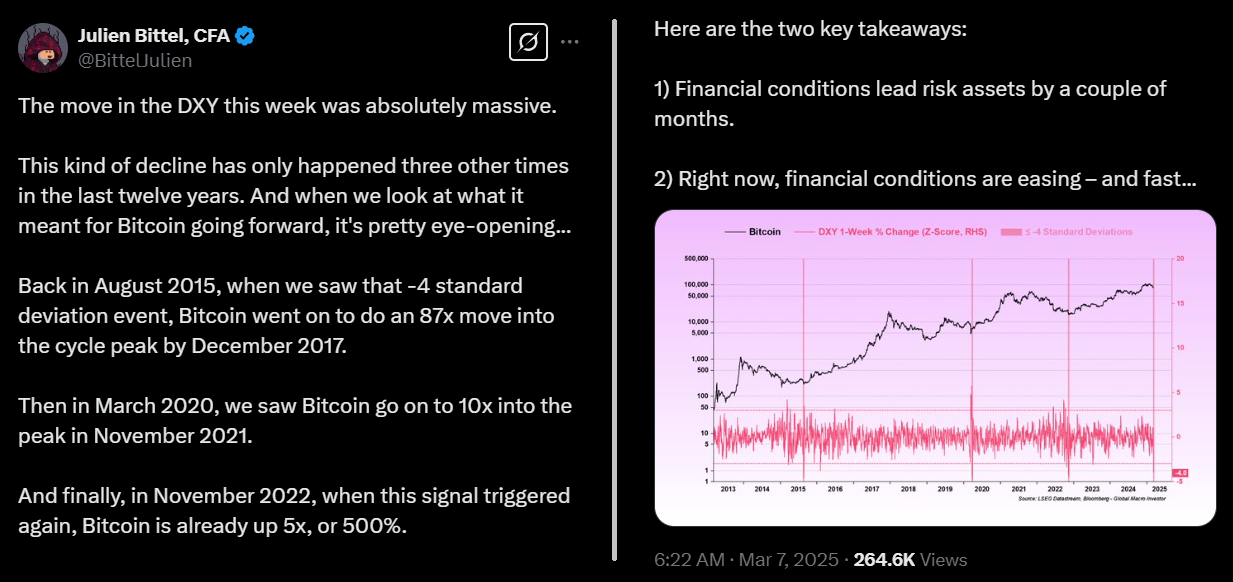

Julien Bittel, head of macro research at Global Macro Investor, pointed out that the dollar index recently fell from 107.6 on February 28 to 103.6 on March 7, a decline that has only occurred three times in the past twelve years.

Source: BittelJulien

Bittel's post on the X platform emphasized that after the last significant drop in the dollar index in November 2022, as well as after the event in March 2020, Bitcoin's price surged. In the weeks following the onset of the COVID-19 crisis in March 2020, the dollar fell from 99.5 to 95. His analysis highlights that "financial conditions tend to lead risk assets by several months. Currently, financial conditions are rapidly loosening."

While Bittel's comments are extremely bullish for Bitcoin's price, the positive effects of a weakening dollar have often taken over six months to manifest, and in some cases, even years, such as during the 2016 to 2017 cycle. User @21_XBT believes that Bitcoin's current poor performance may be due to "short-term macro concerns."

Source: 21_XBT

This analyst briefly listed several reasons for Bitcoin's recent price weakness, including "tariffs, DOGE, yen carry trades, yields, dollar index, growth panic," but concluded that these factors have not changed Bitcoin's long-term fundamentals, indicating that its price will ultimately benefit from them.

For example, the cuts from the U.S. government efficiency department (DOGE) are extremely beneficial for the economy in the medium term, as these measures reduce overall debt and interest payments, freeing up resources for productivity-enhancing initiatives. Similarly, if the Trump administration achieved a more favorable trade balance by increasing U.S. exports, tariffs could also prove beneficial, as they may pave the way for sustainable economic growth.

The measures taken by the U.S. government have curtailed excessive and unsustainable growth, causing short-term pain while lowering U.S. Treasury yields, thus reducing refinancing costs. However, there are no signs that the dollar's status as the world's reserve currency is weakening, nor has demand for U.S. Treasuries decreased. Therefore, the recent decline in the dollar index is not directly related to Bitcoin's appeal.

Over time, as user @21_XBT pointed out, macroeconomic concerns will dissipate as central banks adopt more expansionary monetary policies to stimulate the economy. This could lead to a decoupling of Bitcoin from the dollar index, laying the groundwork for new historical highs in 2025.

This article is for general informational purposes only and should not be construed as legal or investment advice. The views, thoughts, and opinions expressed in this article are solely those of the author and do not necessarily reflect or represent the views and opinions of Cointelegraph.

Related: Analysts say the dollar's plunge fuels Bitcoin bull market, but other indicators raise concerns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。