Original Author: Kevin, the Researcher at Movemaker

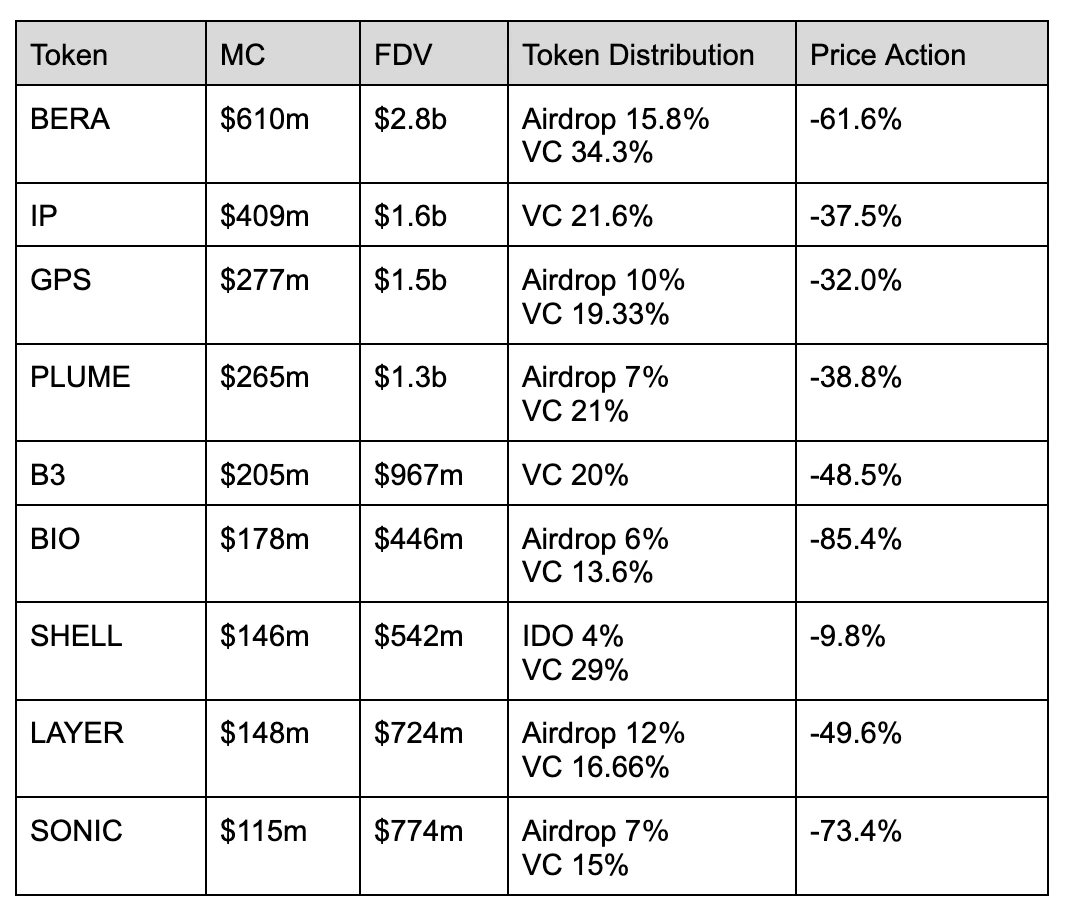

The proportion of VC in the aforementioned projects generally ranges from 10% to 30%, showing little change compared to the previous cycle. Most projects choose to distribute tokens to the community through airdrops, viewing it as a reasonable method of community allocation. However, in reality, users do not tend to hold onto the tokens long-term after receiving airdrops; instead, they are inclined to sell immediately. This is because users believe that project teams often hide a large number of tokens in airdrops, leading to significant selling pressure in the market after the Token Generation Event (TGE). The concentration of token holdings is not favorable for the effectiveness of airdrops. This phenomenon has persisted over the past few years, with little change in token distribution methods. The performance of token prices indicates that VC-driven tokens perform very poorly, often entering a one-sided downward trend after issuance.

Among them, $SHELL is slightly different. It allocates 4% of its tokens through an Initial DEX Offering (IDO), and the project's IDO market cap is only $20 million, making it stand out among many VC-driven tokens. In addition, Soon and Pump Fun choose to distribute over 50% of the total token supply through fair launches, combined with a small number of VCs and Key Opinion Leaders (KOLs) for large-scale community fundraising. This method of benefiting the community may be more readily accepted, and the proceeds from community fundraising can be locked in advance. Although the project team no longer holds a large number of tokens, they can repurchase tokens in the market through market-making, which not only sends a positive signal to the community but also allows them to recover tokens at a lower price.

The End of the Memecoin Bubble: Liquidity Siphoning and Market Structure Collapse

The market has shifted from a balanced state dominated by VC-driven Builders to a purely "pump" token issuance bubble model, making it difficult for these tokens to avoid a zero-sum game situation, ultimately benefiting only a few while most retail investors are likely to incur losses. This phenomenon will exacerbate the collapse of the primary and secondary market structures, and rebuilding or accumulating chips may take longer.

The atmosphere in the Memecoin market has plummeted. As retail investors gradually realize that the essence of Memecoins is still under the control of conspiracy groups—including DEXs, capital parties, market makers, VCs, KOLs, and celebrities—the issuance of Memecoins has completely lost fairness. Short-term severe losses will quickly affect users' psychological expectations, and this token issuance strategy is nearing a phase of termination.

Over the past year, retail investors have earned the most profit in the Memecoin space. Although the Agent narrative has driven market enthusiasm by placing open-source community innovation at its cultural core, it has been proven that this wave of AI Agent hype has not changed the essence of Memecoins. A large number of individual developers from Web2 and shell projects from Web3 have rapidly occupied the market, leading to the emergence of many AI Memecoin projects disguised as "value investments."

Community-driven tokens are controlled by conspiracy groups and are subjected to malicious price manipulation for "fast passes." This approach has severely negative impacts on the long-term development of projects. Former Memecoin projects alleviated selling pressure through religious beliefs or support from minority groups and achieved an acceptable exit process for users through market makers' operations.

However, when the Memecoin community no longer hides behind religion or minority groups, it indicates that market sensitivity has decreased. Retail investors are still looking forward to the opportunity to get rich overnight; they are eager to find tokens with certainty and hope for projects that have deep liquidity right from the start, which is a fatal blow to retail investors from conspiracy groups. Bigger bets mean richer returns, and these returns have begun to attract the attention of teams outside the industry. Once these teams gain benefits, they will no longer use stablecoins to purchase cryptocurrencies, as they lack faith in Bitcoin. The siphoned liquidity will permanently leave the cryptocurrency market.

The Death Spiral of VC Tokens: Inertia Traps and Liquidity Strangulation Under Short Selling Consensus

The strategies from the previous cycle have become ineffective, yet many project teams continue to use the same strategies out of inertia. Small portions of tokens are released to VCs and highly controlled, forcing retail investors to buy in on exchanges. This strategy has failed, but inertia makes project teams and VCs reluctant to change easily. The biggest drawback of VC-driven tokens is the inability to gain early advantages at TGE. Users no longer expect to achieve ideal returns through token purchases, as they believe that project teams and exchanges hold a large number of tokens, creating an unfair position for both parties. Meanwhile, VC returns have significantly decreased in this cycle, leading to a decline in VC investment amounts, compounded by users' reluctance to take over on exchanges, making the issuance of VC tokens face enormous difficulties.

For VC projects or exchanges, direct listing may not be the best choice. The liquidity siphoned off by celebrity tokens or political token teams has not been injected into other tokens, such as Ethereum, SOL, or other altcoins. Therefore, once VC tokens are listed on exchanges, the contract fee rates will quickly turn negative. Teams will lack the motivation to pump the price, as the listing goal has already been achieved; exchanges will also refrain from pumping the price, as short selling new tokens has become a market consensus.

When tokens immediately enter a one-sided downward trend after issuance, the frequency of this phenomenon reinforces market users' perceptions, leading to a situation where "bad money drives out good." Assuming that in the next TGE, the probability of a project team dumping tokens right after issuance is 70%, while those willing to support the price are only 30%. Under the influence of consecutive dumping projects, retail investors will engage in retaliatory short selling, even knowing that the risk of shorting right after issuance is extremely high. When the short selling situation in the futures market reaches its peak, project teams and exchanges will also have to join the short selling ranks to compensate for the target returns that cannot be achieved through dumping. When the 30% of teams see this situation, even if they are willing to support the price, they are unwilling to bear such a huge price difference between futures and spot markets. Therefore, the probability of project teams dumping tokens right after issuance will further increase, and the number of teams creating beneficial effects after issuance will gradually decrease.

The unwillingness to lose control over tokens has resulted in many VC tokens showing no progress or innovation at TGE compared to four years ago. The constraints of inertia on VCs and project teams are stronger than imagined. Due to the dispersion of project liquidity, long VC unlocking periods, and the constant turnover of project teams and VCs, despite the ongoing issues with this TGE method, VCs and project teams exhibit a numb attitude. Many project teams may be establishing projects for the first time, and when faced with unprecedented difficulties, they tend to exhibit survivor bias, believing they can create different value.

Dual-Driven Paradigm Shift: On-Chain Transparent Games Break the Pricing Deadlock of VC Tokens

Why choose the dual-driven model of VC + community? A purely VC-driven model increases the pricing discrepancy between users and project teams, which is detrimental to the early price performance of token issuance; while a completely fair launch model is easily manipulated by the conspiracy groups behind it, leading to the loss of a large number of low-priced tokens, with prices fluctuating within a single day, which is devastating for the subsequent development of projects.

Only by combining the two can VCs enter at the early stage of project establishment, providing reasonable resources and development plans for project teams, reducing the financing needs during the early development phase, and avoiding the worst outcome of losing all tokens due to fair launches while only obtaining low certainty returns.

Over the past year, more and more teams have realized that traditional financing models are becoming ineffective—the routine of giving VCs small portions, maintaining high control, and waiting for listings to pump prices is no longer sustainable. With VCs tightening their pockets, retail investors refusing to take over, and the listing thresholds for major exchanges increasing, a new gameplay more suited to bear markets is emerging: collaborating with leading KOLs and a small number of VCs to promote projects through large-scale community launches and low market cap cold starts.

Projects represented by Soon and Pump Fun are opening new paths through "large-scale community launches"—partnering with leading KOLs to directly distribute 40%-60% of tokens to the community, launching projects at valuations as low as $10 million, and achieving millions of dollars in financing. This model builds consensus FOMO through the influence of KOLs, locks in profits in advance, and exchanges high liquidity for market depth. Although it sacrifices short-term control advantages, it allows for compliant market-making mechanisms to repurchase tokens at low prices during bear markets. Essentially, this is a paradigm shift in power structure: from a VC-led game of hot potato (institutional takeovers - listings - retail buying) to a transparent game of community consensus pricing, forming a new symbiotic relationship between project teams and the community in liquidity premiums.

Recently, Myshell can be seen as a groundbreaking attempt between BNB and project teams. Its 4% of tokens are issued through an IDO, with an IDO market cap of only $20 million. To participate in the IDO, users need to purchase BNB and operate through exchange wallets, with all transactions directly recorded on-chain. This mechanism brings new users to wallets while allowing them to gain fair opportunities in a more transparent environment. For Myshell, through market maker operations, it ensures reasonable price increases. Without sufficient market support, the token price cannot be maintained within a healthy range. As the project develops, transitioning from low market cap to high market cap, and with continuous liquidity enhancement, the project gradually gains market recognition. The contradiction between project teams and VCs lies in transparency. When project teams issue tokens through IDOs, they no longer rely on exchanges, thus resolving the transparency conflict between both parties. The on-chain token unlocking process becomes more transparent, ensuring that past conflicts of interest are effectively resolved. On the other hand, traditional centralized exchanges face the dilemma of frequent price crashes after token issuance, leading to a gradual decline in trading volume, while the transparency of on-chain data allows exchanges and market participants to more accurately assess the true situation of projects.

It can be said that the core contradiction between users and project teams lies in pricing and fairness. The purpose of fair launches or IDOs is to meet users' expectations for token pricing. The fundamental problem with VC tokens is the lack of buying pressure after listing, with pricing and expectations being the main reasons. The breakthrough point lies with project teams and exchanges. Only by fairly allocating tokens to the community and continuously advancing the construction of the technical roadmap can the value growth of the project be achieved.

As a decentralized community organization, Movemaker has received millions of dollars in funding and resource support from the Aptos Foundation. Movemaker will have autonomous decision-making power, aiming to efficiently respond to the needs of developers and ecosystem builders in the Chinese-speaking region, promoting Aptos's further expansion in the global Web3 field. Movemaker will take the lead in building the Aptos ecosystem through a community + VC dual-driven approach, including the deep integration of DeFi, artificial intelligence, and blockchain, innovative payments, stablecoins, and Real World Assets (RWA).

About Movemaker

Movemaker is the first official community organization authorized by the Aptos Foundation, jointly initiated by Ankaa and BlockBooster, focusing on promoting the construction and development of the Aptos ecosystem in the Chinese-speaking region. As the official representative of Aptos in the Chinese-speaking area, Movemaker is committed to creating a diverse, open, and prosperous Aptos ecosystem by connecting developers, users, capital, and numerous ecological partners.

Disclaimer

This article/blog is for reference only, representing the author's personal views and does not represent the position of Movemaker. This article does not intend to provide: (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets, including stablecoins and NFTs, carries high risks, with significant price volatility, and they may even become worthless. You should carefully consider whether trading or holding digital assets is suitable for you based on your financial situation. If you have specific questions, please consult your legal, tax, or investment advisor. The information provided in this article (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in compiling this data and charts, but no responsibility is accepted for any factual errors or omissions expressed therein.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。