Source: Cointelegraph Original: "{title}"

The CEO of cryptocurrency analysis platform CryptoQuant has stated that the Bitcoin bull market may have ended — a shift from his position earlier this month when he claimed that the Bitcoin bull market cycle, although progressing slowly, was "still intact."

"The Bitcoin bull market cycle has ended, and prices are expected to show bearish or sideways trends in the next 6 to 12 months," said Ki Young Ju, founder and CEO of CryptoQuant, in a post on the X platform on March 17.

Ju noted that all signals currently indicate a bearish trend.

Ju stated that all on-chain indicators for Bitcoin (BTC) suggest that we are currently in a bear market. "With new liquidity drying up, new whale investors are selling Bitcoin at lower prices," Ju said.

Just a few days ago, Cointelegraph reported that Bitcoin's funding rate (which reflects the cost of holding long or short positions in cryptocurrency futures) was hovering near 0%, indicating that traders are becoming increasingly hesitant.

Ju's comments contrast sharply with a post he made on March 4, when he pointed out that key indicators were neutral and stated that the Bitcoin bull market cycle, while still slow, was "still intact."

"The fundamentals remain strong, and more mining machines are coming online," Ju said in a post on the X platform on March 4.

Other analysts are not as pessimistic. Pav Hundal, chief analyst at cryptocurrency trading platform Swyftx, told Cointelegraph, "There is no reason to panic."

Hundal explained that while investors were "spooked" by the tariff policies introduced by U.S. President Trump, "all data shows that the global economy is moving in the right direction."

"When the market is ready to take on risk, funds will flow into risk assets."

According to CoinMarketCap, at the time of this article's publication, Bitcoin was trading at $83,030, down 14.79% over the past month.

Bitcoin has dropped 14.89% over the past month. Source: CoinMarketCap

Some analysts believe that given the recent record high in global broad money supply (M2), Bitcoin may see an upward trend.

"What I want to say is that the global money supply has once again reached a historical high. We are about to see Bitcoin rebound again," cryptocurrency analyst Seth said in a recent post on the X platform.

Similarly, Dave Weisberger, CEO of cryptocurrency trading platform CoinRoutes, stated that if historical trends continue, Bitcoin could reach a new all-time high in late April.

"If Bitcoin's BETA correlation with the money supply remains unchanged, Bitcoin is expected to hit a new all-time high within a month," Weisberger said in a post on the X platform on March 17.

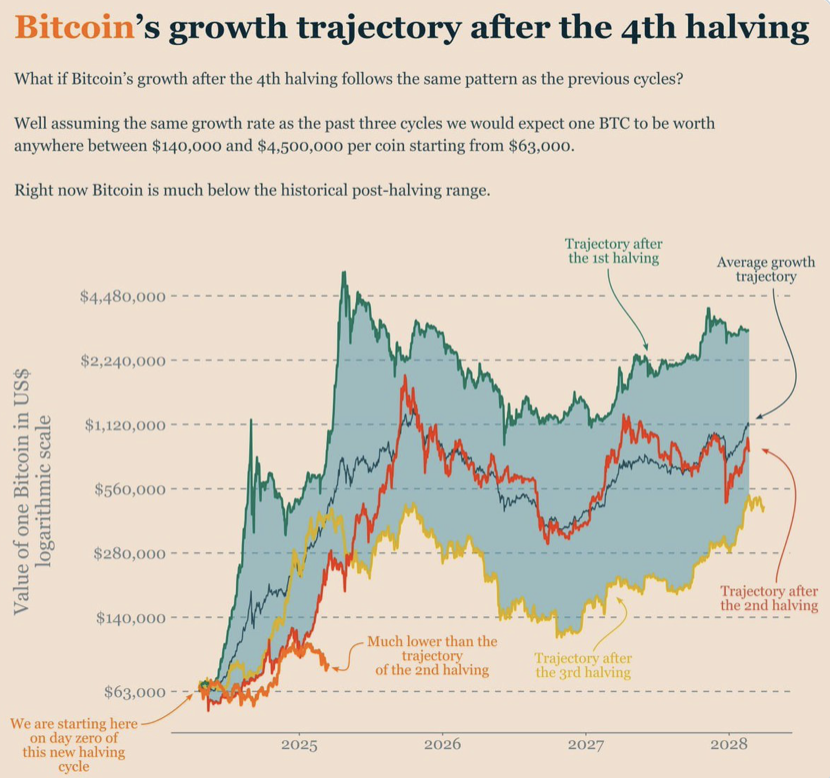

However, according to Alan Knitowski, former CEO of mobile app development company Phunware, based on historical data, Bitcoin's current price is 67% lower than its expected lower limit.

"At this stage of the current cycle, the lower limit of the historical price range should be around $250,000," Knitowski said in a post on the X platform on March 17.

Source: Alan Knitowski

Cory Klippsten, CEO of Bitcoin trading service platform Swan Bitcoin, recently told Cointelegraph, "We have over a 50% chance of seeing Bitcoin hit a new all-time high before the end of June this year." The current all-time high for Bitcoin is $109,000, set on January 20, just hours before Trump was sworn in as President of the United States.

Related: From derivatives indicators, Bitcoin has a chance to return to $90,000

This article does not contain investment advice or recommendations. Every investment and trading operation carries risks, and readers should conduct their own research when making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。