DeFi is no longer a substitute for traditional finance; it is becoming an important pillar of the global financial system.

Author: LSTMaximalist

Translation: Deep Tide TechFlow

In 2025, DeFi is at a critical juncture of transformation. From its initial niche experiments aimed at crypto-native users, it has gradually evolved into a complex and rapidly expanding decentralized financial ecosystem. Today, deep participation from institutional investors, the gradual improvement of regulatory frameworks, and significant advancements in scalability and cross-chain interoperability technologies have elevated the efficiency and accessibility of DeFi to new heights. The development of DeFi is not limited to the technical level; its application scope is also continuously expanding—from the tokenization of real-world assets to the optimization of on-chain derivatives, and the introduction of risk management solutions.

This article will delve into four key trends in DeFi for 2025: accelerated institutional adoption, the evolution of the regulatory environment, breakthroughs in Layer-2 technology (second-layer scaling solutions) and cross-chain technology, as well as the rise of emerging use cases. As DeFi matures, it has transcended the traditional realms of liquidity mining or decentralized lending, redefining the future landscape of finance.

Institutional Adoption

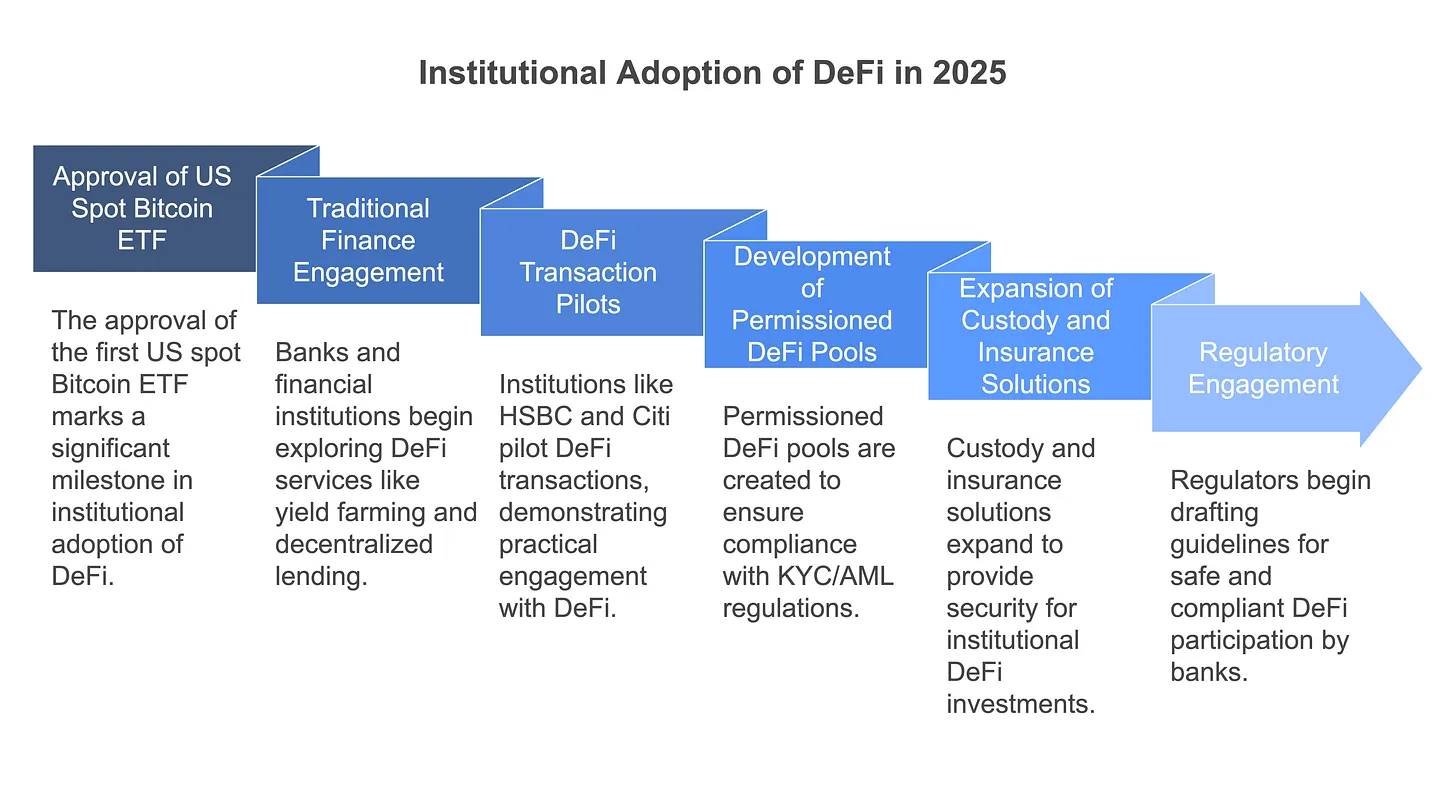

In 2025, DeFi is ushering in an important moment of deep integration with traditional finance (TradFi). Decentralized finance, which once primarily served crypto-native users and retail investors, is now attracting the attention of banks, asset management companies, and fintech firms. For example, in January 2025, the first spot Bitcoin ETF in the U.S. was finally approved after a long wait, a milestone event that is said to have "opened the door to mainstream participation" and paved the way for the subsequent launch of other ETFs like Ethereum.

At the same time, the new U.S. government has released friendly signals towards cryptocurrencies, further boosting institutional confidence in DeFi. Several traditional financial giants have also begun actively exploring DeFi application scenarios; for instance, JPMorgan, Goldman Sachs, and BlackRock are researching liquidity mining and decentralized lending services, seeking to integrate blockchain technology products into their business systems. Some large banks have even started pilot projects for DeFi trading; for example, HSBC and Citibank completed a foreign exchange settlement experiment through Aave's private network in 2024, while Swift is collaborating with Chainlink to test tokenized asset settlement solutions aimed at connecting traditional financial systems with decentralized ecosystems.

The participation of institutional investors is driven by clear motivations: the efficient and automated protocols of DeFi can provide higher yields and 24/7 liquidity, which is highly attractive to hedge funds, government bonds, and even mutual funds in a low-interest-rate environment. Moreover, institutional adoption is accelerating the innovation and compliance development of DeFi products. Permissioned DeFi pools like Aave Arc are emerging, allowing institution users verified through KYC and AML to conduct lending operations securely. At the same time, the improvement of custody and insurance solutions has made professional investors feel more secure when allocating funds to DeFi. The term "institutional DeFi" is gradually becoming a buzzword in the industry, marking the combination of DeFi's high-yield characteristics with traditional financial-level risk management.

With the influx of institutional capital, the liquidity and stability of the DeFi market are expected to further improve, while also bringing about stricter regulatory demands. In fact, by 2025, regulatory agencies themselves have begun to actively participate in the research and practice of DeFi. Central banks and other relevant institutions are closely monitoring and experimenting with DeFi. For example, the European Central Bank and U.S. regulators initiated the drafting of guidelines for regulated DeFi applications at the end of 2024 to ensure that banks comply with safety and compliance requirements when participating in DeFi. Overall, 2025 is a significant turning point for institutional adoption of DeFi, and many predict that this year will be remembered for successfully bridging the gap between DeFi and TradFi.

Regulatory Dynamics

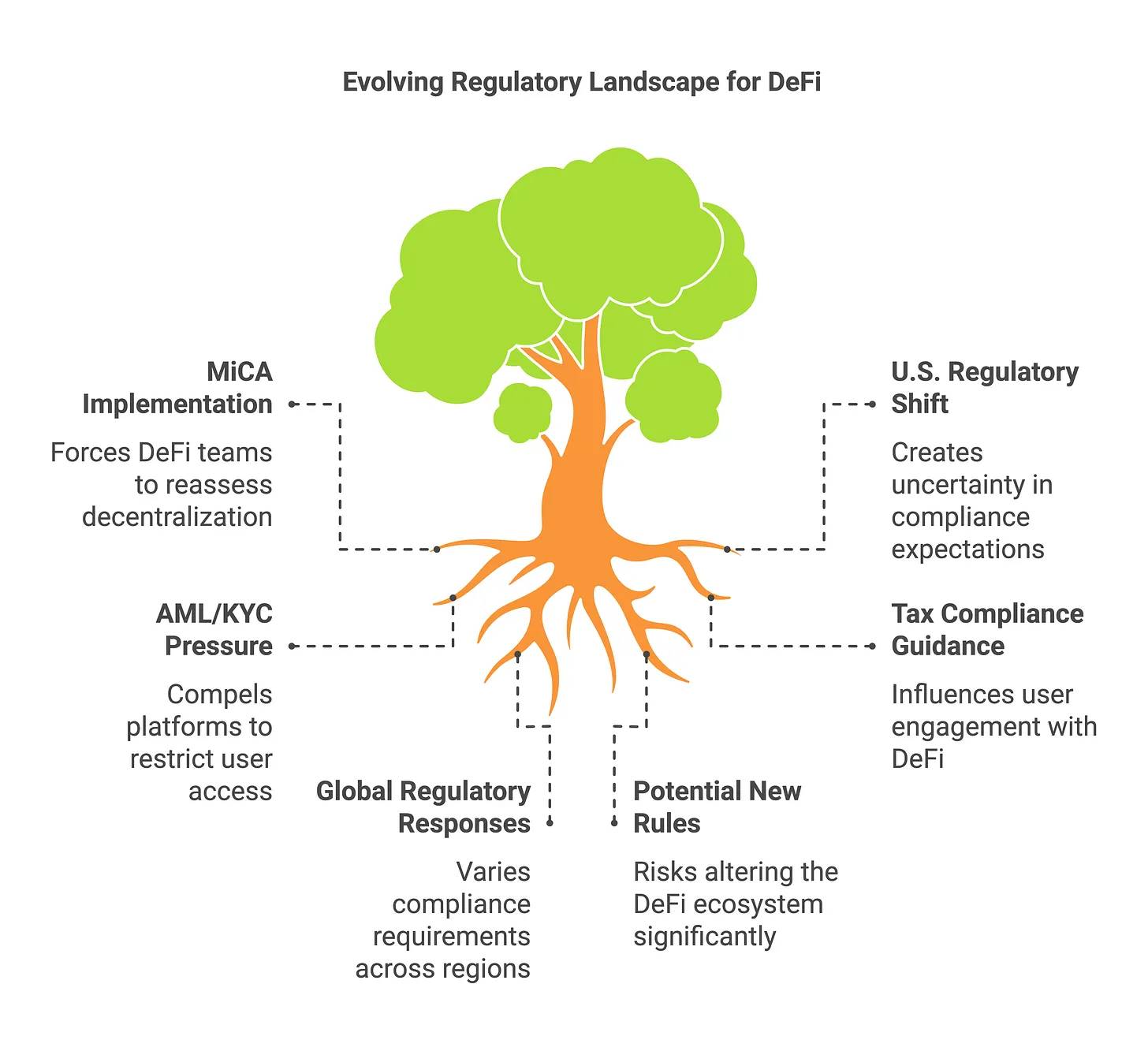

The regulatory environment for DeFi is rapidly evolving. In the European Union, the landmark Markets in Crypto-Assets (MiCA) regulation officially came into effect in early 2025, providing a unified regulatory framework for member states. MiCA requires crypto asset service providers (CASPs) to obtain operating licenses and comply with certain disclosure and compliance standards. Although MiCA's primary focus is on centralized participants (such as exchanges and stablecoin issuers), its implementation has prompted DeFi project teams to reflect on their own "degree of decentralization" and consider which rules they may be subject to in the future.

European regulatory bodies (such as the European Securities and Markets Authority (ESMA) and the European Banking Authority (EBA)) have also begun to pay attention to the specific risks of DeFi. For instance, a joint report from the EU noted that there are approximately 7.2 million DeFi users in the EU (about 1.6% of the total population), but less than 15% of these users regularly use DeFi. This indicates that regulators are collecting relevant data and may formulate specific policies targeting DeFi based on this information.

In the U.S., regulatory actions in 2024 were characterized by strict enforcement, but a significant change in regulatory attitude occurred in 2025. Under new leadership, the U.S. Securities and Exchange Commission (SEC) re-evaluated its strategy: in February 2025, the SEC announced the termination of its high-profile investigation into Uniswap Labs and decided not to take further enforcement action. Prior to this, the SEC had also halted or withdrawn several actions against other crypto companies, and this series of moves is seen as a signal that the regulatory environment may be "thawing." The Uniswap team stated that this is a "major victory for DeFi," and it has led the market to anticipate clearer guidance from regulators in the future rather than retrospective penalties.

At the same time, U.S. regulators are exploring how existing financial laws (such as securities and commodities laws) apply to DeFi protocols, and some industry leaders are advocating for more targeted custom rules to be introduced in 2025. Globally, other regions are also actively exploring regulatory strategies for DeFi: for example, Singapore and Hong Kong are creating regulatory sandboxes for regulated DeFi projects. Some developing countries view DeFi as a potential tool for promoting financial inclusion but remain cautious about its risks.

In the regulatory discussions surrounding DeFi, AML and KYC compliance are frequently mentioned as key points. The Financial Action Task Force (FATF) emphasizes that DeFi should not become a haven for illicit funds and urges countries to implement anti-money laundering measures such as the "Travel Rule" on crypto platforms. In practice, this has led some front-end interfaces, such as DEX aggregators, to impose geographic restrictions or screenings on users, while also promoting the development of decentralized identity solutions to support the compliance needs of permissioned DeFi.

Tax compliance has also become an important area recently. Countries are beginning to issue tax guidance regarding liquidity mining, staking, and liquidity provision, and these policies will directly impact user behavior patterns. Overall, the clarity of regulations worldwide is gradually improving: the comprehensive regulatory framework in Europe and the potentially more lenient attitude in the U.S. bring positive signals for the development of DeFi. However, project teams within the industry remain cautious, as any new rules regarding DAO (Decentralized Autonomous Organization) liability or protocol registration could have profound impacts on the DeFi ecosystem.

Layer 2 Scaling and Cross-Chain Interoperability

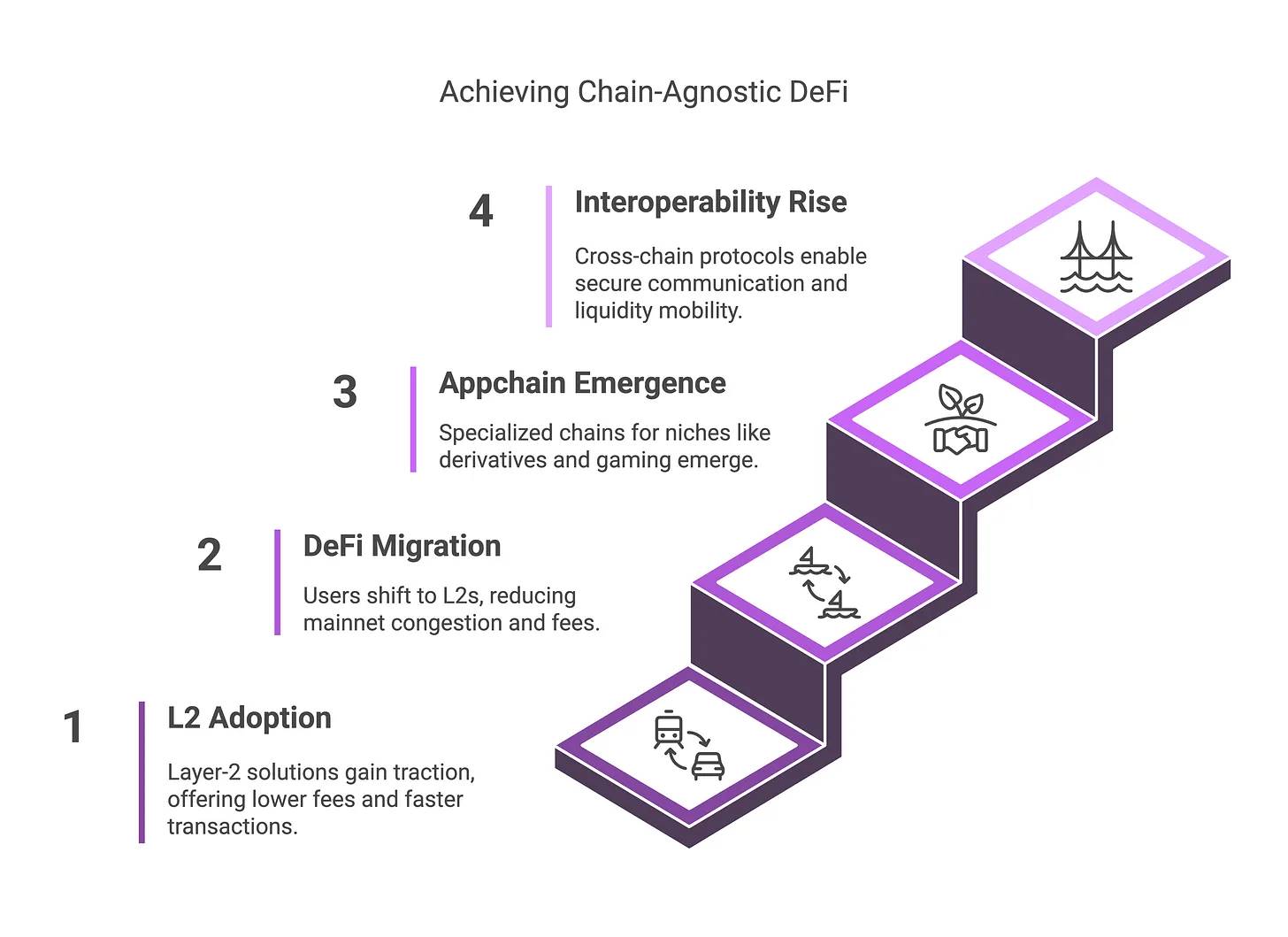

By 2025, with significant breakthroughs in scalability and interoperability technologies, the use of DeFi is no longer reliant on specific blockchains. This is thanks to the rapid development of Layer-2 (L2) solutions on Ethereum (such as Arbitrum, Optimism, and zk-Rollups). These L2 networks not only significantly reduce transaction costs and greatly increase transaction speeds but also inherit the security of the Ethereum mainnet. This combination provides an ideal solution for users who were excluded due to the high costs of the Ethereum mainnet.

By the end of 2024, the total value locked (TVL) in Arbitrum and Optimism had reached billions of dollars, successfully supporting popular DeFi applications such as Uniswap, Aave, and GMX, with user activity levels comparable to that of the Ethereum mainnet. Additionally, the L2 chain Base launched by Coinbase in 2023 quickly rose to occupy about 2.8% of the total value locked in DeFi within the first few months of its launch. These developments have effectively alleviated Ethereum's throughput bottleneck: as a large number of users shift their daily DeFi activities to L2 or sidechains, the Gas fees on the Ethereum mainnet have dropped by approximately 98% from their peak.

This change not only makes DeFi more user-friendly for ordinary users, making small transactions or loans economically viable again, but also promotes the rise of on-chain high-frequency trading strategies. Looking ahead, dedicated application chains and Rollups tailored to specific needs (such as those focused on derivatives trading or gaming assets) are continuously emerging, further driving the decentralization of DeFi activities across multiple chains.

At the same time, cross-chain interoperability technologies have also made significant progress, making inter-chain liquidity more efficient and flexible. Early DeFi users needed to manually bridge assets to transfer between isolated blockchains, but technological breakthroughs in 2024 changed this situation. Universal messaging protocols (such as LayerZero and IBC, the Inter-Blockchain Communication protocol) have begun to gain popularity, allowing secure communication between smart contracts on different blockchains.

Emerging Use Cases in 2025

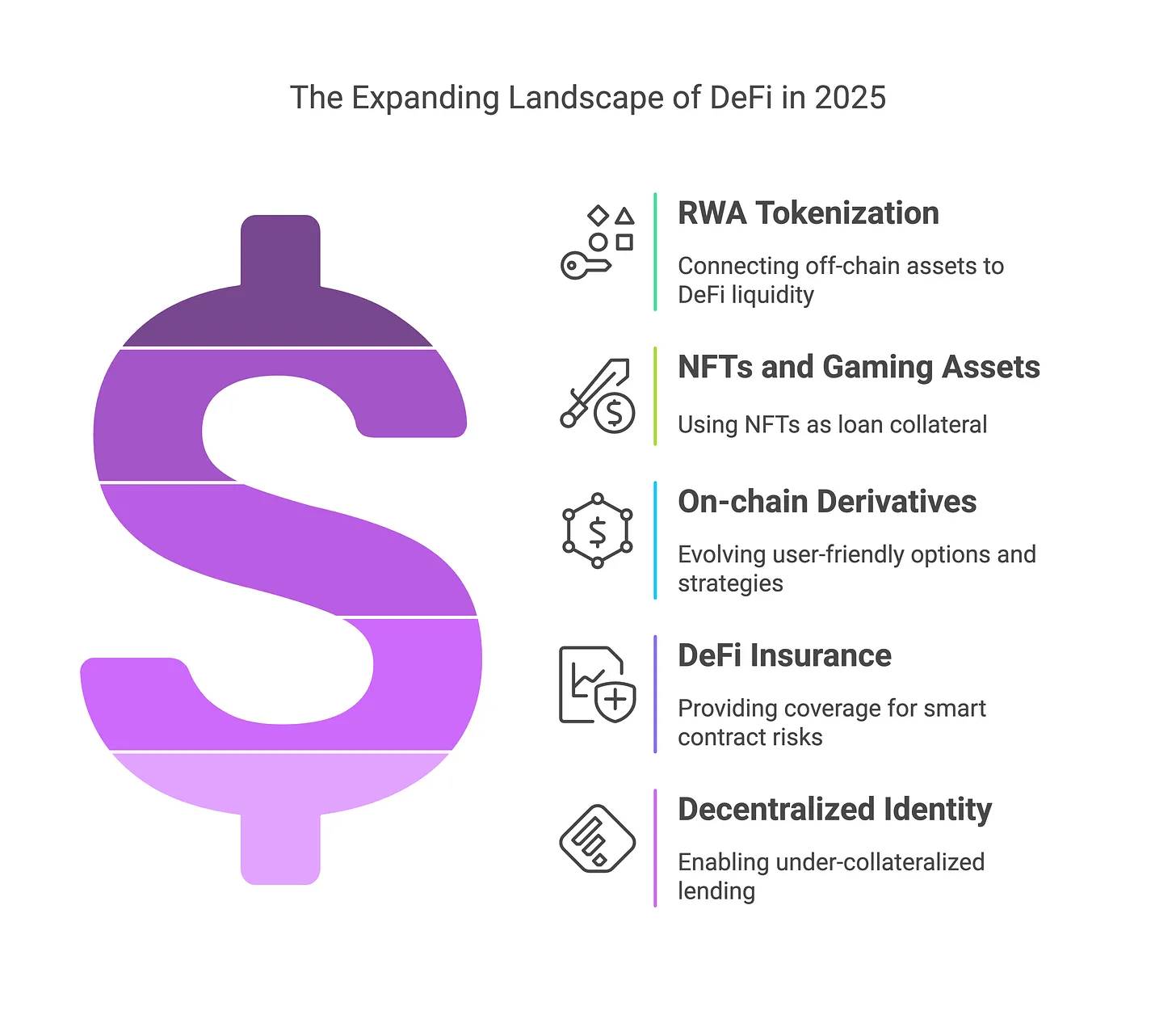

In 2020, DeFi primarily offered basic functions such as trading, lending, and liquidity mining, but by 2025, DeFi has expanded into a more diverse range of financial services.

One area of significant attention is the tokenization of Real-World Assets (RWA). After experiencing rapid growth in 2024, RWA platforms began connecting off-chain assets (such as government bonds, real estate, and commercial invoices) to DeFi liquidity pools. Through protocols like MakerDAO, Goldfinch, and Centrifuge, real-world loans and bonds are being brought on-chain, providing users with stable returns backed by traditional assets.

Another rapidly emerging use case is DeFi services aimed at NFTs and gaming assets. In the past, NFTs primarily existed as speculative collectibles, but starting in 2024, some projects have allowed users to use high-value NFTs as collateral for loans. This trend is expected to accelerate in the future—users can quickly collateralize valuable NFTs or in-game assets in exchange for stablecoins, thereby converting assets that were previously difficult to liquidate into liquid funds.

On-chain derivatives and structured financial products are also continuously evolving. In addition to the ongoing growth of perpetual futures exchanges, 2025 has seen the emergence of more user-friendly options products, vaults, and automated strategy tools, providing users with a more diverse range of choices.

Meanwhile, DeFi insurance and risk management are gradually becoming a publicly recognized field. Platforms like Nexus Mutual, InsurAce, and Risk Harbor are providing insurance services for risks such as smart contract vulnerabilities or stablecoin price deviations (de-pegging). By 2025, mainstream DeFi platforms are expected to directly integrate insurance functionalities to reduce risks for users.

Decentralized identity and credit scoring represent another emerging use case, although it is still in its early stages. Some projects based on on-chain reputation are exploring the possibility of low-collateral loans, a development that is expected to bring broader consumer financial services into the DeFi ecosystem.

Overall, DeFi in 2025 is no longer limited to trading and liquidity mining; it is gradually encompassing core functions of traditional finance (such as asset management, insurance, payments, and credit services) and implementing them in a decentralized manner.

Conclusion

The DeFi ecosystem in 2025 has undergone a dramatic transformation compared to its early days. With accelerated institutional adoption, a gradually clearer regulatory framework (albeit slowly), and continuous improvements in underlying technologies, DeFi is moving from an experimental phase to a more mature stage that is closely integrated with traditional finance.

However, challenges remain. Regulatory uncertainty continues to be a major obstacle to industry development, and security risks remain high. The industry needs to ensure compliance and the safety of user assets while maintaining its innovative vitality. But it is certain that DeFi is no longer a substitute for traditional finance; it is becoming an important pillar of the global financial system. Whether through permissioned DeFi, tokenization of real assets, or advanced cross-chain liquidity solutions, this field is demonstrating its strong adaptability and resilience.

Looking ahead, there is no longer doubt about whether DeFi can succeed; the focus is now on how it will continue to evolve. The next emphasis in DeFi development will shift to optimizing user experience, promoting sustainable growth, and ultimately bridging the gap between decentralized finance and traditional finance to serve a broader user base.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。