Author: Luke, Mars Finance

Recently, the native token $AUCTION of Bounce Finance has experienced a remarkable surge in price, rising from a low point of less than a month ago to a peak of over $35, an increase of more than 400%. This unusual movement not only broke the atmosphere of market stagnation but also sparked widespread discussion. What exactly has driven the explosive rise of AUCTION? Before analyzing the specific reasons, let's systematically understand AUCTION and the project behind it.

What is AUCTION?

$AUCTION is the native token of the decentralized auction platform Bounce Finance, operating on the BNB Chain (formerly Binance Smart Chain). Bounce Finance was established in 2020, initially focusing on providing decentralized auction tools that allow users to create various auction pools, including token sales and NFT auctions. Its uniqueness lies in breaking the limitations of traditional centralized platforms, providing flexible and efficient financing and trading methods for project parties and investors.

As the core token of the platform, $AUCTION has multiple functions: users must hold AUCTION to participate in the platform's auction activities, pay fees, or receive additional rewards. At the same time, AUCTION is also used for governance, allowing holders to propose suggestions and vote on the platform's development direction. As the platform's functions have expanded, the application scenarios of AUCTION have gradually extended from pure auction tools to DeFi, NFTs, and even physical asset auctions.

In recent years, Bounce Finance has continuously iterated, launching diversified mechanisms such as fixed-price auctions and Dutch auctions, and has attracted a large number of project parties and users through deep integration with the BNB Chain ecosystem. The Auction Intelligence (AI Agent Launchpad) launched in early 2025 further introduced AI technology to the platform, marking its move towards intelligence and diversification. The total supply of AUCTION is 10 million tokens, with a circulating supply of about 7.8 million tokens, and its market value had already ranked among the small to medium-sized DeFi tokens before the surge.

On-chain whales hoarding large amounts, increasing concentration of chips

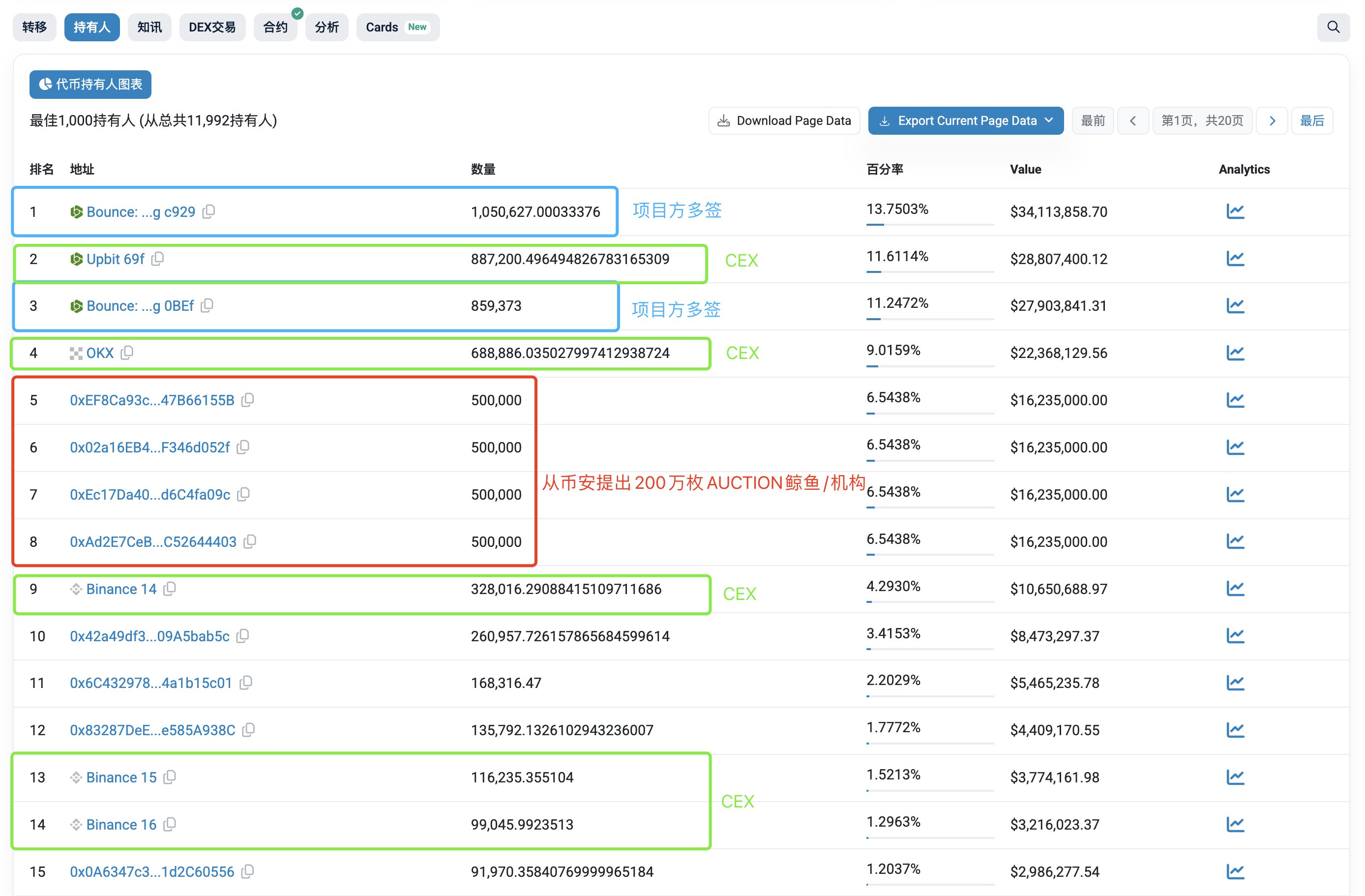

On-chain data shows that the circulating chips of AUCTION are rapidly concentrating in the hands of a few large holders. According to monitoring, one or a group of whales/institutions have cumulatively withdrawn 2 million AUCTION from Binance through multiple addresses over the past three weeks, accounting for 26% of the total supply, with a total value of about $62.44 million. As of March 16, Binance's AUCTION balance was only 706,000 tokens (about 9%), significantly reducing the potential selling pressure from the exchange's spot market.

The specific timeline is as follows:

- On March 8, a newly created wallet withdrew 160,700 AUCTION from Binance (about $2.45 million).

- On March 10, whales cumulatively bought 386,300 AUCTION (about $6.31 million), with unrealized profits reaching $465,000.

- From March 14 to 16, the same institution withdrew another 365,000 AUCTION (about $9.62 million) and 134,000 AUCTION (about $415,000) through new addresses.

Current on-chain chip distribution shows:

- Exchange wallets (Upbit/Binance/OKX): 2.11 million tokens (27%);

- Whales/institutions hold: 2 million tokens (26%);

- Project party multi-signature address: 1.91 million tokens (25%).

This highly concentrated chip structure indicates that the whale/institution has achieved a certain degree of "control." The tightening liquidity in the spot market lays a solid foundation for price increases.

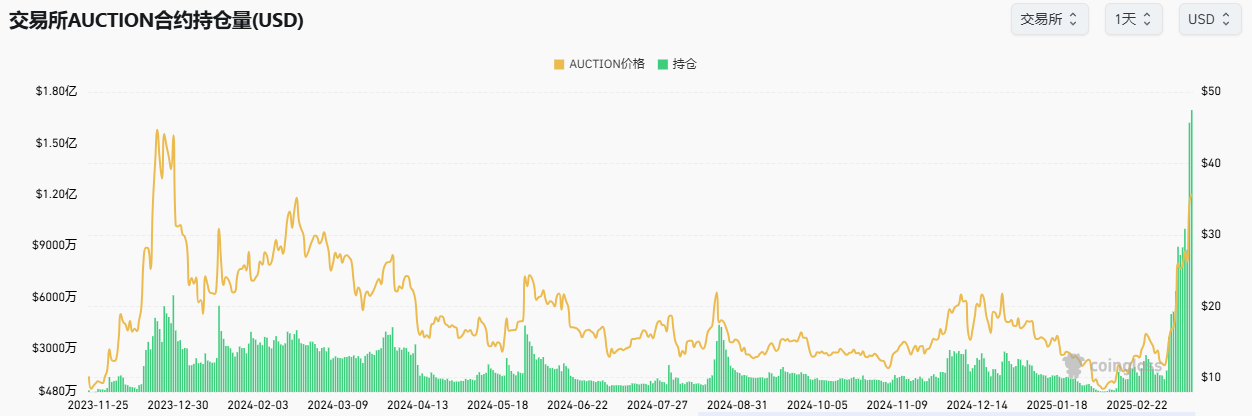

Surge in contract trading volume, leverage fuel boosts the rally

The explosive rise of AUCTION is closely related to the booming contract market. Data shows that the recent contract trading volume of AUCTION has reached 10 times that of the spot trading volume, with prices completely breaking through the dense area of bottom chips. This high ratio of contract positions has brought significant effects and explains why some investors favor such tokens.

The logic can be summarized as follows:

First, high contract positions mean intense long-short battles, with ample market counterparties providing momentum for price fluctuations. The contract positions of AUCTION even exceed its market value, suggesting that the strength of the backers is strong, with ample chips and a strong willingness to push the price. Second, the panic operations of high-leverage players become the "fuel" for the rally. Once the price starts to rise, the chain reaction of liquidation or reverse buying can quickly amplify the increase.

For example, if an investor shorts AUCTION at $25 and the price rises to $28, facing the pressure of losses, they may choose to cut losses and close their position or even go long. This psychological game is infinitely amplified in an environment of high contract positions, and the panic operations of a large number of retail investors further push up the price. Currently, AUCTION has reached a 300-day high, but the inflow of funds has slowed down, indicating that the rally's momentum may be approaching a temporary peak. This also confirms the characteristics of tokens with high contract positions: strong control by backers, significant leverage effects, and substantial short-term explosive power.

Expectations for new projects and the catalytic heat of the BNB ecosystem

The price fluctuations of AUCTION have always been closely related to the popularity of IEO (Initial Exchange Offering) projects on the Bounce Finance platform. This surge coincides with the platform's launch of the new AI Agent Launchpad—Auction Intelligence. This project went live on March 3 on the BNB Chain, allowing users to participate in the creation and issuance of AI agent tokens by holding $AUCTION or $Broccoli tokens. The platform also distributes 1,000 AUCTION tokens daily for 10 days. This mechanism directly stimulates token demand and ignites market expectations for new IEO projects.

At the same time, the BNB ecosystem has recently performed strongly, and as an important DeFi project on the BNB Chain, Bounce Finance and its token AUCTION naturally benefit from this trend. The innovative concept of AI+DeFi in Auction Intelligence further enhances the project's attractiveness and may serve as an important signal for whales to position themselves in advance.

Additionally, Bounce Finance has announced the upcoming launch of a physical auction event featuring Yayoi Kusama's artwork "Pumpkin" (1998), which will be exhibited in Seoul, South Korea, in mid-April, reinforcing the status of $AUCTION as a core utility token. This series of positive news injects more imagination into the market.

Conclusion

The explosive rise of AUCTION stems from a combination of multiple factors: the hoarding of on-chain whales has built a chip foundation, the leverage effect in the contract market has propelled prices upward, the excitement of Auction Intelligence and the BNB ecosystem has stimulated market enthusiasm, and speculative sentiment has further fueled the upward trend. For investors, it is essential to closely monitor on-chain capital movements and changes in contract positions in the short term while remaining vigilant about high-level pullbacks. Whether the new IEO will become the trigger for the next wave of market activity remains to be confirmed by the subsequent developments of Bounce Finance.

Meanwhile, the market is weaving a series of straightforward and enticing narratives for investors: BTC's "insider dumping and liquidation battles," BNB's "ecological hype," AUCTION's "whale control," and BNX's "contract settlement games." These stories hide similar logic behind them—markets dominated by backers, where bold following can provide opportunities for profit. However, this "backer-led" model, while simple and crude, conceals hidden dangers: the 26% concentration of AUCTION chips may signal short-term profits, but the potential selling risks from backers are also chilling. In this wave, the contest between rationality and impulse has just begun.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。