Trump calls out again, investors have withdrawn from U.S. stocks, turning to cash, bonds, gold, and overseas assets, as the pillars of the U.S. economy face severe challenges.

Author: Xiao Yanyan

Trump stated that he will begin imposing broad reciprocal tariffs and additional tariffs on specific industries starting April 2.

On Air Force One on Sunday local time, Trump told reporters, “In some cases, we will impose ‘two’ taxes on foreign goods imported into the United States. They charge us, and we charge them; in addition, we will impose extra tariffs on cars, steel, and aluminum.”

This statement indicates that, despite the initial measures disrupting financial markets and straining alliances, Trump still plans to push for a more aggressive tariff regime.

Trump had previously stated that his administration was preparing to impose what he calls reciprocal tariffs, which are tariffs calculated based on the tariffs and non-tariff barriers of the exporting countries. However, he also mentioned that he wants to prepare for key U.S. industries, including automobiles, steel, aluminum, microprocessors, and pharmaceuticals. It is still unclear whether these industry tariffs will be included in the reciprocal tariff system or if additional tariffs will be imposed on top of that.

Trump said, “April 2 is the day of liberation for our country. We want to take back some wealth that was given away by very, very foolish presidents who didn’t know what they were doing.”

Trump has already imposed a 25% tariff on steel and aluminum. He also announced a 25% tariff on goods from Canada and Mexico but later granted a one-month extension for goods that comply with the North American trade agreement (USMCA) negotiated during his first term. Trump also stated that Canada’s energy and potash (a key fertilizer) will only be subject to a 10% tax.

For many Americans, the era of “one-time” investments has just ended.

The chaotic tariffs and government budget cuts of the Trump administration have shocked a large number of ordinary investors, leading them to withdraw from U.S. stocks and invest in cash, bonds, gold, and European defense stocks. The S&P 500 index has maintained a difficult-to-surpass increase, but last week it fell into correction territory, with Wall Street worried that the economy is sliding into recession.

According to a survey by the American Association of Individual Investors, the proportion of investors optimistic about the U.S. stock market is currently at its lowest level since September 2022. Of course, many people have not moved their portfolios but are following standard financial advice to avoid making hasty decisions during market turbulence.

People's economic outlook is also closely related to their political leanings. Some of Trump’s supporters say they are not worried and are even looking for buying opportunities. However, this is a sudden shift, as in recent years, it was easy to assume that the stock market would continue to rise due to a strong economy.

According to data from the Investment Company Institute, in the seven days ending March 5, individual investors added a net $30.4 billion to money market funds, the largest weekly increase in over a year.

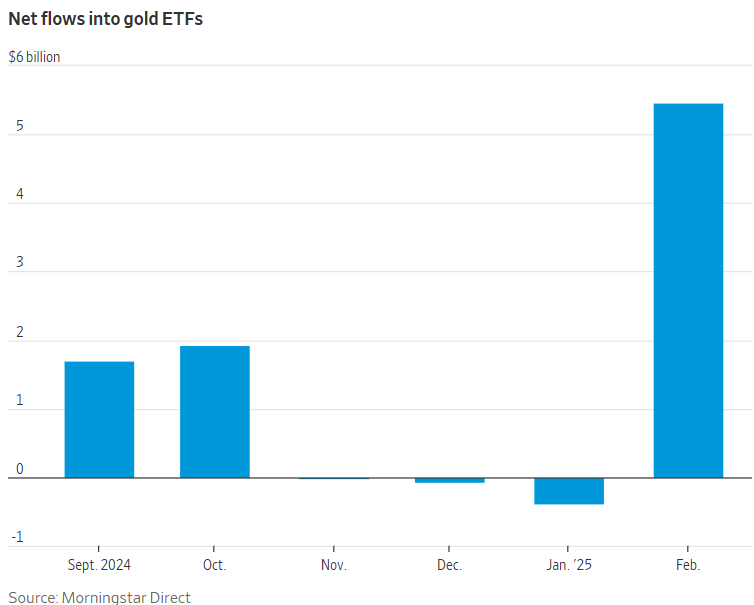

At the same time, according to data from Morningstar, in February, net inflows into U.S. physical gold ETFs exceeded $5 billion. As of last Tuesday, investors had added another $1 billion this month. Gold prices broke through $3,000 per ounce for the first time last week.

Net inflows into gold ETFs

Others are looking overseas. Data from the London Stock Exchange Group shows that last month, investors invested $1.8 billion in European stock ETFs registered in the U.S.

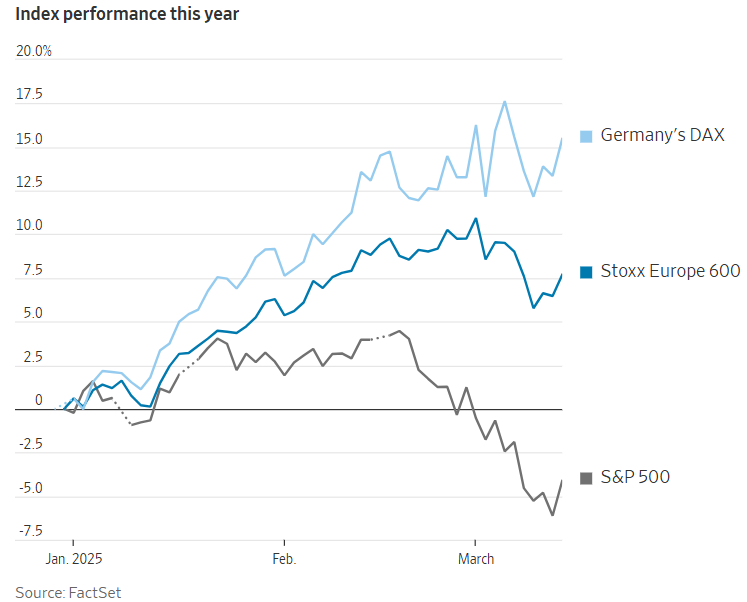

In the first few months of 2025, international markets have outperformed the U.S. stock market. The Stoxx Europe 600 index has risen 7.7% so far this year, the German DAX index has risen over 15%, while the S&P 500 index has fallen 4.1%. Some believe that signs of a crisis are emerging in the U.S. market, while others think there is no need for concern.

Stock index performance this year

Stock market decline threatens the pillars of the U.S. economy

U.S. consumer spending is highly dependent on the wealthy, who in turn are highly reliant on the stock market. Investors are worried that the White House's aggressive and rapidly changing tariff war could undermine a soft landing for the economy. Sentiment has turned gloomy, but the market shrinkage may just be the beginning of a chain reaction that could cause more collateral damage.

Harvard economist Gabriel Chodorow-Reich estimates that, all else being equal, a 20% drop in the stock market in 2025 could reduce this year's economic growth by as much as one percentage point. As of last Friday's close, the S&P 500 index has fallen 4.1% so far in 2025.

A drop in stock prices could siphon off two major engines of recent U.S. prosperity: strong household spending and corporate capital investment.

“In a super-financialized economy like the U.S., asset prices can lead the economy, and a decline in asset markets poses a risk of weakening the real economy,” said Alex Chartres of the British fund management company Ruffer.

According to Moody's data, the top 10% of earners in the U.S. now account for about half of all spending, compared to just 36% thirty years ago.

A recent survey by the Federal Reserve showed that as of 2022, the top 10% of households had an average of about $2.1 million in stocks per person, accounting for about 32% of their net worth. In 2010, stocks accounted for about 26% of the average net worth of this group.

In the past four years, spending by the top 10% of earners has increased by 58%. The influx into the stock market is not limited to the wealthiest. Reports from Vanguard and Fidelity show that participation and contribution rates for the working class in their 401(k) plans have reached record highs.

Federal Reserve data shows that by the end of last year, 43% of American households' financial assets were in stocks, a record high. Many low-income households do not own stocks, but the proportion of those who do is continuing to rise.

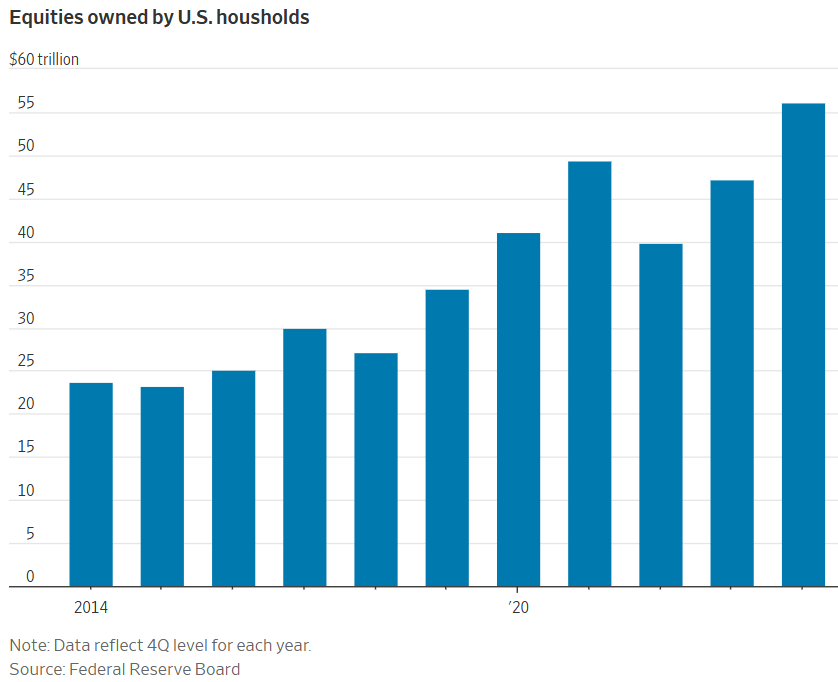

Value of stocks owned by American households

For this reason, some economists are concerned that a severe market downturn could prompt Americans to cut back on all spending, from vacations to buying new clothes, a phenomenon known as the wealth effect. According to Deutsche Bank economists, if the stock market had merely stabilized last year instead of rebounding, last year's consumer spending would have grown by only about 2%, rather than the 3% partially driven by the stock market wealth effect.

Some signs indicate that consumption may have already begun to decline. Companies including Delta Air Lines, Foot Locker, and Brown-Forman, the maker of Jack Daniel's whiskey, have reported that consumers seem to be more cautious. In January, retail sales fell by 0.9%, the largest monthly decline so far in 2023, although some economists attribute this to unusually cold weather. February data will be released on Monday.

Matthew Luzzetti, chief U.S. economist at Deutsche Bank, said that if nothing else changes, a 20% drop in stocks could drag down consumer spending by 1.2 percentage points in 2025. Since consumption accounts for about 70% of GDP, this would result in a roughly 0.8 percentage point drag on economic growth.

Independent economist Phil Suttle is concerned that as the Nasdaq index has fallen more than 10% from its peak, frightened executives may abandon plans to spend about $1 trillion on AI-related investments over the next few years.

Chodorow-Reich and two colleagues found in a 2021 study that for every $1 change in stock market wealth, household spending is affected by about 3 cents on average. According to Federal Reserve data, as of the end of last year, American households owned over $56 trillion in stocks directly or through products like mutual funds, so the impact of stock market fluctuations on household spending is significant.

Economists Sydney Ludvigson and Martin Lettau studied the wealth effect in the early 2000s. They concluded that over time, stable stock returns promote consumption, but people generally do not overreact to short-term market fluctuations. The challenge for economists is that before a rebound or reversal becomes a thing of the past, you cannot know which rebounds or reversals will persist.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。