Author: flowie, Nianqing, ChainCatcher

Last week, Binance suddenly ordered a crackdown on market makers, shifting the conflict from VCs and exchanges to market makers. However, for most people, market makers are like a black box, difficult to understand and often misunderstood. This article organizes some common questions and reference answers that people have regarding crypto market makers (mainly referring to market makers serving projects on CEX).

1. What are the crypto market makers?

Currently, RootData has recorded about 60 crypto market makers. However, the actual number of market participants may be far more than this, as many market makers operate anonymously behind the scenes.

Among the 60 publicly disclosed, only a few are active in the public eye, and which market makers are involved in which projects remains a black box for most ordinary users.

It is difficult to clearly categorize or rank market makers, but based on the total on-chain holdings, the larger ones include Jump Trading, Wintermute, QCP Capital, GSR Markets, B2C2 Group, Cumberland DRW, Amber Group, and Flow Traders, which are also well-known market makers in the market.

2. Which type of market maker might be manipulating the market?

From an insider's perspective, market makers are generally divided into proactive market makers and passive market makers. @MetalphaPro's Head of Ecosystem Maxxx provided a detailed introduction in his tweet. Recommended reading: Confessions of a Frontline Market Maker: A Dark Forest Survival Guide for Project Parties

In simple terms, proactive market makers are often referred to as "whales," colluding with or backstabbing project parties to manipulate market prices and harvest retail investors. Many proactive market makers may only come to light after being investigated and prosecuted by regulatory agencies.

Passive market makers primarily place maker orders on the order books of centralized exchanges, providing market liquidity and are more neutral, not dominating coin prices. The strategies and technologies they provide are also more standardized.

Due to significant compliance risks, proactive market makers often operate anonymously.

Some proactive market makers may disguise themselves as investment institutions, incubators, etc.

The market maker Web3port, which was recently reported to be banned by Binance, appeared as an incubator and has participated in 26 investments in the past year, with at least 6 projects that have issued tokens.

The extent of profitability can also indicate whether a market maker is proactive or passive. According to crypto KOL @octopusycc, "profitable market-making institutions" are likely to be manipulating the market, with few actually engaged in market making.

A healthy market-making business should provide quotes for both buyers and sellers, maintaining market liquidity and relatively stable prices. In this model, the profit margins are not large and rely on exchange incentives and other models.

3. Which crypto market makers have been sued or investigated by regulatory authorities?

After the crypto crash in 2022, crypto market makers became one of the key targets for regulatory investigations. However, after Trump took office, the regulatory environment loosened, and some lawsuits were gradually withdrawn or settled.

The first market maker to be closely monitored by regulators was Jump Crypto. A 2023 U.S. class action lawsuit revealed that during the 2022 Terra UST stablecoin collapse, Jump Crypto's subsidiary Tai Mo Shan Limited collaborated with Terra to manipulate the UST price, profiting nearly $1.3 billion, leading to an SEC lawsuit for market manipulation and operating as an unregistered securities dealer. However, in December 2024, Tai Mo Shan agreed to pay the SEC $123 million in settlement and has recently been expanding its team to resume crypto operations.

In addition to the SEC's accusations, on June 20, 2024, Fortune reported that the CFTC is also investigating Jump Crypto, but the CFTC has not yet initiated formal charges. Recommended reading: “With a Troubled Past, Jump's Full Resumption of Crypto Operations Faces an Awkward Situation”

Another large market maker, Cumberland DRW, was also accused by the SEC of being an unregistered securities dealer, and Cumberland allegedly earned millions of dollars in illegal profits through trading with investors. This lawsuit was also recently withdrawn.

Compared to these two large market makers, in October 2024, a large-scale fraud and manipulation case involving 18 individuals and entities in the crypto market initiated by the SEC in conjunction with the FBI and DOJ brought some market makers to light, including Gotbit Consulting, ZM Quant Investment, and CLS Global. These market makers were primarily accused of being meme market makers.

In addition to regulatory accusations, the very active crypto market maker DWF Labs has been repeatedly reported by media such as CoinDesk and The Block for market manipulation details.

For example, The Block stated that DWF was able to collaborate with 35% of the tokens ranked in the top 1000 by market capitalization within its short 16-month history. One significant reason is that DWF promised clients "to pump the price" when negotiating. For instance, shortly after its establishment in September 2022, DWF's promotional materials frequently mentioned price action. In a section titled "Price Management," DWF claimed it could synchronize with potential clients' marketing teams to help the token's price respond to relevant events, commonly known as "coordinating favorable news to pump the price."

_Recommended reading: _“The Block Investigates DWF Labs: The Operational Secrets Behind Investing in 470 Projects”

4. What common manipulative behaviors do market makers exhibit?

The malfeasance of market makers typically manifests as harm to the market and harm to project parties. Common manipulative behaviors include:

Wash trading. Creating artificial trading activity by simultaneously buying and selling assets to increase trading volume and liquidity.

Fraud. Placing large buy or sell orders without the intention of executing them, aiming to mislead other traders and influence asset prices.

Pump and dump. These schemes involve coordinating with other market participants to artificially raise asset prices through aggressive buying. The market maker then sells at a higher price, leading to a price crash.

Examples of market malfeasance are not uncommon. For instance, Jump Crypto was fined $123 million for manipulating the UST price in collaboration with Terra, and Alameda Research was implicated in the previous bull market collapse.

Let's look at a case of harm to a project party:

In October 2024, crypto game developer Fracture Labs sued Jump Trading, accusing Jump of implementing a "pump and dump" scheme using its DIO game token.

In the lawsuit, Fracture Labs stated that in 2021, it reached an agreement with Jump to assist in the initial issuance of its DIO token on the cryptocurrency exchange Huobi (now HTX). Fracture Labs lent Jump 10 million DIO tokens, worth $500,000, and sent an additional 6 million tokens to HTX, worth $300,000. The token price then soared to a high of $0.98, with Jump's borrowed tokens valued at up to $9.8 million, and Jump subsequently sold all its holdings at the peak.

The "mass liquidation" caused DIO to plummet to $0.005, and Jump later repurchased 10 million tokens at a lower price (about $53,000) and returned them to Fracture Labs, terminating the agreement.

In this incident, the cooperation model between Fracture Labs and Jump is a mainstream Token loan model. Although common, there are numerous cases where project parties have been "cut."

5. What cooperation models exist between market makers and project parties?

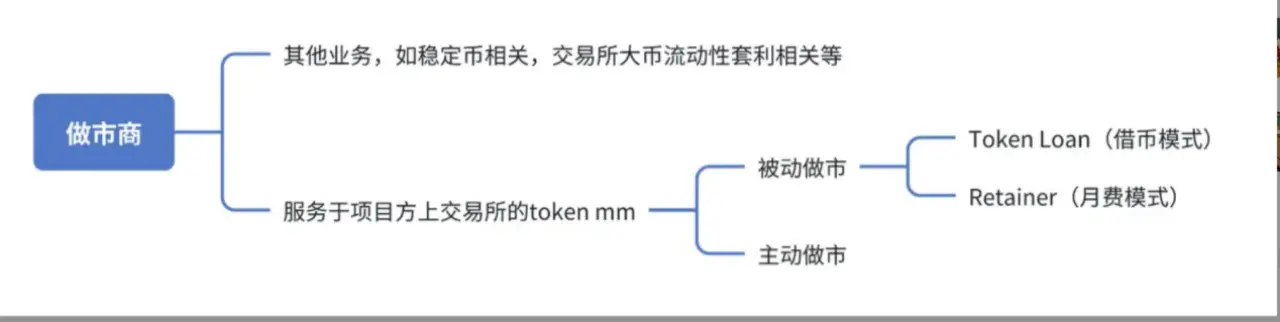

As mentioned earlier, market makers are divided into proactive and passive.

Proactive market makers often have no standard practices. Maxxx mentioned that the terms of cooperation vary widely, involving token lending, API access, financing, profit sharing, and other models. There are even cases where rogue market makers do not communicate with project parties and directly use their own funds to seize tokens, and after acquiring enough chips, they operate the market themselves.

So how do market makers operate? Canoe founder Guangwu shared common methods for institutions to operate tokens in his article.

One is strong whale control, where, under the condition that the project's fundamentals are sound, a target is chosen to start operations (the project party may know or may not know, which is not significant).

- Phase one: Accumulation. The typical market behavior is to continuously accumulate at low prices.

- Phase two: Consensus phase of the market-making institution. The main indicator in this phase is trading volume, first raising a wave, then exchanging hands with other market makers during fluctuations (recovering costs, improving capital utilization, establishing risk control models).

- Phase three: Harvesting phase. Further raising the price while selling to recover funds, some institutions may also voluntarily assist the project party in building fundamentals during this step.

The second is to create a value anchor for the target, rapidly improving the project's fundamental quality in terms of funding and trading volume through lending and derivatives. The former head of trade at FTX, @octopuuus, mentioned that under the lending model, collateralizing FTT to borrow BTC/ETH, the value anchor of FTT is BTC and ETH, with circular lending and leverage, which could even lead to borrowing BTC/ETH to pump FTT.

_Recommended reading: _“The Past of Market Manipulation: The Love-Hate Relationship Between Market Makers, Project Parties, and Exchanges”

The more benign passive market maker services are relatively standardized. The service models are divided into Token loan (borrowing tokens) mode and monthly fee mode. The Token loan mode is currently the mainstream and most widely adopted cooperation model. Recommended reading: Confessions of a Frontline Market Maker: A Dark Forest Survival Guide for Project Parties

Source: Maxxx's tweet

In the Token Loan mode, the project party needs to lend a certain proportion of tokens to the market maker for market making.

After the service period ends, the project party needs to return the tokens but will settle according to the agreed option value. (The option value refers to the economic value of the option contract at a specific point in time), for example, if 1 million U tokens are borrowed, and the option value accounts for 3% of the borrowed asset, when returning, the project party can earn 30,000 U as cooperation income, which is also the main source of income for market makers.

The benefit of the project party choosing the Token Loan mode is that it can quickly establish liquidity through the professional capabilities of the market maker, avoiding the risks of operating the market themselves.

The monthly fee mode is relatively easier to understand; the project party does not lend tokens to the market maker, and the market maker provides market making through API integration. The project party does not have to worry about the market maker engaging in malfeasance, but they bear the profits and losses during the order placement process. The project party also needs to pay a monthly service fee.

6. How competitive are market makers? Why do VCs want to build their own market-making teams?

Maxxx mentioned in his tweet that not only are market makers becoming increasingly competitive, but many VCs and project parties are also forming temporary teams to start market making. Some teams even lack basic trading capabilities and just take the tokens first, as they ultimately end up at zero, not fearing the inability to cash out.

The reason is clear: in a situation where the price of tokens becomes the only product for most projects, the liquidity that unlocks at the opening is the most valuable part.

For example, although VCs obtained token shares early on, they had to wait for the project party to open the market, unlocking step by step according to the rules, while market makers can unlock at the opening, providing them with significant operational space.

7. Why are crypto market makers investing?

According to a perspective provided by industry insiders, generally good project parties are surrounded by market makers. By investing, they can engage with project parties early on, transforming from a purely passive party to one with a certain degree of initiative. After investing, they can also legitimately follow up on the progress of the project party, seizing key projects and critical nodes to gain an advantage in market making.

For project parties, in addition to receiving real cash, they also gain a sense of security from being in a community of interests with market makers. During the token listing phase, market makers can indeed provide significant assistance. Exchanges already have some requirements for market makers regarding listed projects.

However, this is not entirely a good thing. The investment that project parties receive from market makers may also come with a "price tag." Even if market makers invest in project parties, they may choose to dump the tokens for profit once they obtain liquidity that unlocks at the opening.

Moreover, market maker investments may not necessarily be genuine investments. The Block reported on DWF, stating that many industry insiders believe DWF's multimillion-dollar investments in crypto startups are better described as over-the-counter transactions. These OTC transactions allow startups to convert their tokens into stablecoins instead of DWF injecting cash upfront, after which DWF transfers the tokens to exchanges.

Some market maker investment activities have become signals for ordinary investors to anticipate price increases.

In addition to investments, crypto market makers also provide other resource support to collaborate with project parties.

For example, liquidity support; if it is a DeFi project party, the market maker can promise to provide liquidity support.

They can also facilitate connections with resources such as VCs and exchanges. For instance, introducing more VC investors and helping project parties manage relationships with exchanges. Especially in the strong buying market of South Korea, market makers can provide some so-called comprehensive liquidity planning.

8. Why do project parties mostly choose multiple market makers?

Knowing that eggs should not be placed in one basket, project parties will choose three or four market makers to diversify the opening liquidity held by market makers, reducing the risk of malfeasance.

However, the saying "three monks have no water to drink" suggests that this approach may also carry risks. According to industry insiders, some market makers may slack off and not perform their duties, making it difficult for project parties to monitor the market-making behavior of market makers and hold them accountable.

9. Do market makers have such significant capacity for malfeasance?

A study by Forbes in 2022 on 157 cryptocurrency exchanges found that over half of the reported Bitcoin trading volume was fake or non-economic wash trading.

As early as 2019, a white paper submitted by Bitwise Asset Management to the U.S. SEC pointed out that among the 83 cryptocurrency exchanges analyzed at that time, 95% of Bitcoin trading volume was fake or non-economic. This finding sparked widespread attention to the behavior of market makers in the industry.

Market makers may not be the root cause, but they are indeed the primary tools for implementing operations.

As service providers, market makers are often more like guns, tools. The demands of exchanges and project parties are the starting point.

During bull markets, the entire system jointly creates massive profits, allowing all parties to maintain at least a minimum level of harmony. However, during bear markets, this entire chain accelerates the outbreak of liquidity crises, leading to a repeat of face-tearing and mutual accusations.

Market makers are not entirely the "scapegoats" for liquidity exhaustion. The current predicament in the crypto market is not solely caused by market makers. Although they are direct creators of "false prosperity," the entire complete interest chain also includes project parties, VCs, KOLs, and yield farming studios.

10. Why is it difficult to constrain the malfeasance of market makers?

The lack of regulation is indeed a core reason for the malfeasance of market makers, but the inability of project parties, exchanges, and other trading counterparts to effectively constrain them is also an important factor.

Due to the covert nature of market maker behavior, the industry has not yet formed clear and unified standards and norms. Project parties themselves also find it challenging to supervise and restrict the operations of market makers. Once malfeasance occurs, project parties often have to rely on post-event accountability, but this accountability is also very weak.

According to industry insiders, apart from on-chain market making, only centralized exchanges can monitor the behavior of market makers. Although market makers generally agree with project parties on monitoring methods, once tokens are sent to a third party, they must rely heavily on that party's reputation and ethical standards.

Of course, project parties can also choose the monthly fee model offered by market makers. The monthly fee model usually involves short-term contracts (settled monthly), allowing project parties to flexibly adjust cooperation partners or strategies based on market performance, avoiding long-term binding with unreliable market makers. Project parties can also negotiate to include KPIs (such as minimum daily trading volume, maximum price spread limits) in the monthly fee contract to ensure the quality of market maker services. However, the problem with this model is that project parties transfer the risks originally spread across market makers back onto themselves, needing to bear losses.

Additionally, while project parties can stipulate details such as accountability for breaches of contract in the contract terms, determining what constitutes a "breach" by the market maker is also challenging. Project parties need to provide sufficient evidence to prove the market maker's breach, but even with trading records, proving "causal relationships" (i.e., that the market maker's actions directly led to a price crash) requires extensive data analysis, which is costly and time-consuming in legal proceedings. Market makers can still argue that market fluctuations are caused by external factors (such as macroeconomic events or investor panic).

The entire process involves different trading counterparts, including exchanges, project parties, and market makers, making it difficult for project parties and the market to be 100% informed about market maker operations.

Furthermore, due to the symbiotic nature of cooperation between centralized exchanges and market makers, exchanges find it challenging to implement thorough crackdowns on their largest profit creators. Therefore, in the GPS and SHELL incidents, Binance ultimately chose to freeze the accounts of market makers involved in the GPS incident and publish detailed evidence and malfeasance methods, which is highly significant. Proactively disclosing evidence and taking action is, to some extent, a positive response to regulatory pressure and also reflects industry self-discipline. This may encourage other exchanges to follow suit, forming a new trend in the industry to protect users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。