With only two days left until the Federal Reserve's Federal Open Market Committee (FOMC) meeting on March 19, 2025, global financial markets and cryptocurrency investors are holding their breath for this interest rate decision. As one of the eight regular meetings in 2025, this meeting will not only determine whether to maintain the current benchmark interest rate (4.25%-4.5%) but may also reveal the future direction of monetary policy through remarks from Federal Reserve Chairman Jerome Powell. This article synthesizes predictions from authoritative media and key opinion leaders (KOLs) in the cryptocurrency and investment circles, providing an in-depth analysis of the potential outcomes of this meeting and its impact on the crypto market.

Federal Reserve Interest Rate Predictions: Consensus on No Change

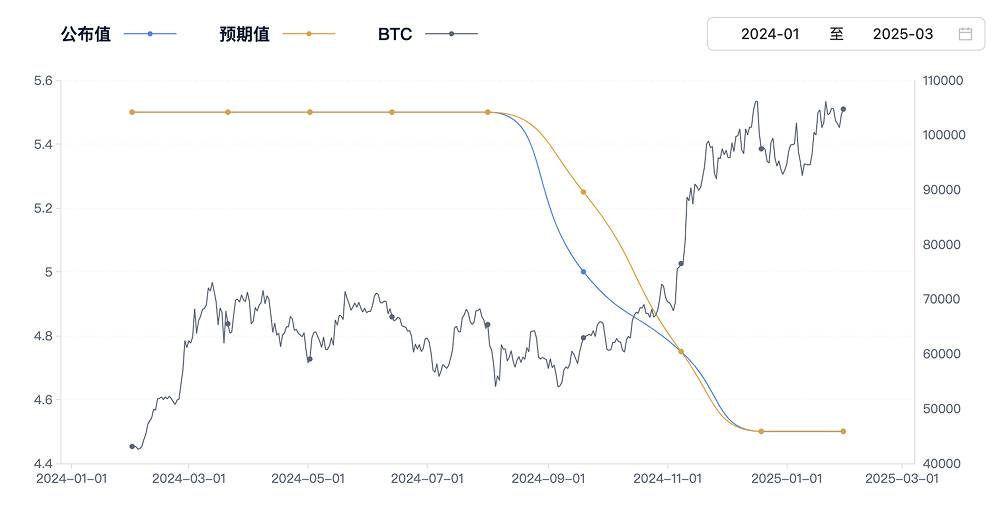

According to the latest reports from authoritative media, the market widely expects the Federal Reserve to maintain interest rates at 4.25%-4.5% on March 19. Forbes, in its March 3 article "Remaining FOMC Meeting Schedule and Interest Rate Outlook for 2025," pointed out that the fixed income market anticipates two to three rate cuts in 2025, but the likelihood of cuts in March and May is relatively low. Investing.com cited economic calendar data indicating that the current inflation rate is stable at around 2.8% (February data), and the job market remains robust, suggesting that the Federal Reserve may pause rate adjustments to observe more economic signals. Kiplinger further added that market expectations for the first rate cut in June or July are heating up, but March will still be a "wait-and-see" period.

The Federal Reserve's decision-making logic is based on multiple factors: inflation has fallen from its peak in 2022 but remains above the long-term target of 2%; while the labor market has not significantly deteriorated, signs of slowing growth are emerging; global economic uncertainties (such as geopolitical tensions and supply chain pressures) may also prompt the Federal Reserve to remain cautious. A Bloomberg analyst, who wished to remain anonymous, stated, "Unless there are unexpected fluctuations in March data, the Federal Reserve has no reason to disrupt the current balance."

Views from Crypto and Investment KOLs: Short-Term Stability, Long-Term Bullish

In the cryptocurrency and investment fields, KOLs have provided additional perspectives on the predictions and interpretations of this meeting. Here are analyses from several representative figures:

Anthony Pompliano (@APompliano): Founder of Pomp Investments, Pompliano predicts, "Unless Powell unexpectedly makes hawkish remarks, this week's Federal Reserve meeting will have little impact on the market, and cryptocurrencies will continue to rise steadily." He believes the market has already priced in the expectation of maintaining interest rates, and Bitcoin and other crypto assets may remain stable or even rise slightly in the short term.

PlanB (@100trillionUSD): Known for the Stock-to-Flow model, PlanB stated, "Bitcoin is holding above $80,000 before the FOMC, and if the Federal Reserve maintains 4.25%-4.5%, I expect it to consolidate first and then push to $100,000 in the second quarter." He analyzed that Bitcoin's key support level is at $80,000, and if the meeting results are as expected, the market may continue its bullish trend.

Raoul Pal (@RaoulGMI): CEO of Real Vision, Raoul Pal pointed out, "The Federal Reserve may keep rates unchanged this week, but the crypto bull market doesn't care—liquidity is flowing in from other channels (like ETFs and reserves)." He emphasized that even if the interest rate policy remains unchanged, institutional funds and policy support (such as a potential U.S. Bitcoin strategic reserve) will be the main driving forces for market growth.

Erik Voorhees (@ErikVoorhees): Founder of ShapeShift, Voorhees downplayed the importance of the interest rate decision in a post earlier this month: "Central banks cannot stop the wave of decentralization; interest rate decisions are just noise in the long-term trend of crypto." He believes that short-term fluctuations will not change the structural growth of the crypto market.

Brian Armstrong (@brian_armstrong): CEO of Coinbase, Armstrong stated, "In a high-interest-rate environment, the adoption of cryptocurrencies is accelerating as people seek alternatives." If rates remain at 4.25%-4.5%, he may see more investors turning to assets like Bitcoin to hedge against uncertainties in traditional finance.

Crypto Rand (@crypto_rand): Technical analyst Crypto Rand predicts, "There is a 98% probability that the FOMC will keep rates unchanged on March 19, with Bitcoin resistance at $82,000, and altcoins waiting for breakout signals." He advises investors to pay attention to market reactions after the meeting, especially whether Bitcoin can break through key resistance levels.

Niu Ge.eth (@btc100w100w) noted on March 17, "The FOMC meets next week, BTC is mainly consolidating, as long as it holds $80,000, it's fine," emphasizing short-term stability and suggesting a wait-and-see approach. Dayu (@BTCdayu) predicted on March 16, "If rates remain unchanged and there are no hawkish remarks, BTC can return to $82k," and added on March 14 that if the meeting hints at a rate cut in June, BTC and altcoins are likely to rise together. DiscusFish (@bitfish1) warned on March 17, "Rates are stable, but if the dot plot is too hawkish, BTC may need to test $75k," suggesting the market may consolidate until the end of the month. Hua Hua (@huahuayjy) stated on March 16, "If rates remain unchanged, BTC stabilizing at $78k is a win, and if dovish, it can push to $85k," focusing on Powell's statements.

Potential Impact on the Crypto Market

The Federal Reserve's interest rate decision affects cryptocurrency prices through mechanisms such as liquidity, risk appetite, and market expectations. Here is an analysis of different scenarios:

Scenario 1: Maintain Interest Rates (4.25%-4.5%), Dovish Tone

- Short-term impact: If Powell hints at the possibility of rate cuts in May or June during the post-meeting press conference, the crypto market may rise due to increased liquidity expectations. PlanB predicts Bitcoin will challenge $100,000 in the second quarter, while Raoul Pal is optimistic about the continued inflow of ETF funds. Altcoins may follow Bitcoin's rise after a breakout but will need more catalysts (such as favorable regulations).

- Long-term impact: Clarification of rate cut expectations will stimulate demand for risk assets. Historical data shows that after the Federal Reserve slowed rate hikes in the first quarter of 2023, Bitcoin's price rose by 20% (AiCoin data). KOLs like Saylor and Armstrong believe this will strengthen Bitcoin's safe-haven attributes.

Scenario 2: Maintain Interest Rates, Hawkish Signals

- Short-term impact: If the Federal Reserve delays rate cuts until the second half of the year or emphasizes inflationary pressures, the market may experience a brief pullback. Pompliano warned that hawkish remarks could trigger sell-offs, and Bitcoin may test the $80,000 support level. Altcoins, being more sensitive to liquidity, may experience larger declines.

- Long-term impact: Despite short-term pressure, Voorhees and Tyler Winklevoss believe the decentralization trend in the crypto market and external capital inflows (such as ETFs) will offset the negative impacts of the interest rate cycle.

Scenario 3: Unexpected Rate Cut (to 4%-4.25%)

- Short-term impact: Although the probability is low (market expectations are under 5%), if it occurs, Bitcoin may quickly break through the $82,000 resistance level, and altcoins will also see a broad rebound. Crypto Rand predicts that funds will rapidly flow into high-risk assets.

- Long-term impact: An early rate cut may signal the start of a loosening cycle, similar to the policy shift after the pandemic in March 2020, and the crypto market may enter a new bull market.

Data Support

- Historical response: After the rate cut in December 2024, Bitcoin rose 5% in the short term but fell 3% due to subsequent hawkish expectations (CryptoBriefing). This indicates the market's sensitivity to Federal Reserve guidance.

- Current technical situation: X posts show that Bitcoin is facing pressure at the $81,000-$82,000 level before the meeting, with volatility potentially exceeding 15% within 72 hours after the decision (@m_mieast).

Conclusion

The Federal Reserve's interest rate meeting on March 19, 2025, is not only a focal point for traditional financial markets but will also influence the cryptocurrency ecosystem through expectations. Authoritative media predict that interest rates will remain unchanged, while crypto KOLs generally believe that short-term fluctuations will be limited and the long-term trend remains positive. Whether through PlanB's technical analysis, Saylor's safe-haven narrative, or Pal's macro perspective, the structural bull market in crypto seems to have transcended the constraints of a single monetary policy. Investors should remain patient and closely monitor the meeting results and subsequent economic data to seize potential opportunities.

This article represents the author's personal views and does not reflect the stance or views of this platform. This article is for informational sharing only and does not constitute any investment advice to anyone.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。