No matter how big the matter today, by tomorrow it becomes a small matter; no matter how significant the matter this year, by next year it becomes a story; no matter how great the matter in this life, by the next life it becomes a legend. Life is like a journey, full of hardships and scenery along the way. What you see is the realm of your life. If you always see people better than yourself, it means you are on the uphill path; if you always see people worse than yourself, it means you are on the downhill path. Instead of complaining, it is better to think about change.

Wise people do not need to say much; the results are obvious. Did the weekend market validate the predictions of Zongheng? Saturday had almost no market activity, and the fluctuations on Sunday night and early Monday proved this point. Yesterday's market almost went through a decline followed by a rebound and then a further dip, and now it is again in a rebound phase. Originally, starting from around 5 PM yesterday, the market began to decline from around 84200. We once thought there would be no more opportunities to short, but unexpectedly, it rebounded to around 85000, directly giving us a position to enter short, and ultimately, as expected, it led to a decline, successfully reaching the target position of 82000. The only regret is that we had originally planned to buy at 81000 but couldn't get in; otherwise, it would have been an absolutely perfect situation. The profit margin was 3000 points, marking a good start for this week. Additionally, those who stopped losses last Friday were able to recover their losses, and there is still a surplus, which is a way to repay the trust of the brothers and sisters who have always believed in Zongheng. Zongheng also thanks everyone for their support; we will continue to work hard. As always, when we make money, we laugh together; when we incur losses, we bear them together. Zongheng's motto for everyone: Although dreams are distant, do not be afraid; steadfast action will lead to distant goals!

Returning to today's market, I don't know what happened today. Zongheng opened the market and looked at various cycles, feeling quite inexplicable, thinking that the market seems a bit strange, but I can't quite put my finger on it. First, from the larger weekly cycle perspective, it is clear that we are still in a major bearish adjustment period. From last week's K-line closing, there is a small bullish cross with a long shadow, which has a certain double-bottom probing flavor. Whether this bullish cross can become a turning point for the entire trend still needs confirmation. From a structural perspective, the current weekly line can only be considered to have ended the entire bearish cycle if it breaks above 95000, which will take some time.

The daily line is actually quite interesting. After a large bullish candle closed on Friday, the MACD began to enter a bullish volume cycle, but the weekend saw a fluctuating decline, preventing the bullish trend from strengthening. Thus, the current market, which is running in a descending channel, failed to build momentum for a breakout, leading to many unknown possibilities for the upcoming trend.

The four-hour chart is the most peculiar. The K-line on Saturday has already flattened out. Generally, there should have been a clear directional choice yesterday, but now we see that although there were fluctuations on Sunday night and early today, the moving averages have formed a tightly bonded structure, and there has been no actual directional breakout. Additionally, from the trading perspective, it seems that at the current position, there is a clear struggle between bulls and bears, with intense battles between market forces, creating a situation akin to a celestial battle. Therefore, today's theme is that the market is restless, and a good show is about to begin. The focus is on which side, bulls or bears, will prevail. For the bulls, they need to break above 85500, while for the bears, the key level is 82000. During the day, the market is unlikely to move significantly, especially with the opening of the US stock market, as the correlation between the crypto market and the US stock market is still quite strong. The four-hour bearish expectation we mentioned earlier has indeed played out, and now we need to consider whether this rebound can gain strength after the indicators are repaired. According to the plan, although we did not enter a low long position yesterday, today presents an opportunity to go long.

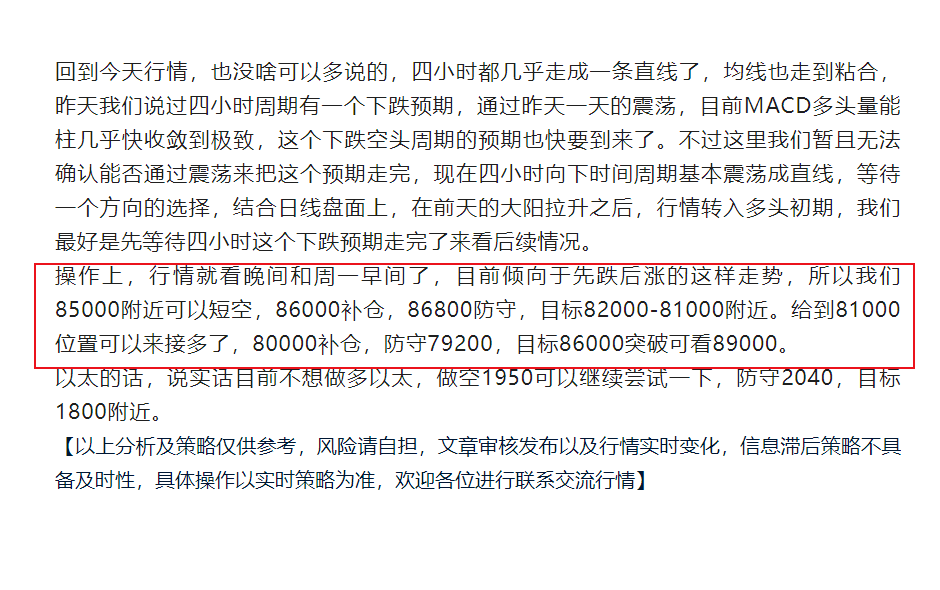

In terms of operations, if the market dips near 82000, we should enter a long position first, add to the position at 81000, with a stop loss at 80200, and target 85000-87000. If the market rises first, we can consider placing orders in the evening.

Ethereum did not provide a short position at 1950 yesterday. It seems that Ethereum is brewing something recently, with both rises and falls appearing to stabilize. Therefore, we consider going long on Bitcoin, while for Ethereum, we can set up a long position near 1850, with a stop loss at 1750, targeting above 2000.

【The above analysis and strategies are for reference only. Please bear the risks yourself. The article is subject to review and publication, and market conditions change in real-time. The information may be outdated, and specific operations should follow real-time strategies. Feel free to contact us for market discussions.】

Scan to follow!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。