Master Discusses Hot Topics:

It's Monday again, let's first talk about the market from the weekend until now. The funds that the bulls poured in last Friday night have not shown any significant signs of retreat so far. However, there will be a meeting late Wednesday night, and by Wednesday daytime at the latest, the main forces may choose to step back and observe.

Before and after the meeting, there will definitely be a clash between bulls and bears, and at that time, opportunities for short positions to take profits and for low-entry positions will emerge. Personally, I expect that if there is a dip after the meeting, there might be a rebound.

Because Powell shouldn't be too hawkish this month, after all, the market has already been quite miserable in February and March. A bit of easing would be beneficial for the future market; otherwise, we would face another one-sided drop, which no one can bear.

As for the short term, we will take it step by step, doing whatever the market brings us, and not always trying to predict anything. This year has been full of fluctuations, and shorting at highs is the main strategy, but it doesn't mean I am bearish; more often, it's about respecting the short-term pressure levels when they are reached and making a move when there is resistance.

If it drops to a key support level, as long as it doesn't break, trying to go long for a rebound is still worth a shot. However, at this stage, going long is just supplementary. This week, we can change our mindset and focus on low longs; if it doesn't make new highs, we won't short.

Everyone can think about which month the main forces would allow us to only trade in one direction for three or four weeks in a row? In a non-strong market, taking profits in batches on low longs is the safest. Timely adjusting positions, if it breaks through, we can change the pattern, and if it drops back, we can still protect our capital, as the saying goes, we can attack when we advance and defend when we retreat.

In the case of shorting at highs, we should pick strong resistance levels to act on; we don't need to worry about small points at general levels, as trading there can easily lead to being trapped. If you really want to play, try with a light position, and add to your position near the intraday high, forming a normal position, and wait for a pullback to take profits.

Speaking of Bitcoin, I personally expect the bulls and bears this week to tussle around 84.6 to 85k. If the meeting is hawkish, Bitcoin might directly retest 80k, or even explore 78 to 76k again.

If it leans dovish, it could break above 85k. If it stabilizes above 83.8k, it could directly surge to around 86.3 and 86.6k, then pull back to 85750 and 85150. If it stabilizes, it could head towards 89.8k, and if it stabilizes at 88k, we could see 91.1k and 95k.

This would be the most favorable scenario for the bulls. Whether the main forces will give us a breather is still uncertain, but we still need to prepare for both scenarios. If it turns down directly from 85 to 86k, the next big correction will come, and the third short-term bottom might be around 74k to 72.4k.

By the way, I don't know if you have noticed a pattern in the recent major corrections. The lowest point often rebounds to the 0.5 and 0.618 levels of the drop, then tops out, followed by a consolidation and further adjustment.

This is a typical one-sided decline, but after the Federal Reserve meeting on March 20 in the past two years, there was a long consolidation from April to September. This year is different; the correction came two months early, so this March 20 meeting is likely to ease things up.

From the market perspective, the daily line rebound trend is still in place, and with a bit of positive stimulus, breaking through 85.3k upwards shouldn't be a problem, so 85k is a turning point.

Therefore, even if it rises, it won't spike too sharply. The bears are set up in a strong formation at 85 and 86k, and even if the trend changes upwards, there will still be profit-taking opportunities. As for the bulls, we need to be cautious not to break the 80k threshold!

Master Looks at Trends:

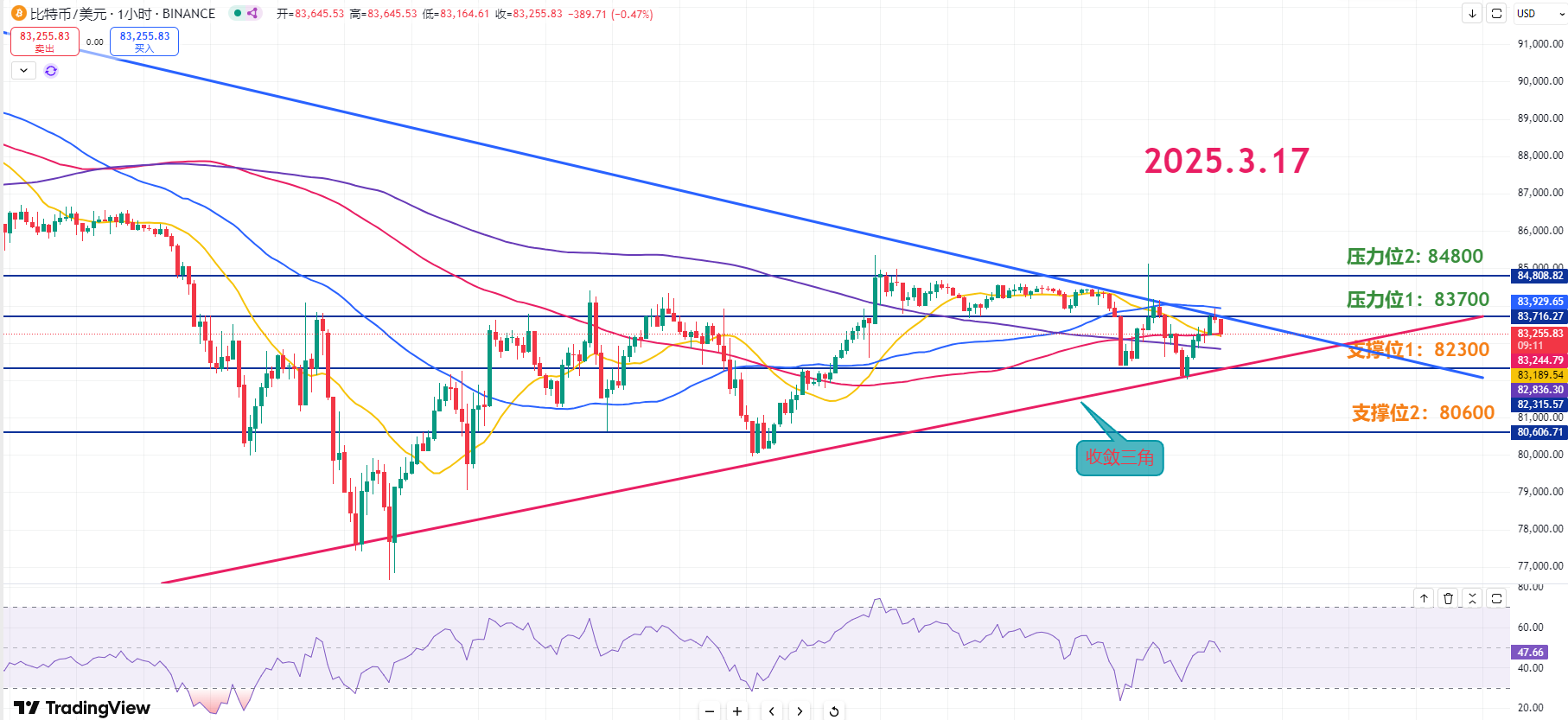

Resistance Levels Reference:

First Resistance Level: 83700

Second Resistance Level: 84800

Support Levels Reference:

First Support Level: 82300

Second Support Level: 80600

Today's Suggestions:

Currently, Bitcoin has rebounded from the low but still hasn't broken through the descending trend line, while there is an ascending trend line supporting the low. Thus, it has formed a triangular convergence pattern, currently within an undecided range.

The current K-line is still above the moving averages, and the moving averages are positively arranged, so the short-term upward trend is expected to continue. If we can break through the descending trend line we marked, the upward expectation will strengthen, and a rapid surge is anticipated.

Since there hasn't been a sustained action of making new highs yet, the resistance near the descending trend line and previous highs remains strong. If it tests the trend conversion near the descending trend line, whether it breaks or not is still uncertain, so it is recommended to remain cautious during the European session.

The first support at 82.3k is the current formation of the previous low range and is also a short-term entry point on the ultra-short line. If the price deviates from the ascending trend line, the maximum downward target would be 80.6k. As long as this range is not broken, the rebound perspective can be maintained, so it can be set as an important trend line.

3.17 Master’s Band Strategy:

Long Entry Reference: Not currently referenced

Short Entry Reference: Light short in the 84800-86000 range, Target: 83700-82300

This article is exclusively planned and published by Master Chen (public account: Coin God Master Chen). Master Chen is the same name across the internet. For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading techniques, operational skills, and knowledge about K-lines, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Warm reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing authenticity, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。