Source: Cointelegraph Original: "{title}"

The price ratio of Ripple (XRP) to Ethereum (ETH) reached its highest level in five years over the weekend, continuing its price recovery trend.

On March 15, the XRP/ETH trading pair hit 0.00128 ETH for the first time since April 2020. This represents a 925% rebound from the historical low of 0.00013 ETH set in June 2024; since Trump won the U.S. presidential election in November 2024, the increase has been about 620%.

XRP/ETH weekly price chart. Source: TradingView

XRP is expected to break through against ETH

The rise in the XRP/ETH price has sparked speculation among market observers that Ripple may surpass Ethereum to become the second-largest cryptocurrency by market capitalization.

For instance, analyst Dom emphasized that 0.0012 ETH is a historically significant resistance level, and in past cycles, every time this threshold was broken, it was accompanied by explosive price increases. He noted that after breaking this resistance level, Ripple tends to exhibit parabolic growth, which in previous instances has led to at least a 160% increase.

XRP/ETH 12-hour price chart. Source: TradingView/Dom

He illustrated this through three key breakout points — at the beginning of 2017, the end of 2017, and in 2018, when Ripple significantly rose against Ethereum after confirming a breakout above the 0.0012 ETH resistance level.

As of March 16, Ripple tested this key level again. Dom stated that if history repeats itself, even an 80% partial increase would be enough for Ripple to surpass Ethereum in market capitalization, especially considering that Ethereum's price faces more downside risks in 2025.

Ripple's market capitalization is $138 billion, with less than a $100 billion gap from Ethereum's market cap. Additionally, earlier this week, Ripple's fully diluted valuation (FDV) briefly exceeded Ethereum's fully diluted valuation.

It should be noted that fully diluted valuation represents the theoretical total value of all tokens, including those not yet in circulation, while market capitalization only accounts for currently circulating tokens.

Why is Ethereum underperforming compared to Ripple?

Since Trump was re-elected on November 5, Ripple's market dominance has increased by over 300%.

XRP.D vs ETH.D daily price chart. Source: TradingView

During the same period, Ethereum's market share has declined by over 35.50%, indicating a clear lack of interest from traders compared to other top crypto assets.

A key factor in this disparity is the regulatory stance. Trump has positioned the U.S. as the future "world cryptocurrency capital," appointing pro-crypto regulators and promising to create a more favorable environment.

This shift particularly benefits Ripple, as it targets enterprise users, especially after Ripple announced its institutional decentralized finance (DeFi) roadmap in February.

Meanwhile, Ethereum's price has declined due to increased competition from rival layer-one blockchains, particularly Solana (SOL).

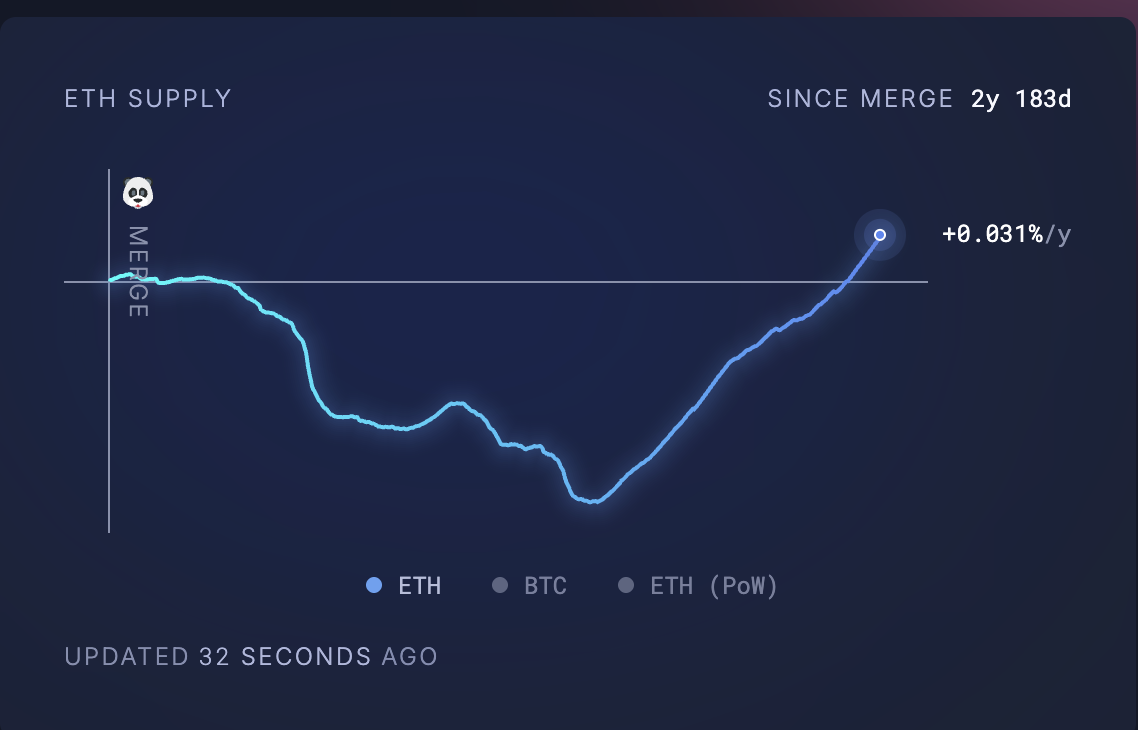

The Dencun upgrade in March 2024 reduced Ethereum's transaction fees by 95%, aiming to improve its scalability. However, this also lowered Ethereum's burn rate, increasing its supply and weakening its deflationary appeal and the concept of "super sound money."

Ethereum's supply rate since the merge. Source: UltraSound Money

At the same time, Solana's dominance has risen, with its trading volume now comparable to the total trading volume of Ethereum and all its layer-two blockchains.

Solana's faster and cheaper transactions have made it the preferred platform for decentralized finance (DeFi) activities, meme coin trading, and non-fungible token (NFT) markets, areas that were previously dominated by Ethereum. This shift has eroded Ethereum's market share, especially among traders and developers seeking high-speed, low-cost transactions.

This article does not contain investment advice or recommendations. Every investment and trading operation carries risks, and readers should conduct their own research when making decisions.

Related: SEC delays decision on ETF approvals for Ripple, Solana, Litecoin, and Dogecoin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。