💡This week will welcome a super central bank week, as global central banks collectively assess the impact of Trump's trade policies on the economy. Key points to watch include:

1⃣ On March 19 (Wednesday), the Bank of Japan's interest rate decision is expected to maintain rates unchanged, with attention on the yen exchange rate and future rate hike signals.

If hawkish signals are released, it may lead to yen appreciation, affecting Japanese stocks and global capital flows; if dovish, it may continue the yen's weakness.

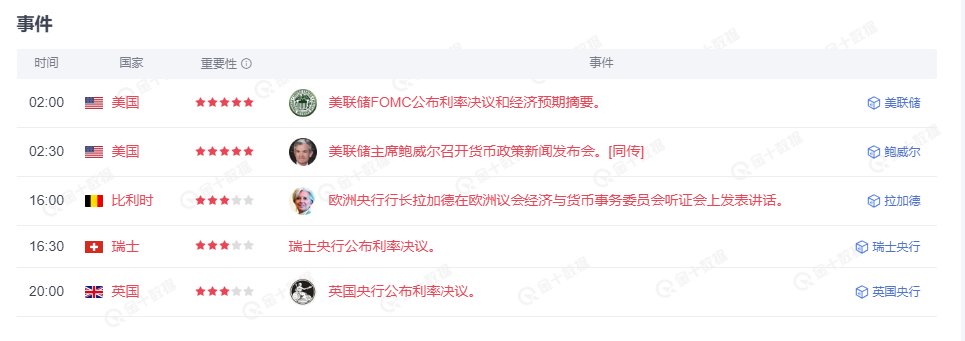

2⃣ On March 20 (Thursday), the Federal Reserve's interest rate decision is expected to maintain rates at 4.25%-4.5%, with focus on the dot plot and Powell's speech.

If signals for rate cuts are released, it may suppress the dollar and boost risk assets (U.S. stocks, gold); if leaning hawkish, it may exacerbate market volatility.

3⃣ The Bank of England's interest rate decision is expected to remain unchanged, with attention on dovish remarks affecting the pound. If future rate cuts are hinted at, it may weigh on the pound, benefiting export-oriented UK stocks.

The main focus is on the attitude of various central banks towards interest rates, but there is a general sense of maintaining the status quo. The market has just gone through a round of adjustments, and clarity is yet to be seen; "caution" is the main tone, and "wait-and-see" is the primary attitude.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。