Elders retreat, new recruits falter, but the game is not over. Survival of the fittest, elimination of the unfit.

Author: Sankalp Shangari

Translation: Deep Tide TechFlow

This is not just another ordinary cryptocurrency cycle; it feels more like your favorite underground bar being acquired and transformed into a high-end cocktail lounge. Those who once dominated the market, the "decentralized gamblers" and retail speculators, are licking their wounds, while hedge funds, sovereign wealth funds, and traditional financial giants enter the scene in tailored suits, armed with algorithmic strategies, ready to dominate the game.

The cryptocurrency veterans have experienced more dramatic events than reality shows—from the Mt. Gox collapse, the ICO frenzy, to the DeFi summer boom and the NFT gold rush that turned into a garage sale. They now hope Bitcoin can quickly rebound to $120,000 to $150,000, contemplating whether to cash out like retired poker pros or if there’s still a chance to play one more "crazy hand."

But let's be clear—cryptocurrency has not perished; it is undergoing a "corporate transformation." New rules are forming, and the question is: will you choose to adapt, or are you still asking, "Can Dogecoin reach $10?"

1. The Market is No Longer What It Used to Be

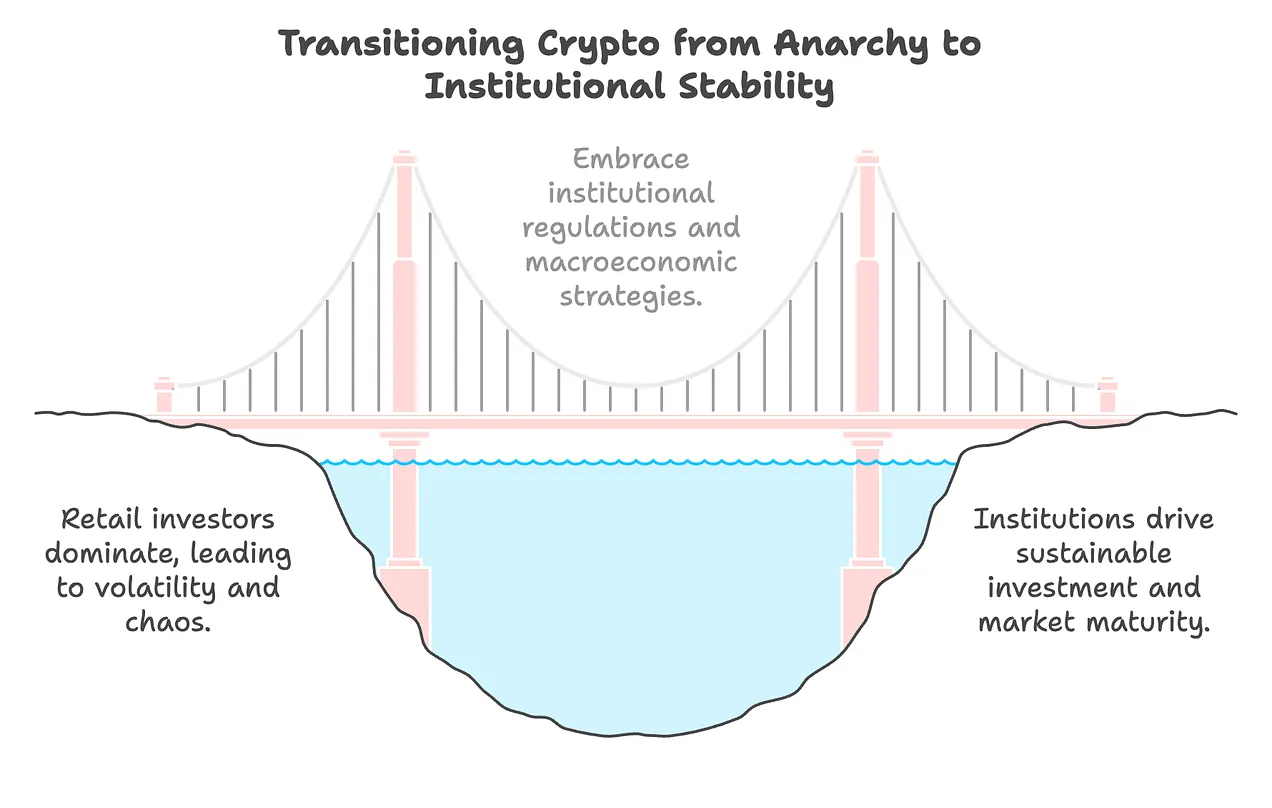

The cryptocurrency market resembles a once-chaotic western frontier town that now has a Starbucks and a planning committee—chaos is fading, and institutional funds are flooding in. The days when a meme and a dream could multiply assets a hundredfold are gone. The new game rules are: suits, regulatory compliance, and macroeconomic gamesmanship.

Bitcoin's New "Operator": Macroeconomics, Not the "Halving Fairy"

If you still think Bitcoin's price is entirely determined by a four-year cycle, you are like an "antique" still waiting for dial-up internet to connect, out of touch with reality. Bitcoin is now a macro asset, responding to interest rates, global liquidity, and economic risk sentiment like an experienced Wall Street trader. If you don’t understand macroeconomics, you’re like bringing a fidget spinner to a chess match.

Retail Investors Exit, Institutions Take Over

Remember when your Uber driver and barber were promoting altcoins and debating Ethereum gas fees? Those days are long gone. Now it’s BlackRock, sovereign wealth funds, and traditional financial giants controlling the market. ETFs have injected billions into the market, but they have also turned Bitcoin into a corporate asset—no longer a wild stallion, but more like a dramatic Tesla stock.

Liquidity Divergence: Bitcoin and Ethereum Become VIPs, Altcoins Are Neglected

Institutional funds are pouring into BTC, ETH, and a few blue-chip altcoins like champagne, while the liquidity of other assets is rapidly drying up, faster than your New Year’s fitness ambitions. Many small altcoins are becoming "ghost chains"—haunted by the dreams of the past bull market and reluctant holders unwilling to cut losses.

The Trump Effect: Is It "Meme" Magic or a Liquidity Trap?

Trump's recent pro-crypto stance has injected new energy into the market, such as discussions about establishing a U.S. strategic Bitcoin reserve and rapidly advancing stablecoin regulation. However, his "meme coin casino" (like $TRUMP, $MELANIA) has become a liquidity black hole, siphoning off speculative funds and leaving the entire market gasping for air. It’s like a carnival where everyone spends their last dollar trying to win a giant teddy bear, only to find they can’t even afford the ride home.

2. Web3 Promised a Revolution, But Where's the Practicality?

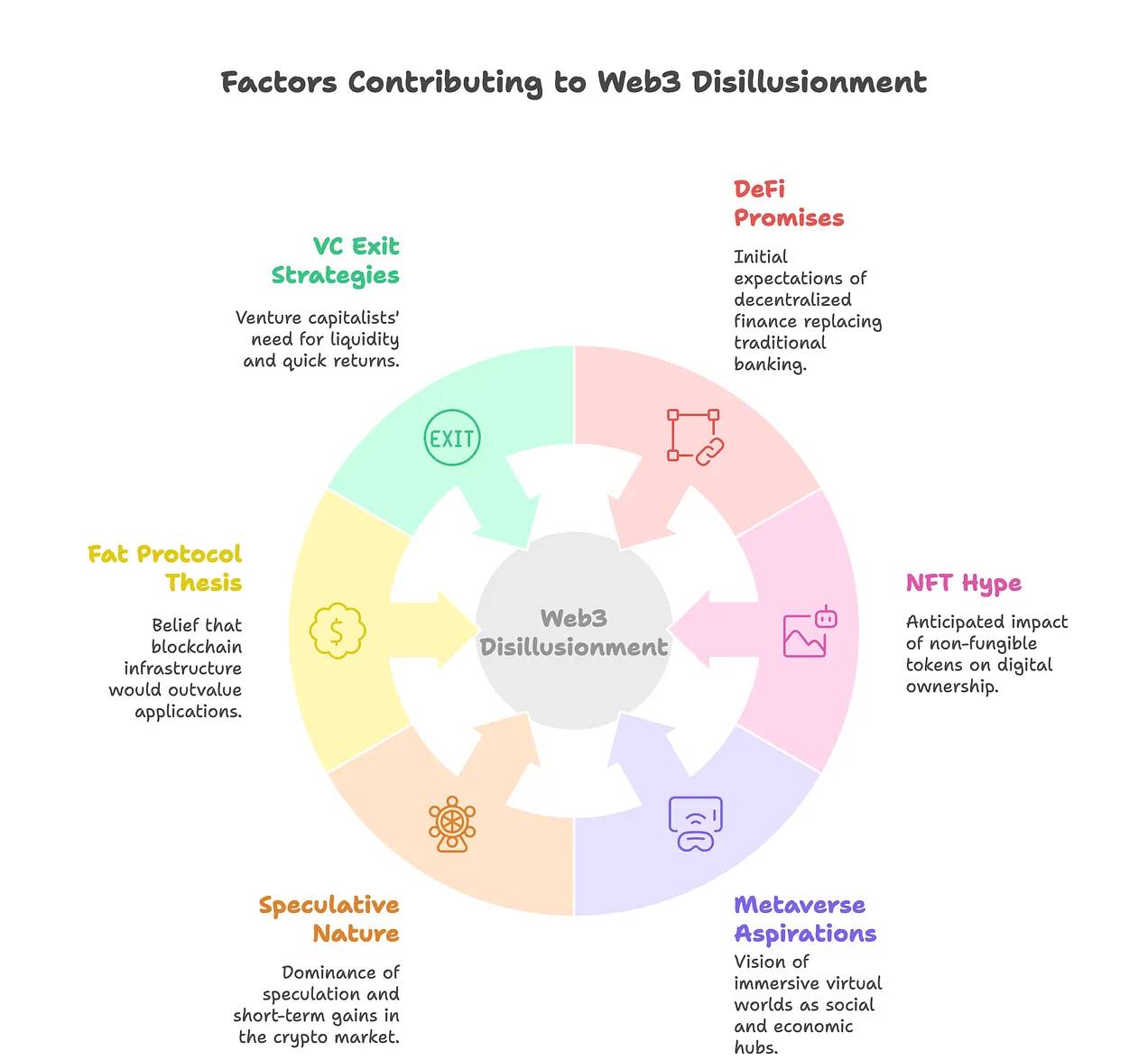

Web3 was supposed to change the world, but it now feels more like a Las Vegas buffet—full of hype, with only a few decent dishes and the rest being junk food. DeFi aimed to replace banks, NFTs were supposed to redefine ownership, and the metaverse was meant to become a new gathering place. But after billions of dollars in promises, the only thing that has been widely adopted is stablecoins.

The Only Killer App: Stablecoins (aka "Premium Internet Dollars")

Forget the DeFi revolution and NFT empire; the only real success in cryptocurrency has been creating a more efficient digital dollar with fewer intermediaries. If Web3 is a sci-fi movie, stablecoins are the only truly functioning alien technology, while everything else is just conceptual art and fan theories.

Speculative Economy: Hype Remains the Main Theme

Cryptocurrency still resembles a high-risk Ponzi carnival, with meme coins, influencer pump-and-dump schemes, and overhyped "next-gen" blockchains (like TIA, SEI, MONAD, BERACHAIN) launching with valuations over $5 billion, yet with very few users. It’s like opening a five-star restaurant, spending millions on marketing, but forgetting to hire a chef.

The Collapse of the "Fat Protocol" Theory

For years, the blockchain's "fat protocol" theory posited that the value of infrastructure should exceed that of the applications built on it. But it turns out this is like investing in a road while expecting it to be more valuable than the cities it connects. In reality, corporate valuations typically have a P/E ratio of 5-15, while some stagnant L1s and L2s still exist at 150 to 1000 times multiples, despite no growth. These chains now resemble a theme park without rides—expensive tickets, yet filled with broken promises.

VCs Still Need Exit Liquidity (And You Are That "Liquidity")

Many "innovative" projects exist solely to provide exit liquidity for early investors, much like the ICO frenzy of 2017. If a project launches with immediate token unlock mechanisms and a fully diluted valuation higher than Coinbase, congratulations—you are not investing; you are becoming their exit liquidity. It’s like buying a house only to find the previous owner sold you the land, walls, and even the air in the rooms separately.

3. Talent Drain in the Crypto Industry: Developers Are Turning to AI

Top developers in the crypto space are fleeing to AI like rats abandoning a sinking ship—or more accurately, like Web3 influencers deleting their "decentralized forever" tweets overnight to become "thought leaders" in AI.

Why Are Developers Abandoning Crypto for AI?

Because AI is the new hot topic, while cryptocurrency feels more like a washed-up rock star trying to keep selling tickets with an old hit from 2017.

- Clearer Regulations

AI is like a potentially brilliant but slightly scary child genius—governments are still hesitating on whether to nurture it or keep it under strict surveillance. And cryptocurrency? Still like that rebellious teenager who maxed out grandma's credit card to buy Dogecoin, viewed as a problem child by the government.

- Better Funding Environment

Venture capitalists treat AI investments like the next Google, while cryptocurrency founders can only pitch their 12th "revolutionary" L1 project in empty conference rooms.

- Fewer Boom and Bust Cycles

AI is like a stable honor student, while cryptocurrency resembles that student who either wins the science fair grand prize or burns down the lab—no middle ground.

The Great Migration from Web3 to AI

Those who once promised a decentralized world as "visionaries" are now training AI models to write corporate emails and even generate disturbingly realistic deepfake videos.

Cryptocurrency once aimed to replace banks.

AI just wants to replace you.

At the current trend, developers remaining in the crypto space are either true believers or too lazy to update their LinkedIn profiles.

4. OGs Are Cashing Out, But the Game Isn’t Over

The cryptocurrency veterans—those who have experienced the Mt. Gox collapse, the ICO frenzy, DeFi exits, and the "I accidentally sent my entire portfolio to the wrong address" phase—are finally starting to cash out. They have been in the industry long enough to know that when BlackRock starts buying Bitcoin, the era of exponential growth is over.

Where Are They Going?

- AI and Tech

Instead of betting on meme coins, they are developing algorithms that can replace financial analysts.

- Real Estate

After years of staking, mining, and leveraged trading, the real 100x return might just be buying a house in Miami.

- Semi-Retirement

Some OGs have had enough of scrolling CoinGecko at 2 AM, moving to tropical islands and communicating only in the language of Bitcoin extremists.

But Institutional Funds Are Taking Over

The exit of OGs does not mean the end of cryptocurrency. On the contrary, large institutional funds are flooding into the market, much like Wall Street's financial elite discovering the allure of DeFi summer, albeit two years late but still enthusiastic.

Cryptocurrency is no longer just a playground for decentralized gamblers and speculators—it is evolving. The casino is still open, but now the slot machines belong to Goldman Sachs.

The question is: are you ready to embrace the next chapter? Or are you just here to FOMO into the next round of meme coins?

5. An Optimistic Outlook: The Next Crypto Boom Will Be… Different

The next cryptocurrency boom will be like that once-crazy party friend, now showing up in a suit at brunch and ordering a salad instead of tequila. The chaos is settling, and the once-rebellious youth is maturing into a well-behaved "investment-grade" adult—well, to some extent.

Regulation is Finally Taking Shape

Cryptocurrency is undergoing a makeover—like that class clown suddenly becoming the student council president. It remains mischievous, but now it’s donned a brand-new suit and is wearing a badge that says, "Let’s play by the rules."

The U.S. Securities and Exchange Commission (SEC) has finally decided to stop treating every cryptocurrency exchange like a villain in a Bond movie. They have dropped lawsuits against Binance, Coinbase, Kraken, Uniswap, as if they finally realized that cryptocurrency is not going away—much like your dad finally stopped arguing with you about your "controversial" tattoo.

Decentralized finance (DeFi) brokerage rules? The IRS may have to stop ruining everyone’s fun. Imagine telling your uncle: “You can keep the party going—as long as you don’t mess it up.”

The U.S. Senate Banking Committee is about to vote on the Stablecoin Act, and the GENIUS Act is also gaining support. It’s like cryptocurrency finally got the parental signature for its extracurricular activities.

Institutional Adoption is Accelerating

Large institutions are joining cryptocurrency with the swagger of the "cool kids" in finance, as if they finally decided to let you sit at their lunch table.

BlackRock, JPMorgan, and sovereign wealth funds are on board, and they are not just "testing the waters"—they are diving straight into the deep end, praying their heavy portfolios don’t hit rock bottom.

The UAE’s Mubadala fund is now a major holder of Bitcoin ETFs, proving that cryptocurrency finally has that "cool uncle" who can tell jokes and pay for vacations.

Solana, XRP, and other ETFs are in the works, making this crypto party feel more like a black-tie gala, with suited individuals replacing the casual crowd in flip-flops.

Cryptocurrency IPOs Are Coming

Now, cryptocurrency is dressed up and ready to go public. We see IPOs for Kraken, Gemini, and BitGo moving forward—they are bringing transparency and credibility to a field that once felt like a high-stakes poker game played in a dimly lit basement.

Going public is like cryptocurrency’s graduation ceremony—finally getting the diploma and having the chance to explain to worried parents what it is you’ve been doing.

The Government's Attitude Toward Cryptocurrency is Warming Up

The government, which once viewed cryptocurrency as that crazy cousin who shows up at family gatherings drunk on homemade brew, is now willing to share a cab with it. Cryptocurrency is gaining the respect it always believed it deserved.

Multiple U.S. states are considering holding Bitcoin reserves—it's like these states added some "cool points" to their balance sheets.

Hong Kong has approved spot Bitcoin and Ethereum ETFs, essentially saying: “We accept it, as long as you don’t mess it up.”

The UAE, Brazil, and Australia are drafting friendly cryptocurrency regulations, becoming the new "cool kids" in the crypto space.

The EU's MiCA framework is like a certificate of good behavior issued by cryptocurrency’s enlightenment teacher, saying: “You were a bit naughty, but we now allow you to play with the other kids.”

Final Thoughts: Adapt and Survive

Yes, the market has changed; yes, the OGs are tired and considering retirement; yes, scammers are still as active as those trying to sell "miracle" weight loss pills on Instagram. But every cycle brings new winners—like a reality show with constantly changing contestants and ever-unclear rules.

In 2013, Bitcoin pioneers were the enthusiastic western pioneers claiming to have gold mines while others were still figuring out how to use PayPal.

In 2017, ICO founders saw white papers and thought, “Let’s raise a billion dollars and then figure out what to do,” like a group of kids selling lemonade in the desert, only their bank accounts had a few extra zeros.

In 2020, DeFi developers were launching new protocols faster than your uncle could tell you about his latest "high-risk" stock. They were like mad scientists rapidly rolling out new protocols, trying to create decentralized currency without blowing up the lab.

In 2021, NFT speculators viewed pixelated ape images as golden tickets to the "chocolate factory," and what they got in return wasn’t candy, but a bag of cash. While the rest of us were still trying to figure out what "minting" meant, they had become the Wall Street stockbrokers of the image world, raking in profits.

In 2024, we witnessed the takeover of institutional ETFs, parallel to the rise of meme coin mania—until the defenders of meme coins realized that the takeover by suited Wall Street bankers far exceeded their imagination. We saw the entire image of cryptocurrency transform from a rebellious youth listening to punk rock into a well-dressed individual suddenly appearing at business meetings (though still with a bit of coffee on the tie).

2025 and Beyond

Institutions have taken over. Either adapt and learn the game, or be eliminated.

Bitcoin remains king, a macro asset akin to gold. Learn macroeconomics, learn Wall Street thinking and trading.

The new government will continue to extract value from cryptocurrency alongside its allies. This is nothing new, just another player, like past FTX, Luna, 3AC, or VC coins. You need to adapt and learn to play against these "players" rather than giving up easily.

As for altcoins, despite massive investments over the past decade, their real value remains limited. Most altcoins, including Ethereum and Solana, are still speculative assets with minimal actual demand for their products. Once institutions start evaluating these tokens based on real fundamentals, many may appear severely overvalued. This is precisely why Bitcoin is becoming increasingly important.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。