Hello everyone! On February 17th at 16:00, the AiCoin Research Institute will discuss [The Truth Behind Coinbase BTC Whale Operations] with everyone. This is a very practical tool, especially for those who want to capture the movements of large holders! Without further ado, let's get straight to the point~

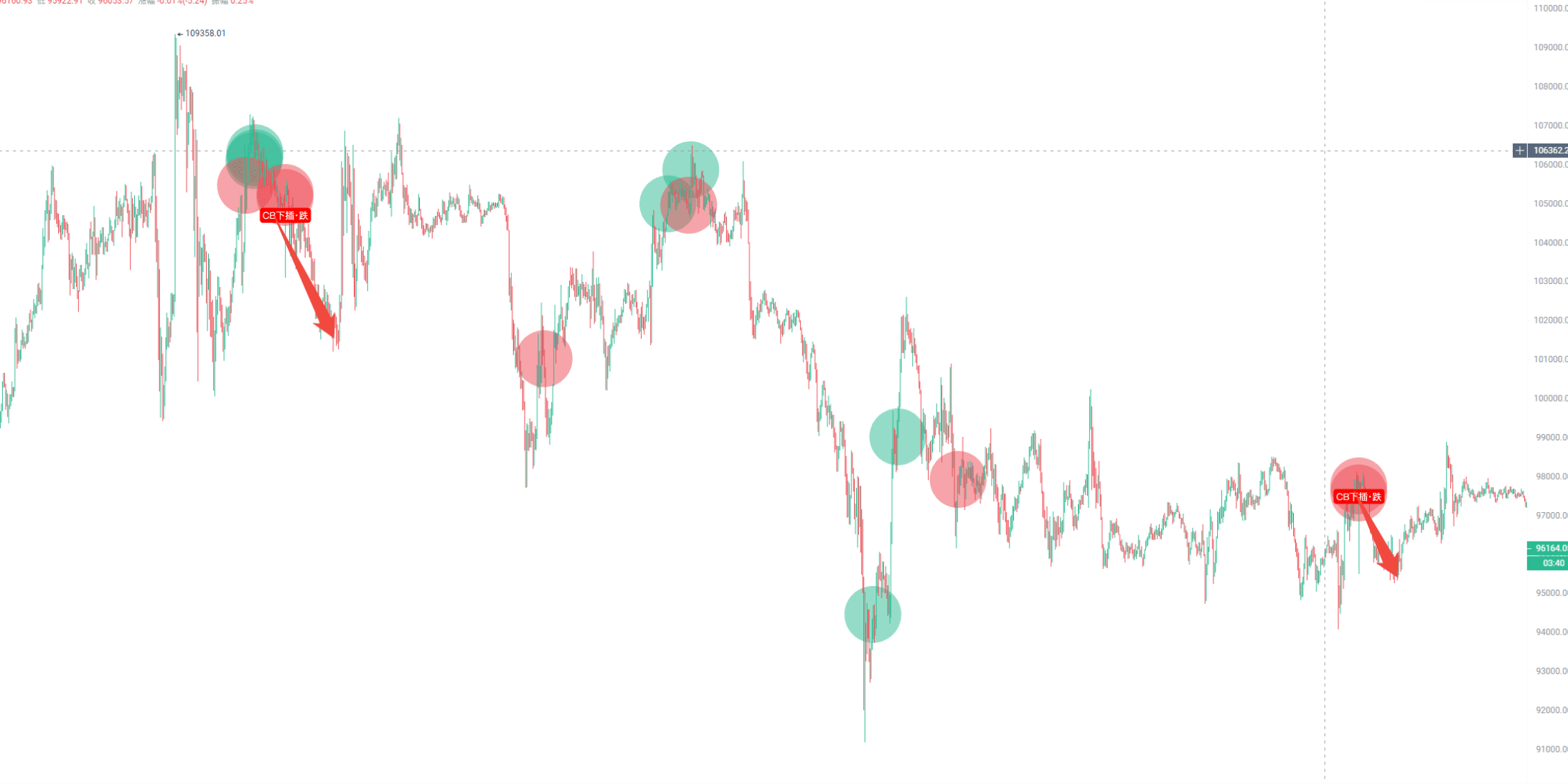

I wonder if anyone noticed last Thursday that Coinbase experienced a rare flash crash, with short-term fluctuations exceeding 2%, while platforms like Binance and OK did not show any unusual activity; only Coinbase had this situation. Based on past market performance, if Coinbase experiences a sharp spike down while Binance, OKX, and other platforms do not show similar anomalies, BTC often revisits that spike price level. In other words, if Coinbase BTC spikes down but Binance and OKX BTC do not, this is usually a bearish signal.

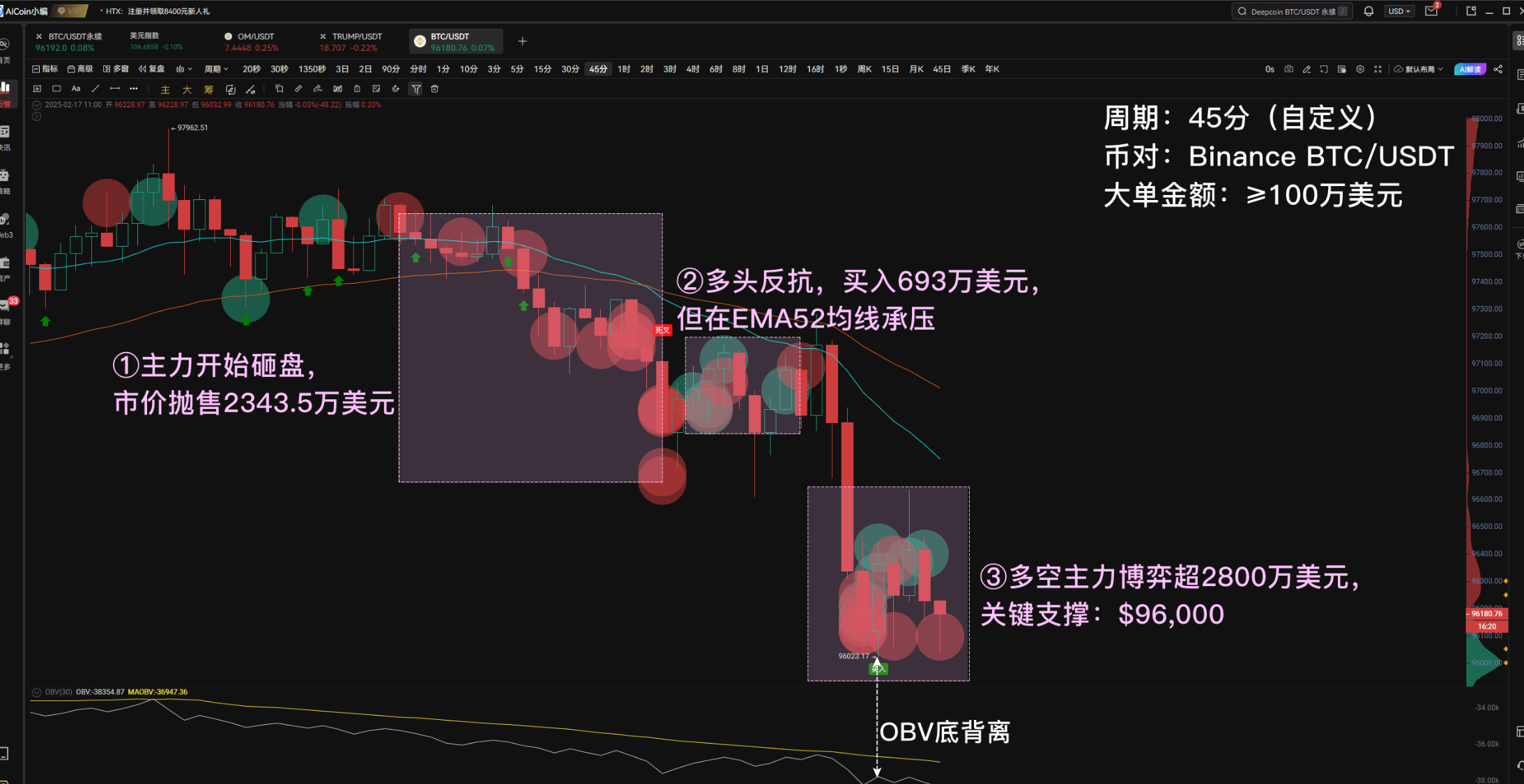

When this happens, it is generally because large holders on Coinbase are dumping, or funds are exiting. For example, during last Thursday's spike, a large holder on Coinbase sold at market price for $42.83 million.

This is not an isolated case! On January 22nd, a similar situation occurred, when a large holder sold $30.25 million.

Large holders dumping is usually a measure taken by institutions or major funds to quickly suppress prices. They will rapidly sell large amounts of cryptocurrencies at the current market price to achieve the goal of quickly driving down prices. This kind of dumping generally has no warning, but we at AiCoin can capture it!

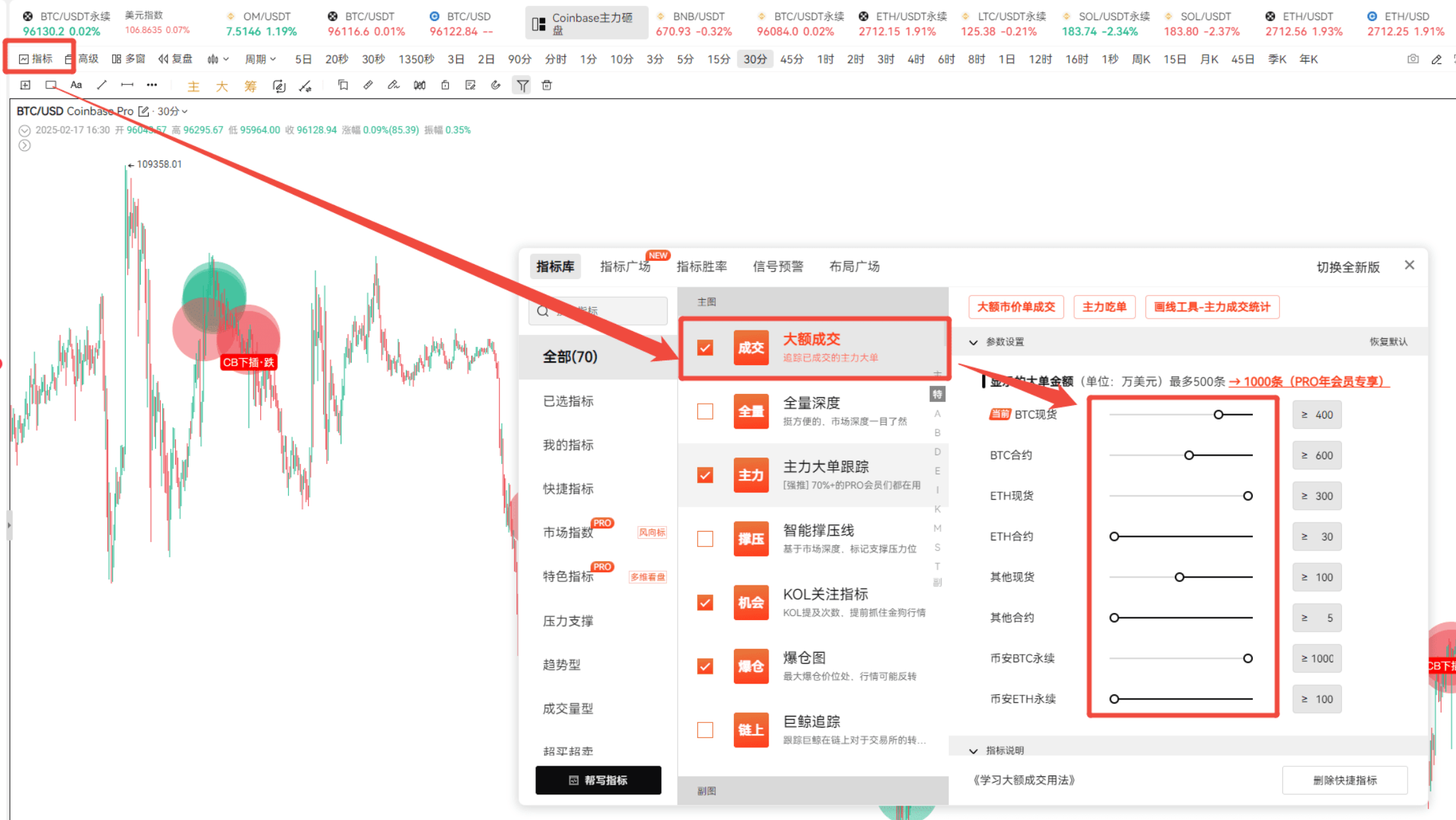

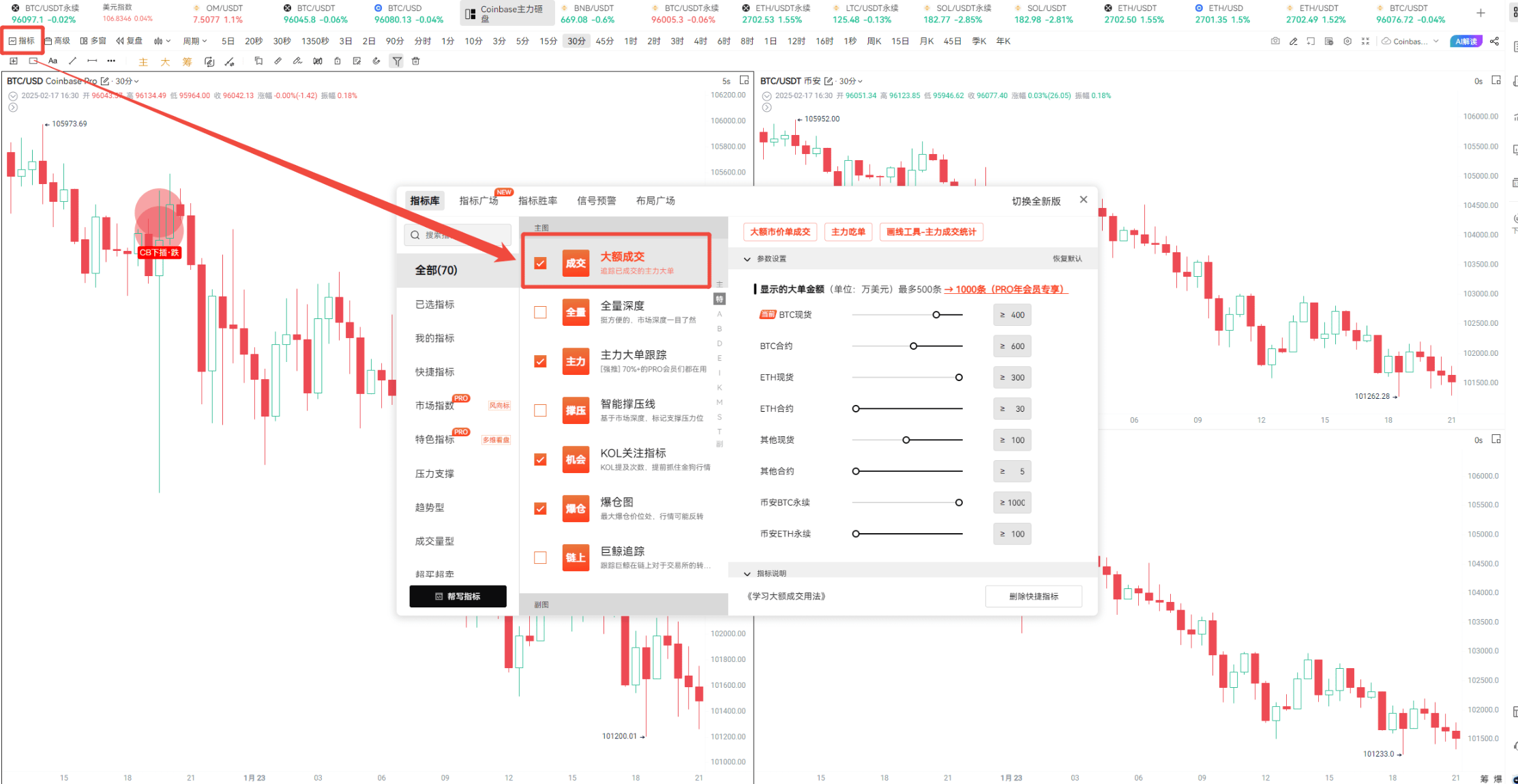

That is by using our large transaction indicators.

You can operate according to the settings in the image. When there are concentrated sell orders (red circles) in the spot currency pair, it indicates that the main force is concentrating on selling, and the selling pressure will increase. At this time, you should follow the large holders out. If there are large buy orders appearing midway, but the amount is not enough to offset the previous selling amount, or if they are buying near resistance levels, this usually indicates a second dip.

You can operate according to the settings in the image. When there are concentrated sell orders (red circles) in the spot currency pair, it indicates that the main force is concentrating on selling, and the selling pressure will increase. At this time, you should follow the large holders out. If there are large buy orders appearing midway, but the amount is not enough to offset the previous selling amount, or if they are buying near resistance levels, this usually indicates a second dip.

When the price drops near support, you should look at the buy order execution and trading volume. If the buy amount starts to increase significantly while the volume expands, it indicates that large holders are starting to bottom-fish, and the market is basically at the bottom. The spike radar indicator I shared earlier is also effective; those interested can check it out: Spike Radar Indicator.

Now that ETH, SOL, and BNB are all weakening, you can use the [Large Transaction] indicator to see if the main force is still selling. Large transactions look at the main force's market transaction situation, while large orders look at the large holders' pending orders.

The usage of the main large order tracking indicator is also very simple:

Main force pending buy orders: Before execution, look bearish (the price needs to fall to execute the pending buy orders); after execution, look bullish (support).

Main force pending sell orders: Before execution, look bullish (the price needs to rise to execute the pending sell orders); after execution, look bearish (pressure).

I previously shared in a live broadcast how to determine whether the main force is dumping at market price or executing limit orders. Those interested can watch the live review or read this article: Judging Main Force Market Price Dumping.

In summary, the interpretation of the truth behind Coinbase BTC whale operations is a very practical tool, especially for those who want to capture the movements of large holders. If you have large funds and want to make steady profits, you can try AiCoin's arbitrage tools and AI grid tools, which are also frequently recommended in our live broadcasts.

Finally, I recommend reading the following articles to help you better understand CME gaps and other trading strategies:

For more live broadcast insights, please follow AiCoin’s “AiCoin - Leading Data Market, Intelligent Tool Platform” section, and feel free to download AiCoin - Leading Data Market, Intelligent Tool Platform.

Risk Warning: The content of this article is for educational purposes only and does not constitute investment advice. Trading should be done with caution, and profits and losses are at your own risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。