Shang Zhongyong · Conspiracy Theories · Old Oilman.

Written by: Zuo Ye

Ethereum has no dreams; Vitalik refuses to be a lifelong benevolent dictator;

Solana has no bottom line; the only remaining active conspiracy group in the blockchain world;

BNB Chain has no future; apart from extreme marketing, only Binance's traffic remains.

Why study public chains?

When you are connected to all retail investors in the cryptocurrency industry, you inevitably become the infrastructure of this industry. So far, only BTC/ETH as public chains and Binance, Coinbase as exchanges have achieved this, one being decentralized and the other centralized, conducting a business that can connect with everyone.

By 2025, there will no longer be L1, non-EVM, and market-influential public chains; L2, Move VM, and Sonic/Bear Chain are merely creating a dojo around tokens. The struggle between Solana and Base resembles a commercial consortium conflict, with little relevance to technical standards or routes.

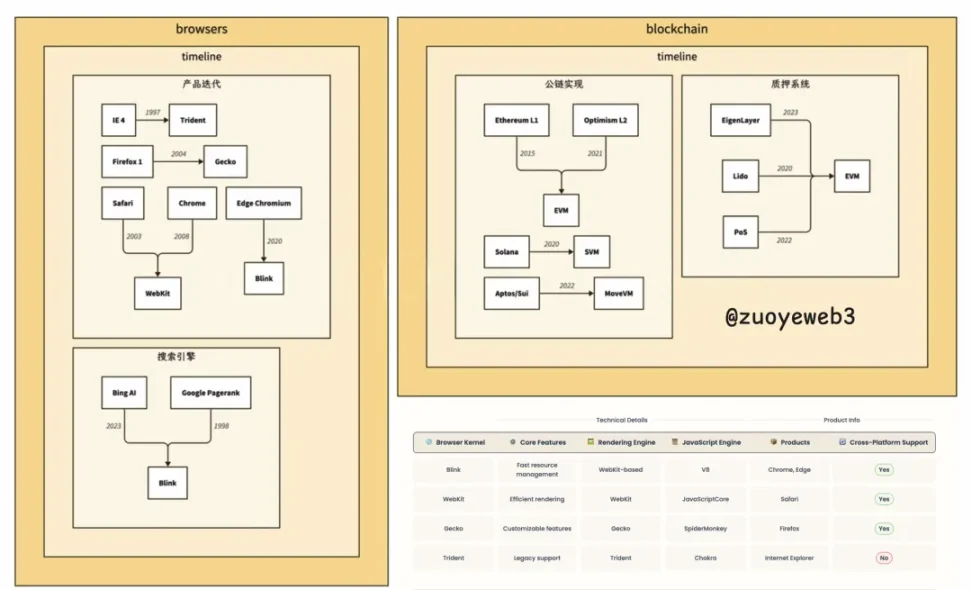

Image caption: The development history of public chains compared to browsers, image source: @zuoyeweb3

Based on this, I summarize three tones of this article, which are also a historical perspective on public chains, just like how the new Edge chose to be compatible with Chromium to start anew; an era of frenzy has ended.

The background of the birth of finance is to hedge operational risks, but since its inception, finance has become the primary source of risk, from the railway protection movement that buried the Qing Dynasty to Bitcoin, which erodes the fiat currency system, all are included.

The development of the internet is a brief history of browser kernels, products, and search engines. In terms of public chain systems, EVM/SVM --> ETH/L2, EVM compatible L1 --> PoS node systems + super dApps.

Public chains are still built on the most fundamental protocols of the internet. After the wild west and the Age of Exploration, the journey of human civilization is a migration from rural to urban areas. The life and death of super public chains reflect the direction of developers.

Experiencing these before becoming Bitcoin

Sending off Bitcoin's successor, welcoming the rebirth of Base?

The Ethereum system represents an era of anarchism and individual free will, conceived as a decentralized response to the fiat currency system and the vision of a world computer, dedicated to this era.

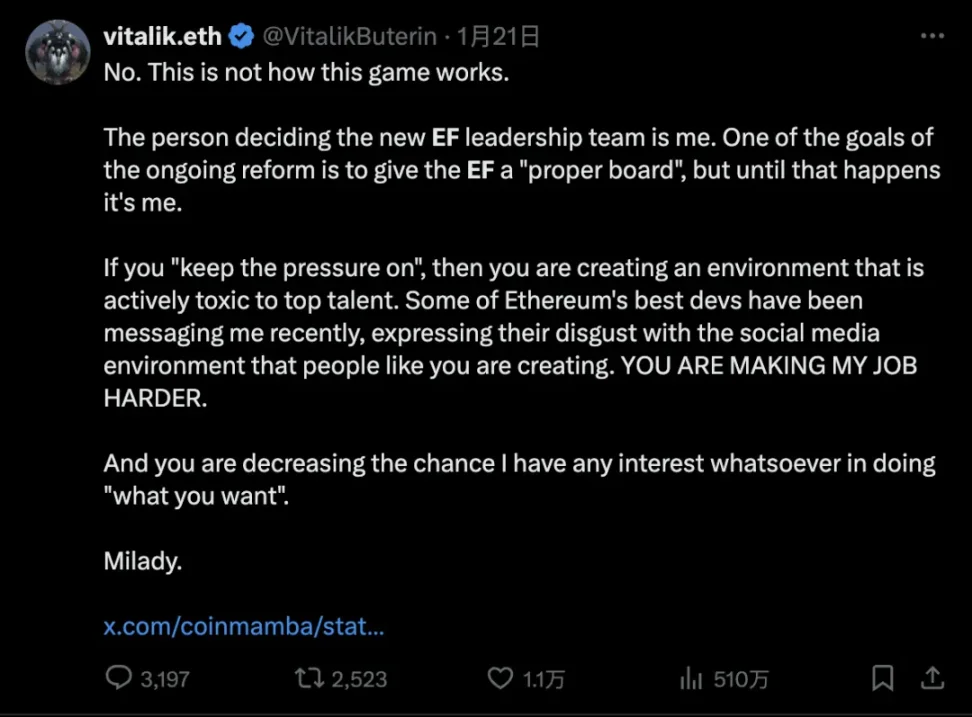

After a year of cold mockery, Vitalik chose to elevate Aya to the position of chair of the Ethereum Foundation (EF), after all, Vitalik himself said he can decide everything about the EF.

However, there is no need to hold more expectations for Vitalik; he is an extremely nostalgic person. Aya is the "drifter" he met while sleeping on the floor at Kraken, a hero's minor era, the softest part of his heart.

I do not want to list various data and charts to prove the problems with Ethereum, because Ethereum itself, along with the EF and EVM ecosystem, actually has no issues. BNB Chain and Base will not temporarily switch to SVM.

Referring to the history of browser development, the most "halal," orthodox, and free FireFox did not continue the glory of Netscape but was subsumed under Google's open-source Chromium and the commercialization of Google Search. 90% of Firefox's revenue comes from setting Google as the default search engine, becoming Google's de facto "official opposition."

Today's ETH/EVM system is similar; every dApp, every L2, every Dev, every VC, and every KOL in the EVM circle has evolved through a unique historical trajectory in a distinct ecological environment via a process of natural selection.

ETH, L2, and EVM are interconnected, forming the currently most "network effect" public chain system. The inherent continuity of the positive feedback mechanism of network effects will double enhance ecological connections, which is also the fundamental reason why everyone curses but cannot leave.

Temporary peace will not last forever; Trident IE will also be replaced by Chromium Edge. The fundamental issue with Ethereum lies precisely in Vitalik's personal problems; the collapse of the governance system has led to the current predicament.

Both of Vitalik's parents are Soviet émigrés, and Vitalik himself is extremely opposed to centralized, authoritarian, and dictatorial systems. Here lies the seed of the DAO system, but as mentioned earlier, he has also stated that he alone can decide everything about the Ethereum Foundation. The rollback after The DAO incident has proven: absolute decentralization will lead to absolute centralization.

Image caption: The person who decides the new EF (Ethereum Foundation) leadership team is me, image source: @VitalikButerin

Referring to Satoshi Nakamoto's departure, hiding his achievements and fame, Vitalik is clearly in a state of chaotic neutrality, not wanting to legitimately lead everything in the EF while hoping to retain ultimate decision-making power over the EF. Unfortunately, in a governance system, this is the worst kind.

Since Machiavelli's "The Prince" and Max Weber's addition of bureaucracy along with Taylor's summary, companies have become the most efficient existence in human social organizational models. The tech right in Silicon Valley, such as Musk and Peter Thiel, believes that companies should take over the state rather than bureaucratically manage society; DOGE is a direct product of this.

However, for organizations that are not so "capital efficiency" oriented, such as the tech geek community, how to govern and collaborate with unpaid, globally dispersed programmers becomes a social need for foundations or DAOs. The Linux and RISC-V foundations are examples, but still not enough; communities will always have conflicts, and people's hearts are not always aligned.

For Linux and Python, their founders can still assume the role of benevolent dictator for life (BDFL), but it is not enough. Last October, Linux founder Linus made the poor decision to ban a Russian administrator, and after the PEP 572 dispute in 2018, Python announced it would no longer have a BDFL role, reminiscent of Aptos co-founder Mo Shaikh's resignation and several AVAX board members fleeing.

However, one must admit that in the early development of technical organizations, the hard work of the founders is indispensable. Yet, the complexity of the EF does not stop there. Capital efficiency-oriented companies only need to be accountable to shareholders, while socially effective technical foundations only need to be accountable to the projects themselves. Programmers are always free; they can choose and freely fork in different organizations.

But the EF is not equivalent to either; the EF can disregard profit, as the ETH in the treasury is sufficient, but the EVM ecosystem must consider profitability. This is the awkwardness of Vitalik--EF--EVM; Vitalik is doing the work of a BDFL but refuses to assume the corresponding role. The downstream of the EF consists of ETH holders and a vast economic system that are waiting to be fed, but they must operate under Vitalik's personal will.

Understanding this is crucial to grasping why Aya's infinite garden route is incredibly correct; it is the only choice to ensure that everyone in the EF can follow Vitalik's will, the patch master of the EVM empire, the central figure in the military machine.

Vitalik is like a child holding gold; the young hero who became famous cannot maintain balance in a complex world, thus introducing external helpers. However, with layers of external involvement, external groups are more concerned with profitability issues. Vitalik can neither govern EF/Ethereum/EVM like a company nor refuse to practically assume the BDFL role like a technical organization. After the DAO was periodically falsified, Ethereum is now in a strictly low-speed state of loss of control, either slowly fading away or being usurped.

Currently, the Ethereum community is discussing the Pectra upgrade, but its attention has dropped to a terrifying level of indifference; this is a precursor to silence. Please believe that this cannot be solved by ETH price surges or a few meme big dogs. Now Ethereum must answer whether it is Vitalik practicing a non-financial decentralized experimental field, or Aya's infinite garden, or a true "world computer."

Vitalik personally insists on a decentralized, non-financial, non-sovereign dream, but the EF does not, and the entire EVM ecosystem is also hard to say it has. The scale effect is both an advantage and a curse.

And public chains like Base have already proven that ETH L2 can indeed strike a balance between efficiency and cost. The parallel route of OP/ZK L2 is absolutely correct; however, Base can operate without tokens, resembling an advanced version of a consortium chain. If this is the bouquet that the EVM system presents to the real world, then it is somewhat laughable.

Folks, let’s take a look at the distant Solana and BNB Chain, at least they are seriously engaged in the matter of coin prices.

The only remaining conspiracy group in the blockchain camp

Wan Wan yellow willow silk, misty mixed flowers droop.

Why choose Ethereum, Solana, and BNB Chain as comparisons for super public chains?

BTC does not need comparison; Ethereum's EVM is the de facto industry standard, just as Chrome has the highest market share. Solana is more like Safari; behind its extreme smoothness lies centralization. BNB Chain is the only true orphan with on-chain activity among old coins like ADA and XRP.

If there is palace intrigue in the coin circle, then Solana is like Huan Huan, after being robbed of Ling (F) Yun (T) Feng (X), it can still stage a grand female lead drama of Xi (coin price) Fei (rise) returning (ecology) to (revival) the palace, just to give two examples: as of February, Solana's DEX trading volume has surpassed Ethereum for four consecutive months, and in March, Solayer's market cap surpassed EigenLayer. Amidst the decline of the meme trend, Solana still proves itself.

Especially the latter, the staking/re-staking system is an original creation of Ethereum and is the most important content of the PoS system. Here, it is also worth mentioning that the corresponding search engine is the PoS node and super dApp. Google is essentially an advertising company, and its profit source is selling the traffic of Google Search to advertisers, while the income of PoS chains comes from node staking in exchange for public chain Gas Fees. Super dApps are also generators of public chain fees; this is the root of their correspondence.

Therefore, the prosperity of public chains is actually directed towards public chain transactions, and the SOL price and low Gas Fees can strike a balance between stimulating nodes and encouraging user transactions. Of course, the cost of this is becoming a "data center chain." It can be said responsibly that Ethereum remains sufficiently decentralized, even with Lido holding about 30% of the staking share.

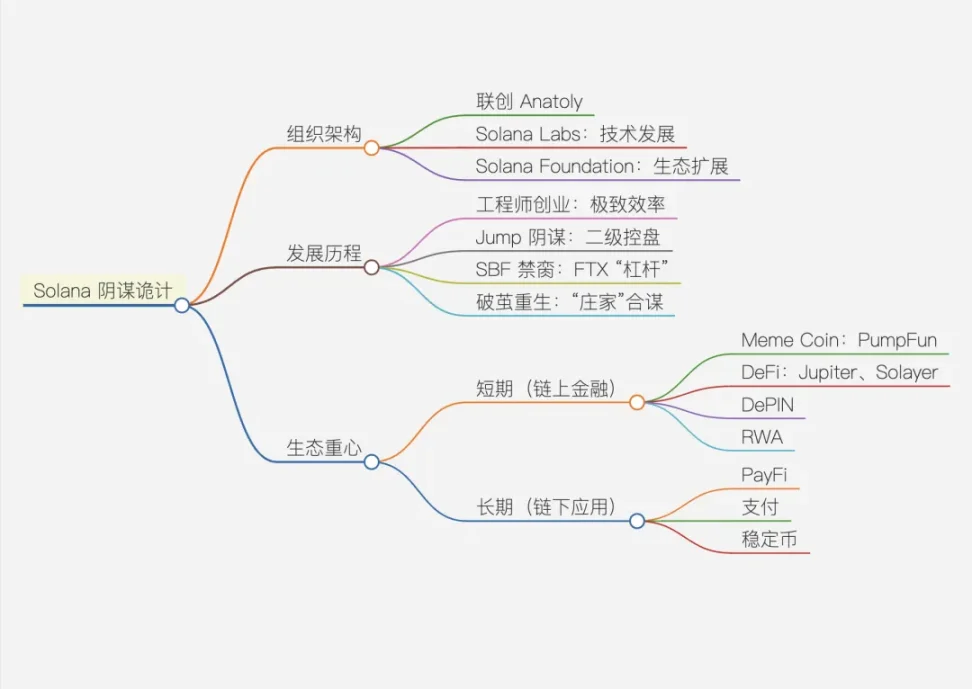

Thus, I really like the term "token issuance group." Solana has been closely associated with conspiracy since its inception, from the high control of Jump and SBF to the Jupiter DeFi small group during the meme era, which is closer to the colors of the PayPal mafia than terms like community or DAO—pursuing extreme capital efficiency.

Image caption: Solana's indomitable half-life, image source: @zuoyeweb3

In terms of absolute ecological scale, Solana/SVM is much smaller than ETH/EVM, but Solana has found the most suitable approach for itself: embracing any conspiracy group. If you think the token issuance group will destroy Solana's image, then please flash back to Jump, SBF, and now the Trump family. I can't say they are not good people, but they are definitely not kind-hearted.

With Labs and Foundation split, Labs focuses more on technological advancement, while the Foundation, under Lily Liu's leadership, actively markets, contrasting with Ethereum's Vitalik-led approach and the EVM's attraction to the ecosystem. This does not mean that the EF should transform into an SF; it emphasizes that Vitalik's name matches reality—either he takes charge himself or completely delegates power, focusing on being a spiritual leader. Wanting both clearly leads to getting nothing.

Since its birth, Solana has grown in the shadows, embracing extreme capital efficiency, returning the original number of the token issuance group in the name of decentralization, with the retail group experiencing a 20/80 split.

From this perspective, Solana represents the opposite of scale effects, the relationship between public chain net income and total assets relative to its number of users: Web2 and industrial companies grow larger with more people, but Web3, supported by token prices, is not the same. BTC, strictly speaking, has no employees, while the EF and Linux's large personnel have already caused bloat. Solana, under a relatively small controlling system, maximizes its economic value.

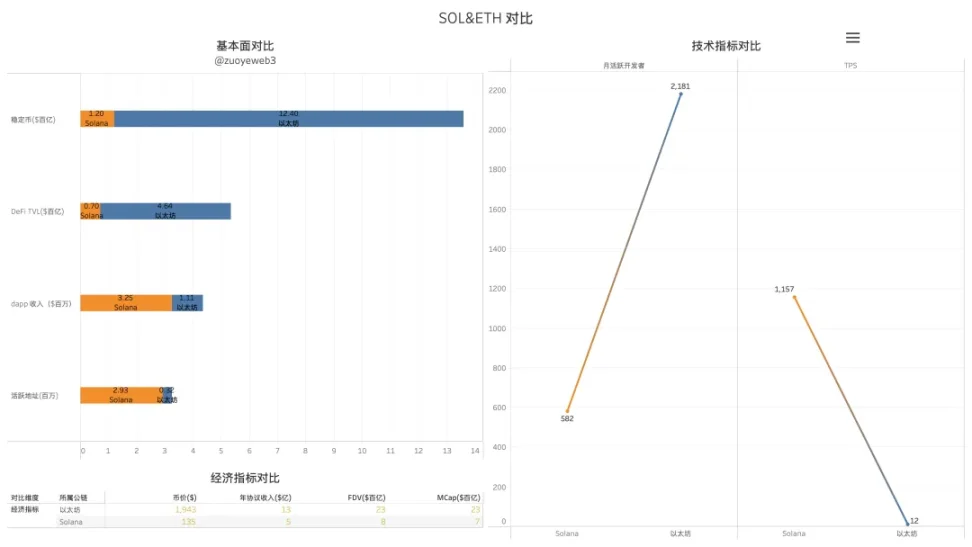

Image caption: SOL ETH comparison, data source: CMC/Defillama/Token Terminal/Chain spect

If we were to evaluate the efficiency ratio, Solana undoubtedly deserves the first place, earning a little red flower. Solana, with a developer scale of 1/4 that of Ethereum, has surpassed Ethereum in active addresses and dApp revenue, and it is even more remarkable given the significant lag in DeFi TVL and stablecoin issuance.

In fact, this achievement was primarily made under the condition that PumpFun occupies the vast majority of memecoin issuance, and it cannot be said that Solana's DeFi has completely surpassed Ethereum overall, as Ethereum's massive scale is also reflected in L2 and the EVM ecosystem, which we will illustrate with BNB Chain.

The Dogecoin Paradise Transforms into Big Brother's Wonderful House

The key to the problem is not the size of our brains, but having the right concepts.

EVM is Chromium, and the best way for BNB Chain is to become Edge, just as Binance plays the role of Microsoft, an absolute top-tier industry traffic entrance. We just mentioned that Solana has the highest efficiency ratio, so BNB Chain's active addresses crush everything, with BNB Chain boasting 4.4 million, far exceeding Solana's 3 million and Ethereum's 300,000.

Perhaps it is Binance's past glory that overshadows everything; most people still refer to BNB Chain as BSC. This reflects that BNB Chain's highlights are all in the past. How should it strive for the future is not something that memes can bear, because BNB is the essence, not the ecosystem, which is also the wonder of BNB Chain.

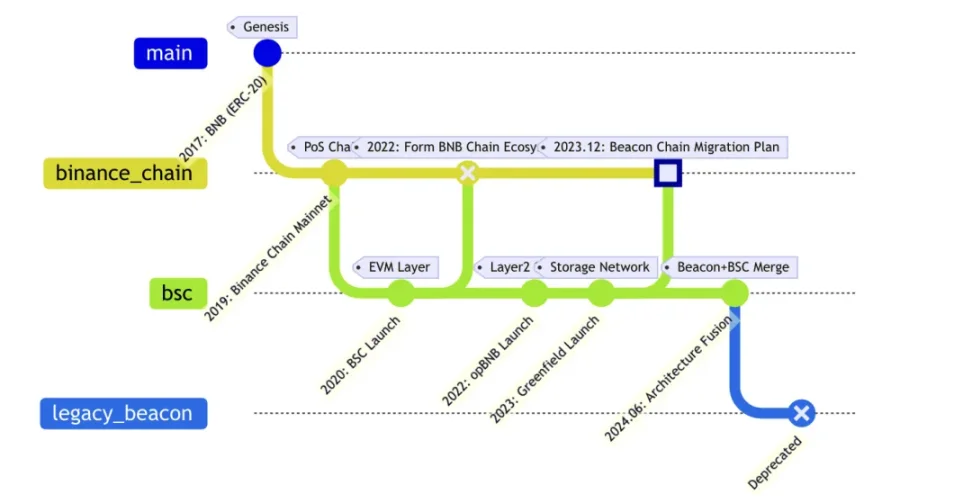

Image caption: The evolution of BNB Chain, data from Binance Academy, image source: @zuoyeweb3

To complain a bit, the name changes of BNB Chain highlight the "big company disease," having clearly gone through more than one leader. One can distinctly feel that BNB Chain's focus during industry hot cycles is completely different.

The confusion of names is an external manifestation of entropy; entropy can kill, whether it is genius, technology, or money, everything will move towards disorder and chaos.

Especially the strange names of BNB Chain, which are as odd as ETH Chain or SOL Chain, overly focus on token prices rather than the ecosystem. From the experiences of Solana and Ethereum, moderation is the true gentleman.

If we summarize BNB Chain's development strategy, following strategy is the best evaluation. From early imitation of Ethereum to now "copying" Solana, please note that this is not criticism; everyone likes useful things. AMM DEX sweeps everything; we can't say everyone is copying Uniswap, as Bancor was actually the first.

However, BNB Chain's biggest problem is the continued use of an exchange-based mindset, which is fundamentally different from the thinking required for a public chain. More seriously, it confuses the two.

We can outline the current mixture of the BNB Chain ecosystem:

Ethereum thinking: DeFi/ Staking / RWA/ DePIN/ DeFAI/ Meme

CZ thinking: AI First/ DeSci/ Meme

Solana thinking: Payments / Stablecoins / Meme

In fact, memes are not the focus of BNB Chain's development because they are "new," but rather a consensus zone after a game of strategy. Although CZ/Binance has stated they do not own or manage BNB Chain, their influence remains enormous.

Especially after CZ was banned from managing Binance, BNB Chain became his main battlefield. We can understand the value of BNB and BNB Chain according to the split Binance ecosystem.

BNB's dual identity, serving as both Binance's platform token and supporting the main site ecosystem, while BNB also serves as the value support for BNB Chain, satisfying both the "old" large node holders' returns and new users' high-speed low-fee meme needs.

If Binance's own shares are in a 9:1 ratio between CZ and He Yi, then the rise in BNB price and node returns is the only way to reward node users. This ensures that large holders are willing to hold BNB, so retail users' Gas Fees must be consumed through popular tokens.

As long as the ecological construction costs (pump) are lower than the fees contributed by users, then BNB is a cash cow, especially now that CZ has effectively started selling his shares, the stability of BNB is crucial. After all, when Binance launched, it sold BNB, not Binance shares, maintaining the value and price of BNB as two sides of the same coin.

Only in this way can we understand the significance behind BNB Chain frequently deploying liquidity subsidy strategies. BNB Chain aims to become a barrier for Binance's main site cash flow, rather than a floodgate for blood loss.

However, flowers do not bloom for a hundred days, and rivers have 103 palms. Whether Binance, which is closely aligned with the existing American political system, can maintain the status quo in the midterm elections and four years later is known only to heaven.

Because Base and Solana are more American, while Ethereum and BTC are more global, the current development paths of public chains have only two: 99% belong to America, and 1% belong to all humanity, with no middle ground.

Conclusion

The sequel to the spirit of Netscape, FireFox, nurtured the Rust language, which has become the precursor to Solana and Move VM. This is also a kind of bond between Web3 and Web2.

Vitalik once wanted to intern at Ripple and almost became a colleague of Sun Yuchen. I don't know if it was fortunate or unfortunate that Sun Yuchen failed to inject Eastern philosophy into Vitalik, leaving Tron with the infamous label of copying Ethereum.

In comparison, Solana's story is not so legendary, and BNB's story resembles that of a commercial company. However, everyone's focus is now on Vitalik himself. He "defeated" the seven co-founders of Ethereum and became the main spokesperson for Ethereum. This is a historical opportunity, but also a heavy responsibility.

Milady!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。