The homework for Sunday is still not complicated. Although the volatility has increased slightly, it has almost no impact on most investors. It’s already good to have a smooth weekend, as starting next week we will enter a game mode. Yesterday's homework was quite clear; the Japanese monetary policy meeting on the 19th is unlikely to make any adjustments, and the Federal Reserve's meeting on the 20th is also very likely to remain unchanged.

However, the market is beginning to anticipate a pause in the tapering on the 20th, and it is possible that there will be an early reaction when the market opens on Monday. After all, the U.S. government shutdown ended over the weekend, and Polymarket has given a 100% probability that the Federal Reserve will stop tapering before May. This is actually a relatively dangerous signal; if it really happens, it could be seen as the Federal Reserve having a positive outlook on inflation or as a concern about tariffs leading to a recession.

With the dot plot and Powell's speech, it really is a gamble now, and it’s a complete gamble. For example, scenarios of cutting rates three times and pausing tapering, only cutting rates three times without pausing tapering, cutting rates twice and pausing tapering, only cutting rates twice, and cutting rates less than twice, all test the market sentiment significantly.

Today, this issue was also discussed in Space. If there are too many rate cuts, stopping tapering could indicate a concern about recession; if there are too few rate cuts and no tapering, it may not indicate a concern about recession, but there will be worries about inflation. Therefore, it is very difficult for investors.

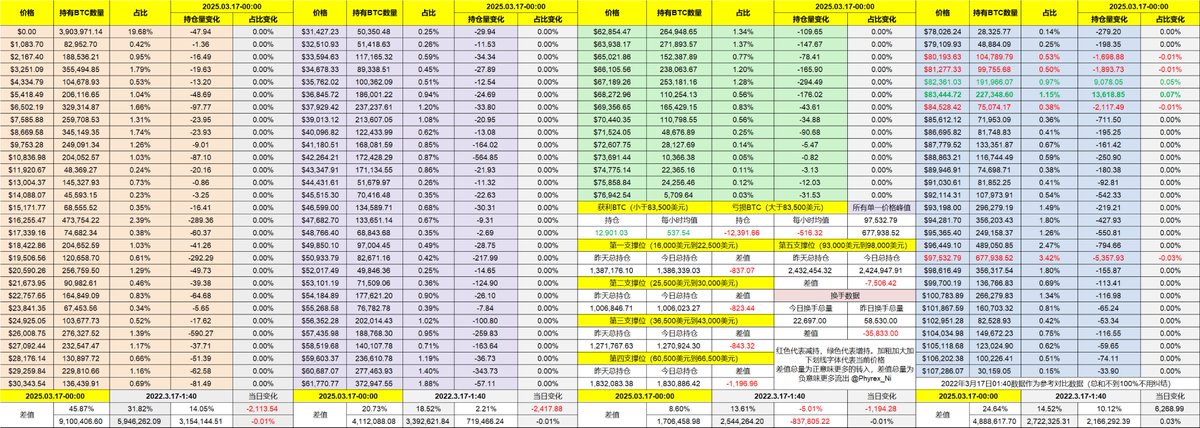

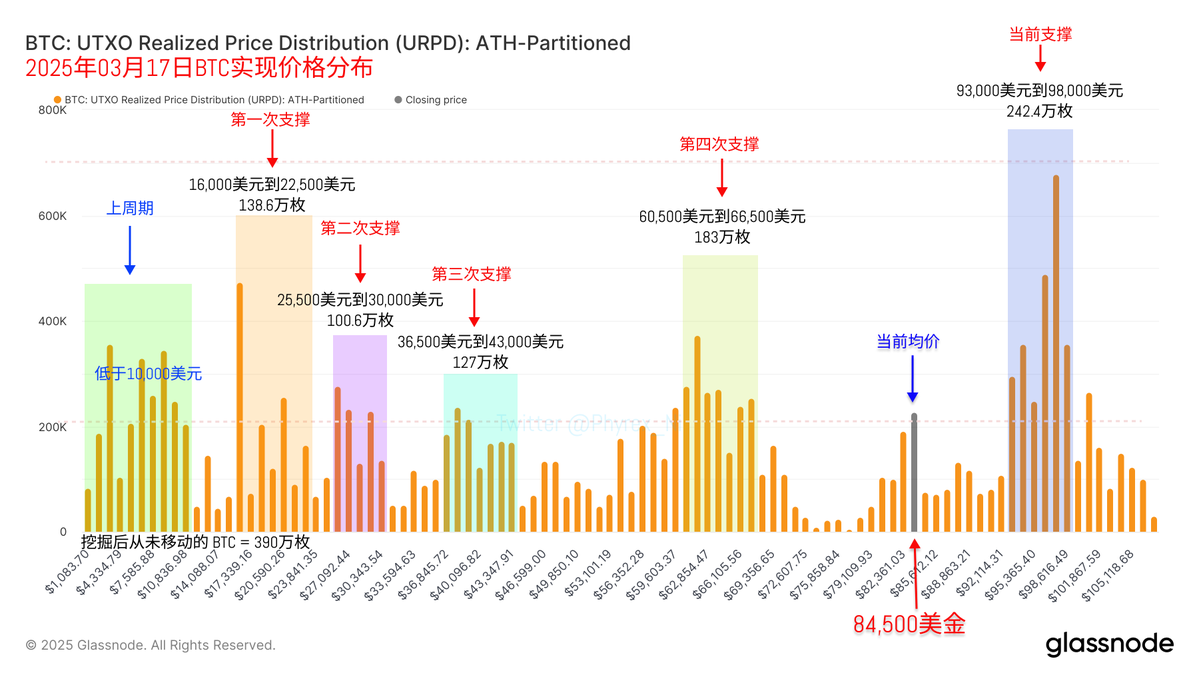

Looking back at the data of #Bitcoin itself, the weekend was still quite relaxed. Although the volatility was slightly high, the impact was minimal, and it is evident that there was very little turnover among on-chain investors. This was almost the day with the lowest turnover rate since 2025, with only over 20,000 $BTC changing hands throughout the day, indicating that most investors have no interest in the current price.

This turnover rate has little to analyze, and it can also be seen that without the interference of market makers and institutions, the real investors' mentality is reflected. However, this low turnover is more susceptible to emotional influences. Regardless of the outcome on the 20th, such calm days may not last for long.

Naturally, low turnover will not affect support levels. Although there are signs of accumulation around $83,000, it will take a long time to establish a bottom. Meanwhile, the levels between $93,000 and $98,000 remain very strong, and there are still no signs of panic in the short term.

The rest will depend on next week.

Data has been updated, address: https://docs.google.com/spreadsheets/d/1E9awSVwrVOxKOiaMdYT5YZvfveeFd9ENU-iO6dVcGj0/edit?usp=sharing

This post is sponsored by @ApeXProtocolCN | Dex With ApeX

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。