Author: Frank, PANews

The SIMD-0228 proposal, the most controversial in Solana's governance history, ultimately failed with less than 66.6% of votes in favor. This vote not only sparked a technical debate over inflation reform but also evolved into a battle of interests among validator classes.

Top players attempted to push for ecological efficiency upgrades, while small and medium validators fiercely resisted for their right to survive. When the "democratic facade" of on-chain governance was torn apart by data, Solana revealed not only the inflation problem but also the real rift in interests between large and small validators. How will this storm reshape the future of the ecosystem? The answer may lie in the interplay between code and the ballot box.

The Interest Game Between Large and Small Validators Led to Proposal Failure

The main content of the SIMD-0228 proposal was to enhance the network's staking rate by dynamically adjusting the inflation rate. Previously, PANews provided a detailed interpretation of the proposal's content (Related reading: Solana's Inflation Revolution: SIMD-0228 Proposal Ignites Community Controversy, 80% Increase in Issuance Hides "Death Spiral" Risk)

In general, if the proposal passed, it was highly likely that Solana's block rewards would decrease. When the proposer suggested this idea, they believed it would not significantly impact validators' income. Their reasoning was based on a substantial increase in MEV income for validators in the fourth quarter of 2024, suggesting that even with reduced inflation and block rewards, the overall income level for validators would not be affected.

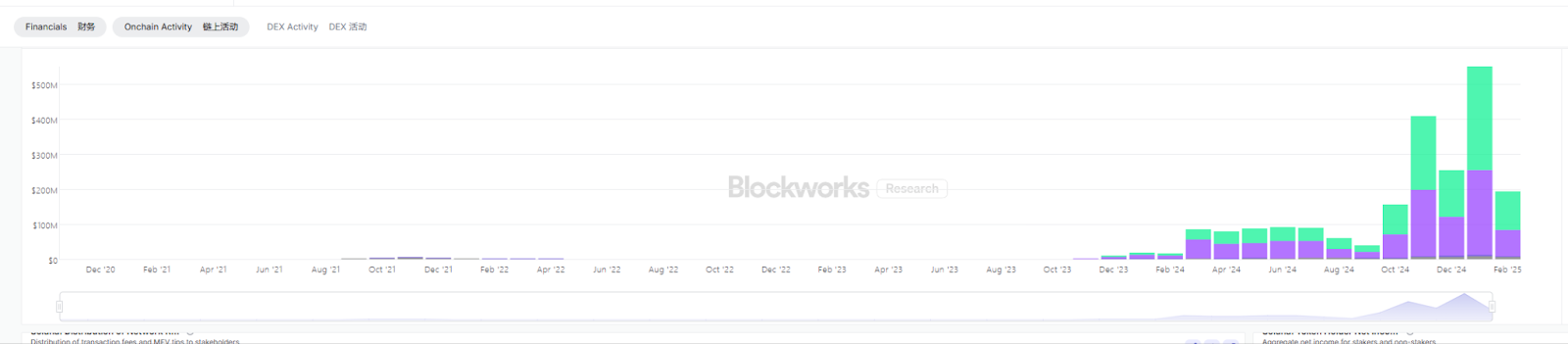

However, in fact, data from February 2025 showed that MEV income on the Solana chain had significantly shrunk. Compared to a total income of $550 million in January, it dropped to $195 million in February, a monthly decline of 64%. The income for March is expected to be even lower than that of February.

This means that the premise of the 0228 proposal no longer exists, and the most affected are undoubtedly the small and medium nodes.

Therefore, in this vote, a clear polarization in attitudes was evident. The voting results showed that 67.5% of small nodes with a staking amount of less than 100,000 SOL voted against the proposal, while over 60% of medium nodes with a staking amount below 500,000 SOL also voted against it. In contrast, 51.6% of validators with a staking amount between 500,000 and 1,000,000 SOL voted in favor, and the approval rate among nodes with over 1,000,000 SOL was 65.8%.

It can be said that the failure of the SIMD-0228 proposal was essentially a battle of interests between large and small validators within the Solana network.

The Survival Dilemma of Small and Medium Validators: Sharp Decline in MEV Income Affects 90% of Validators

The core reason for this situation lies in the different operating models of large and small validators.

Large validators operate on the logic of enhancing their share of leading blocks to provide better on-chain services to clients. Therefore, it is evident that the top-ranking large validators extract less MEV commission, with many earning zero. These validator operators are either centralized exchanges or service providers like Helius that offer RPC services.

Small and medium validators, on the other hand, rely more on block rewards and MEV income. Most small and medium validators primarily depend on block rewards and MEV income for reasonable revenue. Once this income sharply declines, they either have to exit the validator ranks or resort to methods like running sandwich attack bots to increase gray income.

Before analyzing the specific impact of the proposal on small and medium validators, it is necessary to clarify their cost structure.

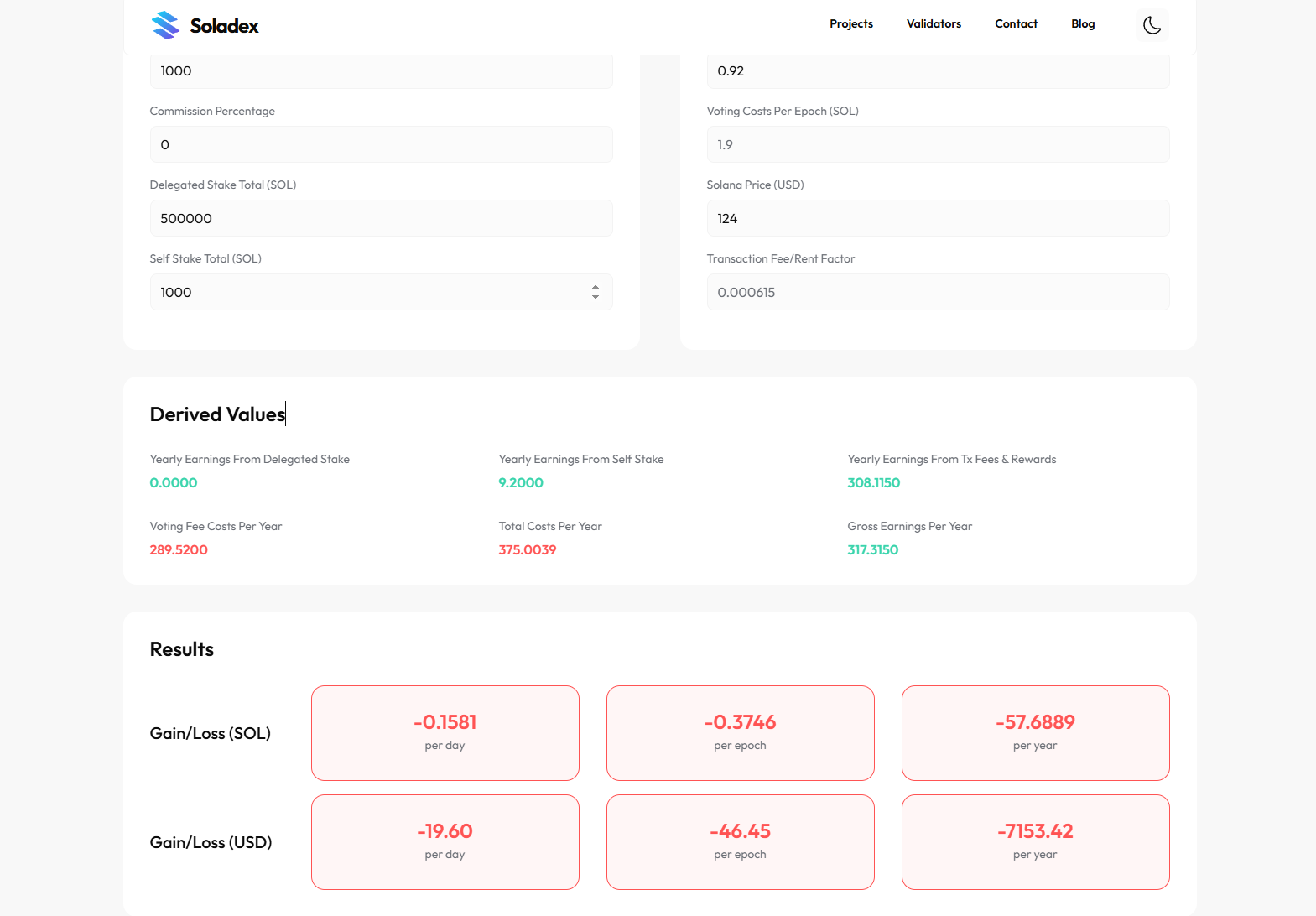

For the smallest unit of validators, the current recommended equipment for running a validator requires several important configurations: 512GB of memory and 10GB of bandwidth. These two items represent the highest costs, with a server configured this way costing at least about $800 per month. Additionally, a minimum of 1,000 SOL in staking equity is required. The total investment amounts to approximately $134,000. If block rewards drop to 0.92% (the expected inflation rate of the proposal), the daily net loss would reach $19.6, while also bearing the risk of value loss from a decline in SOL tokens.

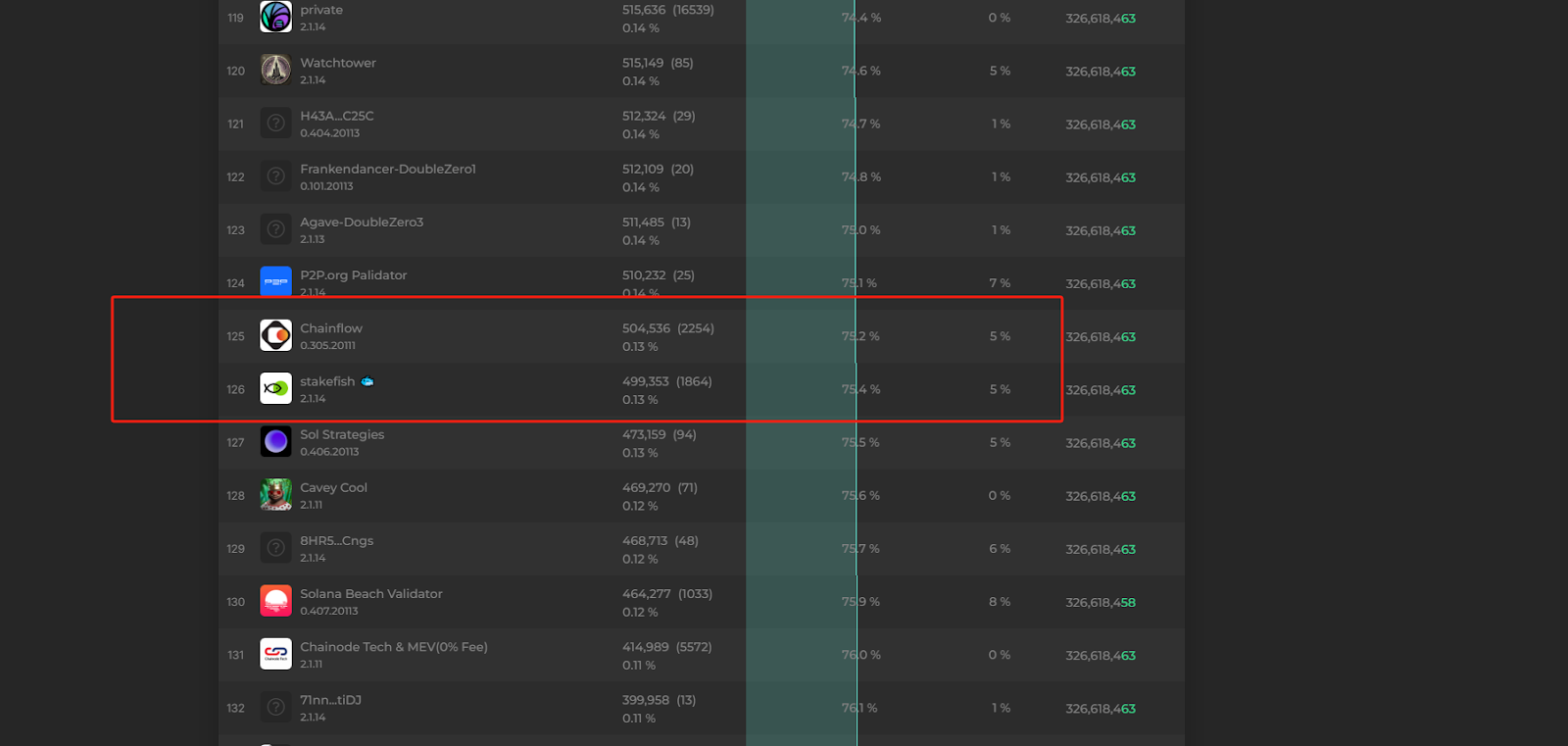

According to the current distribution of validator nodes, over 90% of validators have less than 500,000 SOL. To attract more staking volume, these validators typically adopt a low commission rate of 0-5%, meaning they charge very little staking commission from delegators, with most of their income coming from their own staked funds.

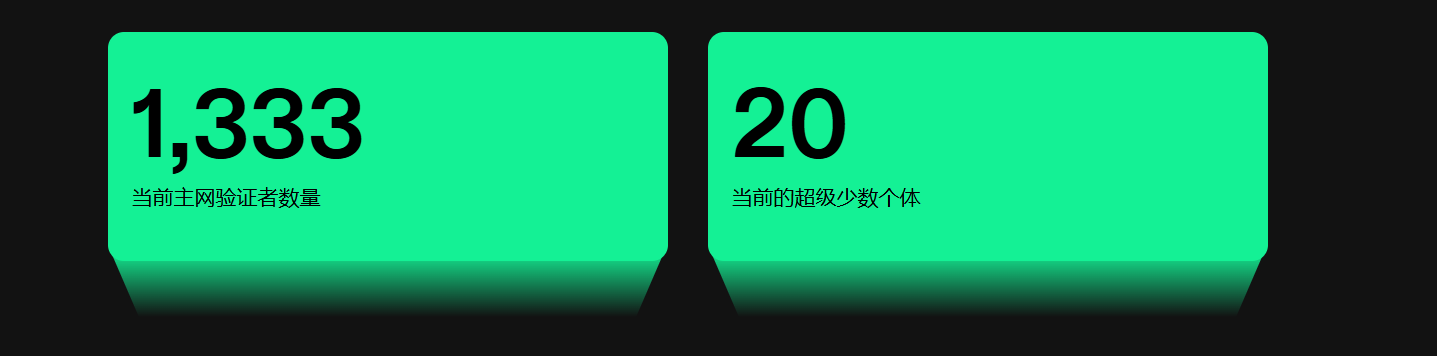

Looking at the distribution of priority fees, there are currently 1,333 validators, with the top 125 large validators holding 75% of the share. The remaining 1,208 small validators share about 25% of the market. Based on the total on-chain fees of $195 million in February, these 1,208 validators could collectively receive $48.75 million, averaging about $40,000 in income per small validator.

Taking the median node (ranked 729) as an example, this node's self-staking amount allows it to earn $3.67 per day, but if the inflation rate is reduced to 0.92%, this node could potentially lose $17 per day.

Solana Co-Founder Proposes New Plan to Reduce Inflation

In fact, another proposal, SIMD-0123, was concurrently discussed alongside 0228. Similar to 0228, this proposal was also designed to limit validators' income. It aims to automatically distribute rewards that validators promise to delegators at the end of each cycle through a protocol upgrade. Under the current mechanism, validators issue NFTs or LSTs (liquid staking tokens) as settlement vouchers, but this settlement method is neither public nor accurate. There have been instances where some validators privately adjusted commission rates to reduce returns to delegators.

However, this proposal did not spark widespread discussion like 0228 and ultimately passed with a support rate of 74.91%. Solana co-founder Toly commented on X, stating, "Simd 228 did not pass, but 123 did. Although both proposals aim to reduce validators' income, opposition to 228 is not solely for their own benefit."

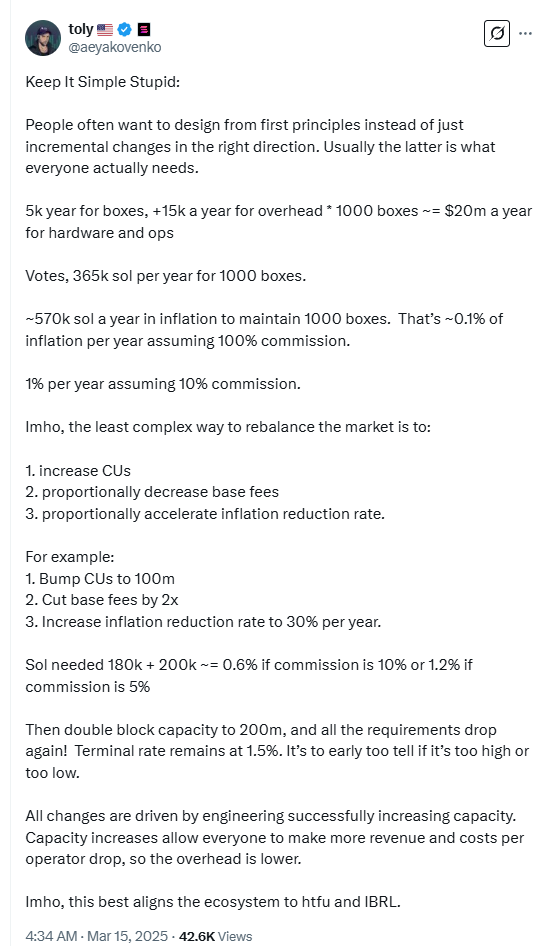

Nevertheless, the failure of the 0228 proposal does not mean a halt to Solana's inflation reform plans. After the voting concluded, Toly proposed another more moderate plan on X, which involves increasing the block CU (computing unit) amount to double the network's throughput and accelerating the annual deflation rate to 30%.

Overall, Toly advocates for reducing the cost of individual transactions through engineering optimization and increasing network efficiency while decreasing reliance on inflation, gradually achieving a sustainable model of "high throughput, low inflation." This plan avoids the complex governance games of SIMD-0228 and relies more on the natural evolution of technological upgrades.

However, this proposal has not yet been formally presented in the developer forum; it is merely a suggestion. Regardless, the inflation issue of SOL seems to be one of the key problems that the Solana ecosystem must address moving forward.

The failure of the SIMD-0228 proposal reflects the complex interest structure within the Solana ecosystem and the urgent need to optimize governance models. Although this proposal ultimately failed, it may represent a successful collective participation in Solana's governance journey. Moving forward, how to balance the interests of all parties while optimizing the token inflation model, ensuring the ecosystem has a unified goal to continue progressing, may be one of the most challenging issues in Solana's governance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。