In the financial market, we often talk about arbitrage, including cross-market arbitrage, cross-period arbitrage, statistical arbitrage, triangular arbitrage, and so on. However, in #Web3, understanding the trends of Web2 is a good strategy, especially the linkage between primary and secondary markets, which presents many opportunities for statistical arbitrage. Today, let's take a look at the latest research report released by Redpoint Ventures! It includes macro thoughts, perspectives on primary VC investments and the secondary market, and is definitely worth a look! 🧐

As one of the top venture capital firms in the United States, Redpoint Ventures is well-known, with notable investment cases including: #Netflix, #Twitter, etc. Web3 projects such as: #SUI, #Arbitrum, #DUNE, etc., are also part of their investment portfolio. Today, we will briefly discuss this report 👇 (If you need a bilingual PDF version, we have already completed the translation, feel free to message me to complete a small task for a free copy).

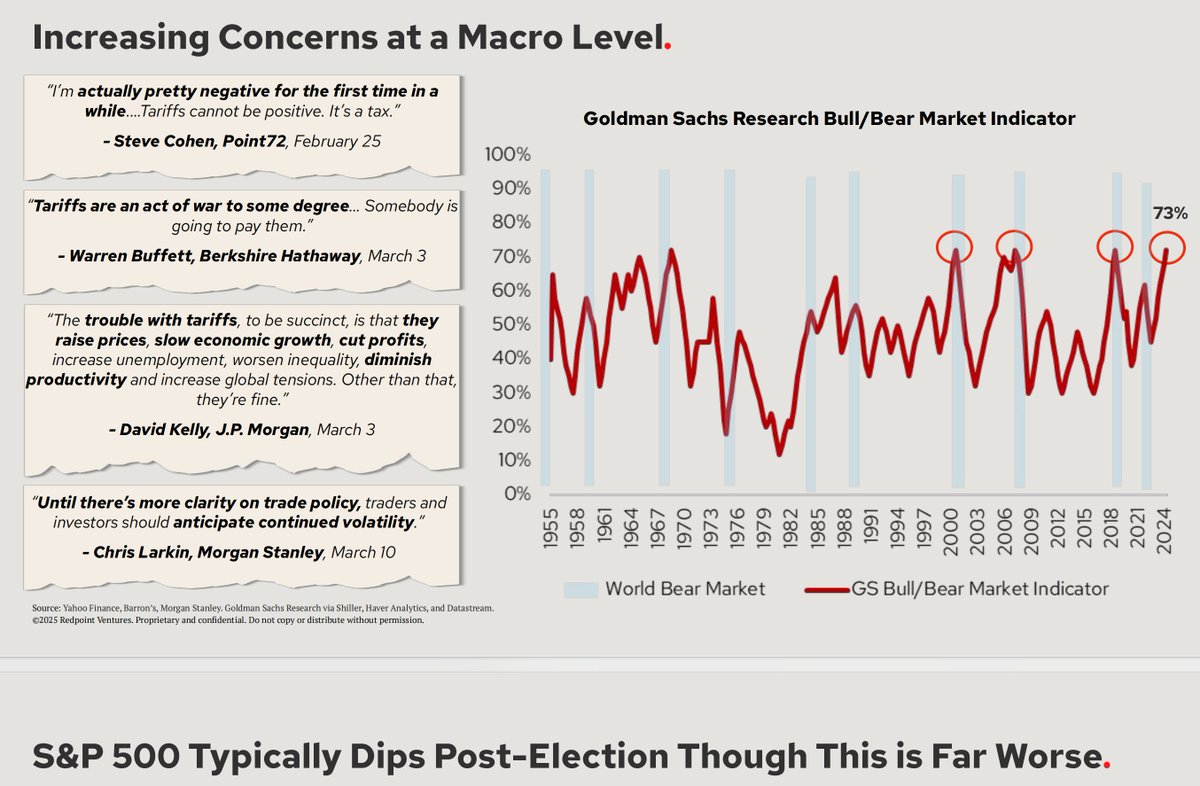

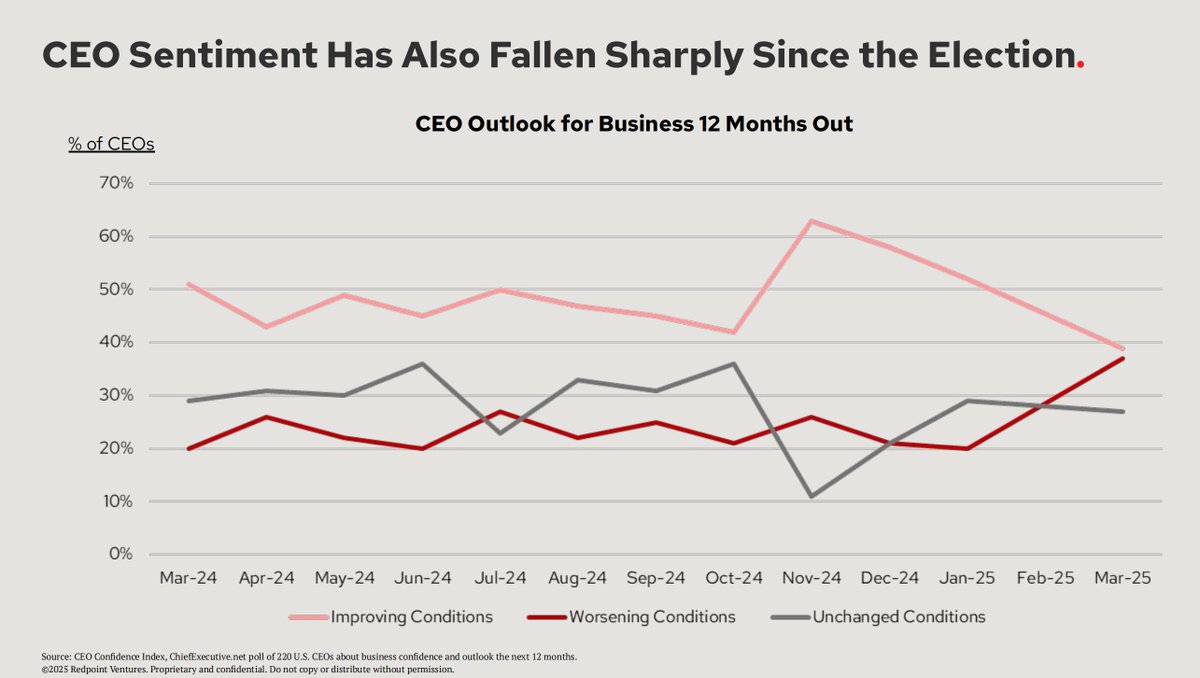

1️⃣ Macro Market (See Figures 1 and 2)

· Institutional investors are increasingly worried about the (U.S.) macro economy.

· Historical data shows that U.S. stocks typically decline in the months following elections, but this time the drop is far greater than in the past.

· M7 yields are astonishing, but there was a significant sell-off after Trump took office.

· Growth is sluggish, and listed companies prioritize ensuring profitability (through layoffs and other means) over scaling growth.

2️⃣ Overall Market Data 📊

· The Matthew effect is evident, with market differentiation causing a widening gap in market capitalization between large software companies and others.

· Large tech companies are most focused on keywords like AI, macroeconomics, and efficiency.

· The time for startups to achieve extremely high valuations (over $50 billion) has shortened; it used to take 26 years to reach a $50 billion market cap, but now it only takes 11 years.

3️⃣ Primary VC Market

· Total venture capital reached a bottom about two years after its peak, and the market shows signs of recovery.

· Although the activity level of Series A financing is still below pre-pandemic levels, Series B and C have rebounded.

· Compared to the public market, the ARR valuation of software projects in the primary market remains above historical averages.

· AI-related transactions are rapidly increasing their share of overall transactions, with VC funds concentrated in top companies, where the top 20 companies account for 40% of the total funds raised.

4️⃣ Observations on the AI Sector

· Native AI applications are growing revenue faster, achieving millions of dollars in annual revenue scales earlier than SaaS startups.

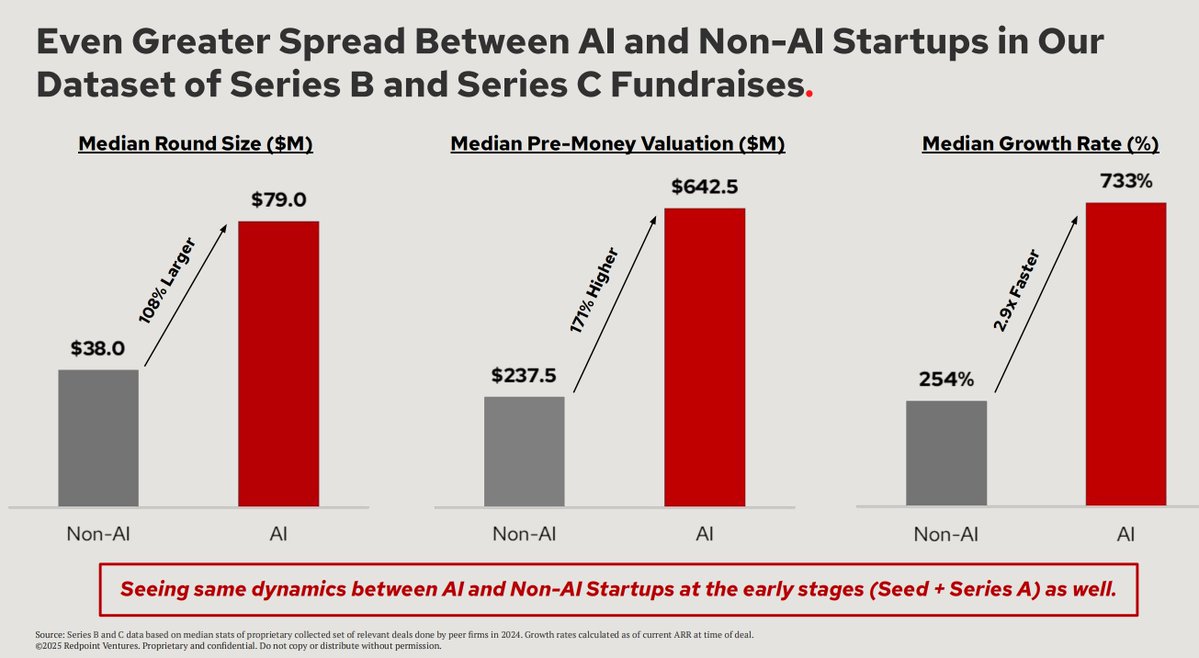

· AI companies have a significantly higher median valuation in each round of financing compared to non-AI companies, showing a valuation premium (See Figure 3).

· At the B and C round levels, AI companies' single-round financing scale, pre-financing valuations, and growth rates far exceed those of non-AI companies, with the gap continuing to widen.

· Today, large startups can obtain unprecedented large-scale primary capital support from the private market.

· The concentration of funds is increasing, with the top AI leading companies receiving a larger share of investment funds.

5️⃣ Investment in the AI Sector Remains a Focus

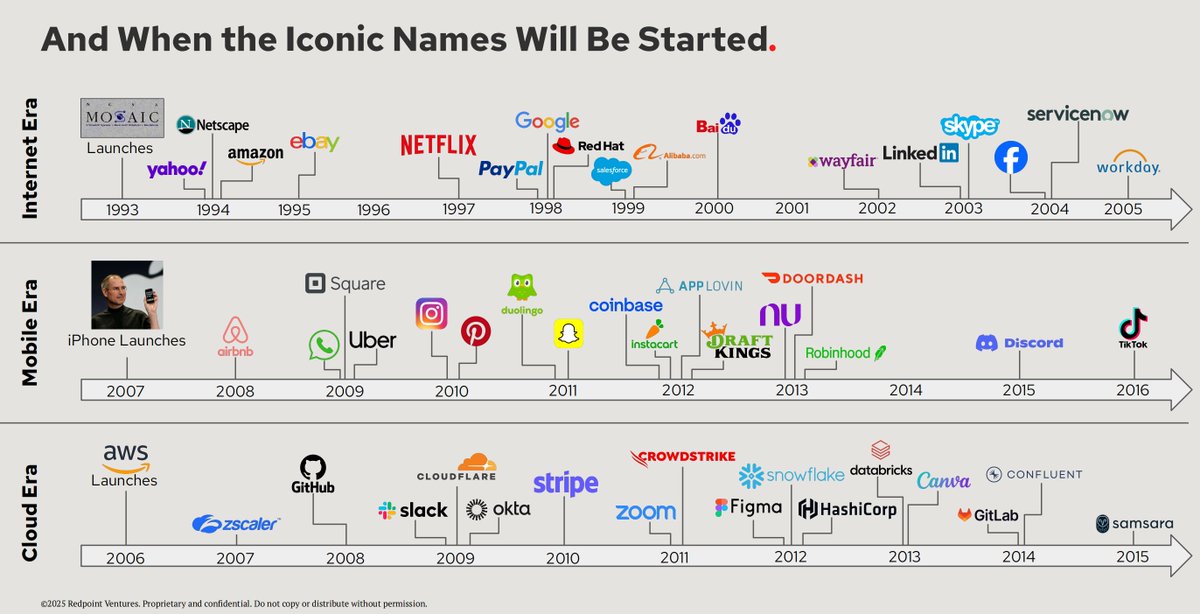

· AI is gaining unanimous recognition from the world's top tech leaders and is seen as the next major platform shift after the internet and cloud computing.

· Leading cloud providers ("hyperscale" companies) are accelerating massive investments in building AI infrastructure, laying the groundwork for future competition.

· Companies are rapidly releasing budgets for AI, with the proportion of funds allocated to AI-related work expected to significantly increase over the next three years.

· AI is believed to fundamentally reshape workflows, with potential outputs creating trillions of dollars in new market value.

· While it is still uncertain which platform growth curve AI will mimic, a new batch of iconic companies may emerge in this wave (See Figure 4).

Summary: Following smart money and the wisest group of people in the world to uncover investment opportunities is often a safe bet. Learning AI, investing in AI, and positioning in AI cannot be delayed; let us grow and improve together by 2025. Grateful 🙏

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。