Source: Cointelegraph Original: "{title}"

According to Kevin Rusher, founder of the real-world asset (RWA) lending platform RAAC, if the price of Ether drops another 20%, this decline could trigger up to $336 million in decentralized finance (DeFi) liquidations.

The executive warned that a price drop to $1857 would trigger $136 million in liquidations, while a drop to $1780 could additionally trigger $117 million in loan liquidations—thus these will become key price points to watch.

Rusher added that the worst-case scenario is if the ETH price drops 20%, falling to around $1500, which could lead to $336 million in DeFi loans being liquidated, further causing a market crash. In a written statement shared with Cointelegraph, Rusher stated: “The main trigger for this crisis is a $130 million loan collateralized by ETH on the Sky (formerly Maker) platform. Although the borrower rushed to add more collateral, this loan is still on the brink of collapse. In every cycle, cryptocurrency-collateralized loans face extreme volatility, which can lead to cascading liquidations and subsequently cause asset prices to plummet.”

The executive called for the inclusion of much more stable real-world assets, such as real estate and gold, into the DeFi ecosystem to offset volatility and prevent cascading liquidations caused by over-leveraging.

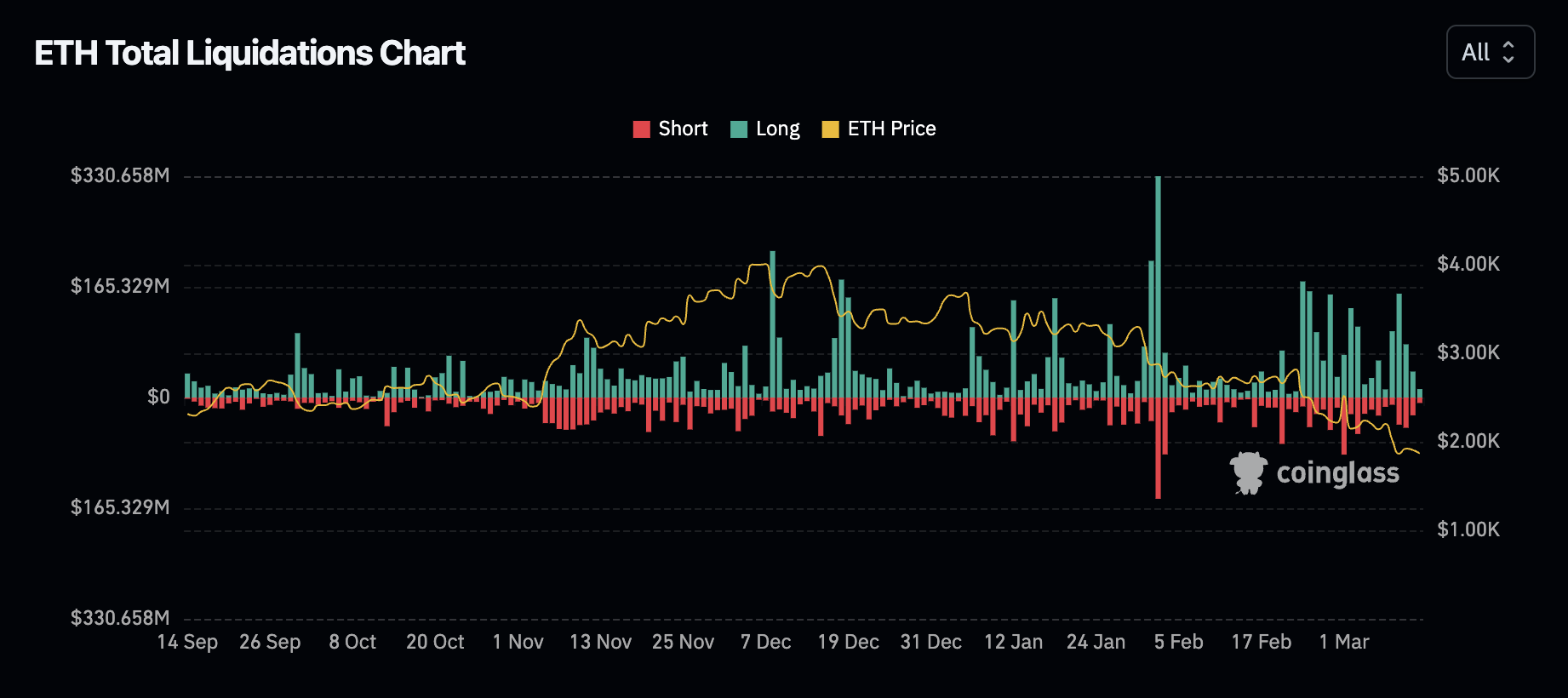

Total ETH liquidations. Source: CoinGlass

ETH price plummets, more pain ahead?

Ether against Bitcoin (BTC) has fallen to multi-year lows, indicating that it could drop another 30% against this fixed-supply asset, leading some analysts to predict that the bottom for ETH's price may be around $1600.

In the past seven days, ETH's price has dropped over 15%, and since February, it has been trading well below the 200-day exponential moving average (EMA).

The relative strength index (RSI) is currently at 31, almost in the oversold range, which could represent a local bottom or signal an impending price reversal.

Current Ethereum price trend and analysis. Source: TradingView

Ether's disappointing price performance has prompted some market analysts to call for a shift towards better-performing altcoins to maximize potential profits.

“If you still hold ETH, now is likely a good time to sell it and buy altcoins with a higher beta coefficient,” trader Alex Krüger stated in a post on the X platform on March 12.

Related: Ethereum delays Pectra upgrade, advances deployment of third testnet Hoodi

This article does not contain investment advice or recommendations. Every investment and trading operation carries risks, and readers should conduct their own research when making decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。