Money is just a measure of your progress, but that doesn't mean you can "save your progress" when you reach your goals.

Author: Res

Compiled by: Deep Tide TechFLOW

Over the past three months, after losing most of the assets in my portfolio, I have been reflecting on a question:

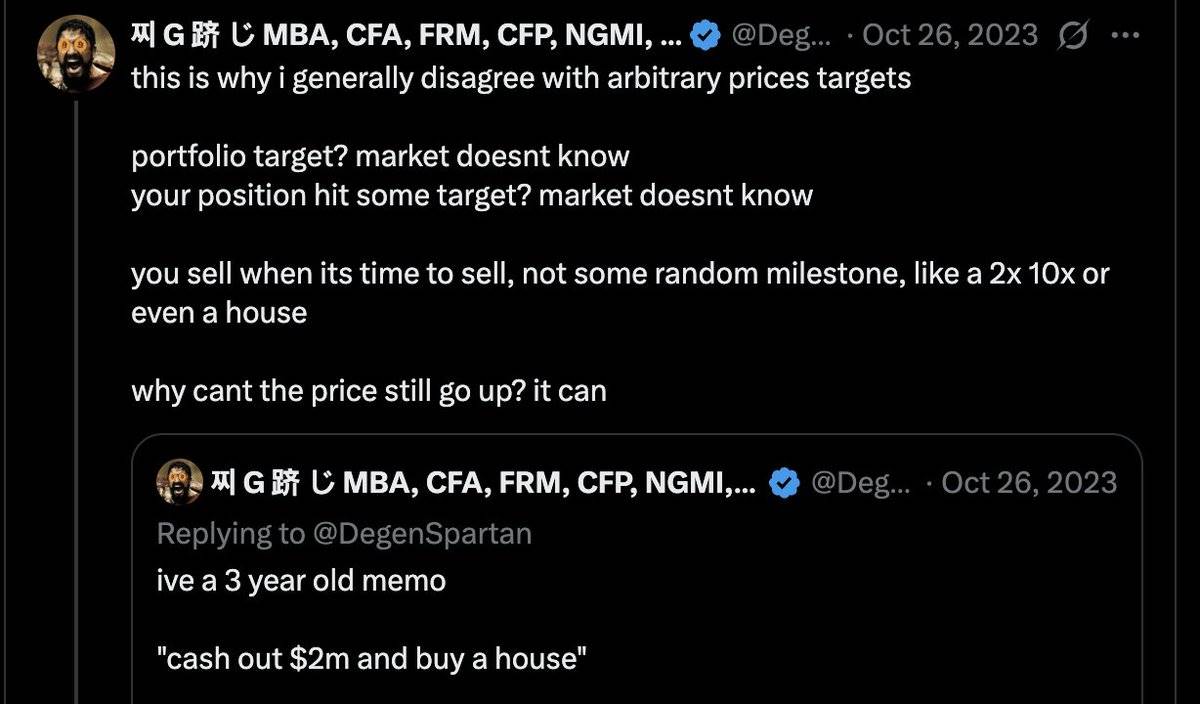

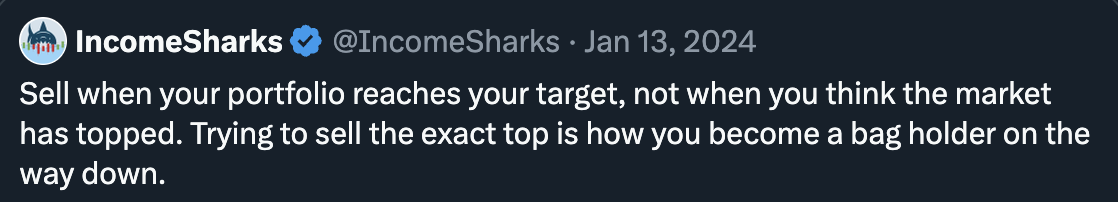

"Sell when your portfolio reaches your target, rather than waiting until you think the market has peaked."

I have always believed that selling based on personal goals is counterproductive because your trading risks and behaviors should be determined by the market. By the way, you can see @DegenSpartan's post, where he defends this viewpoint.

If I achieved my goal when Bitcoin (BTC) reached $50,000, why would I sell if I think it might rise to $100,000? It doesn't make sense to me.

Similarly, if your portfolio has already reached $870,000 and your target is $1,000,000, you wouldn't force the market to keep rising just because your target is $1,000,000, especially when the market may have already peaked.

You have to accept reality and then let go.

However, this mindset is overly idealistic, or rather, only that 0.01% of people might be able to do it. Yes, this approach is perfect, but the reality is that you cannot accurately pinpoint the market's peak.

How many people have experienced their funds falling back from a high point? I bet there are many here who once achieved their dream of financial freedom months or even years ago, only to watch that wealth evaporate in a matter of weeks.

Illiquid junk coins, revenge trading, leveraged operations… some people have even fallen from eight-figure assets to having nothing.

You can never know if the market has peaked because you don't have that ability.

The reason that allows you to make big money is often the same reason that leads you to lose everything—most of the time, you are a "perma-bull," and your high-risk tolerance brings huge returns during good market conditions, but this behavioral pattern and the positive feedback from continuous victories can lead you to lose your mind during bad market conditions, ultimately getting "harvested."

Not to mention the timing of the market: bottoms usually take months to form, while tops often appear suddenly within days, especially after exponential rises.

Except for those very few excellent traders, most people will still be bullish when they should sell because that is how their trading style is set up.

And when they make mistakes, especially big ones, some people can't even bear it. If you have already reached your goal, why not "save your game progress" and start over from a calm, abundant, and objective state? It's like playing a video game—you wouldn't not save your progress after completing a level in one go.

After you have lost a lot, you will realize that what you once had is more real and profoundly valuable than the numbers on the screen.

On the other hand, I don't think those who hold the mindset of "I will stop when I reach a certain point" can succeed. This mindset will never bring you closer to your goals because you must love the game: learn > improve > win. Money is just a measure of your progress, but that doesn't mean you can "save your progress" when you reach your goals.

Sometimes, more gains don't significantly change your life, but the risks you take are high. You will always be tempted to think that now is the time to go all in, and you will always have reasons to be bullish on the market.

The vast majority of people trading in these markets should adopt a systematic approach to achieve profitability and risk management:

Avoid "going all in" behavior. Accept the reality that you are not that top trader. Maybe one day you will be, but not now.

Gradually withdraw funds while making profits, regardless of your view on the market.

Set larger goals based on your lifestyle and clarify the risk-to-reward ratio (R:R). Once your net worth reaches a certain level, you should start reducing risk because further gains may not significantly change your life, but losses can have a huge impact.

For example, going from $500,000 to $900,000 may not change your life much, but the impact of dropping from $500,000 to $100,000 is enormous, even though both have a net difference of $400,000.

Withdraw more funds at your set level and reduce risk. Your goal is to start from an abundant mindset, not driven by fear and scarcity. You will be surprised at how objective you can become—suddenly, emotions no longer control you.

- Manage risk based on market dynamics. In certain situations, you can take on risk more aggressively, such as when an ETF is approved, the Federal Reserve starts cutting interest rates, Trump wins, or when the next Trump, Powell, or other key figures clearly signal a buy.

Your risk management and portfolio allocation should be a combination of 1) market-based and 2) personal life-based factors, rather than considering only one of them.

Most people focus only on market factors and ultimately fail to achieve their goals because that is not realistic for most.

- Love the game and focus on progress, and money will naturally follow. To succeed, you can never stop moving forward. If you want to stop, you will never succeed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。