Source: Cointelegraph Original: "{title}"

The blockchain network Hyperliquid, focused on trading, has announced an increase in margin requirements for traders after its liquidity pool suffered millions of dollars in losses during a large-scale liquidation of Ether (ETH).

On March 12, a trader intentionally liquidated a long position of approximately $200 million in Ether, resulting in a loss of $4 million for Hyperliquid's liquidity pool when the trade was closed.

In a post on the X platform on March 13, Hyperliquid stated that starting March 15, it will require traders to maintain at least 20% collateral margin on certain open positions to "reduce the systemic impact of large positions that can affect the assumed market during liquidation."

This incident highlights the growing pains faced by Hyperliquid, which has become one of the most popular leveraged perpetual contract trading platforms in Web3.

Hyperliquid has adjusted its margin requirements for traders. Source: Hyperliquid

Hyperliquid stated that the $4 million loss was not due to a vulnerability exploit but rather a foreseeable consequence of its trading platform's operating mechanism under extreme conditions.

Hyperliquid said, "Yesterday's event highlighted an opportunity to strengthen the margin framework to better respond to extreme situations."

Hyperliquid noted that these changes apply only in certain cases, such as when traders withdraw collateral from their open positions. Traders can still use up to 40x leverage to establish new positions.

Perpetual futures, or "perpetual contracts," are leveraged futures contracts with no expiration date. Traders deposit margin collateral (usually the US dollar stablecoin USDC on the Hyperliquid platform) to secure their open positions.

By withdrawing most of their collateral and liquidating their position, the trader effectively exited the trade without incurring slippage (the loss associated with selling a large position all at once).

Instead, these losses were borne by Hyperliquid's HLP liquidity pool.

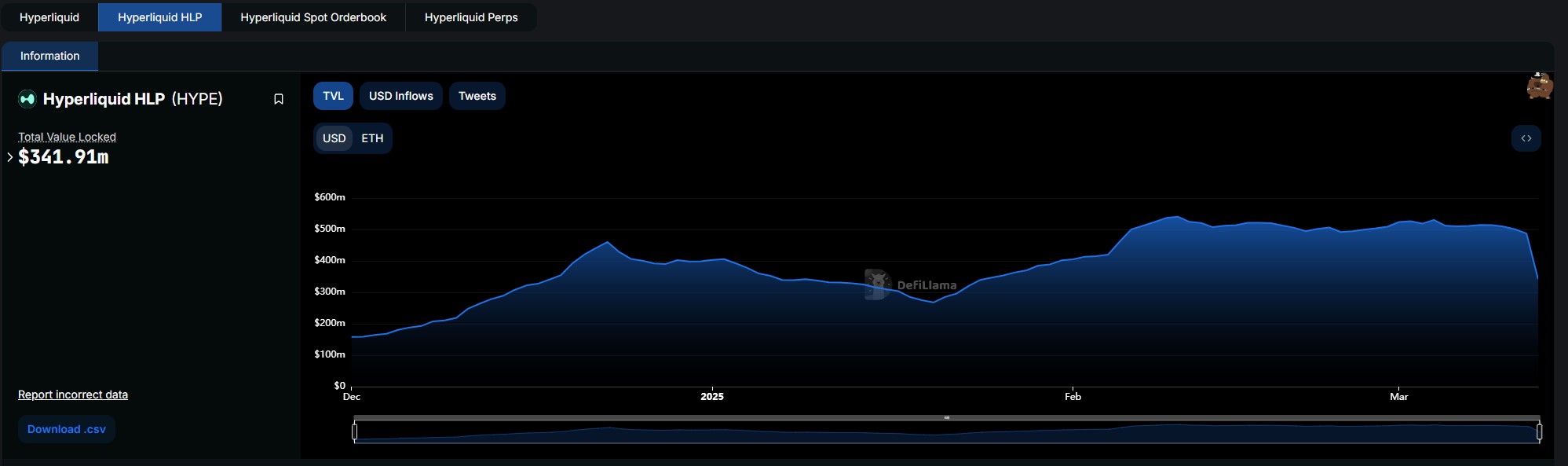

Hyperliquid's HLP total locked value (TVL) exceeds $350 million. Source: DeFiLlama

Leading Perpetual Contract Exchange

According to DeFiLlama, as of March 13, the total locked value of HLP was approximately $340 million, all sourced from user deposits.

A report released by asset management firm VanEck in January indicated that Hyperliquid's flagship perpetual contract exchange, set to launch in 2024, has captured 70% of the market share, surpassing competitors like GMX and dYdX.

Hyperliquid claims its trading experience is comparable to centralized exchanges, featuring fast settlement speeds and low fees, but it is less decentralized than other exchanges.

According to DeFiLlama, as of March 12, Hyperliquid's average daily trading volume was approximately $180 million.

Related: Traders profit $6.8 million by betting on BTC and ETH before Trump’s crypto reserve announcement.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。