The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui who talks about coins, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. Welcome to all coin friends' attention and likes, and reject any market smokescreens!

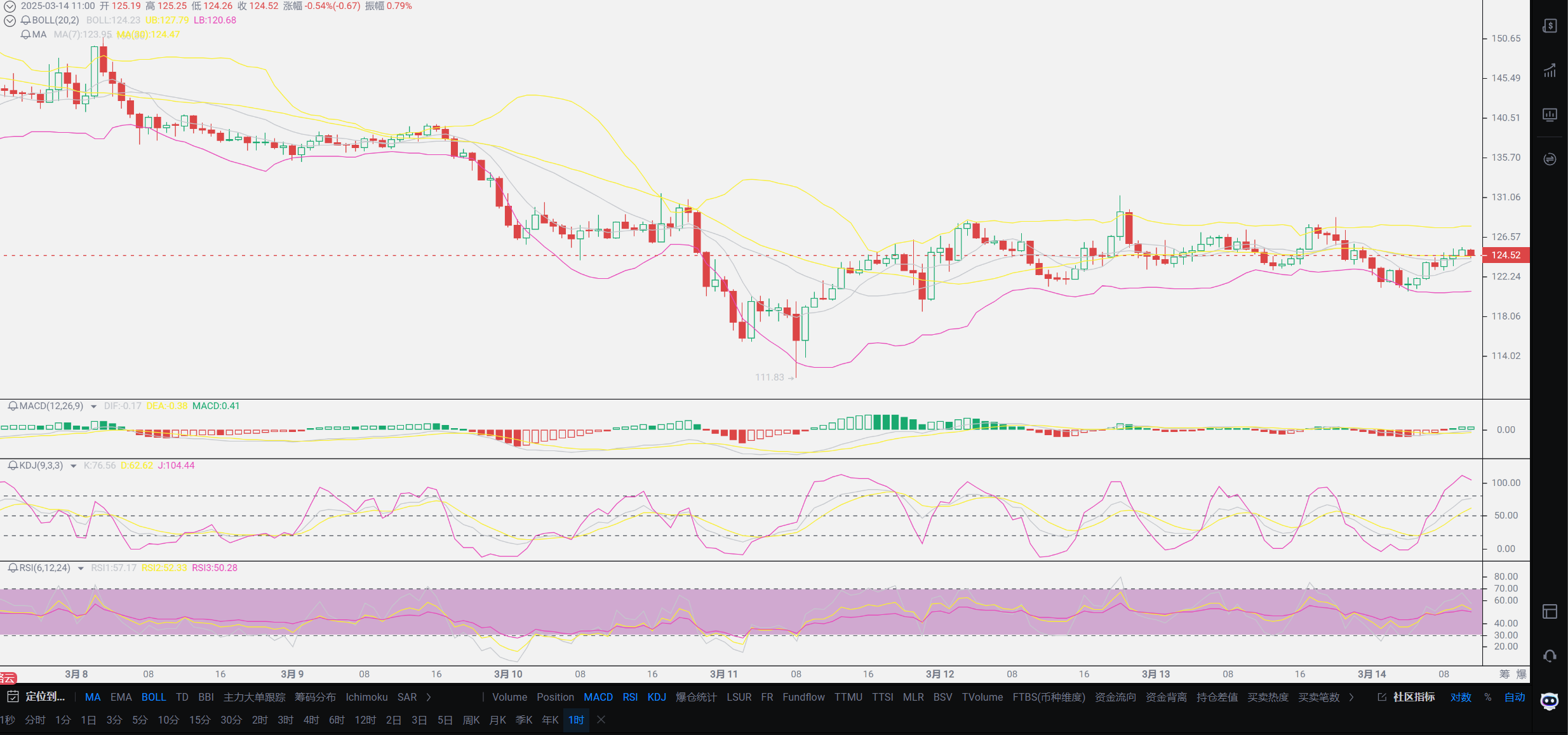

The continuous ups and downs have once again left everyone lost, this is the trend that belongs to Bitcoin. Especially for users who pay attention to candlestick charts, it is very obvious how the downward channel has opened. However, today Lao Cui needs to give everyone a shot of confidence; the downward space will not be too far. Especially for Ethereum and SOL, the downward space is visibly dissipating, and the probability of sideways movement in the later stage is greatly increasing. Particularly, the data released by the US shows a slowdown in growth for the first time in the first half of the year, and the probability and frequency of interest rate cuts may undergo significant adjustments this year, further proving our previous speculation of at least two interest rate cuts this year. The latest information has revealed that BlackRock is signaling a short-term bottom-fishing for Ethereum. Ethereum has suffered a halving in this bull market, while SOL has even exceeded that, with only Bitcoin in a strong position. Do you think Lao Cui has a good grasp of this bull market? The conclusion for this bull market is that Bitcoin stands out alone, while other coins benefit from it, and there will not be another spring for small coins.

Let's move directly to the next round of analysis. From the perspective of capital flow, you may feel that the trends in the US stock market and the cryptocurrency market are almost identical in the short term, leading many users to wonder how the cryptocurrency market could be linked to the US stock market. This includes Lao Cui's articles, which often mention the US stock market, creating a significant smokescreen for everyone and fostering many coin friends' attention to the international financial situation. This is a good signal, but Lao Cui needs to remind everyone that the linkage between the US stock market and the cryptocurrency market has no real connection; it is merely the influence from the past that has led both to be in a recovery phase, with completely different amplitudes and frequencies. The similarity between the two is that last year's interest rate cuts drove new highs, and the short-term capital connection issue led both to enter a recovery phase simultaneously, but there is no direct link between them. Lao Cui refers to the US stock market and US bonds merely to grasp the global financial situation. This also includes foreign trade data, the US non-farm payroll data, and exchange rate issues, all of which are integrated consultations to provide a rough prediction of the cryptocurrency market's trends. The US economy is the most reflective of the global financial direction, and at this stage, the US is indeed experiencing high inflation, especially after increasing tariffs, which will definitely lead to exacerbated inflation. Meanwhile, we are in a state of monetary easing, which will further spike US inflation; everyone should be clear about a certain logic: the increase in US tariffs will not cause inflation, but a trade war, where both sides increase tariffs, and the countermeasures from other countries will lead to high inflation rates in the US. This will determine that the short-term inflation data in the US will rise, leading to the implementation of the Federal Reserve's interest rate cut strategy, which is a complete underlying logical chain.

It is precisely because there are plans for interest rate cuts this year, and for the next two years, we will be in a cycle of interest rate cuts, which means there will not be a large-scale bearish attack. Whether the US's interest rate cut strategy can turn the tide and support the collapsing structure, this will establish the growth scope for the entire financial market. Even if it is only a temporary increase, it is good news for the cryptocurrency market; this is the judgment of the trend. Secondly, the technology sector's stock market has frequently set new highs in the past 25 years, and blockchain technology happens to be linked with technology. Whether it is algorithm optimization or computing power enhancement, this is good news for the cryptocurrency market as it optimizes the channels. Although, in our estimates for the first half of the year, our expectations for Trump were a bit too high, fortunately, we did not chase this wave of long positions. When February arrived, Lao Cui also timely adjusted the trend direction; Trump's policies did not bring much benefit to the cryptocurrency market. This has also led to a mid-term situation where the capital in the cryptocurrency market is in a broken state, which can be seen through the performance of the US stock market, including how the performance of the US stock market indirectly affects the yields of US bonds. Meanwhile, the performance of Old A has instead shown a growth trend similar to that of gold, and the movement of funds is also very obvious. The capital system for artificial intelligence is too large, and the support for the cryptocurrency market has already dried up. It is unrealistic to expect a return to a bull market trend in the short term; the market is likely to operate in a volatile manner.

Regarding the strategy aspect, it is necessary to remind everyone that our inflation data in February is not ideal, which also means that we will likely maintain a deflationary situation this year. Deflation means that the economic situation is not optimistic; the winter for the real estate industry may not have truly arrived, including foreign trade aspects, and the costs of essential items that most affect our daily lives will increase. From familiar items like mobile phones, clothing, food, and housing, to the already increased electricity and gas bills, there may be adjustments to varying degrees. Of course, doing business will become increasingly difficult, and income will not grow but rather decline. Everyone should treat their investment situations with caution, unless new industries, particularly those related to artificial intelligence, rise, which will inevitably drive down traditional industries. For the cryptocurrency market, any industry's rise is dividing the assets of the cryptocurrency market. Since the beginning of this year, many capital choices have been to cash out and exit. The only good news currently is still BlackRock, which has chosen to bottom-fish Ethereum at its low point, and Trump's attitude towards Ethereum is also relatively good. The last round of decline also saw a new round of capital entering the market. In terms of strategy, the old capital in the cryptocurrency market is still active. At least this proves that they still have enough confidence in the cryptocurrency market; as long as they can continue to persist, there is no so-called bear market for Bitcoin.

Lao Cui's summary: Overall, the recent trends are still consistent with our previous predictions. However, today I need to remind everyone that the downward space for Ethereum is very limited. Lao Cui estimates that at most around 1500, one should choose to enter the market fully, and even if lower points appear, they will most likely only occur in the form of spikes. A special reminder: both Ethereum and Bitcoin are already listed coins, and even if the downward space opens, one should not blindly be bearish. The current stage is not an era where platforms and previous grayscale can sway cryptocurrency prices. The involvement of old capital will inevitably stabilize listed coins, and the current stability is the best good news for the cryptocurrency market. Excessive volatility and too much back-end operation will only lead to stricter reviews of cryptocurrency listings by the US in the future. Regardless, there will be capital intervention to save the market; the definition of listing is the establishment of a lower limit, and interest rate cuts determine the existence of an upper limit. Spot users can now consider taking action; the space for Ethereum is limited, and only for Bitcoin, Lao Cui does not dare to make rash statements. This year for Ethereum, Vitalik's statements will optimize channels and technology, reduce packaging fees, and a series of measures may still drive a wave of growth for Ethereum. Recently, Lao Cui will also start to layout long positions for Ethereum. Users familiar with Lao Cui know that Lao Cui still has Ethereum around 3000, and only Ethereum and SOL make Lao Cui extremely sad, and I need to find a way to lower the average price of these two positions. If you also have positions that are stuck, you can choose to discuss with Lao Cui. As for the layout, at this stage, Lao Cui will focus on long positions. If you have the same idea, remember to keep your positions light; the first position can only occupy 5% of the total.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation, strategizes for the big picture, and does not focus on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。