Source: Cointelegraph Original: "{title}"

The founder of the Solana-based exchange platform Titan, Chris Chung, told Cointelegraph that the Chicago Mercantile Exchange (CME) is set to launch Solana futures, marking the imminent listing of the first Solana ETFs in the United States.

On March 17, CME is preparing to launch Solana futures contracts. Following the launch of related products by Coinbase in February, these contracts will become the first regulated Solana futures contracts to enter the U.S. market.

Chung told Cointelegraph that this listing "paves the way for the eventual approval of Solana ETFs."

Chung expects that the U.S. Securities and Exchange Commission (SEC) may approve the spot Solana ETF proposals submitted by asset management firms VanEck and Canary Capital as early as May.

Chung stated that the existence of regulated Solana futures "indicates to regulators that Solana as an asset is maturing, making it easier for regulators to approve other financial products of similar risk and type."

Futures contracts are standardized agreements to buy or sell an underlying asset at a future date. They play a crucial supporting role for cryptocurrency spot ETFs, as regulated futures markets provide a stable benchmark for measuring the performance of digital assets.

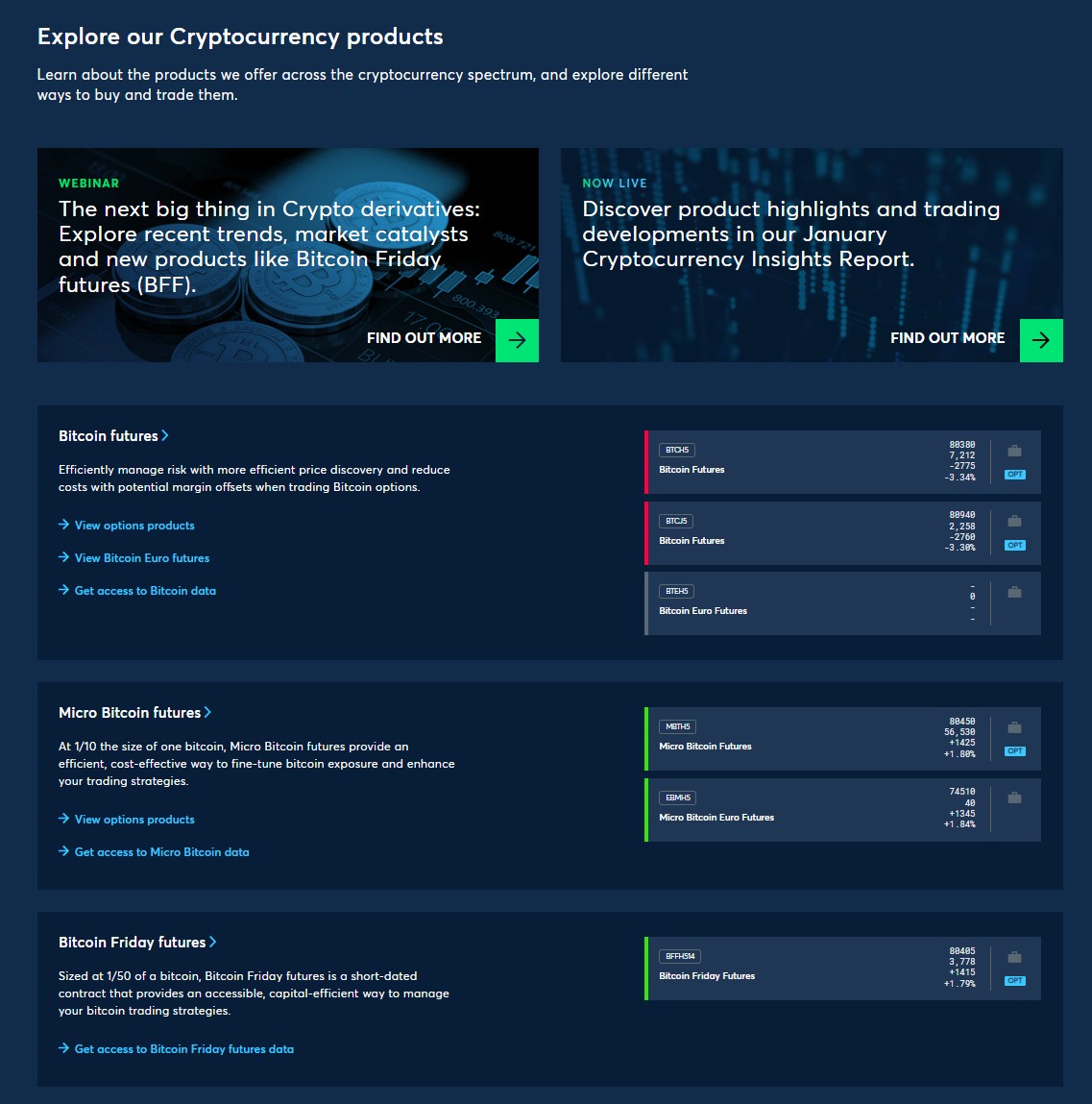

CME has already listed futures contracts for Bitcoin (BTC) and Ether (ETH). U.S. regulators approved ETFs for both cryptocurrencies last year.

CME has listed cryptocurrency futures, including Bitcoin contracts. Source: CME

Beyond Meme Coins

Additionally, Chung stated that Solana futures and ETFs will help drive the development of Solana, moving it beyond mere reliance on meme coins. Meme coins played a key role in the success of the Solana blockchain network in 2024.

Chung believes these products "will bring in larger and more stable capital, paving the way for the development of other real-world application scenarios such as payments and remittances."

These application scenarios "may not be as exciting as meme coins, but they are reliable long-term revenue sources that can support Solana's price in the next bear market."

According to asset management firm VanEck, meme coin trading is largely associated with the popular Pump.fun platform, which accounts for about 80% of the revenue from the Solana blockchain network.

However, following a series of scandals related to meme coins that dampened retail traders' sentiment, activity on the Solana network declined in February.

Price chart of Solana compared to Ethereum. Source: TradingView

Competing with Ethereum

Despite this, asset management firm VanEck stated on March 6 that cryptocurrency trading volume on Solana remains comparable to the trading volume of the entire Ethereum ecosystem, including its second-layer scaling chains.

Chung indicated that he expects the Solana ETF to be popular among retail investors, partly because its competitor, the smart contract platform Ethereum, is facing numerous challenges.

According to TradingView data, since the beginning of 2024, the performance of Solana's native token SOL has been about twice that of Ether.

Since March 2024, the spot price of Ethereum has performed poorly, following the Dencun upgrade on the Ethereum network, which reduced transaction fees by approximately 95%.

Chung stated, "Given the extremely weak price trend of Ether that we are seeing, for retail investors looking to invest in cryptocurrencies other than Bitcoin but not wanting to take on full risk, Solana is now the only choice."

Bloomberg Intelligence believes that the likelihood of the SEC approving spot Solana and Litecoin ETFs is 70%.

Related: SEC delays decision on approval for Ripple, Solana, Litecoin, and Dogecoin ETFs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。