The financial situation of Dongda is far from as optimistic as it seems.

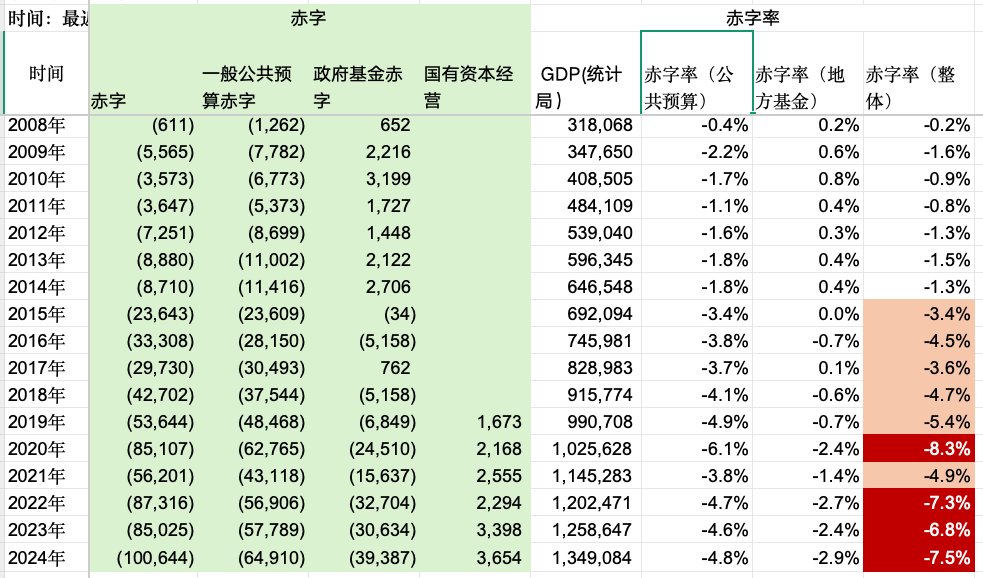

On the surface, the fiscal deficit does not appear high, with the general public budget deficit rate for 2024 at 4.8%. However, China's finances actually consist of four accounts, the most important of which are the general public budget and government funds. When combined with the income from state-owned enterprises, the total fiscal deficit for 2024 amounts to 10 trillion, resulting in a broad deficit rate of 7.5%.

Historically, prior to 2015, the overall deficit rate was well controlled. Starting in 2015, the fiscal deficit rate began to increase, possibly in response to that year's economic downturn. From the revenue side, government fund income (mainly from land sales) rose from 4 trillion in 2015 to nearly 10 trillion by 2021, while government fund expenditures (such as urban infrastructure) also surged. Initially, this did not lead to a deficit, but starting in 2020, a government fund deficit of 2.4% of GDP emerged, combined with a budget deficit from oil of 6.1%, resulting in an astonishing level of 8%.

Overall, there are two narratives:

1/ Since 2015, government spending has become deficit-driven, with the general public budget deficit increasing from below 3% to above 3%.

2/ Local government infrastructure spending surged from 2016, initially balancing income and expenditure. However, starting in 2020, the growth rate of land sale income slowed, and from 2021 onwards, it began to decline, while expenditures remained at a level of 10-11 trillion, leading to an additional deficit of about 2.5%.

Thus, although Dongda is making strides in the tech market, its overall financial condition has some issues.

From another perspective, there are only two ways out of the fiscal deficit: one is a significant recession, such as abruptly cutting local infrastructure spending… The other is monetary expansion and devaluation. The U.S. has chosen recession, while Dongda has not made that choice for now.

The specific path is already in place, which is the central bank buying government bonds… The U.S. can manage its situation, but Dongda cannot?

Therefore, both the U.S. and Dongda are in a difficult position. The overvaluation of the dollar is squeezing the manufacturing sector, necessitating devaluation. However, the renminbi also has a need for devaluation, yet on the other hand, it does not want to devalue against the dollar - this has been very evident over the past two years.

Thus, the conclusion is clear: gold is soaring, and BTC is soaring.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。