Original|Odaily Planet Daily (@OdailyChina)

As one of the key figures promoting Bitcoin strategic reserve legislation, U.S. Senator Cynthia Lummis recently stated, "The executive order from the Trump administration is just the beginning." Following this, she and U.S. Representative from Alaska, Nick Begich, jointly announced that "a major announcement regarding Bitcoin policy will be made on March 11 (this Tuesday)."

On March 11, Cynthia Lummis announced the latest news: the reintroduction of a new version of the Bitcoin bill, which will incorporate President Trump's vision of establishing a strategic Bitcoin reserve for the United States.

Previously, Odaily Planet Daily had assessed that the establishment of a cryptocurrency reserve through a presidential executive order still retained the possibility of "purchasing 1 million BTC over 5 years," and considering the specific content of the new Bitcoin bill released today, the likelihood of the U.S. government purchasing BTC as a strategic reserve remains significant. Odaily Planet Daily will summarize the latest developments of the Bitcoin bill in this article for readers' reference. Recommended reading: “Trump Promises to Establish BTC Strategic Reserve, But Funding Sources Solely Depend on Seizures?”

Bitcoin Bill Update: 1 Million BTC to be Held for at Least 20 Years, Treasury and Federal Reserve May Co-Fund

On March 11, at a Bitcoin conference organized by the Bitcoin Policy Institute, Cynthia Lummis delivered a speech stating, "We will reintroduce the Bitcoin bill to purchase 1 million dollars' worth of Bitcoin."

Bitcoin Magazine CEO David Bailey expressed support, saying, "What people overlook about SBR (Strategic Bitcoin Reserve) is that it is not just implemented through executive action or legislation. We need both. Executive action clears the political path and tells Congress this is a priority. Now is the time for the Bitcoin bill."

Additionally, the bill has received co-sponsorship from Republican Senators Jim Justice of West Virginia, Tommy Tuberville of Alabama, Roger Marshall of Kansas, Marsha Blackburn of Tennessee, and Bernie Moreno of Ohio, among others, supporting it.

Collective Appearance of Seven Republican Senators

It is worth mentioning that the new Bitcoin bill has not only received strong support from Republicans but also from Democrats, with California Congressman Ro Khanna stating, "Bitcoin should be bipartisan. We cannot have one president issuing an executive order and another rescinding it, leading to uncertain policies. We need to reach a consensus that Bitcoin benefits both America and the world… Democrats should embrace Bitcoin." According to Cynthia Lummis herself, the bill has also received support from Trump himself.

On March 12, at the Bitcoin For America summit, Alaska Republican Congressman Nick Begich announced a 2025 updated version of the Bitcoin bill in response to Senator Lummis's proposal for a Bitcoin strategic reserve last year, suggesting that the U.S. acquire 1 million Bitcoins without increasing the tax burden on taxpayers and protect the rights of American citizens to self-custody Bitcoin. "The bill explicitly protects the right of individuals to own, hold, and trade Bitcoin," Congressman Begich stated, "It views self-custody as a fundamental right."

On March 13, the latest version of the Bitcoin bill was officially launched on the Congress website, with key differentiated content including:

Clear Purchase Quantity: The 2025 version of the Bitcoin bill sets a stricter plan to purchase 200,000 Bitcoins annually (instead of "up to" 200,000 in the 2024 version).

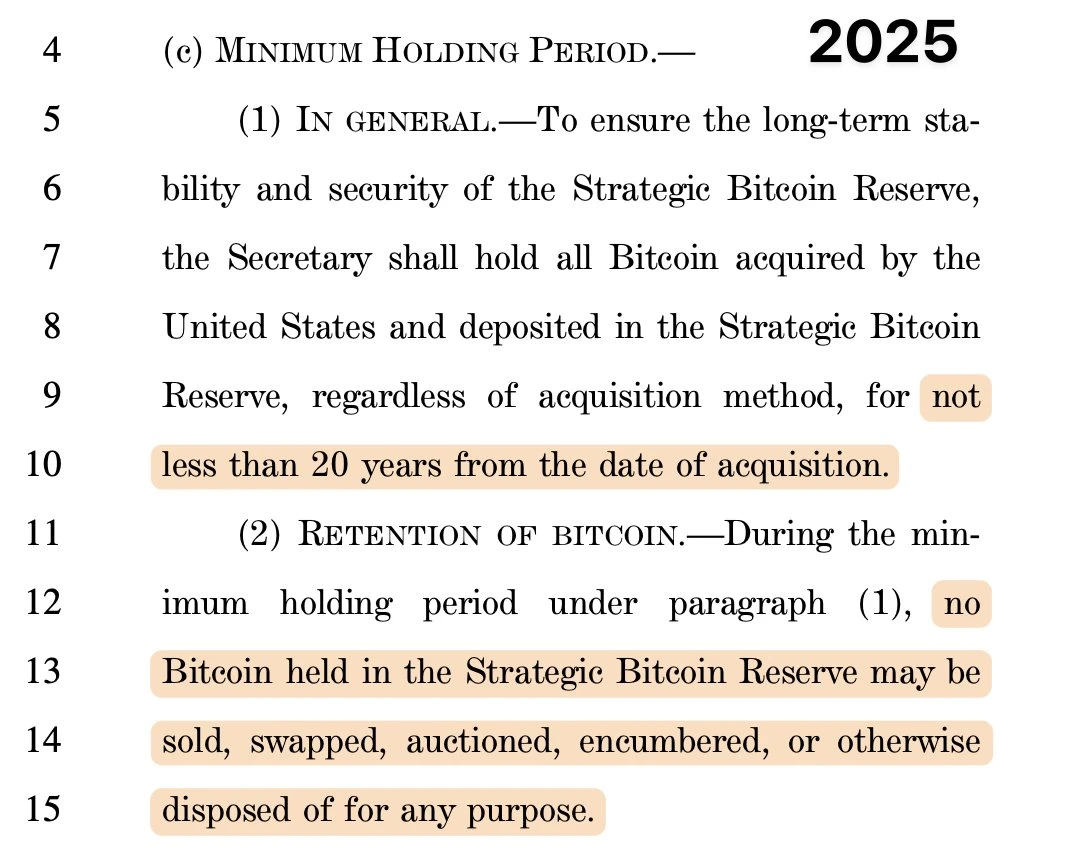

Strict Holding Requirements: The new version also strengthens the holding requirements, mandating a minimum holding period of 20 years, and removes the previously mentioned "exception clause regarding strategic reserve BTC being used as a tool for repaying federal debt," in other words, the holding requirements for purchased BTC are stricter.

Content of the Latest Bill

- Source of Purchase Funds: The bill adds provisions for coordinating Bitcoin purchases with the Exchange Stabilization Fund (ESF) (Note: ESF is a reserve fund under the U.S. Treasury with approximately $39 billion in assets, and the executive branch may use this fund for BTC purchases; regarding gold revaluation, the latest version explicitly states that the proceeds from revaluing federal reserve gold will be used to purchase Bitcoin, whereas the previous version only included these funds in the general fund, which is a significant change; additionally, the latest bill also mentions that "existing diversified funding channels" from the Federal Reserve system will allocate the first $6 billion of Federal Reserve remittances annually from 2025 to 2029 for establishing reserves.

Furthermore, aspects regarding quarterly reserve proof for BTC, voluntary participation of national powers, and financing through federal government revenue remain largely unchanged.

There are still 4/5 of the process to become law: Mainly depends on two votes, ultimately determined by Trump

According to information from the official Congress website, the bill has currently undergone two readings and has been referred to the Committee on Banking, Housing, and Urban Affairs.

After a series of votes, debates, or amendments, if the bill can be passed by a simple majority (218 votes out of 435) in the Committee on Banking, Housing, and Urban Affairs, it will subsequently be submitted to the Senate for committee debate and voting, also adhering to the simple majority (51 votes out of 100) principle to be approved. Finally, a joint committee composed of members from both the House of Representatives and the Senate will resolve any discrepancies between the House and Senate versions of the bill, and the resulting bill will return to the House and Senate for final approval. The government printing office will print the revised bill in a process called "registration." At that time, as the final step, President Trump will have 10 days to sign or veto the registered bill.

In other words, the 2025 version of the Bitcoin bill still needs to wait for 4 steps before it can finally become law and advance to specific implementation.

Congress Website Information Interface

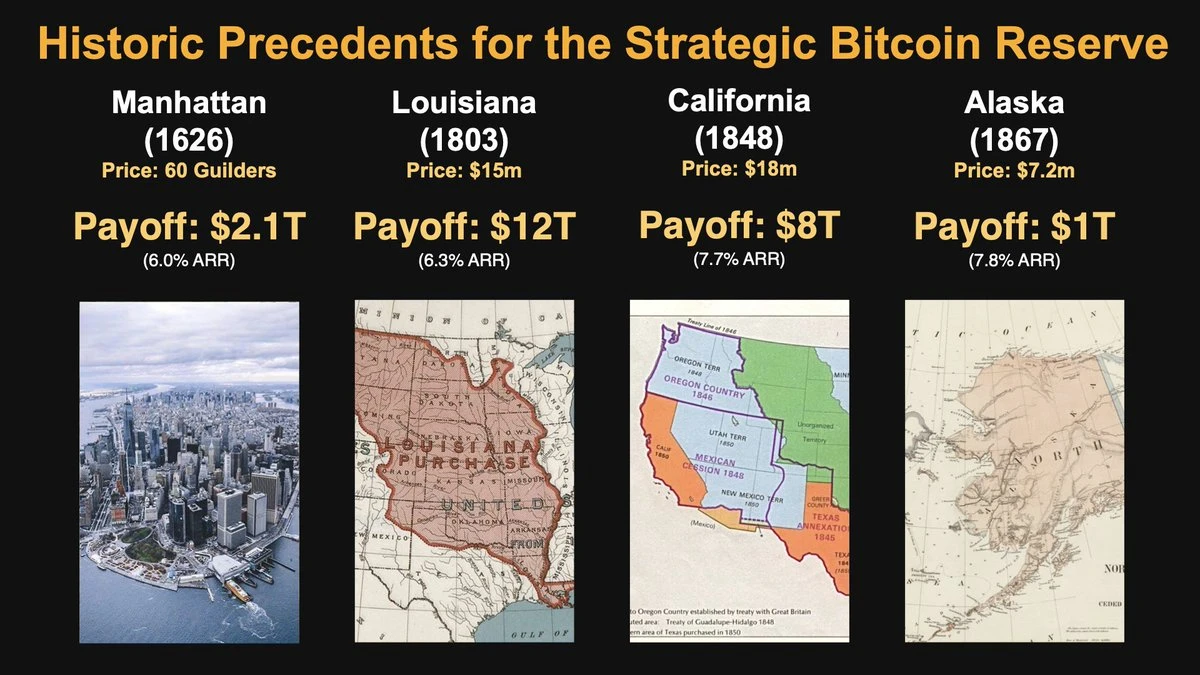

It is worth noting that in this update of the Bitcoin bill, in addition to using the proceeds from gold revaluation as a channel for purchasing Bitcoin, it also compares the Bitcoin strategic reserve with the gold strategic reserve, giving equal importance to the scale and strategic significance of both.

As Congressman Nick Begich stated in his speech, "The battle for innovation is over, the golden age of digital currency has arrived."

As of March 12, according to the Bitcoin Voter Project's disclosure on the X platform, the bill has received strong support from 12 members of Congress.

Cynthia Lummis's Second Batch of "Allies"

Industry Experts Comment: Praising the Latest Bitcoin Bill, It May Become the Next "Louisiana Purchase"

Jack Mallers, CEO and co-founder of Bitcoin payment company Strike, stated at the Bitcoin For America conference that the Bitcoin strategic reserve is "a turning point in American history."

Michael Saylor, founder of Strategy (formerly MicroStrategy), posted on X that the significance of the Bitcoin strategic reserve is on par with historical land acquisitions that expanded the territory of the United States. He remarked, "We once purchased 78% of the land in America for $40 million. The U.S. should buy Bitcoin." (Note from Odaily Planet Daily: Throughout history, the U.S. has spent varying amounts of money to purchase regions such as Manhattan, Louisiana, California, and Alaska.)

"Bitcoin Reserve Moment" in American History

It must be said that in ensuring the leading economic position of the United States, the Bitcoin strategic reserve is seen as a crucial element by many professionals in both the political and crypto fields.

Conclusion: The Financial Future of the United States Will Be Guarded by Bitcoin

After Trump took office, he swiftly implemented a series of tariff protection policies, which led to a decline in both the U.S. stock market and the crypto market due to the impact of these policy announcements. Some believe that this move by the Trump administration may be aimed at leveraging a slight recession in the U.S. economy to prompt the Federal Reserve to make more interest rate cuts, thereby providing support for the recovery and further development of the U.S. economy.

On the other hand, the Bitcoin strategic reserve may become a "touchstone" for Trump to promote various policy implementations, gradually alleviating the pressure on U.S. debt on one hand, and potentially becoming an important part of the competition for economic decision-making power between Trump's cabinet, including the Treasury, and the Federal Reserve on the other.

In ensuring the financial future and economic hegemony of the United States, the role of Bitcoin will gradually become apparent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。