Source: Cointelegraph Original: "{title}"

The U.S. Securities and Exchange Commission (SEC) has delayed its decision on whether to allow the Chicago Board Options Exchange BZX (Cboe BZX Exchange) to list options related to Fidelity's Ethereum (ETH) exchange-traded fund (ETF).

According to a document submitted by the SEC on March 12, the agency will extend its deadline to May 14 to decide whether to approve the application for options related to the Fidelity Ethereum Fund (FETH) proposed by the Cboe BZX.

The document states that the Cboe BZX initially applied to list options for the Fidelity Ethereum ETF in January.

Listing options for the Ethereum fund is an important step in attracting institutional capital into the cryptocurrency space.

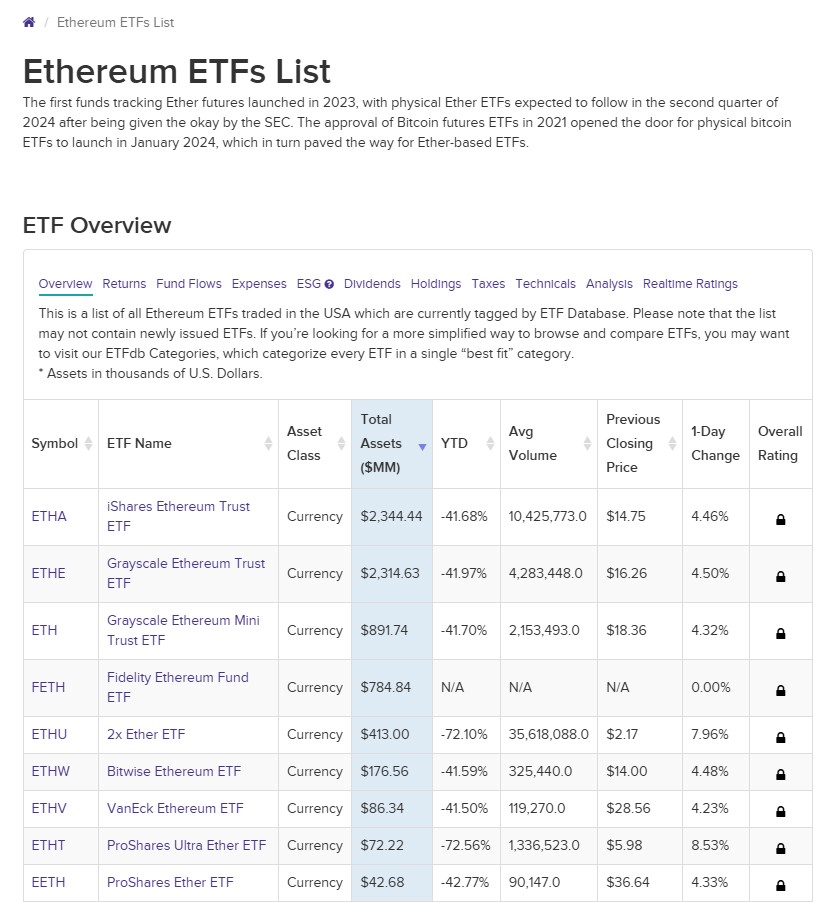

Ethereum ETF ranked by net assets. Source: VettaFi

Numerous application documents

According to records, in February, the SEC confirmed a dozen exchange application documents related to cryptocurrency ETFs.

This confirmation by the SEC highlights a softening of the agency's stance on cryptocurrencies since U.S. President Trump began his second term on January 20.

On March 11, the Cboe BZX requested regulators to approve the inclusion of staking in Fidelity's Ethereum ETF. Currently, no publicly traded Ethereum fund in the U.S. is allowed to engage in staking.

Staking Ethereum can enhance returns by depositing ETH as collateral with validators in exchange for rewards.

According to VettaFi, as of March 12, Fidelity's FETH is one of the more popular Ethereum ETFs, with net assets of approximately $780 million.

In February, the SEC delayed its decision on similar rule changes proposed by Nasdaq ISE and the Cboe Exchange, both U.S. exchanges.

The agency intends to decide by April whether Nasdaq can list options related to BlackRock's iShares Ethereum Trust (ETHA).

Data from VettaFi shows that BlackRock's fund is the largest Ethereum ETF, with net assets exceeding $3.7 billion.

The SEC will rule on the Cboe's application to list options for the Fidelity Ethereum Fund in May.

According to VettaFi, the Ethereum spot ETF was listed in July 2024, subsequently attracting nearly $7 billion in net assets.

Options are contracts that give the holder the right to buy or sell (in trader jargon, "call options" or "put options") the underlying asset at a specific price.

Related: SEC delays approval decisions for Ripple, Solana, Litecoin, and Dogecoin ETFs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。