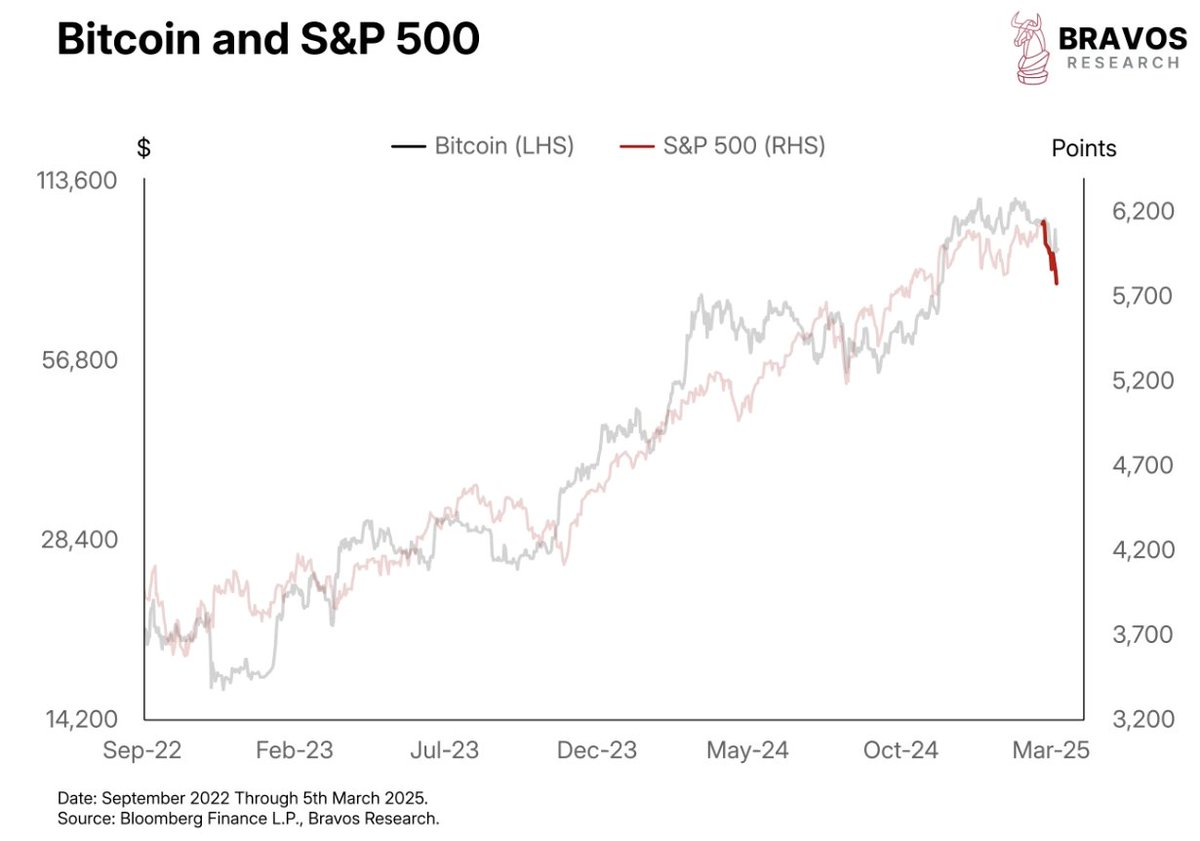

This pullback may be painful, but it does not seem to negate the major trend of institutional adoption.

Author: Bravos Research

Translated by: Deep Tide TechFlow

Trump officially announced the establishment of a Bitcoin strategic reserve. Could this be a turning point for Bitcoin?

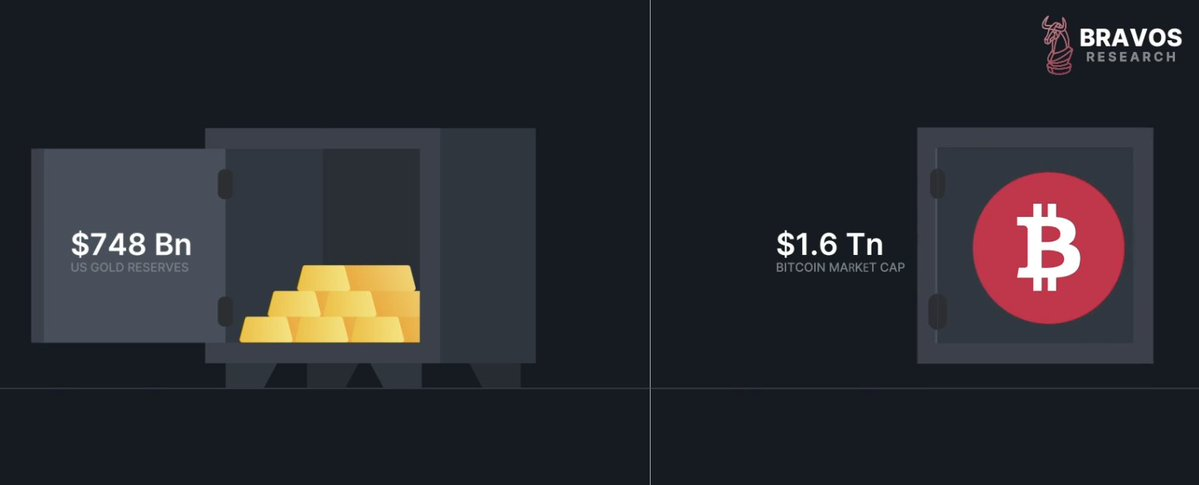

The United States currently holds $748 billion in gold reserves, while Bitcoin's market capitalization is approximately $1.6 trillion.

If the government establishes a reserve similar to gold, it could drive Bitcoin's price up by 50%.

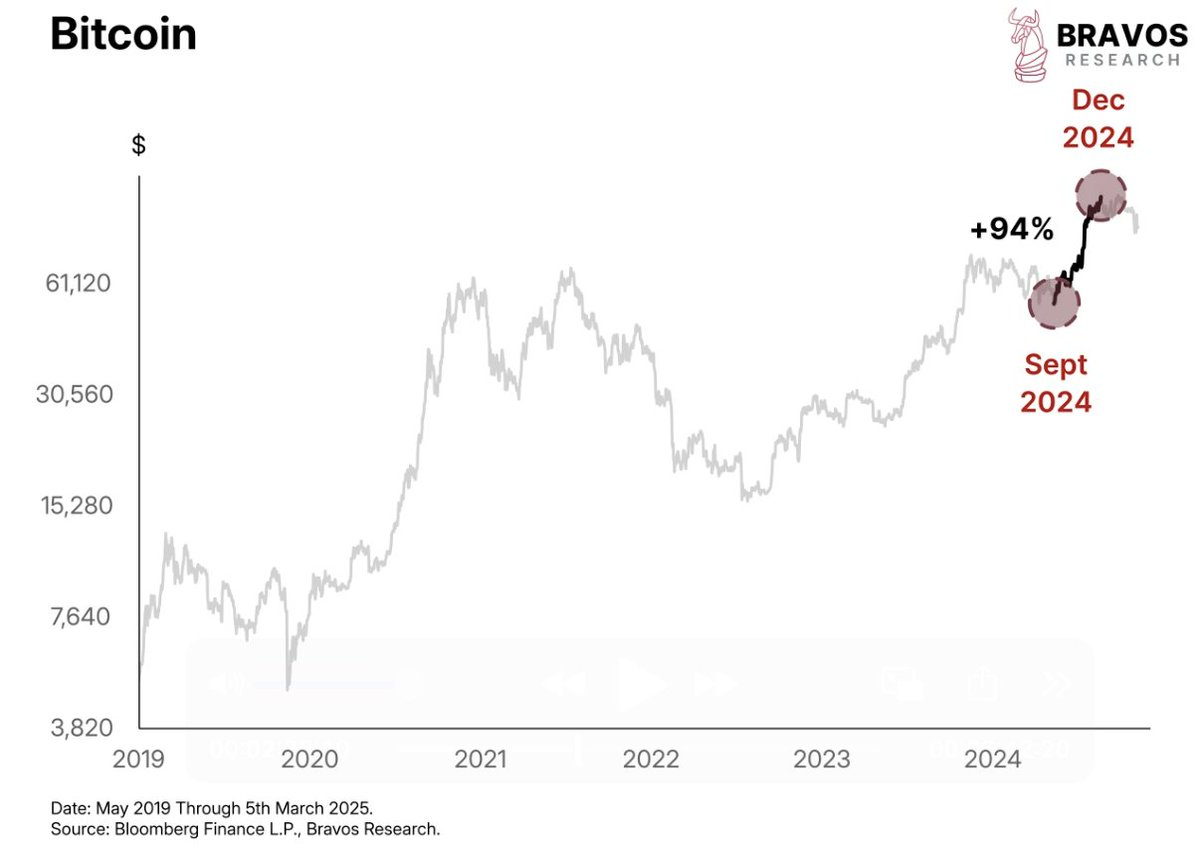

Remember, between September 2024 (before the election) and December 2024 (after Trump's victory), Bitcoin surged by 94%. At that time, rumors about a Bitcoin reserve had already begun to brew.

This suggests that the narrative of reserves may have already been digested by the market in advance. Meanwhile, Bitcoin is also facing other risks, such as the recent plunge in the U.S. stock market over the past month.

However, we still believe that the importance of the reserve announcement may exceed people's expectations, and this move could lay the groundwork for a significant rise in Bitcoin in 2025. After all, the U.S. is not the only country with strategic reserves.

The total global gold reserves amount to about $2 trillion, which exceeds Bitcoin's market capitalization. Additionally, the U.S. government's holding of Bitcoin adds credibility to this asset class, and Bitcoin's prosperity is built on trust and confidence.

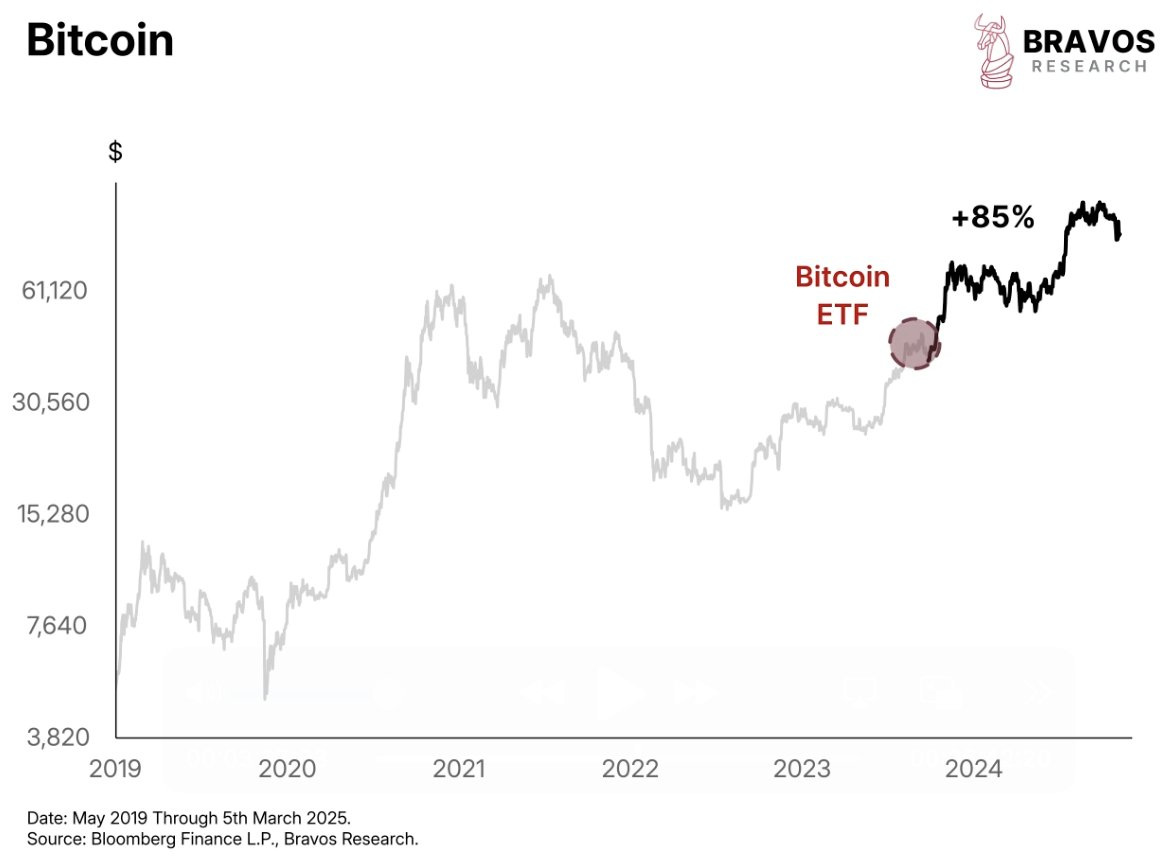

Since December 2022, Bitcoin's bull market has primarily been driven by institutional adoption. The launch of the Bitcoin ETF in November 2023 sparked tremendous optimism, and since then, Bitcoin has risen by 85%.

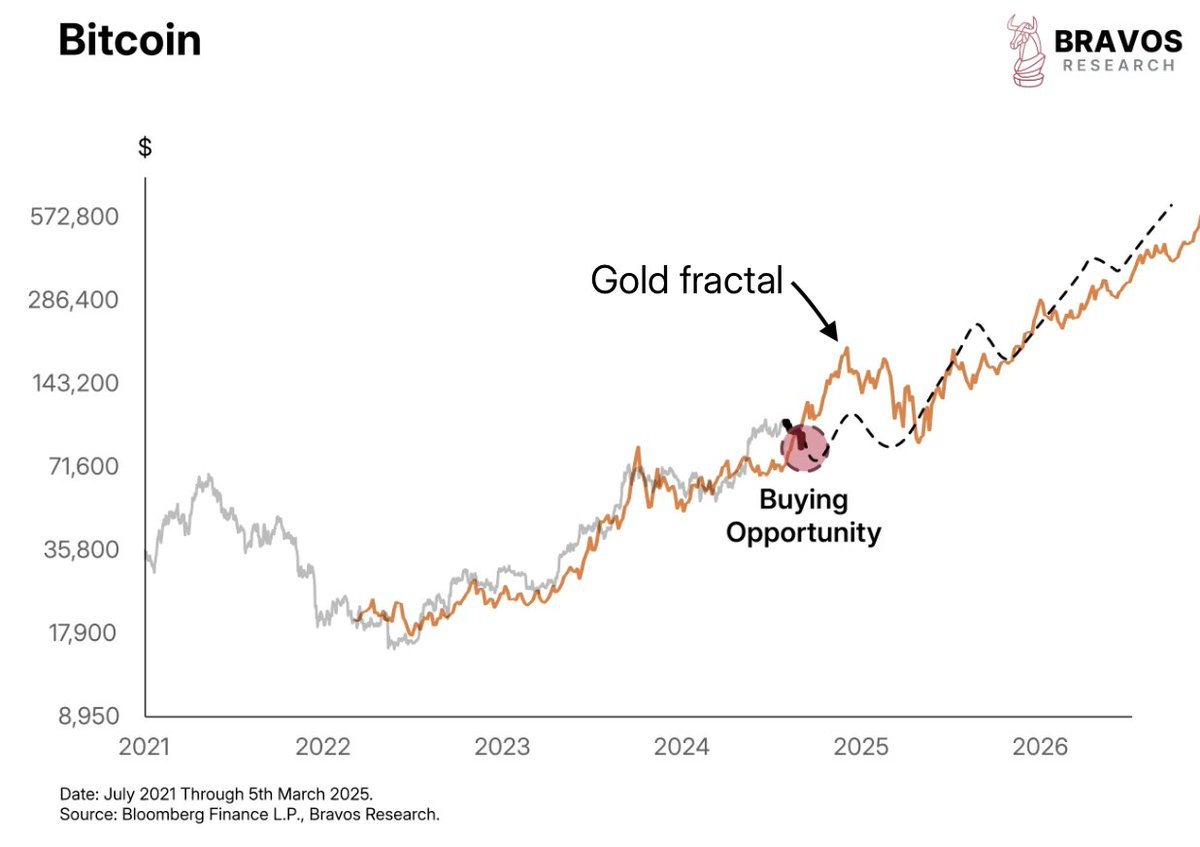

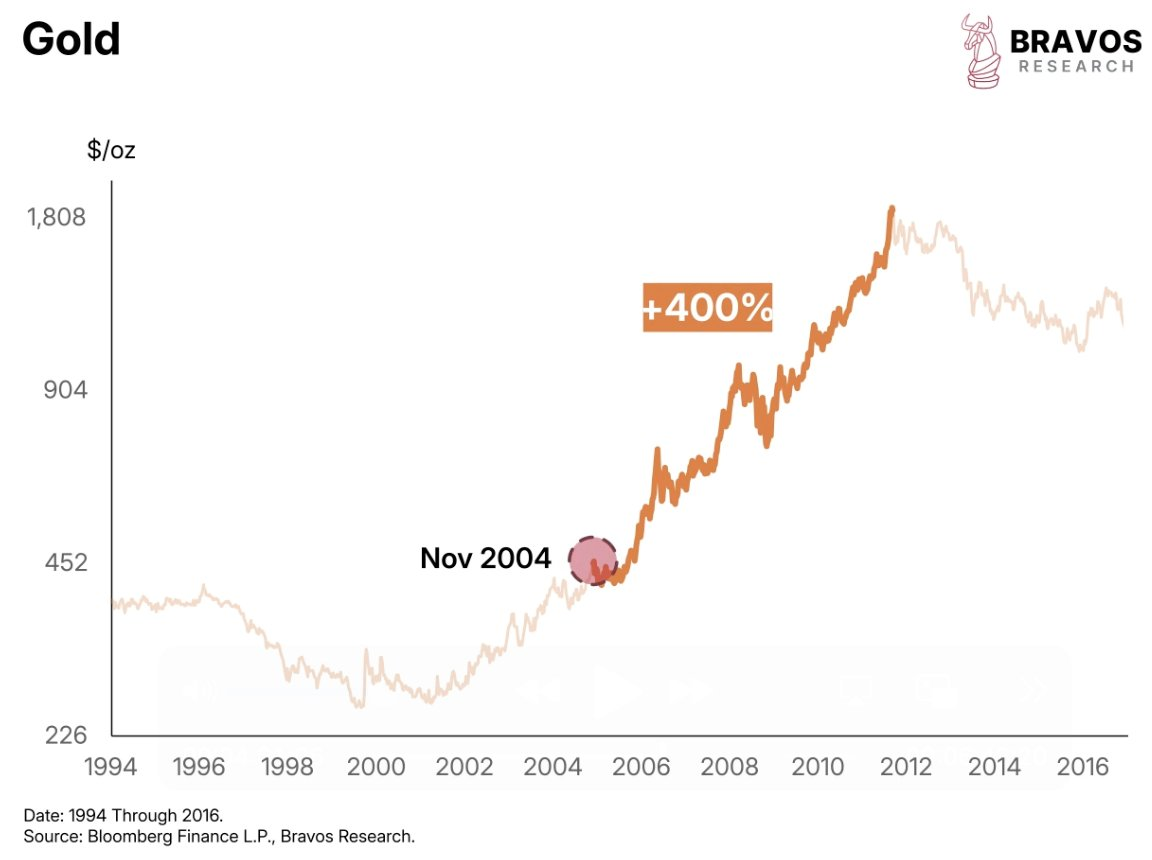

In our view, this is very similar to the adoption of gold in the early 2000s: the first U.S. gold ETF was launched in November 2004, marking the beginning of a 400% bull market over the next few years.

However, the bull market for gold did not happen overnight. The rise was gradual, and it experienced multiple pullbacks during that time.

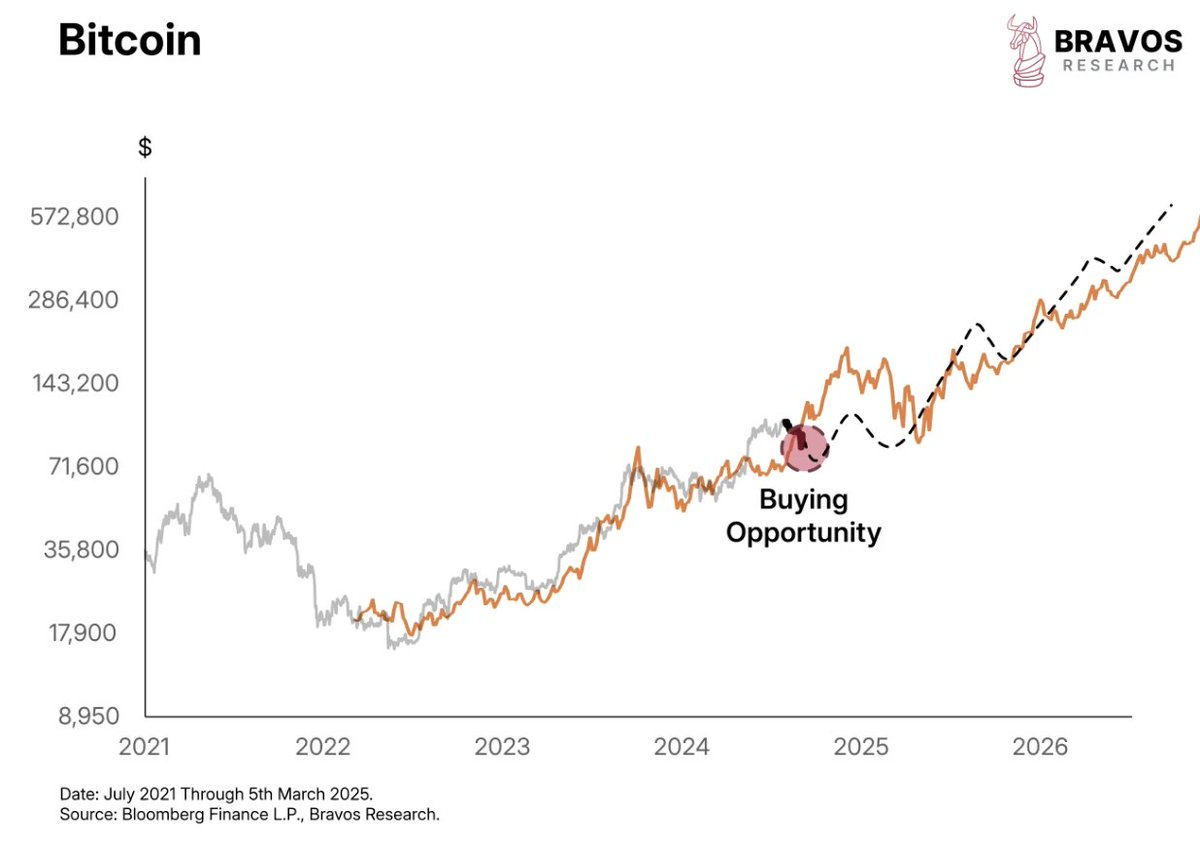

If we compare the bull market for gold in the 2000s with Bitcoin's current rise, the patterns are very similar. This pullback may be painful, but it does not seem to negate the major trend of institutional adoption.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。