Original source: SolEasy Labs

Recently, a governance proposal from the Solana community, SIMD-0228, has become a focal point of attention. Once this proposal was introduced, it sparked numerous discussions within the community, with some praising it and others expressing concerns. So, what exactly is it? In simple terms, SIMD-0228 attempts to upgrade Solana's SOL issuance mechanism from a fixed inflation model to a flexible dynamic adjustment model, anchored by the staking participation rate, thereby reshaping the network's economic model. This not only concerns the value of SOL but may also press an important button for the future development of the Solana ecosystem.

Why has SIMD-0228 attracted attention?

SIMD-0228 was jointly proposed in January this year by three heavyweight figures in the Solana ecosystem, including Tushar Jain and Vishal Kankani, co-founders of Multicoin Capital—one of the earliest and most important supporters of Solana. Additionally, Max Resnick, the chief economist of the Solana core development team Anza, also expressed strong support.

Currently, Solana's inflation mechanism follows a fixed schedule, with the annual inflation rate decreasing from an initial 8% to about 4.669% now, aiming for long-term stability at 1.5%. However, this fixed model lacks flexibility and cannot adjust according to the actual needs of the network or the staking participation rate.

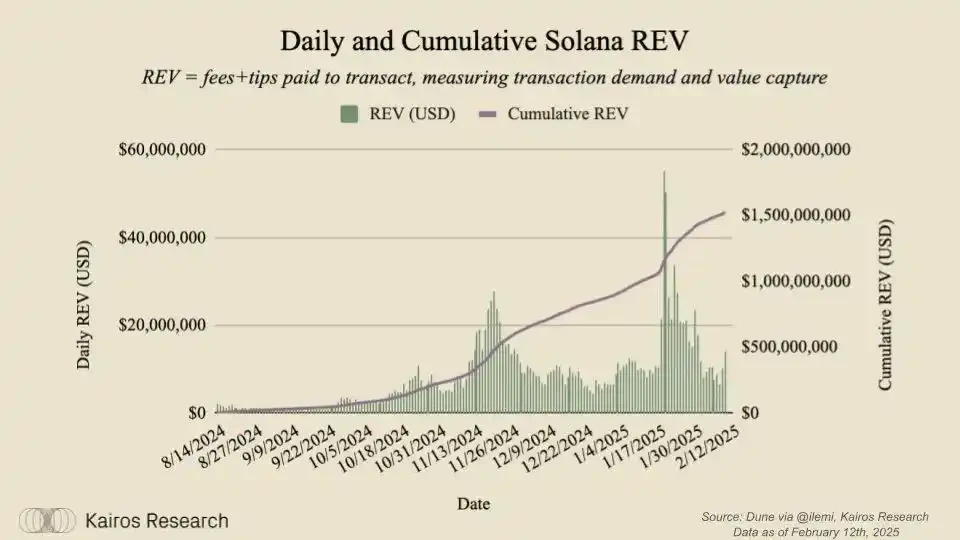

In the past six months, Solana's on-chain activity has been booming, generating over $1.5 billion in REV (network revenue = transaction fees + tips), demonstrating strong demand for network usage. Meanwhile, Solana's staking rate has also reached a historical high of 65.7%, creating favorable conditions for reducing inflation. Therefore, the proposers believe that the inflation strategy should be optimized, avoiding the blind issuance of excess SOL, which would allow the network to develop more healthily.

The core of SIMD-0228 lies in introducing a "smart inflation" mechanism, which dynamically adjusts the issuance of SOL based on the staking rate. Specific goals include:

Dynamic incentives for staking: When the staking rate declines, the system will automatically increase the issuance of SOL to encourage more users to participate in staking, ensuring the network's security.

Minimum Necessary Inflation (MNA): The system will minimize unnecessary SOL issuance, only issuing the minimum amount of tokens required to maintain network security, avoiding market sell pressure.

Network security: Ensuring the security of the network while releasing more capital into the DeFi ecosystem, promoting healthy development of the ecosystem.

The proposers believe that this adjustment can help Solana break free from the old path of "inflation" and move towards a more sustainable development trajectory. It sounds perfect, but what will happen after implementation? What impacts will it bring?

What impacts might SIMD-0228 bring?

If SIMD-0228 passes smoothly, Solana's economic model will undergo significant changes, affecting the entire ecosystem.

1. Impact on the Solana network

If the proposal passes, based on the current staking rate of 65%, the inflation rate could plummet from the current 4.5% to 0.87%, significantly reducing staking rewards. This means that validators' income will rely more on MEV (Miner Extractable Value) rather than inflation rewards. For ordinary holders, the dilution of SOL will decrease, sell pressure will lighten, and the potential for price increases will grow.

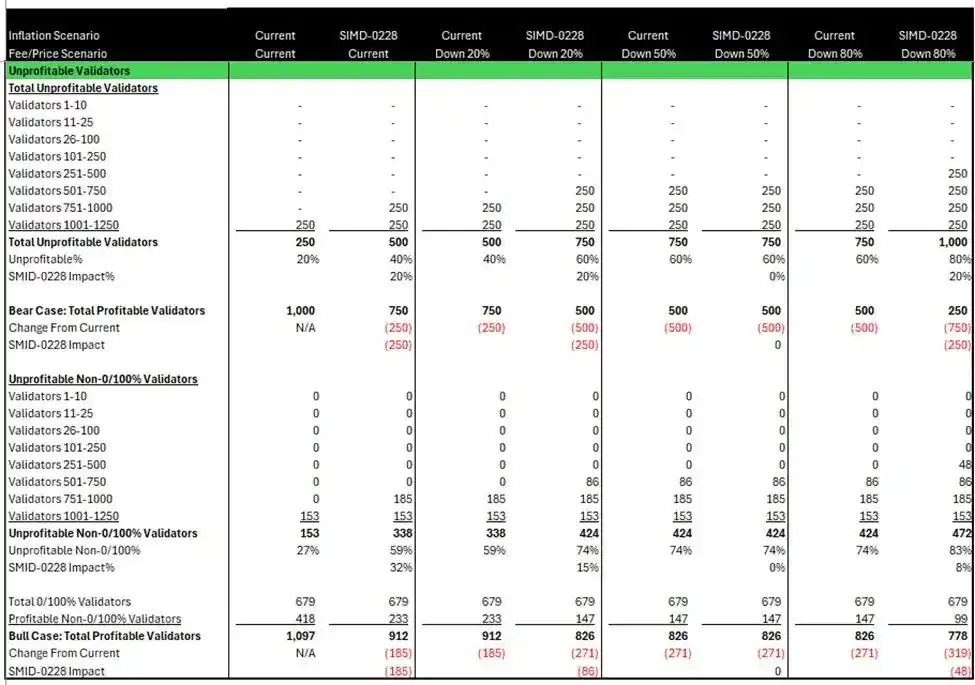

However, for validators, especially small validators, low yields may make it difficult for them to sustain operations. Former Grayscale research director David Grider created a model predicting that Solana could lose between 50 to 250 validators as a result, increasing the risk of network centralization. Therefore, this is also a game of "security versus efficiency."

2. Impact on ecosystem builders

The reduction in staking rewards will leave more SOL with nowhere to go, ultimately flowing into the DeFi ecosystem and increasing liquidity. Ian Unsworth stated that this will drive up the adoption rate of liquid staking tokens (LST), creating a positive windfall for currently liquid DeFi protocols (such as JitoSOL), while also benefiting VRTs built on its re-staking platform (such as Renzo, Fragmetric, and Kairos).

Additionally, this will lead to rewards being directly linked to network usage, with most rewards coming from priority fees and Jito fees. Validator tips may create a potential flywheel effect, where the wealth effect injects higher chain usage = higher rewards = higher chain usage. At the same time, low base yields will compel developers to create "yield-enhancing" products, ultimately leading to an explosion of staking derivative products.

Editor’s note: Jito validator tips, or Jito Validator Tips, are features launched by Jito Labs, a Solana ecosystem MEV infrastructure protocol, aimed at optimizing the revenue distribution mechanism for validators by directly distributing part of the MEV earnings (such as profits from arbitrage and liquidation) to validators in the form of "tips."

However, everything has two sides; reducing the issuance of new tokens may limit the funding and liquidity for ecosystem projects and developers, potentially slowing down innovation and growth, which could affect the overall vitality of the ecosystem. Moreover, with fewer network validators, if network security is compromised, it may directly impact the development of ecosystem projects and reduce user confidence.

3. Impact on holders

For SOL holders, "smart inflation" greatly enhances the controllability of Solana's inflation, which is particularly attractive to institutional capital. More funds may flow into DeFi protocols in pursuit of high yields, making SOL's long-term price performance worth looking forward to. The model can also maintain a competitive return rate based on the staking participation rate, enhancing asset value. However, for large holders, the reduction in staking rewards may lead them to reassess: should they continue staking or turn to other yield channels? This is not just a technical adjustment but a reconstruction of investment logic.

The game of interests surrounding SIMD-0228

The heated discussion around the SIMD-0228 proposal reflects the complexity of the ecosystem, with major viewpoints showing large investment institutions in support, a divided validator community, and a complex stance from developers and ecosystem builders.

The two proposers of SIMD-0228, Tushar Jain and Vishal Kankani, both believe that SIMD-0228 will release more SOL into the DeFi ecosystem, providing more opportunities to develop and promote new DeFi products and services, increasing liquidity and user participation.

Solana co-founder Anatoly Yakovenko also expressed support for the proposal, believing that a pragmatic release gives Solana the "opportunity to correct the mistakes of our youth."

Ben Hawkins, staking director of the Solana Foundation, supports dynamic $SOL issuance to reduce inflation.

Max Kaplan of Sol Strategies proposed the idea of "better roughly right than precisely wrong," emphasizing the flexibility of market-driven mechanisms.

Marius, co-founder of Kamino, pointed out that "staking encourages hoarding and reduces financial activity," supporting the reduction of inflation to enhance liquidity.

Thus, for large investment institutions, the SIMD-0228 proposal can shape the narrative of a "market-driven efficient network," attracting more institutional investment, while the reduction in inflation rates helps to reduce token dilution and maintain the value of their holdings.

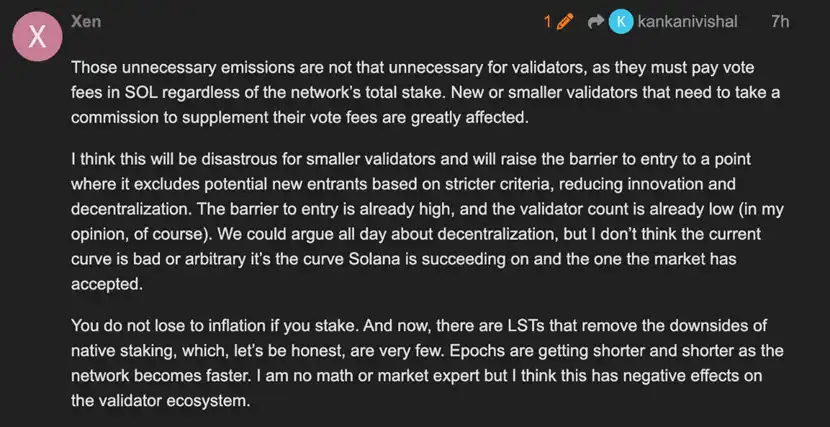

Although experts hold an optimistic view, members of the Solana community have expressed their concerns. For example, validator Xen stated that if rewards ultimately favor those with more SOL, smaller validators may find it difficult to make a profit, thus falling into an "inflation spiral."

Xen's concerns are not unfounded; Solana's MEV earnings in Q4 2024 reached an astonishing $430 million, more than ten times that of Q1. Therefore, even with a significant reduction in the inflation rate, large professional validators can compensate for reduced earnings through MEV and transaction fees, maintaining profitability.

For small and medium-sized validators, there are still 250 small validators that are not profitable and can only stay online through the Solana Foundation's delegation program. A model established by former Grayscale researcher David Grider indicates that after the passage of the SIMD-0228 proposal, Solana may lose an additional 50 to 250 validators under different revision scenarios.

Community member Leapfrog candidly stated on the Solana developer forum that the proposal "will have catastrophic effects on Solana." He believes that if inflation rises during a period of low investment confidence, leading investors to withdraw and sell, it will exacerbate panic, making volatile assets unsuitable for long-term large investors, regardless of how high the staking returns are.

The managing partner of Multicoin Capital stated that the current inflation rate is too high and consensus should act quickly. He is not worried about consensus security but acknowledges that the profitability of validators may be affected, predicting that some validators may exit the network, potentially triggering a "zero-commission race," further worsening their economic situation.

He emphasized that excessive caution could lead to "analysis paralysis," hindering Solana's development, and therefore, it is essential to maintain rapid progress to avoid falling into a situation similar to Ethereum. This proposal reform essentially represents a power rebalancing among large token holders, validators, and ecosystem builders, making this vote one of the most important decisions for Solana.

Can SIMD-0228 be further optimized?

SIMD-0228 has undoubtedly sparked heated discussions across the entire Solana ecosystem. If it passes, it will reflect a consensus of public opinion, achieving short-term agreement, but after some time of operation, new issues may arise, leading to new adjustment proposals.

If the vote does not pass, given the current popularity of the proposal, it is likely that new proposals will emerge to modify Solana's economic model. The main contradiction currently lies in the mismatch between Solana's development needs and its economic model. As long as this contradiction exists, there will be sufficient motivation within the ecosystem to push for new proposals.

From the various viewpoints surrounding the passage of SIMD-0228, we can sense that most discussions are not focused on whether this contradiction exists but rather on the specific adjustment methods within the SIMD-0228 proposal. Therefore, it is highly probable that new proposals will continue to emerge.

So, if a new proposal is to be put forward to address the current contradictions, what aspects could be considered?

First, some modifications to the parameters mentioned in SIMD-0228. A portion of the opposition to SIMD-0228 stems from its drastic changes, which could have a significant impact on the ecosystem.

If some parameters are adjusted to slow down the overall changes, for example, changing the minimum inflation rate in SIMD-0228 from 0% to around 2%, it would reduce the extent of income loss for validators, allowing them to survive, and also lessen the fluctuations in the staking rate. Perhaps a more moderate version of SIMD-0228 could be proposed.

Second, redesign the dynamic adjustment plan for the inflation rate. For instance, Polkadot also has a dynamic mechanism for adjusting staking rewards. It has designed an optimal staking ratio, and when the actual staking ratio deviates from this optimal ratio, staking participants cannot receive all the inflation rewards, as a portion will flow into the treasury. This mechanism encourages people to keep the staking ratio close to the optimal level, making it the most cost-effective for staking participants, thereby regulating the overall staking ratio of the network.

However, Polkadot's mechanism involves funneling part of the inflation funds into the treasury, which adds complexity to governance. Nonetheless, it is undeniable that there are mechanisms that can dynamically adjust staking rewards, thereby influencing the development of the entire ecosystem, which Solana can learn from.

As for the portion of inflation funds that Polkadot funnels into the treasury, considering that Solana does not have a treasury design, it could be considered to burn these funds, thereby regulating Solana's staking rate to a relatively ideal ratio (for example, 33%). At the same time, when the staking ratio is not optimal, Solana's total inflation rate would decrease due to the additional burning, and staking rewards would also decrease.

The above methods still involve dynamically adjusting the inflation rate itself, but similar effects can also be achieved by dynamically adjusting other parameters.

For example, one could consider directly adjusting the initial inflation rate to a fixed value of 3%, but dynamically adjusting the current fee burning ratio. Currently, the fee is 50% burned and 50% given to validators. We can dynamically adjust this 50% ratio, increasing the burn when necessary or decreasing it when needed, ensuring that staking rewards do not become too high and affect ecosystem development, while also leveraging the ecosystem's strength to reduce inflation.

Of course, if it is felt that the speed of directly reducing the current inflation rate from around 4.5% to 3% is too fast, one could consider setting it to decrease by 0.5% every six months, reaching the endpoint of 3% in a year and a half, which would mitigate the impact of this adjustment on the ecosystem.

The above is merely a point of divergent thinking regarding SIMD-0228, but it is sufficient to show that there are many ways to adjust Solana's economic model. As one of the most successful public chains today, the adjustment of its economic model is an important experiment in the blockchain industry.

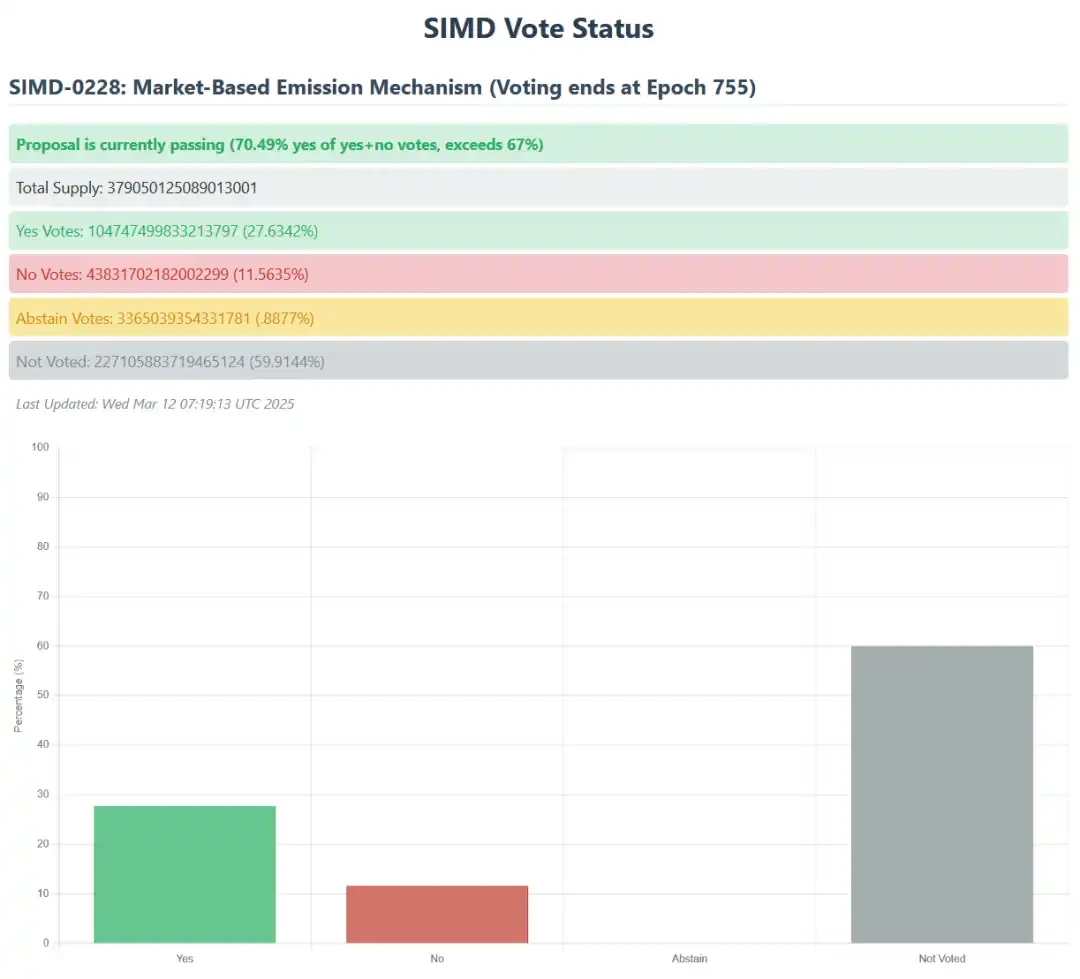

Currently, SIMD-0228 is in the voting process, with votes exceeding 33%, reaching the quorum, and the approval rate has surpassed 70%. Voting will continue until the 755th Epoch. If it successfully passes, it will provide a reference paradigm for "dynamic inflation" for other public chains. Even if it does not succeed, this governance struggle has profoundly changed the narrative of Web3: the future of blockchain economics lies in the delicate balance between code rules and human incentives, and Solana is undoubtedly leading the industry's development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。