In 2024, public chain RWA is experiencing explosive growth, signaling the rise of a new financial paradigm. Driven by the triple engines of institutional entry, continuous technological breakthroughs, and gradually clarified regulations, RWA is accelerating its transition from proof of concept to large-scale application. Innovative models such as asset tokenization, cross-chain interoperability, and smart contract automation are emerging, reshaping the financial ecosystem. However, structural issues such as liquidity layering, yield-risk mismatches, and legal challenges regarding asset control cannot be overlooked. Looking ahead to 2025, innovations in asset classes, the evolution of technological paradigms, and the reconstruction of regulatory frameworks will become the three main themes of RWA market development, injecting new momentum into the healthy growth of RWA.

This article is contributed by RealtyX DAO community contributor Sanqing.

I Data Panorama: From Scale Explosion to Structural Transformation

1.1 Total Breakthrough and Growth Differentiation

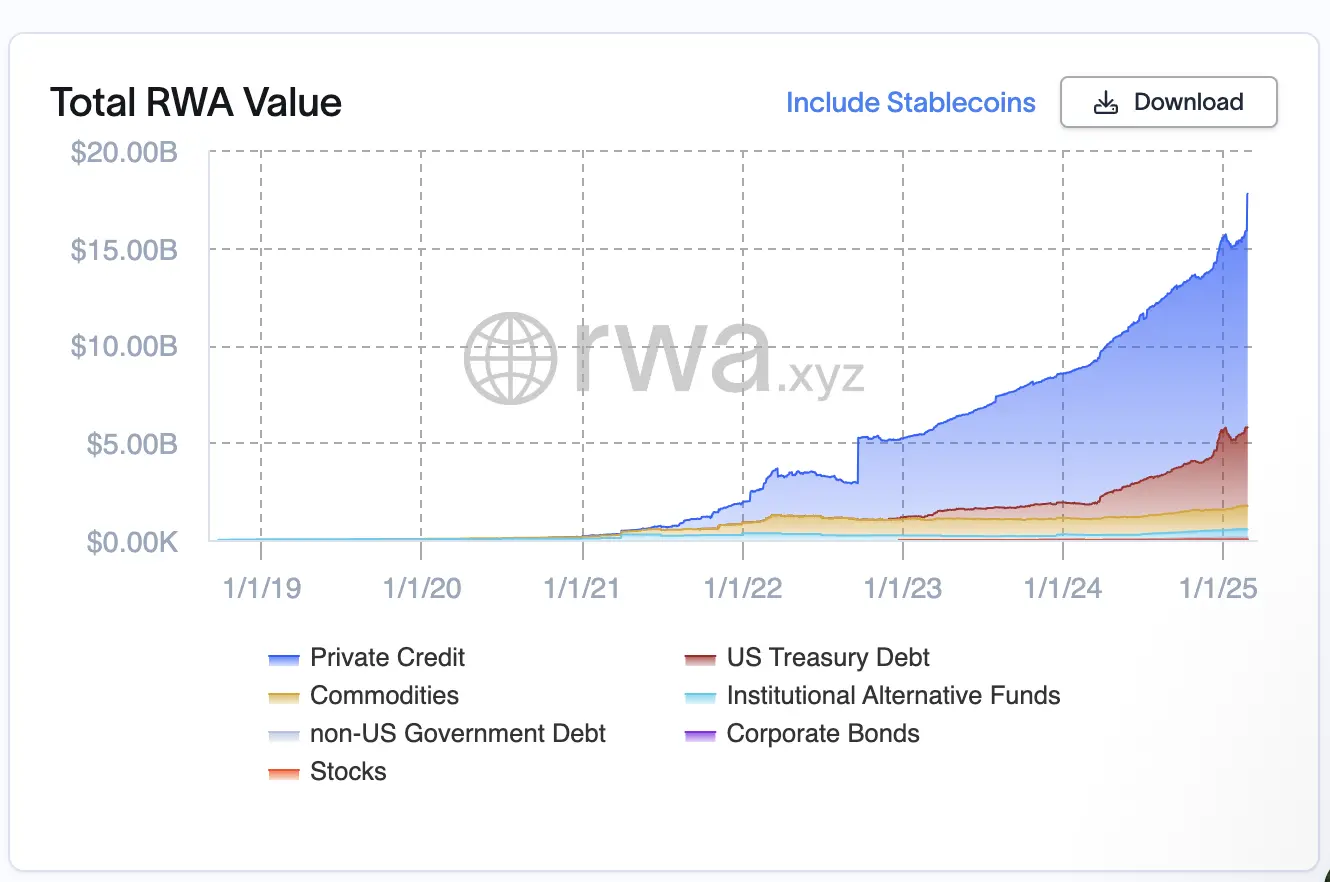

(Source: rwa.xyz)

(Source: rwa.xyz)

Total on-chain RWA scale: Approximately $15.4 billion by the end of 2024 (excluding stablecoins), a year-on-year increase of about 80% (2023 data: approximately $8.6 billion)

Growth differentiation characteristics:

U.S. Treasury Bonds: Year-on-year growth of approximately 415% ($769 million → $3.96 billion)

Private Credit: Year-on-year growth of approximately 48% ($6.656 billion → $9.828 billion)

Commodities and Other Assets: Year-on-year growth of approximately 32.6% ($1.16 billion → $1.537 billion)

Real Estate Tokenization:

| Institution | Base Year Market Value | Target Year Market Value | Compound Annual Growth Rate | |-------------|------------------------|-------------------------|-----------------------------| | aceanalytic | $2.81 billion (2023) | $11.8 billion (2031) | 19.9% | | spherical | $2.78 billion (2023) | $16.51 billion (2033) | 19.5% | | prophecy | $3.8 billion (2024) | $26 billion (2034) | 21.2% |

While the overall market is expanding significantly, different asset classes are showing clear growth differentiation: U.S. Treasury Bonds have achieved extremely high growth due to their safe-haven properties and institutional adoption, while private credit and commodities reflect differentiated attention from market participants regarding risk, yield, and liquidity. Institutions hold an optimistic long-term outlook on real estate tokenization, expecting its compound annual growth rate to approach 20%, suggesting that digital transformation and improved asset circulation efficiency will drive this field towards large-scale implementation.

1.2 Market Structure Evolution

The 2024 RWA market presents a "dual-core drive, diversified expansion" pattern

Dual-core drive: U.S. Treasury Bonds (annual growth of 415%) and private credit (annual growth of 48%) together account for over 85% of the market, with the former benefiting from macro safe-haven demand and institutional entry, and the latter attracting allocations due to its high-yield characteristics.

Diversified expansion: Traditional categories such as real estate and commodities are steadily growing, while emerging fields like ESG assets, art, and supply chain finance are accelerating their penetration, collectively supporting market diversification.

This layered expansion is driven by the synergistic effects of technology, capital, and regulation. Three major trends—liquidity reconstruction, large-scale implementation, and asset innovation—constitute the core narrative of market evolution.

Three Major Trends: From Liquidity Reconstruction to Ecological Prosperity

Liquidity premium release: Blockchain reshapes pricing logic

Technological empowerment: Around-the-clock trading and smart contracts reduce transaction costs by 30–90%, compressing liquidity premiums and enhancing RWA asset valuations.

Positive cycle: Improved liquidity → attracts more issuers and investors → further reduces premiums, forming a market expansion flywheel.

Large-scale application: Dual breakthroughs in institutions and infrastructure

Traditional finance entry: BlackRock (BUIDL Fund), Franklin, and others have launched compliant tokenization products, validating the RWA business model.

Emergence of dedicated public chains: Layer 1 solutions like Plume and Mantra provide compliant and efficient tokenization infrastructure.

Pricing infrastructure: Chainlink oracles cover over 70% of on-chain RWA assets, addressing the challenge of real price anchoring.

Asset diversification: "Core-Boundary" layered evolution

Core dominance: Treasury bonds and credit maintain dominance, but growth differentiation (415% vs. 48%) reflects differences in risk appetite.

Boundary expansion:

Digitalization of traditional assets: Real estate (19–21% CAGR) and commodities enhance liquidity through tokenization.

Emergence of new categories: Long-tail assets like ESG, luxury goods, and IP are accelerating on-chain, while supply chain finance (e.g., accounts receivable tokenization) releases financing potential for SMEs.

The above three trends—liquidity reconstruction reducing transaction friction, institutional-grade infrastructure enhancing credibility, and asset expansion releasing long-tail value—jointly drive RWA towards deeper penetration. Among them, real estate tokenization, due to its comprehensive integration of the three trends, has become the most representative paradigm breakthrough.

Focus Area: Paradigm Breakthrough in Real Estate Tokenization

At the same time, although other sub-sectors are relatively small in scale, they still demonstrate sustained market vitality, providing support for the diversified development of the RWA ecosystem.

Growth trajectory: According to the optimistic predictions of the ScienceSoft research team, by 2030, the global tokenized real estate market size could reach a staggering $3 trillion, accounting for 15% of real estate managed assets. They state that although the market is still in its early stages in 2024, the increasing adoption of tokenization technology by property owners and the growing demand from investors further validate the rationale for issuing real estate tokens.

Strategic value: By integrating liquidity enhancement, institutional compliance, and multi-scenario applications, real estate tokenization has become a typical representative of RWA transformation potential, solidifying its core position in the broader RWA ecosystem.

The main application scenarios for real estate tokenization include:

| Scenario | Model | Representative Cases | |----------|-------|----------------------| | Residential real estate fractional tokenization | Splitting residential real estate into affordable shares, lowering the investment threshold for retail investors | RealT, Estate Protocol | | DeFi liquidity integration | Combining with lending and staking protocols to release liquidity of collateralized assets | RealtyX | | Residential mortgage innovation | Tokenizing mortgage certificates to enhance financing flexibility | PropCap |

Value logic: Breaking physical limitations through blockchain to achieve 24/7 global liquidity, releasing the value of existing assets.

II Industry Driving Factors: Analysis of the Triple Power Engine

2.1 Institutional Entry

Institutions not only view RWA as a new investment track but are also attempting to utilize public chains as underlying technology to optimize capital operations and enhance operational efficiency. The entry of institutions will accelerate market maturity, promote the improvement of industry infrastructure, and further expand the digital boundaries of real-world assets.

Strategic Layout of Traditional Financial Giants

BlackRock launched the Ethereum-based tokenized fund BUIDL in March 2024, primarily investing in cash, U.S. Treasury bonds, and repurchase agreements, providing qualified investors with opportunities to earn dollar returns. As of July 2024, assets managed by BUIDL have exceeded $500 million, making it one of the largest tokenized Treasury bond funds.

Additionally, institutions such as Fidelity, JPMorgan, and Citigroup have also made strategic layouts in the RWA field.

Institutional Entry Promotes Standardization and Infrastructure Improvement Process

The entry of institutions has not only brought funds and resources but has also promoted the standardization and infrastructure construction of the RWA market. By collaborating with blockchain projects, traditional financial institutions are exploring best practices for tokenizing real-world assets, facilitating market maturity.

BlackRock's BUIDL fund collaborates with blockchain projects like Securitize and Maple Finance to ensure that tokenized products meet regulatory standards and provide on-chain credit markets, promoting the creation and trading of credit products. They have partnered with Circle to establish a USDC liquidity pool, achieving 1:1 real-time conversion between BUIDL and USDC, enhancing the liquidity of tokenized products.

JPMorgan's Onyx digital asset platform utilizes blockchain to achieve tokenized ownership transfer of money market fund shares through a tokenized collateral network, allowing asset management companies and institutional investors to pledge or transfer fund shares as collateral, improving capital efficiency.

2.2 Technological Breakthroughs

Compliance Breakthroughs

To ensure that blockchain applications comply with regulations such as anti-money laundering (AML) and know your customer (KYC), many projects are exploring embedding compliance mechanisms directly into blockchain systems. For example:

- Tokeny Solutions has developed the ERC-3643 token standard, which integrates identity management and transfer restrictions directly into the token smart contract, enabling issuers to perform investor qualification checks, KYC/AML checks, and compliance rules on-chain. For example, BlocHome uses the ERC-3643 standard to issue tokenized real estate, allowing project parties to automatically verify investors' identities and ensure compliance with regulatory requirements. According to BlocHome, compliance costs have been reduced by 90% after adopting the ERC-3643 standard.

Tether has launched the asset tokenization platform Hadron, which provides risk control, asset issuance and destruction, KYC and AML compliance guidance, and supports blockchain reporting and capital market management.

Circle's Verite framework is an open-source identity verification solution designed to provide interoperable identity standards for the decentralized finance (DeFi) ecosystem. This framework allows users to prove their identity on-chain while maintaining control over their personal data. It is expected to achieve dynamic binding between on-chain identity and real-world asset (RWA) holdings.

Cross-Chain Interoperability

Blockchain interoperability refers to the ability to exchange information and value between different blockchain networks. Achieving cross-chain interoperability is crucial for promoting the collaborative development of the blockchain ecosystem. Currently, cross-chain communication protocols are emerging, aiming to securely connect different blockchain networks and alleviate the challenges present in a fragmented blockchain landscape. For example:

Wormhole has launched the NTT framework, providing an open and flexible cross-chain solution that allows native assets to be seamlessly transferred between different blockchains without the traditional wrapped token model. This innovation eliminates the intermediary risks of wrapped tokens and enhances the integration efficiency of multi-chain liquidity.

Chainlink has released the Cross-Chain Interoperability Protocol (CCIP), a new open-source standard designed to establish universal connections between hundreds of public and private chain networks, enabling cross-chain applications. CCIP addresses the fragmentation issue in the blockchain space by ensuring that data and assets can be securely transferred between different blockchain networks, facilitating seamless interaction among various tokenized assets.

Public Chain Infrastructure

Through smart contracts, RWA public chains can automatically execute compliance checks, transaction settlements, and profit distributions, thereby reducing intermediary costs, improving operational efficiency, and providing a borderless platform for global investors to facilitate cross-border capital flows. Below are two notable RWA-specific public chains.

Plume Network

Plume is the first full-stack Layer 1 public chain built specifically for Real World Asset Finance (RWAfi), aimed at achieving rapid tokenization and global distribution of real-world assets. Its composable EVM-compatible environment supports the access and management of various real-world assets.

End-to-end tokenization engine: Simplifies the asset onboarding process through automated compliance checks, KYC/AML integration, and compliance templates.

Interoperability hub: Its SkyLink cross-chain interoperability solution connects over 16 public chains (such as Solana and Movement). This will enable users to enjoy institutional-level RWA yields across multiple chains without permission, promoting the development of a cross-chain RWA ecosystem.

Ecosystem expansion: Plume has launched over 180 protocols covering areas such as real estate tokenization, private credit, and commodities. Its strategic partnership with rwa.xyz ensures comprehensive data analysis capabilities for on-chain RWA, providing users with industry-leading tokenized asset data.

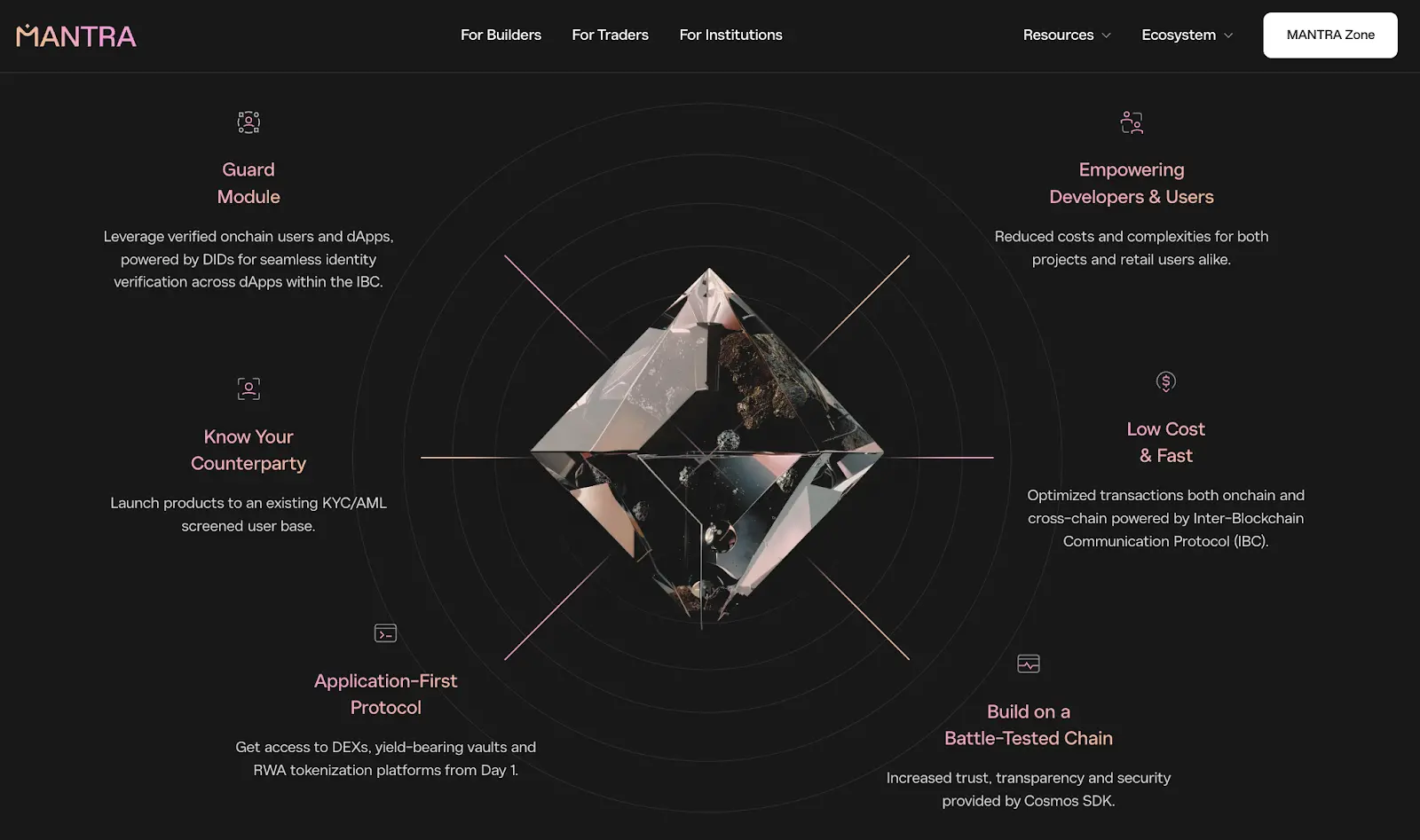

Mantra

Mantra aims to provide a permissionless, high-performance, and scalable Web3 development environment, specifically tailored for compliant RWA applications:

Compliance integration: Mantra is the first platform to obtain a DeFi VASP license issued by VARA, allowing it to legally operate a virtual asset exchange, brokerage, asset management, and investment services in Dubai, further solidifying the legitimacy of DeFi within a compliance framework.

Real-world impact: In collaboration with DAMAC Group, it is tokenizing $1 billion worth of real estate in Dubai, enhancing the liquidity of high-value properties.

Developer-friendly: Provides SDK and API for seamless integration of identity verification, asset custody, and cross-chain settlement.

2024 RWA Technology Stack Review

In summary, the tokenization technology stack for RWA in 2024 has achieved a "three-layer decoupling," which refers to the separation and collaborative development of the asset layer, protocol layer, and application layer.

Asset Layer

ERC-3643 standard: Widely used for compliant equity tokenization. This standard integrates identity management and transfer restrictions directly into the token smart contract, enabling issuers to perform investor qualification checks and KYC/AML checks on-chain, ensuring the compliance of token transactions.

Protocol Layer

Chainlink's oracle network has made significant progress in the coverage of RWA price data sources.

The Cross-Chain Interoperability Protocol (CCIP) supports seamless RWA cross-chain management, addressing inter-chain fragmentation issues and improving liquidity.

Application Layer

Lending: Maple Finance was the first to launch unsecured institutional loans, subsequently opening up to retail users through Syrup.fi (launched in June 2024). Defactor has also become a key player, providing on-chain lending solutions for RWA and retail users.

SME Financing: Centrifuge tokenizes real-world receivables and invoices, releasing blockchain-based liquidity to support SME financing.

AMM Liquidity Provision: IX Swap enhances automated market-making (AMM) technology, promoting liquidity for tokenized assets.

Secondary Market Trading: Polytrade drives the development of the RWA secondary market, enabling efficient trading of tokenized assets.

This decoupled architecture allows each layer to evolve independently while maintaining seamless integration, thus accelerating RWA from niche experiments to scalable institutional-grade solutions.

2.3 Regulatory Game

In 2024, RWA has made significant progress globally, but the large-scale implementation of RWA relies on clear regulatory guidance and policy environments. Governments and international regulatory bodies are actively exploring how to promote the development of this emerging field while ensuring financial stability and protecting investor rights.

Divergence and Coordination of Global Regulatory Trends

U.S. SEC: In 2024, the SEC clarified the regulatory framework for security tokens and tokenized assets, emphasizing that such assets must comply with existing securities laws. This move provides clearer guidance for the compliant operation of RWA. In response to the SEC's regulation of digital assets, some RWA project parties (such as RWA Inc.) are collaborating with compliance consulting firms to analyze the securities nature of their RWA tokens and take corresponding compliance measures based on the analysis results.

EU MiCA: The EU has further supplemented the regulatory provisions for RWA based on MiCA. MiCA categorizes stablecoins into asset-referenced tokens (ART) and electronic money tokens (EMT), setting clear requirements for their issuance and operation. Specifically, MiCA stipulates:

Asset-referenced tokens (ART): Refers to crypto assets that reference the value of one or more fiat currencies, one or more commodities, or one or more crypto assets, aiming to maintain a stable value. MiCA imposes higher capital requirements and stricter operational requirements on ART issuers to ensure they have sufficient asset reserves to support the value of the tokens.

Electronic money tokens (EMT): Refers to crypto assets that reference the value of one fiat currency, aiming to maintain a stable value. EMT issuers must obtain a license from electronic money institutions and comply with relevant regulatory requirements.

Asian Regulatory Sandboxes:

Japan: The revised Payment Services Act clarifies the regulatory positioning of stablecoins as "electronic payment instruments."

Hong Kong and Singapore: By issuing regulatory guidelines and sandbox programs, they provide clear compliance pathways for innovative products like RWA.

Balancing Regulation and Innovation

Dynamic regulation and sandbox mechanisms: Several countries have adopted a "regulatory sandbox" model, allowing companies to experiment with new technologies and business models within a limited scope while collecting data to adjust policies. For example, the sandbox program launched by the Hong Kong Monetary Authority provides a testing platform for digital asset products like stablecoins, ensuring compliance without hindering innovation.

Cross-border regulatory coordination: As the RWA and other digital asset markets globalize, regulatory agencies in various countries are attempting to promote unified regulatory standards within international organizations (such as FATF and G20), which will help alleviate cross-border regulatory conflicts and information asymmetry issues.

III Market Paradox: Structural Contradictions Beneath Prosperity

3.1 Liquidity Layering Phenomenon

The original intention of RWA tokenization is to enhance the liquidity of assets through blockchain technology, allowing assets to be traded more quickly and transparently in the market. However, in practice, there is a significant layering of liquidity among different types of assets:

Differences in Asset Nature and Market Size:

Differences in the intrinsic attributes of assets. For example, tokenized U.S. Treasury bonds have the backing of national credit, a mature trading market, and high credit ratings, resulting in high trading activity, transaction volume, and a well-established price discovery mechanism, thus exhibiting high liquidity. In contrast, assets like real estate and artworks often have complex valuations, limited investor demand, and restricted trading methods, leading to high holding costs and long exit periods, which results in insufficient liquidity.

Market size and participant structure. High liquidity assets typically attract a large number of institutional and retail investors, and with sufficient market depth, buyers and sellers can quickly match at any given time. Conversely, low liquidity assets may create information silos, with fewer investors and sparse buy/sell orders, leading to low trading volumes, high price volatility, and difficulties in executing large transactions without significant slippage.

Market participant behavior and expectation management:

Preference for high liquidity assets. Investors generally prefer assets that are easy to liquidate and have low transaction costs, especially during periods of high market enthusiasm. The trading activity of high liquidity assets further attracts more participants, while low liquidity assets may become marginalized, creating a "survival of the fittest" market dynamic.

Liquidity premium and price volatility. Assets with good liquidity often enjoy a certain premium, while low liquidity assets may face significant discounts when urgently needing to liquidate due to a lack of sufficient trading counterparts, exacerbating price volatility and market risk.

To address this issue, many RWA project parties have taken the following measures:

Introducing market maker mechanisms: Encouraging market makers to provide liquidity for low liquidity assets by offering buy and sell quotes, narrowing the bid-ask spread, and increasing trading activity.

Integrating DeFi protocols: Combining RWA with DeFi protocols, such as using RWA as collateral for lending or including RWA in DEX trading pairs. Through DeFi protocols, the liquidity of RWA can be enhanced, providing investors with more yield opportunities.

Incentivizing user participation in trading: Encouraging user participation in trading low liquidity assets through airdrops, trading competitions, and other methods.

3.2 Yield-Risk Mismatch Crisis

While RWA offers investors diversified yield opportunities, behind the allure of returns often lies the issue of yield and risk mismatch:

Insufficient risk disclosure and transparency

Traditional financial markets require strict information disclosure and regular risk assessment reports, but during the RWA tokenization process, some platforms have yet to establish unified and transparent risk assessment and information disclosure standards. The lack of adequate risk warnings makes it difficult for investors to timely understand the credit status of assets, the quality of collateral, and market volatility.

Disconnection between asset backing and actual risk bearing

In many tokenization projects, to achieve digital management of assets, SPVs (Special Purpose Vehicles), trust funds, or third-party custodians are often established to hold the assets. However, if these structural designs have flaws, in the event of bankruptcy or default, the tokens held by investors may not correspond to the actual assets, exacerbating the yield-risk mismatch. High-yield products often come at the cost of higher default probabilities and credit risks, while some products in the RWA market may lead investors to underestimate potential credit risks due to opaque promotion or ratings, resulting in substantial losses when default events occur.

Fluctuations in market sentiment and risk premiums

Traditional financial markets typically have various risk mitigation tools (such as credit default swaps, guarantee mechanisms, etc.) to balance risk and return, but in many RWA tokenized products, such tools have not been fully developed and applied, making the mismatch between yield and risk more pronounced. In a decentralized trading environment, token prices are more influenced by short-term market sentiment and liquidity fluctuations. When market sentiment is optimistic, high-yield assets may be overly sought after, with prices far exceeding their fundamental support; however, once the market cools or unexpected risk events occur, prices can plummet, leading investors to enter at peaks and exit at troughs, further exacerbating risk mismatches.

3.3 Legal Paradox of Asset Control Rights

In the process of RWA tokenization, the control rights of assets form an inherent paradox between legal systems and technical frameworks. This paradox is primarily reflected in three aspects: the dilemma of rights confirmation, the failure of bankruptcy isolation, and cross-border judicial conflicts, leaving token holders facing a "triple suspension of rights" dilemma.

Dilemma of rights confirmation: Blockchain technology provides a decentralized ledger that can ensure the uniqueness and transferability of tokens through cryptographic methods. However, ownership of real-world assets relies on traditional legal confirmation systems, such as real estate registration, corporate equity structures, and custody agreements. Therefore, the ownership of RWA may become fragmented between on-chain registration and off-chain confirmation.

Smart contracts vs. real-world law: Although token holders possess ownership certificates on-chain, without corresponding legal recognition, such rights may not withstand claims from third parties. For example, in real estate tokenization projects, even if one holds tokens, if formal real estate registration has not been completed, the token holder may not be recognized as the true owner of the asset under current laws.

Automated execution of smart contracts vs. judicial intervention: In judicial litigation, courts may order the freezing or redistribution of assets, while the automated execution logic of smart contracts may not effectively comply with legal orders, leading to conflicts between legal systems and technical frameworks. This means that even if on-chain transactions have been completed, courts may still declare those transactions invalid or revoke them.

Failure of bankruptcy isolation: Tokenized assets typically need to be managed by an entity (such as an SPV, trust fund, or custodian), and once that entity goes bankrupt, token holders may face:

Unclear asset ownership: In traditional financial systems, securities, trust assets, etc., are usually protected by bankruptcy isolation mechanisms, meaning that even if the managing party goes bankrupt, the assets of holders will not be used to settle debts. However, in the practice of tokenized RWA, if the legal structure of the asset custodian is unclear, token holders may face the risk of their assets being seized by courts or used to settle debts.

Token rights potentially viewed as unsecured claims: If regulatory agencies or courts determine that tokens are merely "mappings" of assets rather than direct ownership certificates, token holders may not enjoy priority repayment rights in bankruptcy liquidation and may only queue as ordinary creditors for repayment. This would severely undermine the credit foundation of RWA assets as financial instruments.

Cross-border judicial conflicts: RWA tokenization often involves multiple jurisdictions, such as the location of the assets, the place of token issuance, and the location of investors, and conflicts between national laws may leave token holders' rights in an uncertain state.

Differences in asset ownership recognition across different judicial systems: Some countries' laws consider digital assets to be legitimate property protected by property law, while in others, they may only be contractual rights or note rights, subject to different legal frameworks. Therefore, investors may face legal interpretations that lead to their tokenized assets lacking legal protection in these countries.

Cross-border enforcement issues: Suppose an investor holds a tokenized gold based on blockchain issuance, but the gold is stored in a bank vault in another country. If the two countries have different interpretations of gold ownership under their laws, the investor may be unable to effectively enforce their ownership claim. Additionally, there are technical obstacles to executing court orders for freezing or seizing assets on the blockchain.

Ⅳ Future Projections: Three Major Trends in RWA by 2025

4.1 Asset Class Revolution

The trend of non-standard assets going on-chain:

As the RWA market continues to expand, private credit and U.S. Treasury bonds are expected to maintain their dominant positions due to their excellent liquidity and credit ratings. However, non-standardized assets, particularly real estate in developed regions or rapidly growing economies, will see significant on-chain progress in 2025.

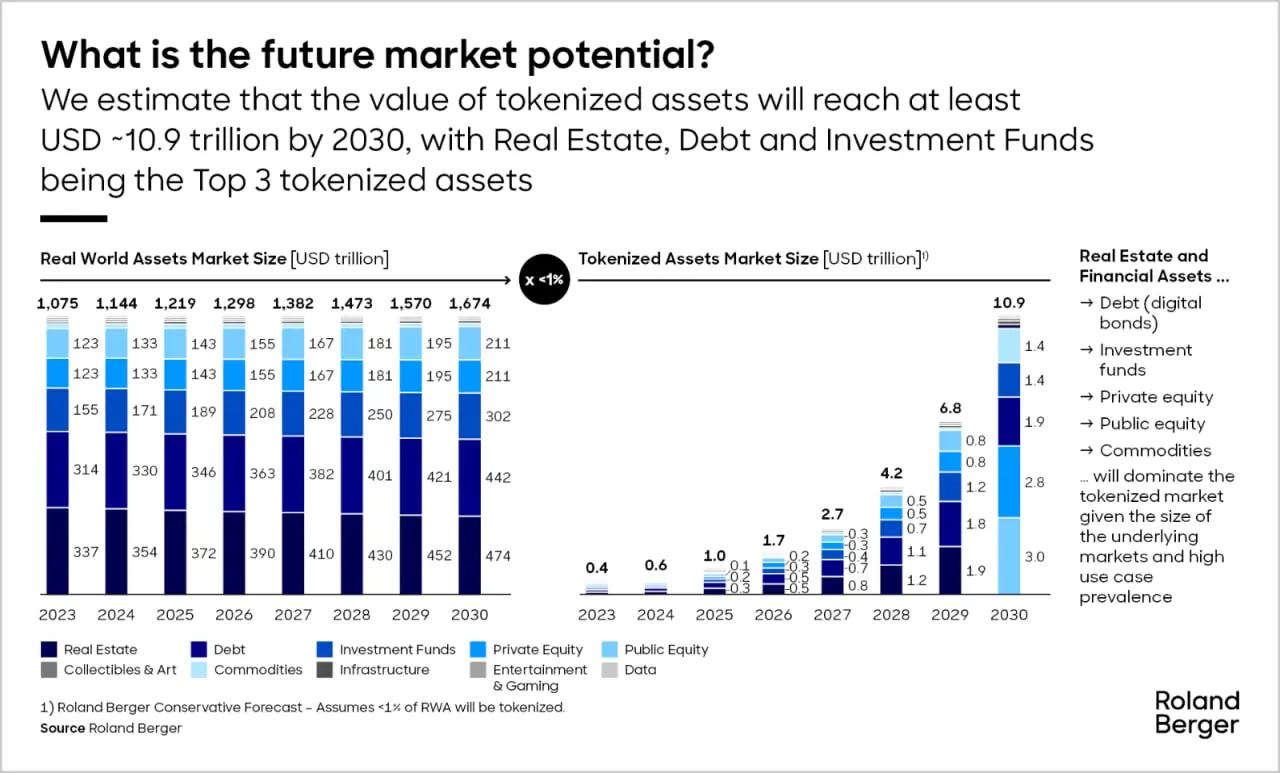

According to Bitwise's forecast, by the end of 2025, the RWA market size is expected to reach $50 billion. Among these, the Security Token Market predicts that tokenized real estate will reach $1.4 trillion, and Roland Berger predicts that real estate will account for nearly one-third of the market share. Roland Berger's forecast indicates that real estate is expected to become the largest type of tokenized asset by 2030, accounting for nearly one-third of the market. This is primarily due to the maturity of blockchain technology and the increasing demand for RWA, as these traditionally illiquid assets seek to achieve more efficient trading and management.

(Source: Roland Berger)

(Source: Roland Berger)Large-scale integration and innovation of RWAFi: Before the real world formally enters the Web3 era, the development of RWA mainly stems from the demand for liquidity in traditional finance. However, as RWA goes on-chain, this process is not just about the digitization of assets but also about the deep integration with DeFi and other blockchain finance. This integration has given rise to a powerful "RWA + any 'Fi'" model, promoting diversity and depth in financial innovation. The combination of real estate tokenization and DeFi is an important direction for RWAFi integration and innovation. By putting real estate assets on-chain and integrating them with DeFi protocols, the following innovative applications can be achieved:

Mortgages: Using tokenized real estate as collateral to obtain loans from DeFi lending platforms (for example, using a tokenized apartment as collateral to exchange for stablecoin loans).

Yield farming: Token holders can deposit RWA tokens into DeFi protocols to earn interest income (such as loan repayment income) or protocol rewards (such as governance tokens). Unlike passive holding, yield farming allows for active optimization of asset returns.

Liquidity mining: Users can provide liquidity for RWA token trading pairs, earning trading fees and liquidity incentives on decentralized exchanges (DEX), with returns proportional to the liquidity provided.

Case Study: RealtyX, Plume Network, and Ecosystem Partners

RealtyX (a real estate tokenization platform) and Plume Network (an L1 blockchain built for RWA) are driving the implementation of the RWAfi innovation framework:

Tokenization: RealtyX tokenizes real estate (such as residential properties in Dubai) through the Plume blockchain, ensuring compliance and cross-chain interoperability.

Collateralized Loans: Token holders can use RealtyX tokens as collateral to obtain loans on integrated lending platforms within Plume (such as Defactor, Mystic Finance).

Yield Farming: By combining RealtyX's real estate tokens with Pendle's yield tokenization protocol, users can create tradable future rental income tokens to optimize investment returns.

Liquidity Mining: RealtyX tokens can be paired with stablecoins to form liquidity pools for trading on DEXs (such as Rooster Protocol), allowing liquidity providers to earn native token incentives from RealtyX and Plume.

4.2 Technological Paradigm Shift

Adoption of Zero-Knowledge Proof Technology

Zero-Knowledge Proof (ZKP) technology has shown great potential in various areas of Web3. In the RWA space, the application of ZKP can enable asset verification and transactions while ensuring data privacy. This is particularly important for on-chain transactions involving sensitive information assets (such as real estate, private credit, etc.), enhancing the security and credibility of transactions.

Adoption of Modular Blockchains

Modular blockchain architecture has demonstrated advantages in enhancing network performance and scalability in other areas of Web3. In the RWA space, the adoption of modular blockchains can allow for the flexible combination of different functional modules to meet the diverse needs of asset tokenization. This will promote the standardization and interoperability of RWA, lowering the technical barriers and costs of going on-chain. For instance, Plume Network has attracted over 180 RWA-related protocols and more than 300,000 user addresses on its testnet, generating hundreds of millions of transactions.

4.3 Regulatory Framework Reconstruction

Shift in U.S. Regulatory Policies

Given the Trump administration's friendly stance towards cryptocurrencies and the accelerated entry of U.S. institutions into the RWA space, it is anticipated that the U.S. will adopt a more open posture regarding the regulation of crypto assets. Policies and regulations supporting RWA tokenization are expected to be introduced, encouraging financial innovation while ensuring market stability and security. This will provide a clearer legal framework for the development of RWA, reduce compliance risks, and attract more institutions and investors to participate.

Unified Cross-Border Regulation

Although this is not a major trend for 2025, as RWA continues to explode, particularly with the anticipated surge in non-standard assets, there may be numerous cross-border lawsuits involving RWA, especially related to non-standard assets this year. This will prompt regulatory agencies in various countries to begin considering the establishment of a unified international regulatory framework to address legal and compliance issues in cross-border transactions.

Conclusion: The Growing Pains of RWA Towards Institutional Maturity

In 2024, RWA tokenization will transition from concept to reality, gradually entering a scalable application phase driven by accelerated institutional investment (such as BlackRock's BUIDL), regulatory breakthroughs, and infrastructure upgrades (such as Plume Network's dedicated L1 for RWA). However, as tokenized assets like government bonds, real estate, and private credit grow, the industry must confront a series of structural challenges.

Core Challenges

- Centralization Dilemma: The Conflict Between Compliance and Decentralization

Many RWA protocols rely on "permissioned DeFi" models (such as custodians, SPVs) to meet compliance requirements, which conflicts with the decentralized ethos of blockchain.

The legal ownership of assets remains constrained by traditional legal frameworks, limiting the autonomy of smart contracts in dispute resolution.

- Decentralization Gap: Barriers to Entry and Regulatory Obstacles

There is a conflict between lowering investment thresholds and KYC/AML compliance, lack of transparency in information disclosure, and high technical barriers.

While DAO governance has potential, it still faces challenges of low participation and regulatory uncertainty.

- Market Fragmentation: Uneven Distribution of Liquidity

Liquidity is concentrated in blue-chip RWA assets (such as U.S. Treasury bonds), marginalizing niche assets.

Cross-border legal uncertainties threaten the enforceability of ownership claims for tokenized assets, increasing investment risks.

Path to Resolution: Collaboration Over Compromise

To achieve the global development of RWA, all industry stakeholders need to focus on promoting the following directions:

Seamless Interoperability

By leveraging Plume Network's dedicated L1 for RWA and RealtyX's DeFi integration, the traditional financial world and blockchain can be connected, reducing asset flow resistance.

Compliance Integration

Integrating KYC/AML mechanisms (such as zero-knowledge proof identity verification) at the protocol level ensures compliance while protecting user privacy, proving that compliance should not be an obstacle to innovation.

Global Governance Alliance

Collaborating with institutions like FATF and BIS to promote the unification of cross-border regulatory standards, ensuring that the rights of tokenized assets are legally protected in cases of bankruptcy, judicial conflicts, etc.

Educational Promotion

By providing more user-friendly interfaces (such as RealtyX's retail-friendly Dapp), lowering the usage threshold for ordinary users, and leveraging Chainlink's asset-level oracles to enhance market transparency.

Blueprint for Responsible Scalable Development

The rise of RWA is not about replicating traditional finance but about reshaping trust:

For institutions: Achieving 24/7 liquidity, allowing previously illiquid assets to enter the global market.

For individual investors: Expanding market access, such as Dubai real estate, Asian private credit, etc.

For developers: Projects like RealtyX are validating that decentralized and real-world financial frameworks can coexist compatibly.

The infrastructure is already in place, and industry trends are irreversible. Now, the key is how to execute efficiently— the industry needs to adopt a rigorous attitude and an inclusive perspective, looking to the future to truly drive RWA towards institutional maturity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。