Introduction

Is the BTC wallet merely a storage tool or an entry point to the ecosystem?

Since the birth of Bitcoin, wallets have always stood at the opposite ends of "security" and "convenience." To achieve absolute security, one must manage their private keys themselves, even if it means that losing them would result in irreversible loss; to gain more convenience, one must rely on centralized custody, which means losing control over their assets. For the past decade, this tug-of-war has never ceased.

However, the market has provided a new answer. The number of global cryptocurrency holders has surpassed 600 million, and the demand for asset management far exceeds mere "storage." CEX wallets still dominate traffic, but non-custodial wallets are growing rapidly, with new models like MPC and smart contract wallets continuously emerging, attempting to find the optimal solution between "security" and "experience." BTC wallets are no longer just places to store coins; they have become the traffic entry point for the entire Bitcoin ecosystem.

The wallet competition has long transcended the battle for market share; it is a game of rule-making. In this intertwined game of technology, capital, and regulation, whoever can find a balance between "security, compliance, and user experience" will be able to control the future direction of BTC.

Ten years ago, we were concerned about how to store BTC; today, the competition is about who the future of BTC should belong to.

1. BTC Wallet Market Overview — Explosive Growth and Ecological Differentiation

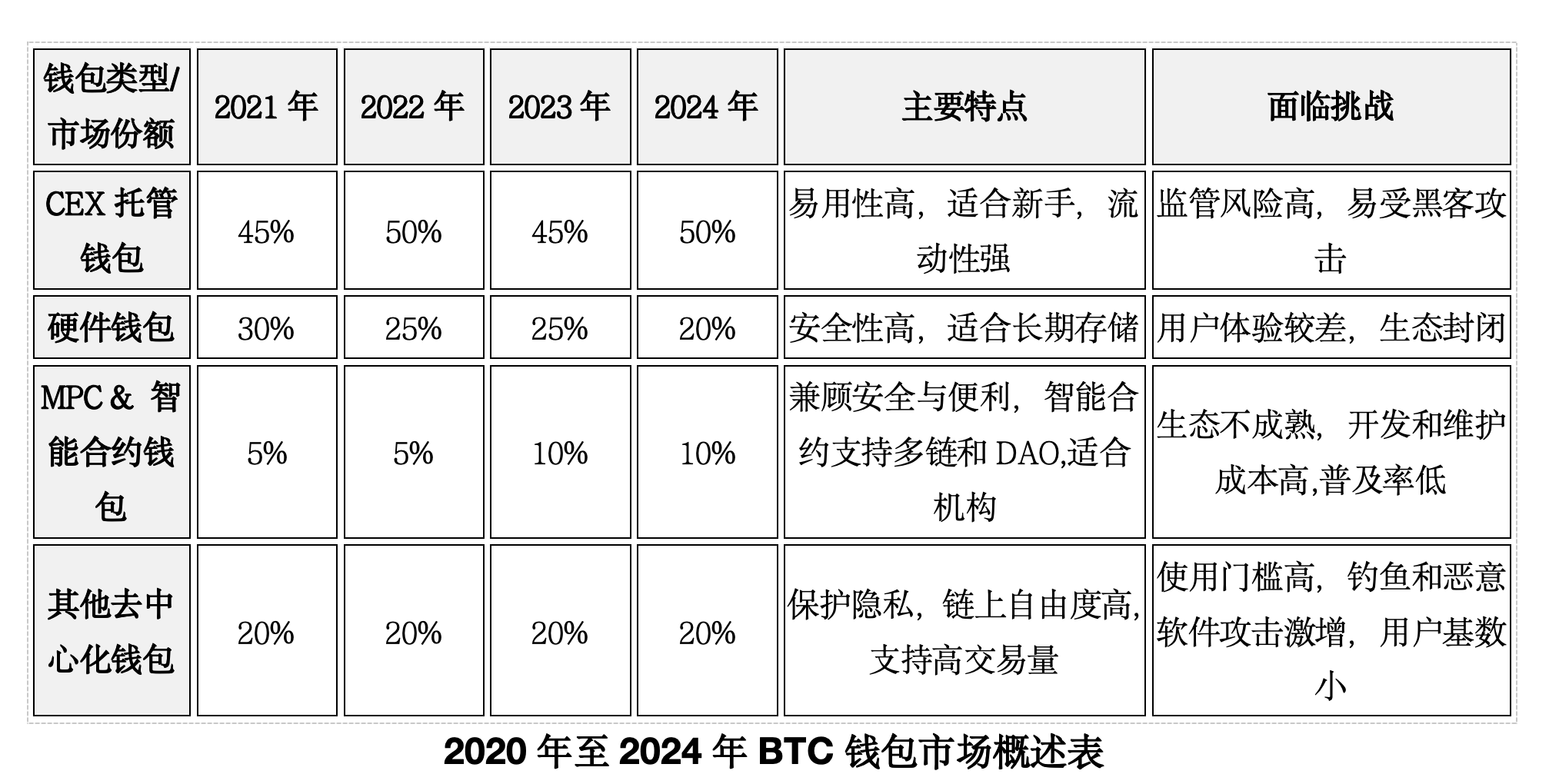

The BTC wallet market is not just about scale expansion; its functional boundaries are also being reshaped. Once merely regarded as a "storage tool," Bitcoin wallets have now become the frontline battleground of Bitcoin ecosystem competition. In recent years, the market has undergone tremendous changes. Bitcoin ETFs have accelerated institutional capital entry, Ordinals inscriptions have surged in popularity, and on-chain transaction demand has skyrocketed, causing the market size of BTC wallets to leap from $8.42 billion to $10.51 billion in just a few years. The rapidly growing market has not only brought an influx of capital and users but has also sparked a "battle for entry" among different types of wallets — CEX custody, hardware wallets, and emerging wallets are each vying for territory, attempting to control the traffic entry point of the BTC ecosystem.

Data Source: Based on Glassnode active address data (from 38 million in 2021 to 45 million in 2024), Chainalysis trend reports, and incomplete statistics on wallet manufacturers' market performance and industry events.

CEX Custodial Wallets: Traffic Hegemony and Trust Crisis "The first Bitcoin for most users is likely bought from an exchange." This has given CEXs like Binance and Coinbase a first-mover advantage in the wallet competition. Coinbase, relying on ETF custody, saw its managed BTC assets soar to $171 billion in Q1 2024, while Binance's Web3 wallet rapidly expanded to six public chains, attempting to bridge trading and DeFi scenarios. However, after the collapse of FTX, the trust crisis of CEX wallets was completely ignited. Users began to reassess the risks of centralized custody, leading to a 2.3-fold increase in hardware wallet sales in 2023, indicating that more people are seeking safer asset management methods. In response to the challenge, CEX wallets have started to introduce MPC (Multi-Party Computation) technology, attempting to find a balance between compliant custody and user autonomy, but for many users, "decentralization" still means distrust of third-party custody.

Hardware Wallets: Security Barrier or Ecological Island? As traditional non-custodial solutions, hardware wallets like Ledger and Trezor have long held 60% of the global market share. However, with Ordinals empowering the BTC ecosystem and the surge in on-chain interaction demand, hardware wallets have gradually become "ecological islands" due to their closed systems. To avoid being left behind by the progress of the times, products like Ledger Live and Trezor Suite have begun to attempt support for NFT and multi-chain asset management, but data shows that users are more willing to sacrifice 5% of security for 80% of convenience, indicating that the market barrier of hardware wallets is gradually weakening.

Emerging Wallets: Disruptive Innovation, Reshaping User Experience The real disruptors in the market landscape are a group of "anti-traditional" emerging players:

- Fireblocks: Using MPC technology to allow 1,500 institutions, including Goldman Sachs, to securely manage $200 billion in assets, challenging traditional custodians.

- UniPass: Eliminating mnemonic phrases and using email login, attracting 220,000 retail users within six months, simplifying the usage threshold for BTC Layer 2.

- Stacks: Creating a Bitcoin version of a "points system" by incentivizing 64% of users to hold STX tokens within the wallet.

At this point, the wallet competition is no longer just a battle for market share but a struggle for ecological dominance. However, in this war, wallets have not found the optimal solution; instead, they are mired in multiple challenges related to technology, security, and user experience. CEXs, hardware wallets, and emerging wallets are each betting on different futures: the ideal of decentralization, the reality of user experience, and the baseline of security. The interplay of these three factors is pushing BTC wallets into a more complex battlefield.

2. Grounded Dilemmas: Three Major Challenges to Survival

The growth of market size does not mean that BTC wallets have found the optimal solution. On the contrary, the expanding user base and rising transaction activity are increasingly exposing the shortcomings of BTC wallets. Network congestion, hacker attacks, and complex operations are three major issues that not only trouble developers but also continuously deter new users. Bitcoin wallets are facing a survival challenge that will determine their future.

Network Congestion: Soaring Transaction Costs and Intensifying Performance Dilemmas In April 2024, the congestion of the Bitcoin mainnet was comparable to the morning rush hour on Beijing's East Third Ring Road. The launch of the Runes protocol combined with the halving event caused single transaction fees to soar to as high as $128, putting ordinary users in a predicament where "the transfer costs more than the asset itself." Although Layer 2 solutions are continuously emerging, their performance remains limited, and the long on-chain confirmation times hinder small payments and interaction experiences. The optimization of BTC wallets is no longer just about reducing transaction costs; it is about how to provide users with a smooth experience without being deterred by technical barriers.

Security Challenges: The Dilemma of Hackers, Private Keys, and User Trust The security of Bitcoin wallets has always been a "cat-and-mouse game." In the past five years, losses from hacker attacks due to wallet vulnerabilities have exceeded $3 billion, with the 2023 Atomic Wallet vulnerability leading to the theft of over $100 million in various cryptocurrencies, exposing the technical risks of non-custodial solutions. However, the problem is not just about hacker attacks. Issues such as lost mnemonic phrases, chaotic private key management, and cross-chain bridge vulnerabilities leave ordinary users at a loss when it comes to security. The higher the security threshold, the greater the cost of using decentralized wallets, ultimately leading many users to return to the embrace of centralized custody.

User Experience Dilemma: Complex Operations, Difficult to Break Through the Novice User Barrier "Downloading the wallet takes five minutes, understanding the operations takes two hours." The high learning threshold of Bitcoin wallets is a common experience for nearly every new BTC user:

- 68% of novice users get stuck during their first transfer due to incorrect Gas fee calculations;

- Ordinary users take an average of 3 hours to complete their first cross-chain interaction;

- Only 9% of BTC Layer 2 users truly understand the Gas token mechanism.

The essence of the user experience gap is not merely a UI design issue but rather that the Bitcoin ecosystem still lacks adaptation for ordinary users. Although some wallet manufacturers have begun to attempt to reduce complexity — eliminating mnemonic phrases in favor of email logins, automating staking processes for "one-click earning," and using zero-knowledge proof technology to shorten cross-chain times — they still have not changed the core pain point of BTC wallets: users must understand private keys, Gas fees, and on-chain interactions to truly control their assets. For ordinary people, this still means "the threshold is too high," which is not only a matter of user habits but also a key variable in whether BTC wallets can truly enter the mainstream in the future.

Faced with these dilemmas, BTC wallets are undergoing a critical choice: will they become safer and more efficient financial infrastructure, or will they be gradually eliminated by users in the face of challenges? However, what truly determines the future of wallets may not be simple technical optimization but a deeper struggle for ecological dominance. When the shortcomings of user experience threaten the foundational base of hundreds of millions of users, a war over the definition of BTC wallets has become inevitable.

3. Power Restructuring of BTC Wallets: Who Can Define the Next Decade?

Who can define the next decade? The answer may lie in who can truly dominate Bitcoin. As elements like DeFi, Layer 2, and financialization flood in, Bitcoin's role has completely changed. Wallets not only determine how BTC is stored but also dictate how BTC is used — and whoever can control the flow of BTC funds can control the ecological rules. However, the problem is that Bitcoin still lacks an absolute leader. The struggle among technology, capital, and ecology continues, with each force attempting to define the future of BTC.

- Technical Route: Does BTC Still Insist on Decentralization? The split of Bitcoin wallets reflects two different directions in the BTC ecosystem: should it maintain decentralization or cater to broader user needs?

- On one hand, the complexity of technology still deters ordinary users; decentralized wallets still require users to manage mnemonic phrases and calculate Gas fees themselves. Over the past decade, the technological upgrades of BTC wallets have focused more on security rather than genuinely lowering the threshold.

- On the other hand, new technological routes are breaking through these limitations. Solutions like account abstraction (AA), social recovery, and on-chain identity are attempting to make Bitcoin feel more "seamless." But does this mean the BTC ecosystem is compromising towards Web2? The choice of BTC's technological route not only affects the future of wallets but also determines whether Bitcoin will ultimately become a closed value storage tool or a currency that can be used in daily life.

- Capital Game: Is BTC Still Decentralized Finance? If technology determines how BTC is used, then capital is deciding BTC's financial attributes.

CEXs (centralized exchanges) are transforming BTC with regulatory frameworks; ETFs are making BTC a compliant asset, while custody models are gradually placing BTC under institutional control. Is Bitcoin becoming another "digital gold"?

The decentralized ecosystem is still trying to regain control over BTC. Layer 2 staking and decentralized custody solutions are still developing, and the BTC DeFi ecosystem is taking shape, but whether it can challenge CEX remains uncertain. Is the future of BTC part of the global financial order, or is it the core asset of the Web3 world? This is not only a technical issue but also a choice of capital.

3. The Ultimate Battle for Wallets: Who Truly Defines BTC?

In this fragmented ecosystem, the future of BTC is still inconclusive. But one thing is certain: wallets have become the key entry point for the flow of BTC funds, and the power to control wallets is reshaping the financial rules of Bitcoin. Bitcoin is no longer just an evolution of code rules; it is a battleground for global economic power:

If CEX wallets dominate, BTC may become a global reserve asset, integrated into the traditional financial system and more deeply influenced by regulation.

If the DeFi ecosystem can win more users, BTC may form an independent on-chain financial system, truly becoming a pillar of the decentralized economy.

If technological breakthroughs bring lower thresholds, BTC could even become a payment tool used daily by global users.

In Conclusion:

Who should the future of BTC belong to? The answer to this question has transcended the competition between products and markets, becoming the ultimate battleground that determines the form of Bitcoin.

The war over Bitcoin wallets may not have a clear ending. The essence of this war is the ultimate confrontation between Bitcoin's "code is law" and "user supremacy," with wallets being the frontline of this clash.

CEXs are building a compliant financial system, Layer 2 is trying to bring BTC into the world of smart contracts, while smart wallets are lowering the barriers to entry, allowing more people to enter the crypto world. They are all defining different futures for BTC, but the ultimate winner may not be any of them.

The Bitcoin ecosystem is entering a brand new decade. It is still evolving, still expanding, and still searching for the form that suits it best.

Today, we see the competition of Bitcoin wallets, a game of power, where technology, capital, and ecology intertwine. But ten years from now, when we look back at today, we may truly understand how this struggle over BTC wallets has shaped the future of Bitcoin.

The ecological rules of Bitcoin are still evolving and have yet to take shape. The conclusion of the wallet war may be further away than we imagine.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。