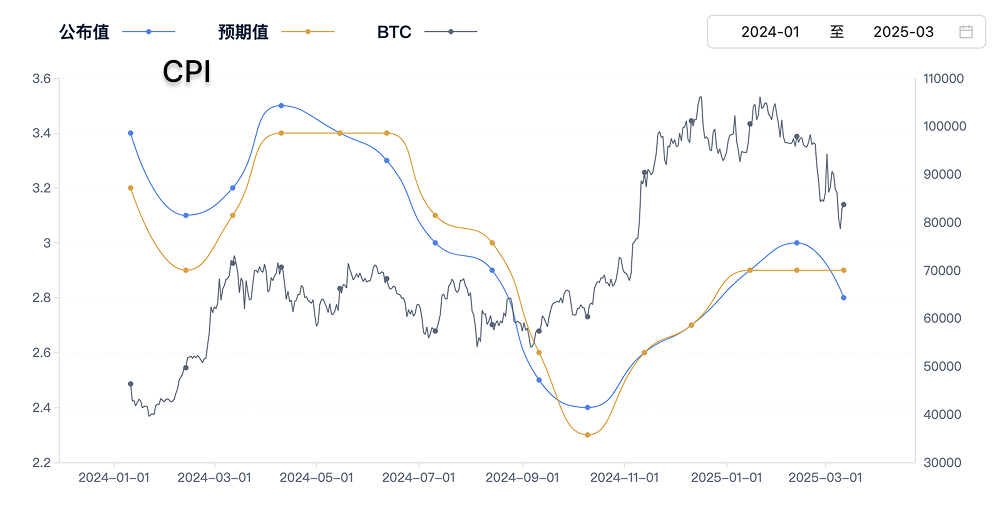

Donald Trump's second term began with a radical tariff policy that reshaped the global trade landscape. Since taking office on January 20, 2025, his trade strategy has not only triggered market turmoil but also impacted the cryptocurrency market through adjustments in the Consumer Price Index (CPI) and monetary policy. This article analyzes this transmission path in detail, combining authoritative media perspectives to reveal the multiple economic effects triggered by tariffs.

The Start of Tariff Policy: Strength and Uncertainty Coexist

Trump quickly signed the "America First Trade Policy" memorandum after taking office, imposing a 25% tariff on goods from Mexico and Canada starting February 4, and a 10% tariff on Chinese goods (which increased to 20% on March 4), along with a 25% tariff on raw materials such as aluminum, copper, and steel. On March 12, Reuters reported that Trump had once threatened to raise tariffs on Canadian metals to 50%, but quickly withdrew after Canada compromised, highlighting the policy's "deterrence and negotiation" characteristics. Bloomberg pointed out that this "erratic" strategy has led to a $4 trillion evaporation in the S&P 500 since its peak in February, with investors worried about its long-term impact on the economy.

Global countermeasures followed. China imposed a 15% tariff on U.S. coal and agricultural products, covering about $50 billion worth of goods; the European Union warned of "reciprocal measures" against U.S. exports. The Financial Times analyzed that if the trade war escalates, disruptions in the global supply chain could raise U.S. import costs and exacerbate inflationary pressures.

Step One: How Tariffs Raise CPI (Lagging)

Tariffs directly raise the prices of imported goods, with CPI being the first to feel the impact. For example, the 20% tariff on Chinese goods covers over $500 billion worth of products, and Bloomberg predicts that prices for electronics and clothing could rise by 5%-10%. The 25% tariff on raw materials raises manufacturing costs, with the automotive industry expecting an increase of about $6,250 per vehicle, 80% of which will be passed on to consumers. Reuters cited ABN Amro economist Rogier Quaedvlieg's view: "The uncertainty of tariffs alone is enough to impact the economy, even if the policy has not fully materialized."

Energy and countermeasure effects: The 25% tariff on Mexico could disrupt the oil supply chain, raising energy prices by 5%-10%, indirectly causing CPI to rise by 0.2%-0.5%. China's and the EU's retaliatory tariffs further increase the costs of substitutes. Overall estimates suggest that CPI may rise by 0.3%-0.7% in the short term (3-6 months) and reach 0.5%-1.2% in the medium term (6-12 months). If Trump follows through on his threat of a 60% tariff, Reuters warns that CPI could exceed 3% by early 2026, 50% higher than the current 2% target.

Step Two: CPI Triggers a Shift in Monetary Policy

An increase in CPI will test the Federal Reserve's ability to control inflation. On March 7, Federal Reserve Chairman Jerome Powell stated at the New York Economic Forum: "If tariffs are just a one-time shock, textbook advice suggests they can be ignored; but if they continue to push prices higher, policy needs to tighten." Bloomberg predicts that if CPI rises to 2.5%-3%, the Federal Reserve may raise interest rates by 0.25%-0.75% in the second half of 2025, pushing the federal funds rate from the current 4.25%-4.5% to 4.75%-5.25%. If the cumulative effect of rising energy prices becomes evident, the rate hike could reach 1%.

Constraints and uncertainty: Reuters reported that Goldman Sachs has lowered its 2025 U.S. GDP growth forecast to 1.7%, stating that tariffs will exacerbate economic resistance. The Federal Reserve may delay rate hikes due to slowing growth, and Trump's criticism of high interest rates could also pressure the central bank. The Financial Times noted that the Federal Reserve's meeting on March 18-19 will release new economic forecasts, which may reveal the initial impact of tariffs on inflation expectations.

Step Three: Interest Rate Adjustments Impact the Crypto Market

Interest rate hikes will tighten market liquidity, putting direct pressure on cryptocurrencies. Reuters cited JPMorgan's analysis: "A 0.75% rate hike in 2022 led to a 20% drop in Bitcoin; a current 0.25% hike could trigger a 5%-10% adjustment." Altcoins react even faster, with short-term declines potentially reaching 10%-15%. In the medium term (6-12 months), if rates rise to 5.25%, the total market value of cryptocurrencies could shrink by 15%-20%.

Hedging and opportunities:

- Safe-haven demand: Bloomberg reported on March 9 that inflation concerns have boosted demand for anti-inflation bonds, and Bitcoin, as "digital gold," may attract funds, with short-term gains potentially reaching 5%-10%.

- Regulatory benefits: Trump's friendly attitude towards cryptocurrencies has garnered attention. The Financial Times predicts that if he introduces tax incentives (such as capital gains tax reductions), market confidence could increase by 10%-20%. Reuters quoted Treasury Secretary Scott Bessent on March 6: "We will support innovative assets through policy."

- Global perspective: If the dollar appreciates due to the trade war, crypto prices may face short-term pressure; if global recession intensifies, Bitcoin's safe-haven attributes may become stronger.

Comprehensive Transmission Path and Outlook

- Tariffs raise CPI: CPI is expected to rise by 0.5%-1.5% in 2025, with energy and countermeasure effects potentially reaching 2%.

- Federal Reserve interest rate hikes: Rates may increase by 0.25%-0.75%, reaching 4.75%-5.25% by the end of the year, with extreme scenarios reaching 5.5%.

- Crypto market response: Short-term (3-6 months): Bitcoin down 5%-10%, altcoins down 10%-15%, with safe-haven demand partially hedging.

Medium term (6-12 months): Market value adjustment of 15%-20%, with regulatory benefits potentially slowing the decline.

Long term (over 1 year): Escalation of the trade war intensifies volatility, with policy support potentially prompting a rebound.

Scenario Analysis:

- Mild scenario: CPI rises by 0.5%, interest rates increase by 0.25%, crypto market slightly declines by 5%, with policy benefits aiding a rebound.

- Extreme scenario: CPI rises by 2%, interest rates increase by 1%, crypto market declines by 20%-30%, with energy shocks exacerbating adjustments.

Conclusion: Investment Insights in a Complex Game

Trump's tariff policy is reshaping the economic landscape with unprecedented force. Reuters warns that its "chaotic implementation" has undermined business confidence and slowed consumer spending. Bloomberg believes that the crypto market will seek a balance between inflationary pressures and policy benefits. Investors need to closely monitor CPI data (to be released next Wednesday), the Federal Reserve's March decision, and Trump's next moves to capture opportunities amid the changes.

Disclaimer: The above content is for reference only and does not constitute investment advice.

AiCoin Official Website: www.aicoin.com

Telegram: t.me/aicoincn

Twitter: x.com/AiCoinzh

Email: support@aicoin.com

Group Chat: Customer Service Yingying、Customer Service KK

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。