Differentiation must come from other aspects: unique features and experiences.

Author: Cem | Sovereign

Translated by: Deep Tide TechFlow

Recently, the main discussion on crypto Twitter has focused on improving the performance of general environments.

Base is achieving its "Gigagas" goal by leveraging Reth and Ethereum's blob upgrade.

Solana is continuously approaching its vision of 1 million TPS (transactions per second) through Firedancer and its amazing optimizations based on the C language network stack.

MegaEth has completely eliminated gas limits with the help of a highly optimized sorter.

As a crypto enthusiast, I have little to complain about. During DeFi summer and the 2021 bull market, I paid hefty fees on the Ethereum mainnet, and now I can enjoy low-cost transactions on Solana. Moreover, in the future, I will also enjoy cheaper and faster transactions across all these platforms.

However, since I first entered the industry around 2017, I have been obsessed with making crypto technology mainstream, and a recent question has been lingering in my mind:

We are rapidly approaching the critical point of over-optimization.

By the end of 2025, block space will become abundant, and performance will become a commodity. Once near-instant and free transactions become the norm, mere speed will no longer be the key to standing out. As developers, we need to shift our mindset.

Post-Performance Era

We call it the "post-performance era" because the performance race has already been won. Most platforms can now achieve fast and cheap transactions, so differentiation must come from other aspects: unique features and experiences.

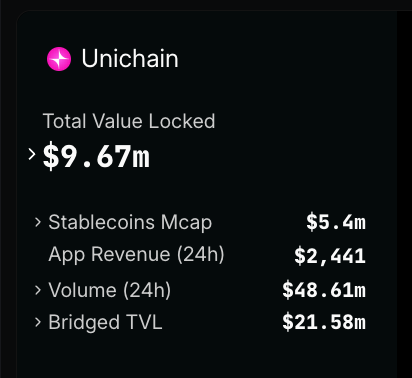

This is where full-stack customization comes into play. It is now 2025, transactions are both cheap and fast, but the look and feel of most applications remain the same. At the same time, the market premium for launching another Ethereum Virtual Machine (EVM) derivative has disappeared. Just look at Unichain, which has not managed to attract widespread attention or liquidity:

Meanwhile, the winner of this round—Hyperliquid—has taken a bold approach. It built the entire stack from scratch, optimized for specific use cases. Among the many interesting customizations it introduced, two points stand out:

Priority Cancellation and Order-Only

By enforcing transaction order by type within the block, Hyperliquid protects stale orders from being easily taken by high-frequency traders. This reduces harmful order flow, making market-making easier and increasing liquidity for all traders.

Vault-Based Copy Trading

Hyperliquid's vault allows anyone to automatically copy the trades of vault builders. Since the vault logic runs as part of block creation, no external maintainers are needed. Hyperliquidity vaults run market-making strategies, allowing anyone to provide liquidity and share in the resulting profits and losses.

Combining these unique features with high performance, low latency, and a seamless user experience, it is easy to understand why Hyperliquid has become the preferred choice for derivatives DEX.

The results speak for themselves:

The Real Bottleneck: Virtual Machines

One major reason most applications lack differentiation is virtual machines (VMs). Many of our tools are built around VMs (or derivative versions of Ethereum and Solana clients), which somewhat hinder the development of customization.

In recent years, there has even been a trend in the industry to push all Rollup implementations towards complete EVM equivalence, enabling them to run natively based on the Ethereum Virtual Machine (EVM). This is indeed cool for us tech geeks, but is this what the market really needs?

I don't think so. In fact, the more you can differentiate on features that truly impact customers, the more likely you are to win the market.

Isn't Interoperability Key?

Yes, even in dedicated blockchains, cross-chain communication is key. Standardized and shared liquidity and messaging tools remain crucial.

That’s why open-source messaging libraries like @hyperlane and intent-based bridging frameworks like @RelayProtocol are expected to succeed. But aside from still being able to integrate these interoperability components on custom chains, developers should have the freedom to fully customize their applications.

Responding to Market Needs

What the market needs are finely-tuned applications built for specific purposes that provide a seamless user experience—not just another ordinary EVM derivative. Therefore, build something truly customized and optimized for your use case.

Only then can we create applications that truly bring crypto technology into the mainstream.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。