Source: Cointelegraph Original: "{title}"

On March 12, during the Asian morning session, Bitcoin reached a high of $83,700, while on the previous day, March 11, Bitcoin briefly fell to a low of $76,600, indicating a slight improvement in market sentiment. However, Bitcoin's price faced resistance at the key level of $84,000, sparking widespread discussion in the market about whether Bitcoin's price would decline further.

Bitcoin price change hourly chart. Source: Cointelegraph/TradingView

Bitcoin demand remains weak

The outflow of funds from spot Bitcoin exchange-traded funds (ETFs) has played a significant role in the decline of Bitcoin prices since the end of February, with over $1.5 billion flowing out in the past two weeks.

Meanwhile, according to data from market intelligence firm CryptoQuant, Bitcoin's explicit demand remains sluggish, indicating a decrease in risk appetite among potential investors.

What you need to know:

Bitcoin explicit demand. Source: CryptoQuant

However, this indicator does not always accurately predict future trends. For example, it also showed negative values at the end of May and the end of October 2024, but subsequently, Bitcoin prices rose by 7% and 73%, respectively.

Bitcoin valuation indicators suggest a deeper correction

Data from Cointelegraph Markets Pro and TradingView indicate that after hitting a four-month low of $76,600 on March 12, Bitcoin's price rebounded slightly but remained about 7% higher than that low.

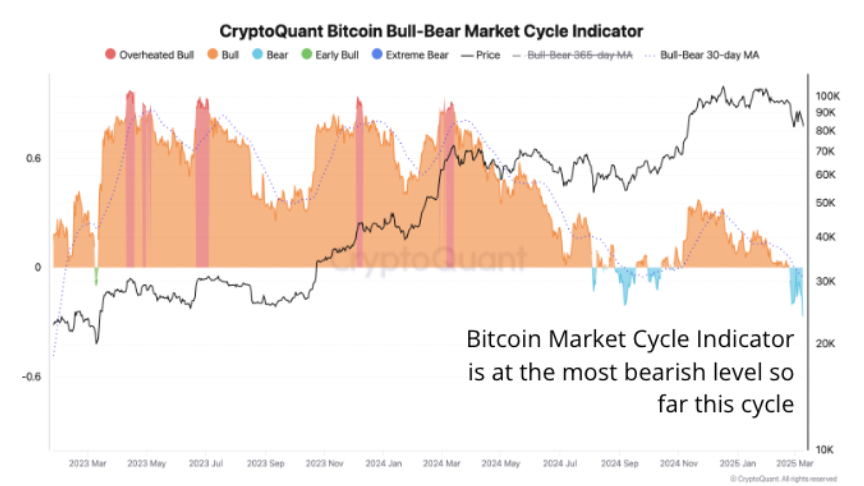

According to CryptoQuant, despite the rebound, some valuation indicators still lean bearish, suggesting a potential for a deeper correction.

Bitcoin bull-bear market cycle indicator. Source: CryptoQuant

Technical analysis shows Bitcoin price is bearish

From a technical perspective, Bitcoin's price is trading in a bearish continuation pattern, indicating that a potential correction is imminent.

Key points:

Bitcoin price 4-hour chart. Source: Cointelegraph/TradingView

Meanwhile, CryptoQuant analysts state that if the current support zone of $75,000 to $78,000 cannot hold the price, Bitcoin may further decline to $63,000.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。