Original Title: Why you shouldn't buy the dip

Original Author: wale.moca (@waleswoosh)

Translation by: Asher (@Asher0210_)

Mainstream cryptocurrencies are in a downward trend, and the most dazzling winner of this cycle—Memecoin—has almost completely retraced its gains from the entire bull market.

In such a market environment, social media is filled with voices saying "now is a good time to buy the dip," and many believe this is a rare buying opportunity. However, the general consensus in the market is often unreliable and may even serve as a contrarian signal. No one can accurately judge the market bottom, but if everyone is advocating for buying the dip, perhaps we should take a different perspective and reassess the current market environment.

Therefore, in this article, I want to explore four reasons why you might not want to buy the dip at this moment.

1. “Undervalued” does not exist

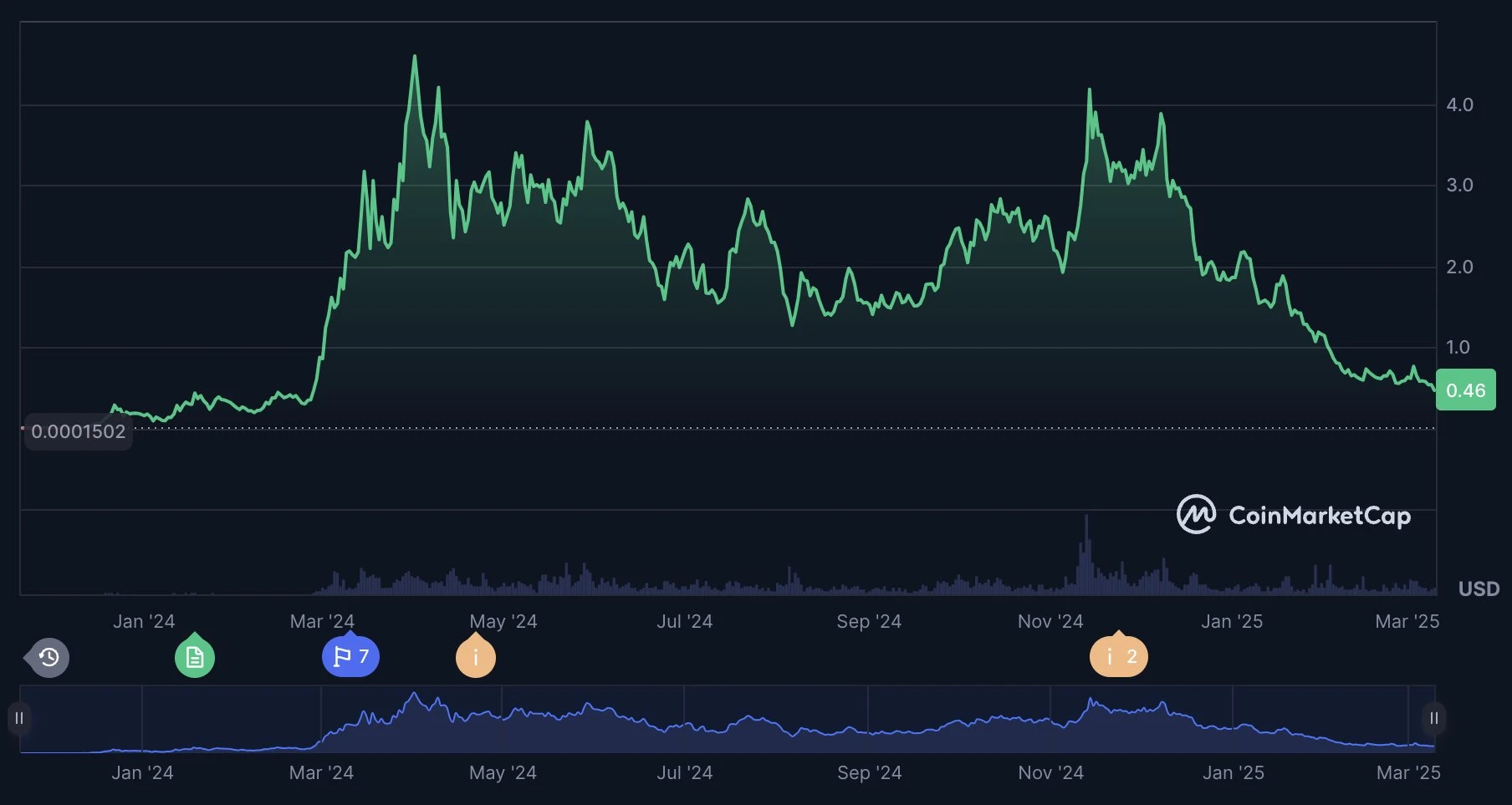

Many Memecoins are now trading at secondary prices even lower than before the Memecoin super cycle began. For example, the price of WIF has fallen back to early 2024, a time when the frenzy for Memecoins had not truly started. For many investors who experienced the first crypto cycle, they might think: “This coin has dropped 95% from its all-time high (ATH), it must be a bargain now.”

This line of thinking is easy to understand because in 2022, I had a similar experience. At that time, I was not focused on Memecoins but on NFTs—“Bored Apes dropped 60%, isn’t this the perfect buying opportunity?” But the reality is, after dropping 60%, it further declined by 80%, and since the beginning of 2023, the floor price of BAYC has shrunk by another 75%. It’s important to note that BAYC is still one of the top three projects in the NFT space, while for most small-cap assets, the declines are even more devastating.

Just because an asset has dropped 90% does not mean it is “undervalued”; it may simply be retreating from an inflated bubble valuation. If a Memecoin once had a market cap of $1 billion and is now down to $50 million, you might think it’s “cheap.” But the reality is, a $50 million valuation may still be far above its true value.

Attempting to trade these “seemingly cheap” declining assets is often the fastest way to lose money. I know many friends who smartly sold at the top of the NFT market in 2022 but suffered heavy losses during the subsequent decline. They were still influenced by the psychological mindset of the bull market, thinking that assets that had dropped significantly were worth buying, only to end up in deeper losses.

2. Bubbles burst slowly

Using Memecoin as an example, we also need to consider the time cycle. The bursting of a bubble is often a lengthy process, and Memecoin has clearly gone through a typical bubble phase.

Even if an asset has retraced 90% from its peak, it does not mean it will immediately hit the bottom. In fact, the decline after a bubble bursts usually does not end in a few weeks but can last for months or even years. The performance of the NFT market after 2022 is a typical case—prices did not rebound quickly but instead experienced a prolonged decline and liquidity exhaustion.

If you continue to buy the dip during the downtrend after a bubble bursts, or stubbornly hold on, your funds will often not quickly go to zero but will be slowly consumed by the market. This is a typical characteristic after a bubble bursts—it does not deliver the painful “zero overnight” experience but rather slowly erodes your holdings like a frog being boiled in warm water until you have to accept losses and exit.

3. No “crazy narrative,” no rebound

This also applies to mainstream cryptocurrencies—the market needs an extremely bullish narrative to support price increases. For example, the previous Strategic Bitcoin Reserve narrative, where the market's optimistic expectation was that the U.S. government would not only hold Bitcoin but also actively buy it using taxpayer money, leading to a global government competition to follow suit, ultimately pushing BTC prices to over a million dollars. However, the reality was not as aggressive as people expected. The event itself was still positive, but due to the originally high market expectations, the final market reaction fell far short.

Strategic Bitcoin Reserve narrative viewpoint

Memecoin has also experienced a similar narrative collapse. The past market logic was: “Retail investors will buy frantically, pushing Memecoin's market cap to hundreds of billions.” But now, no one believes this story anymore. Once the market begins to question a narrative, that narrative will completely collapse and be difficult to recover.

NFTs follow the same pattern. In 2022, the popular narrative was: “NFTs are not only part of the crypto industry but will completely change the world in a short time.” But when this belief was shattered, market sentiment quickly cooled. Today, many excellent NFT teams continue to build, but the market no longer believes in the crazy expectation that “these NFTs will be worth millions in the future.” When the narrative is no longer crazy, the market will not experience irrational fervent rebounds.

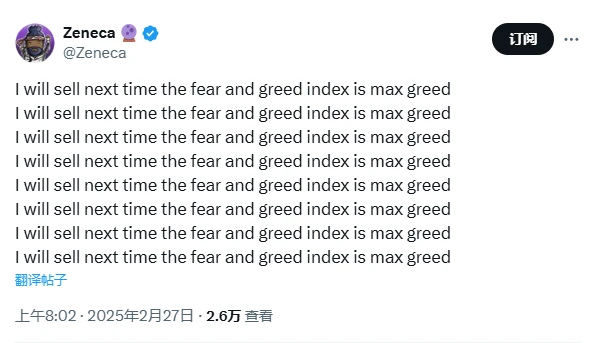

4. The psychological trap of “next time I will definitely sell”

Many people have gone through the cycle of assets “surging—plummeting—rebounding—then plummeting again,” but ultimately failed to sell at the peak. The biggest psychological impact of this experience is a strong sense of regret. If you have ever missed a peak, you might secretly resolve: “Next time the price rises to this level, I will definitely sell!” But it is this very psychology that makes market rebounds more difficult.

When a large number of investors hold the mindset of “I will sell as long as it goes back up,” the market will form persistent selling pressure, leading to:

Any small rebound will encounter a large number of sell orders, suppressing further increases;

Prices will find it difficult to return to past highs.

The market needs a fervent belief to drive prices up, not a short-sighted mindset of “I’ll run as soon as it goes up this time.” Otherwise, it becomes just a game of passing the parcel, and there will always be someone who gives up before you, making it difficult for prices to truly recover.

Is the market completely doomed?

After reading the previous analysis, you might feel pessimistic, but that is not the case. New market narratives will always emerge; the key is to wait for the right moment.

When speculators and trapped funds are completely cleared out, and the market regains faith and gives rise to new narratives, that will be the real buying opportunity. Have we reached this stage? Maybe yes, maybe no—no one can be certain.

But what is certain is: 99.99% of Memecoins are not worth buying even if they drop another 90% because their narratives have collapsed; while the fundamentals of BTC and mainstream coins are stronger than ever, and the long-term trend remains upward. If you buy BTC today, you may see good returns in the long run.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。