When chatting with many OGs, they all lament the unpredictable market changes in 2024/2025, with many veterans unable to make money. An interesting perspective is that 2017/2018 was a "community-driven market," where new asset issuance paradigms created a wealth effect; 2020/2021 was a "technology-driven market," where new asset play (DeFi/NFT) created a wealth effect; and 2024/2025 is a "policy-driven market" (some also call it a "policy bull," haha), where market changes depend on policy changes.

This article mainly focuses on recent policy-driven events, or rather, the impact of policy-related public information on cryptocurrency prices (mainly discussing the extent). As for the memes posted by Trump and his wife, they are not included in this category.

Before this, an important assumption is that people become numb to signals that appear "continuously" over a long period (reasons include being dulled by various strategies/monitoring, people's perceptions becoming blunt, etc.). For example, if you face the sea every day, over time, your excitement about seeing the sea will decrease, and you may even take it for granted (in economics, this is known as diminishing marginal utility).

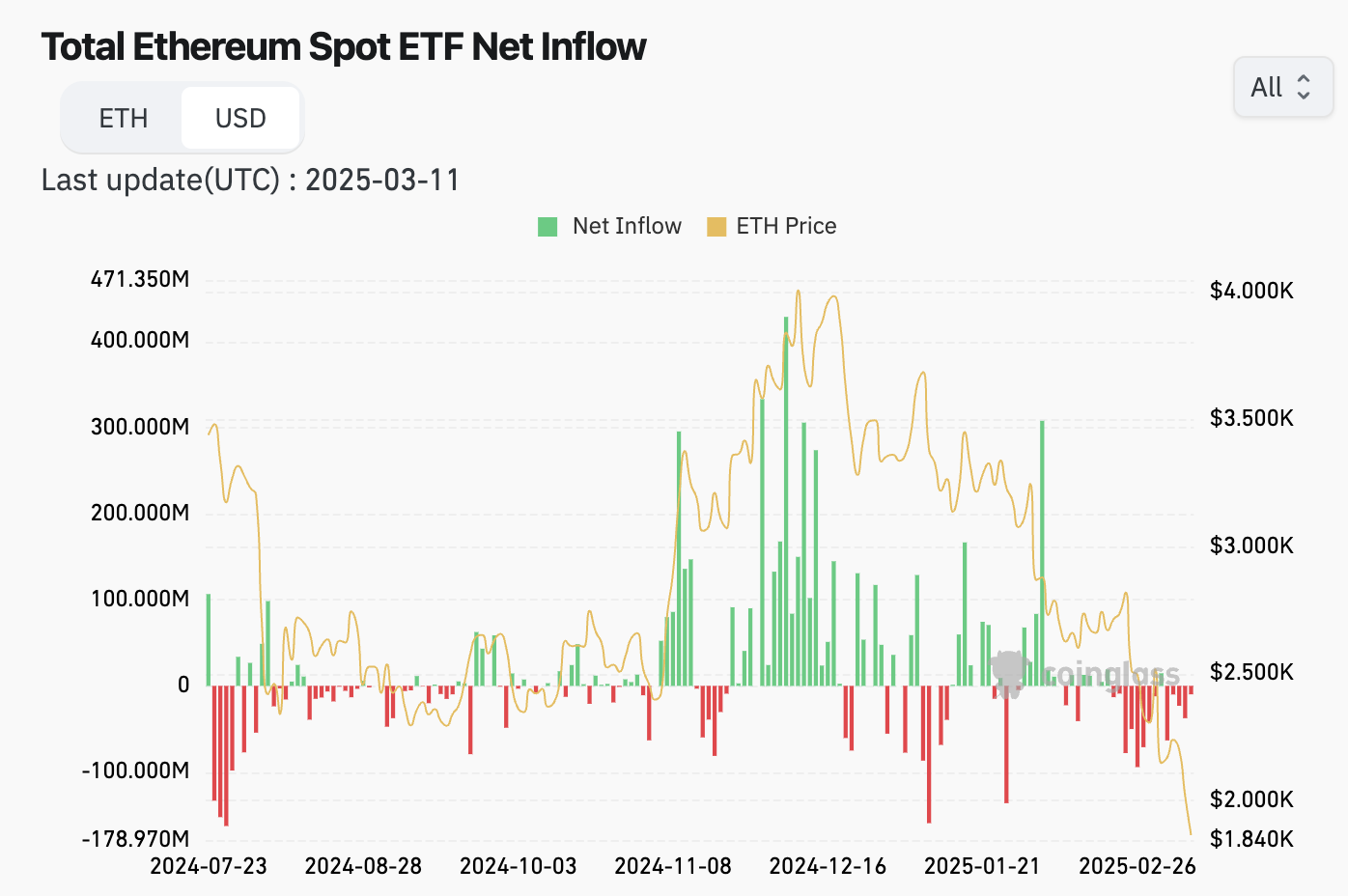

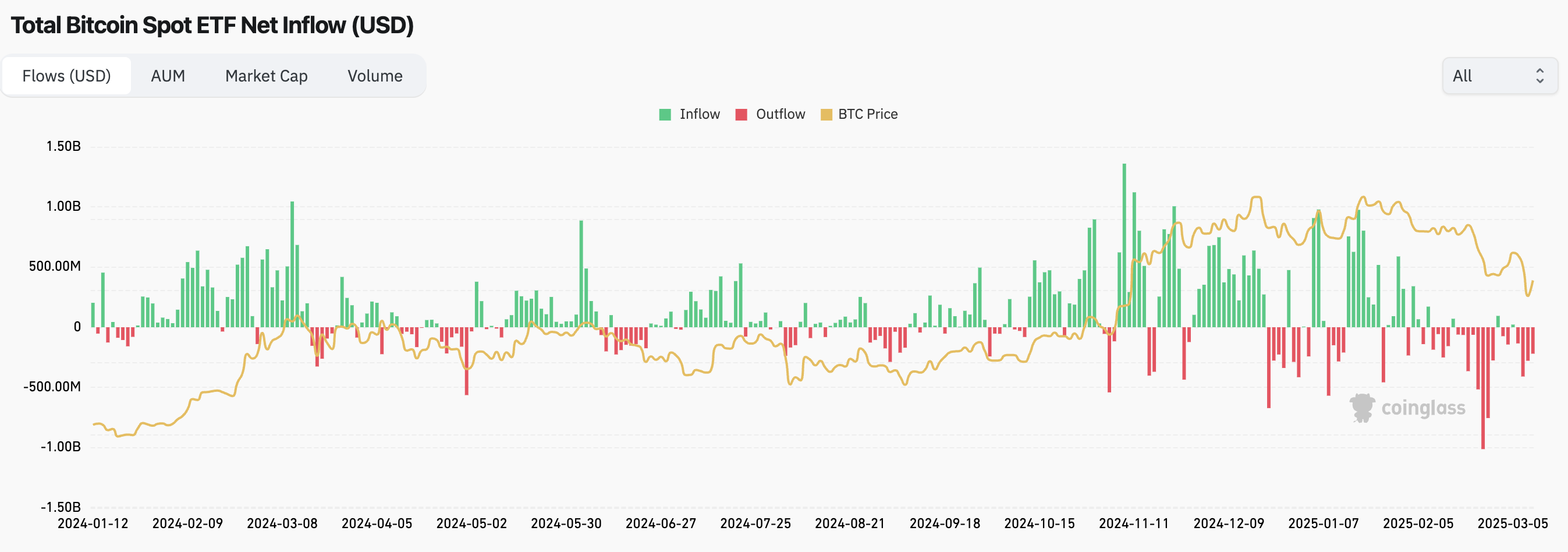

Since the approval of ETFs in 2024, in addition to traditional exchange funding rates, borrowing rates, volatility, candlestick patterns, and other technical indicators, the market has regarded the net inflow/outflow data of ETFs as an important reference indicator for today's price trends. If we consider the net inflow/outflow data of ETFs as public information, how does the market view this data? And will this data significantly affect prices?

Taking ETH as an example, the price of ETH shows a positive correlation with the inflow/outflow of ETFs (if there was a net inflow the previous day, the probability of the price rising the next day is higher, and vice versa).

The price trend of BTC and the net inflow/outflow of ETFs is not as obvious, especially after Trump's victory in November, where the predictive correlation of this part of the trend gradually weakened.

Given that the data is relatively intuitive and considers readability, this article will not display regression analysis. Overall, the market's sensitivity to public market information (referring to this intuitive market information) will gradually decrease, but this does not mean that this information is ineffective.

Below is a summary of Trump's recent statements (tweets) regarding tariffs:

February 1, 2025: Trump signed an executive order imposing a 25% tariff on goods from Canada and Mexico, with a lower 10% tariff on Canadian energy imports, effective February 4, 2025.

February 13, 2025: Trump announced a 25% tariff on all foreign steel and aluminum products, set to take effect on March 12, 2025. Starting April 2, 2025, "reciprocal" tariffs will be imposed on all foreign imports.

March 4, 2025: The tariffs on Canada and Mexico announced by Trump officially took effect at 12:01 AM Eastern Time.

March 7, 2025: Trump announced new tariffs on Canadian dairy products and lumber, expected to take effect on March 11, 2025. (This day also coincided with the White House crypto summit)

March 11, 2025: Trump announced an additional 25% tariff (up to 50%) on Canadian steel and aluminum, expected to take effect on March 12. Additionally, Trump requested Canada to withdraw tariffs on U.S. dairy products.

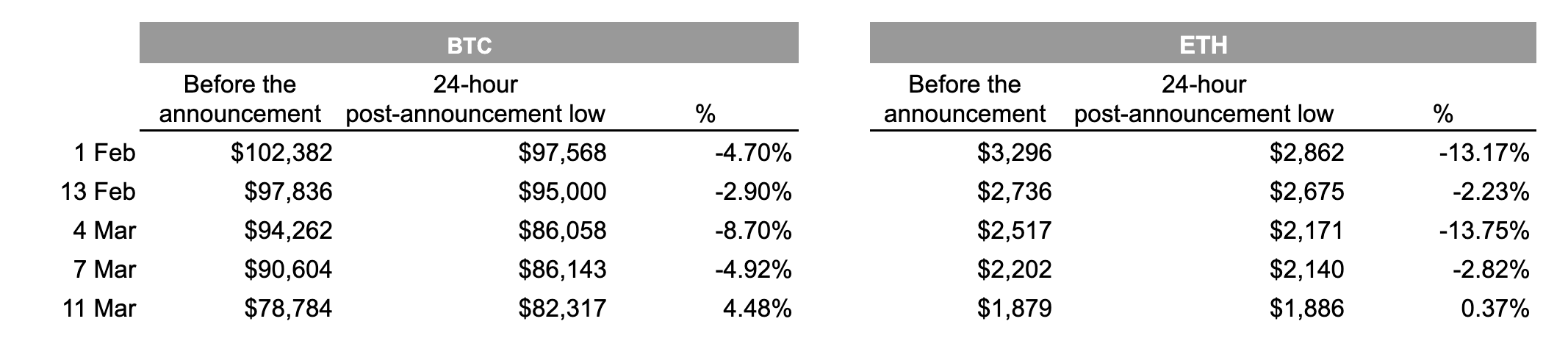

Directly to the data:

Note: One perspective suggests that the drop on March 7 may also be related to the market's overly high expectations for "Bitcoin reserves."

As the saying goes, "Once, twice, thrice, and then it runs dry." Combining the price fluctuations of BTC and ETH at these points in time, the data shows that the first (February 1) and third (March 4) tariff discussions had the largest reactions, while the second (February 13) and fourth (March 7) had smaller reactions. The fifth (March 11) even saw some price increase, but does this mean the market has become desensitized to Trump's "tariff tricks"?

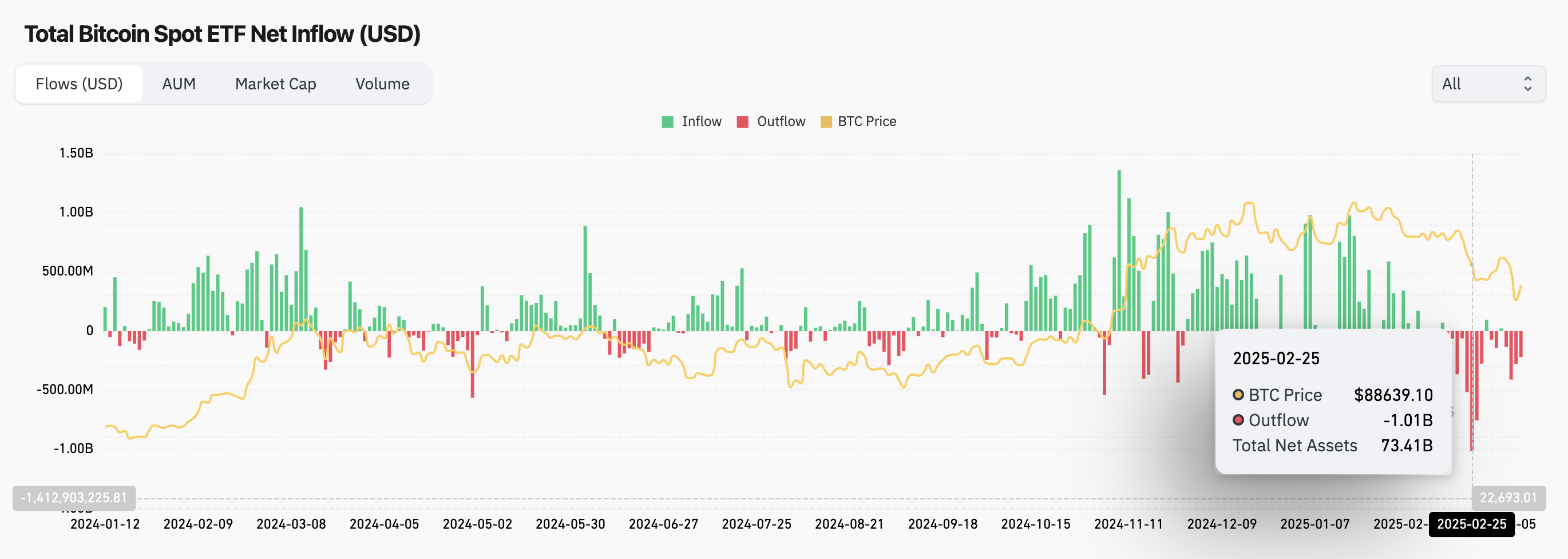

Analyzing the inflow/outflow situation of ETFs:

As early as March 1, BTC ETFs had already seen large-scale outflows, speculated to be for hedging or exiting, indicating that traders who were bearish on the market or resistant to tariff fluctuations had gradually left. This may explain why existing ETF holders are less affected by tariff issues. After all, those who wanted to exit have already left.

Next, let's analyze March 4 and 7. The tariff imposition on March 4, although anticipated by the market (Trump had mentioned in February that there would be a round of tariff sanctions in early March), saw a more intense market reaction due to the impact of the Bank of Japan's interest rate hike, especially with BTC's movements being more volatile than on February 1. The tariff remarks on March 7 also had an impact, but that day also coincided with the Bitcoin summit and the announcement of strategic reserve news, where market expectations > actual policies implemented.

Just as people living by the river may ignore the sound of water, individuals can become numb and indifferent to information that appears continuously over a long time. However, Trump's tariff issues have not yet reached the threshold of continuous long-term exposure. The reaction on March 11 may be a "desensitization" appearance, but the deeper reason is likely that risk-averse funds have already withdrawn, leaving behind traders who have already priced in the "tariff."

The market is not numb or desensitized; it is all about carefully calculated risks.

So, do you still care about what Trump said?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。