Liquidity Pools are an important tool for trading tokens, enabling token swaps through an Automated Market Maker (AMM) mechanism without the need for a traditional order book, thus providing liquidity to the market. However, this mechanism also offers token developers (DEV) or whales the opportunity to secretly manipulate the market. One common and efficient method is "one-sided pool dumping," often seen in MEME coins like $TRUMP, $LIBRA, and Melania. This article will briefly analyze the specific steps, principles, advantages, and methods of identification and prevention of one-sided pool dumping by DEV.

1. What is One-Sided Pool Dumping?

One-sided pool dumping refers to the practice where DEV or market manipulators create a liquidity pool on decentralized exchanges (like Raydium) by depositing only one type of token (usually their own created or held target token, such as $TRUMP) without adding a paired token (like SOL), and set the price range of the pool to be significantly above or below the current market price. They then manipulate the market or hype the token to adjust its price into the activated range of the pool, allowing retail investors to buy in at a high price, thereby gradually emptying their tokens for profit. This method is secretive and efficient, commonly used in the MEME coin market due to its volatile price movements and high retail participation.

2. Specific Steps of One-Sided Pool Dumping

Here are the detailed operational steps for DEV to execute one-sided pool dumping, using $TRUMP as an example:

1. Create a One-Sided Pool

Operation: DEV creates a liquidity pool on Raydium, selecting the target token $TRUMP as the only deposited token, without adding a paired token (like SOL).

Price Range Setting: DEV sets the price range of the pool to be significantly higher than the current market price. For example, if the current market price of $TRUMP is 6 SOL, DEV might set the pool price range to 9-11 SOL.

Logic: Since the pool's price range is above the current market price, it cannot process transactions at the current price (i.e., it cannot accept buys below 9 SOL or sells above 11 SOL). This keeps the pool in a "dormant" state until the price reaches the specified range.

2. Raise Market Price

Operation: DEV uses their own funds or market manipulation techniques (such as placing buy orders to pump the price, creating false trading volume, or spreading positive news) to drive the price of $TRUMP up until it reaches the pool's set price range (e.g., 10 SOL).

Tools and Methods:

Make large buy orders on Raydium or other DEXs to create the illusion of a price increase.

Spread false positive news or FOMO (Fear Of Missing Out) messages on social media (like Twitter, Telegram) to attract retail investors to buy at high prices.

Use bots or multiple accounts to create trading volume and enhance market activity.

Purpose: To activate the pool, making it tradeable and paving the way for subsequent dumping.

3. Attract Retail Investors to Buy and Gradually Dump

Once the price of $TRUMP reaches the 9-11 SOL range, the pool begins to accept trades. Retail investors, seeing the price rise, may FOMO into buying $TRUMP.

Trading Process:

Retail investors inject SOL into DEV's pool in exchange for $TRUMP.

The $TRUMP in the pool is "overflowed" to retail investors, while DEV's pool receives SOL in return.

Since the pool follows the constant product formula X * Y = K (where X is the amount of $TRUMP, Y is the amount of SOL, and K is a constant), each trade adjusts the ratio of tokens in the pool, allowing DEV to gradually empty their $TRUMP holdings.

Secrecy: This operation does not directly appear as large sell orders in the market but is completed through the automated mechanism of the liquidity pool, making it difficult for ordinary candlestick charts or order books to detect.

4. Stabilize Price and Continue Dumping

DEV may continue to pump the price or maintain it within the 9-11 SOL range to attract more retail investors, ensuring the pool continues to process trades.

The transaction fees generated during this period (usually 0.3%) will partially reward DEV, but the main profit comes from clearing $TRUMP at high prices for SOL.

When DEV has sold all their $TRUMP or the market begins to decline, they may quietly exit the pool, leaving with SOL profits.

5. Exit and Market Crash

After completing the process, DEV may withdraw from the liquidity pool, cease operations, or sell the remaining small amount of $TRUMP to the market.

Due to retail investors buying at high prices and lacking subsequent buying support, the price of $TRUMP may plummet rapidly, resulting in losses for retail investors.

3. Principles and Advantages of One-Sided Pool Dumping

Principles

One-sided pool dumping relies on the liquidity pool mechanism of AMM in the Solana ecosystem. The liquidity pool automatically adjusts prices and token ratios through the constant product formula X * Y = K:

When someone buys $TRUMP with SOL, the amount of SOL in the pool increases, the amount of $TRUMP decreases, and the price rises.

By setting the pool price above the market price, DEV ensures that the pool can only be activated when the price is raised, allowing retail investors to buy at high prices.

Advantages

- High Secrecy:

Traditional dumping (like directly selling in the market) would show up on the Central Limit Order Book (CLOB) or on-chain transaction records, making it easy for retail investors or analytical tools (like GMGN dashboards) to detect.

One-sided pool dumping is completed through the "overflow" mechanism of the liquidity pool, with trading records dispersed within the pool, making it hard for ordinary investors to notice.

2. Avoid Market Depth Impact

- Large sell orders may lead to insufficient market depth and price crashes, while one-sided pool dumping gradually releases tokens, reducing direct impact on market prices.

3. Exploit Retail Investor Psychology

- Market manipulators create FOMO sentiment through price pumping and hype, attracting retail investors to buy at high prices, achieving their goal of "cutting leeks."

4. Low-Cost Operation:

- The transaction fees on the Solana network are low, and the cost of creating pools on Raydium is minimal, allowing DEV to easily implement this strategy.

4. Identifying Clues of One-Sided Pool Dumping

Although one-sided pool dumping is secretive, vigilance can be increased through the following methods:

- Monitor On-Chain Data:

Use tools (like GMGN dashboards, Solana Explorer) to track the trading records and holdings changes of whale wallets.

Pay attention to whether a large number of tokens suddenly flow into a specific pool, with price ranges significantly above or below the current market price.

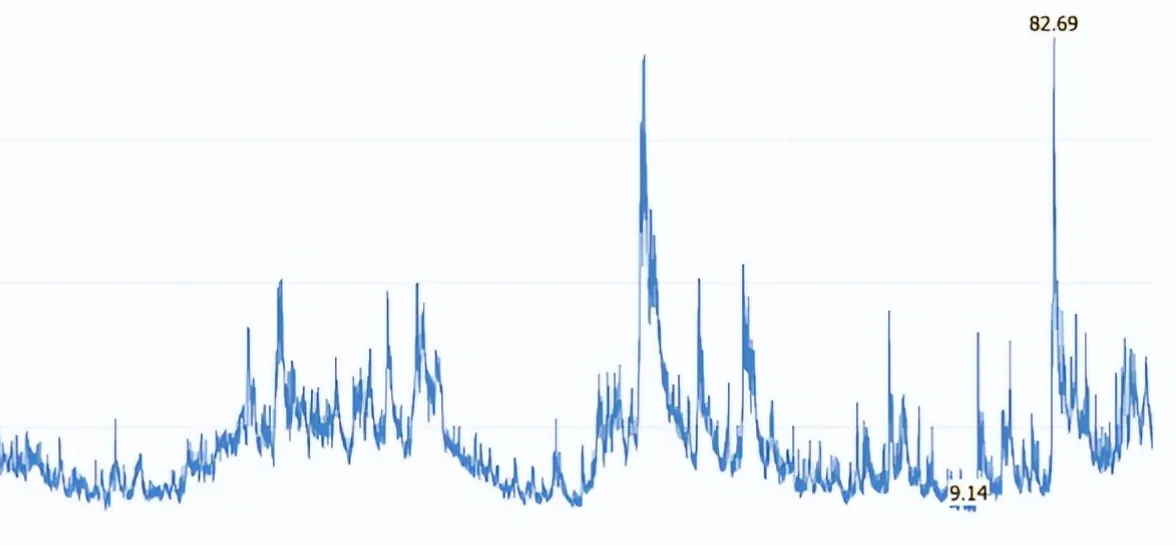

- Analyze Trading Volume and Price Behavior:

If the price suddenly rises but lacks real positive support, and trading volume is unusually concentrated, there may be market manipulation at play.

If the price remains stagnant within a certain range for a long time while trading volume is unusually active, it may indicate that manipulators are dumping through the pool.

- Check Pool Data:

View the pool of the target token on Raydium, paying attention to whether there is a one-sided pool (only one type of token deposited) with an unusually high or low price range.

Check the wallet address of the pool creator to determine if it is related to DEV or whales.

- Social Media and Community Dynamics:

- Be wary of excessive hype or "positive news" on platforms like Telegram and Twitter, which may be tactics used by manipulators to create FOMO.

5. Case Study: One-Sided Pool Dumping of $TRUMP

Assuming the current market price of $TRUMP is 6 SOL, and DEV holds 10,000 $TRUMP tokens and wants to dump at a high price:

Step 1: DEV creates a pool on Raydium, setting the price range to 9-11 SOL, depositing only 10,000 $TRUMP.

Step 2: DEV pumps the price of $TRUMP to 10 SOL through buy orders or hype.

Step 3: Retail investors see the price rise and FOMO into buying $TRUMP, injecting SOL into the pool in exchange for $TRUMP, while DEV's pool receives SOL, and $TRUMP is gradually overflowed to retail investors.

Step 4: DEV maintains the price within the 9-11 SOL range, continuously dumping until all 10,000 $TRUMP are cleared, earning substantial SOL profits.

Step 5: DEV exits, and the price of $TRUMP crashes due to reduced buying pressure, resulting in losses for retail investors.

6. Conclusion

DEV's one-sided pool dumping is a secretive and efficient market manipulation technique that relies on the AMM mechanism of the Solana ecosystem and the FOMO psychology of retail investors. By creating one-sided pools with price ranges above market prices, pumping the price to activate the pool, and attracting retail investors to buy at high prices, DEV gradually clears their tokens for substantial profits. This operation is difficult to detect through conventional candlestick charts, but by analyzing on-chain data, observing trading behaviors, and monitoring community dynamics, investors can increase their vigilance and reduce risks. Understanding the principles and prevention methods of this technique is an important step in protecting one's interests and rationally participating in the DeFi market.

This article is translated by SlerfTools, please indicate the source when reprinting. This article is sponsored by SlerfTools, a comprehensive platform for developers to create and optimize memecoins. It provides one-click token creation, trading tools, and data optimization features to help you succeed in the blockchain space. Visit slerf.tools now to start your journey!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。