The days of easy, cyclical altcoin surges may be replaced by an ecosystem where capital efficiency, structured financial products, and regulatory transparency dictate the flow of funds.

Written by: Bryan Daugherty

Translated by: Block unicorn

Bitcoin exchange-traded funds (ETFs) could fundamentally change the concept of "altcoin season" in the crypto market.

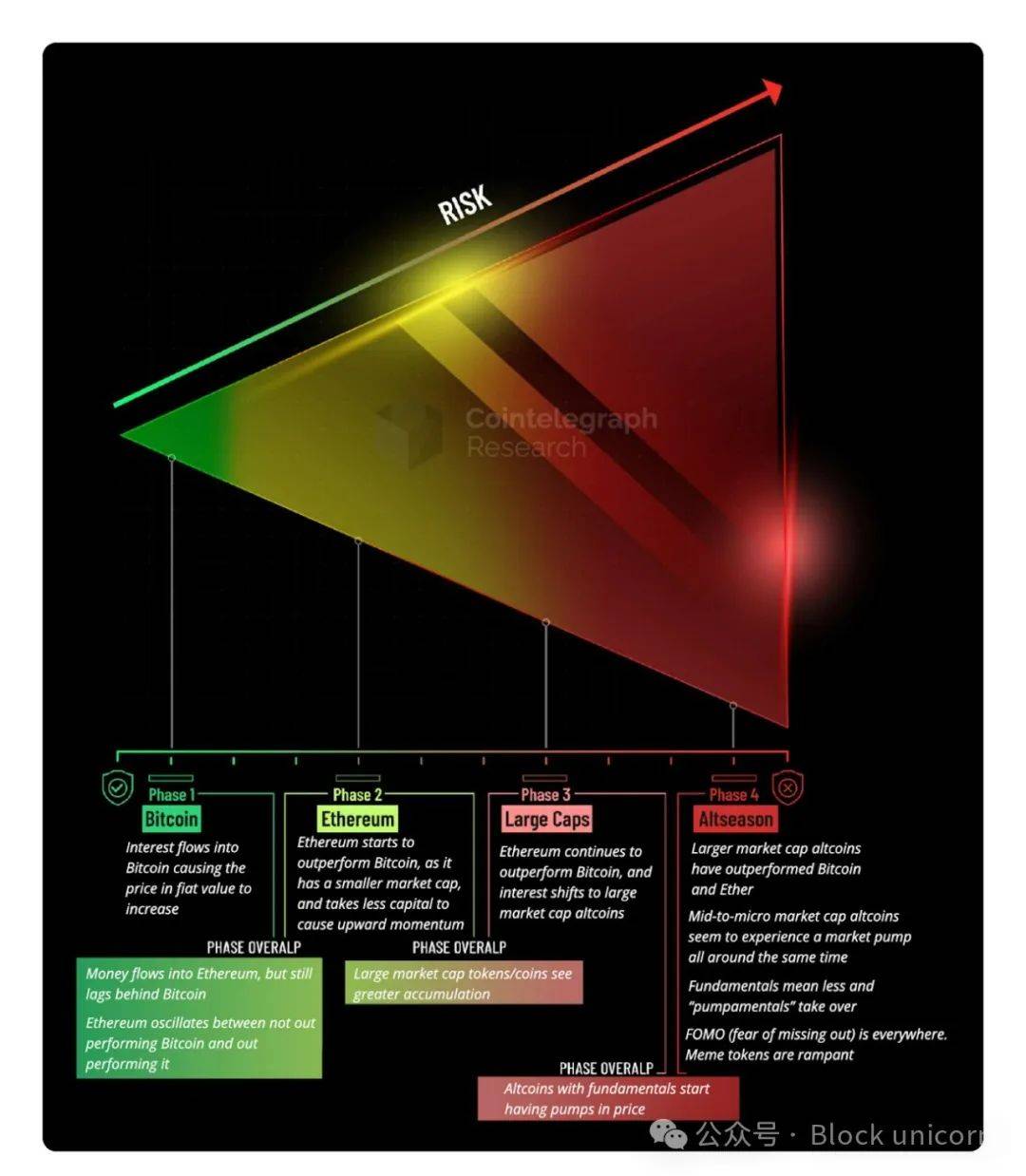

For years, the crypto market has followed a familiar rhythm, with capital rotation being almost predictable. Bitcoin surges, attracting mainstream attention and liquidity, followed by a flood of funds into altcoins. Speculative capital flows into low-market-cap assets, driving up their value, and traders excitedly refer to it as "altcoin season."

However, this once-taken-for-granted cycle is showing signs of structural collapse.

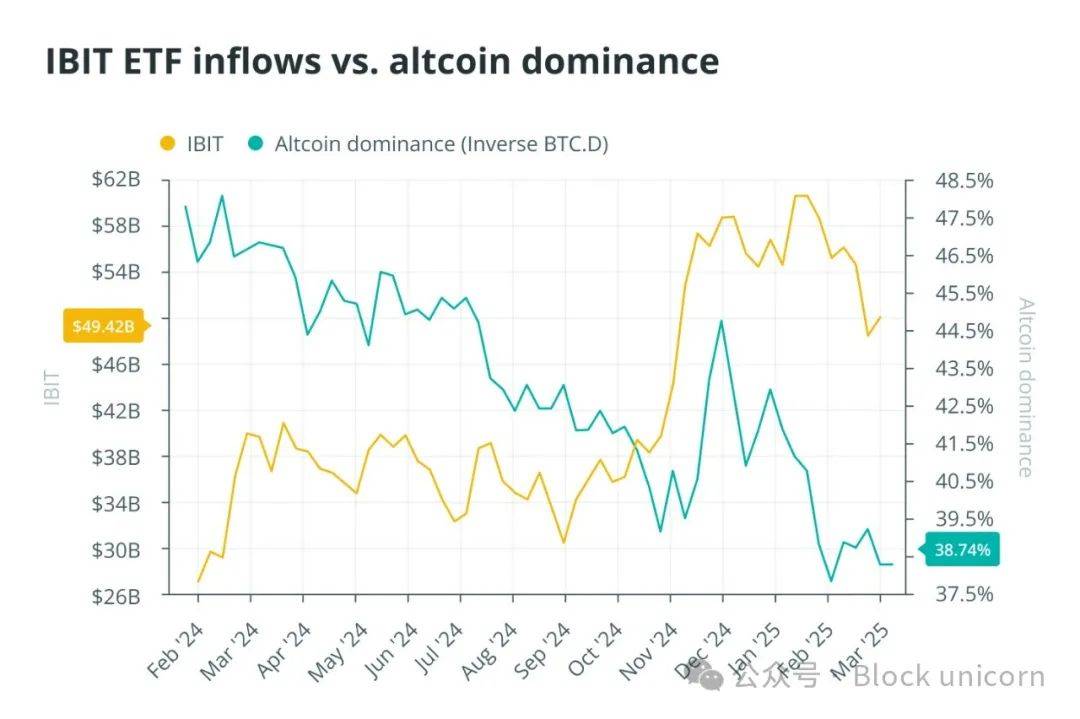

Spot Bitcoin ETFs broke records in 2024, attracting $129 billion in inflows. This has provided retail and institutional investors with unprecedented avenues for Bitcoin investment, but it has also created a vacuum that siphons off funds from speculative assets. Institutional investors now have a safe, regulated way to access cryptocurrencies without taking on the "Wild West" risks of the altcoin market. Many retail investors also find ETFs more appealing than searching for the next hundredfold token. Notably, prominent Bitcoin analyst PlanB even converted his actual Bitcoin holdings into a spot ETF.

This shift is happening in real-time, and if funds continue to be locked in structured products, altcoins will face reduced market liquidity and correlation.

Is altcoin season dead? The rise of structured crypto investments

Bitcoin ETFs provide an alternative for chasing high-risk, low-market-cap assets, allowing investors to gain leverage, liquidity, and regulatory transparency through structured products. Retail investors, who were once the main drivers of altcoin speculation, can now invest directly in Bitcoin and Ethereum ETFs, which eliminate self-custody concerns, reduce counterparty risk, and align with traditional investment frameworks.

Institutions are more motivated to avoid altcoin risks. Hedge funds and professional trading platforms that once chased higher returns in low-liquidity altcoins can now deploy leverage through derivatives or gain exposure via ETFs on traditional financial tracks.

As the ability to hedge through options and futures increases, the motivation to speculate on illiquid, low-volume altcoins significantly diminishes. This trend was further reinforced by a record $2.4 billion outflow in February and the arbitrage opportunities created by ETF redemptions, forcing the crypto market into an unprecedented discipline.

The traditional "cycle" starts with Bitcoin and then moves into altcoin season. Source: Cointelegraph Research

Will venture capital abandon crypto startups?

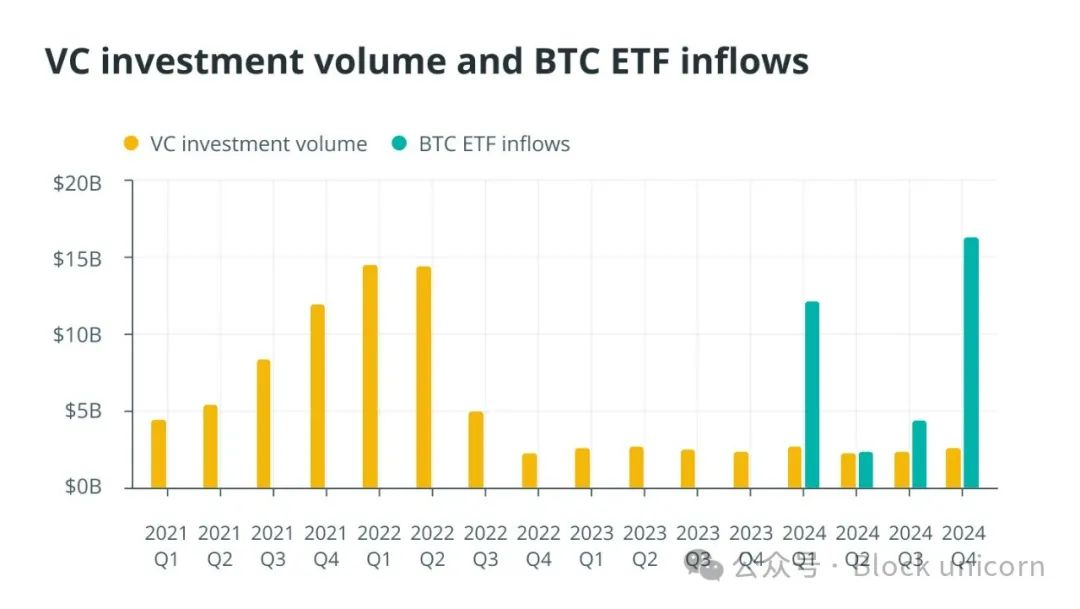

Venture capital (VC) firms have traditionally been the lifeline of altcoin season, injecting liquidity into emerging projects and weaving grand narratives around new tokens.

However, as leverage becomes more accessible and capital efficiency becomes a key priority, VCs are rethinking their strategies.

VCs strive for the highest possible return on investment (ROI), typically ranging from 17% to 25%. In traditional finance, the risk-free rate of capital serves as the benchmark for all investments, often represented by U.S. Treasury yields.

In the crypto space, Bitcoin's historical growth rate serves a similar purpose as an expected return benchmark. This has effectively become the risk-free rate for the industry. Over the past decade, Bitcoin's compound annual growth rate (CAGR) has averaged 77%, significantly outpacing traditional assets like gold (8%) and the S&P 500 index (11%). Even over the past five years, including bull and bear market conditions, Bitcoin's CAGR has remained at 67%.

Based on this benchmark, venture capitalists deploying capital at this growth rate in Bitcoin or Bitcoin-related businesses would see a total ROI of about 1,199% over five years, meaning their investment would increase nearly 12 times.

Despite Bitcoin's continued volatility, its long-term strong performance makes it a fundamental benchmark for assessing risk-adjusted returns in the crypto space. With increasing arbitrage opportunities and reduced risks, VCs may opt for safer bets.

In 2024, the number of VC deals dropped by 46%, although overall investment volume saw a rebound in the fourth quarter. This marks a shift towards more selective, high-value projects rather than speculative funding.

Web3 and AI-driven crypto startups still attract attention, but the days of providing indiscriminate funding for every token with a white paper may be numbered. If venture capital further shifts towards structured investments via ETFs rather than direct investments in high-risk startups, new altcoin projects may face severe consequences.

Meanwhile, a few altcoin projects that have entered the institutional spotlight (such as Aptos, which recently submitted an ETF application) are exceptions rather than the norm. Even crypto index ETFs aimed at gaining broader exposure struggle to attract meaningful inflows, highlighting that capital is concentrated rather than dispersed.

Oversupply issues and new market realities

The market landscape has changed. The sheer number of altcoins vying for attention has created a saturation problem. According to Dune Analytics, there are currently over 40 million tokens in the market. An average of 1.2 million new tokens are launched each month in 2024, with over 5 million tokens created since the beginning of 2025.

As institutions lean towards structured investments and the lack of retail-driven speculative demand, liquidity no longer flows into altcoins as it once did.

This reveals a harsh reality: most altcoins will not survive. Ki Young Ju, CEO of CryptoQuant, recently warned that without a fundamental change in market structure, most of these assets are unlikely to survive. "The era of everything going up is over," Ju stated in a recent post on X.

In an era where funds are locked in ETFs and perpetual contracts rather than freely flowing into speculative assets, the traditional strategy of waiting for Bitcoin's dominance to wane before turning to altcoins may no longer apply.

The crypto market is no longer what it used to be. The days of easy, cyclical altcoin surges may be replaced by an ecosystem where capital efficiency, structured financial products, and regulatory transparency dictate the flow of funds. ETFs are changing the way people invest in Bitcoin and fundamentally altering the liquidity distribution across the entire market.

For those who have built their assumptions on the premise that altcoin booms follow every Bitcoin surge, it may be time to reconsider. As the market matures, the rules may have changed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。