President Trump's statement of "not focusing on the market" is quite significant.

Author: The Kobeissi Letter

Translation: Deep Tide TechFlow

Is the U.S. government anticipating an economic recession?

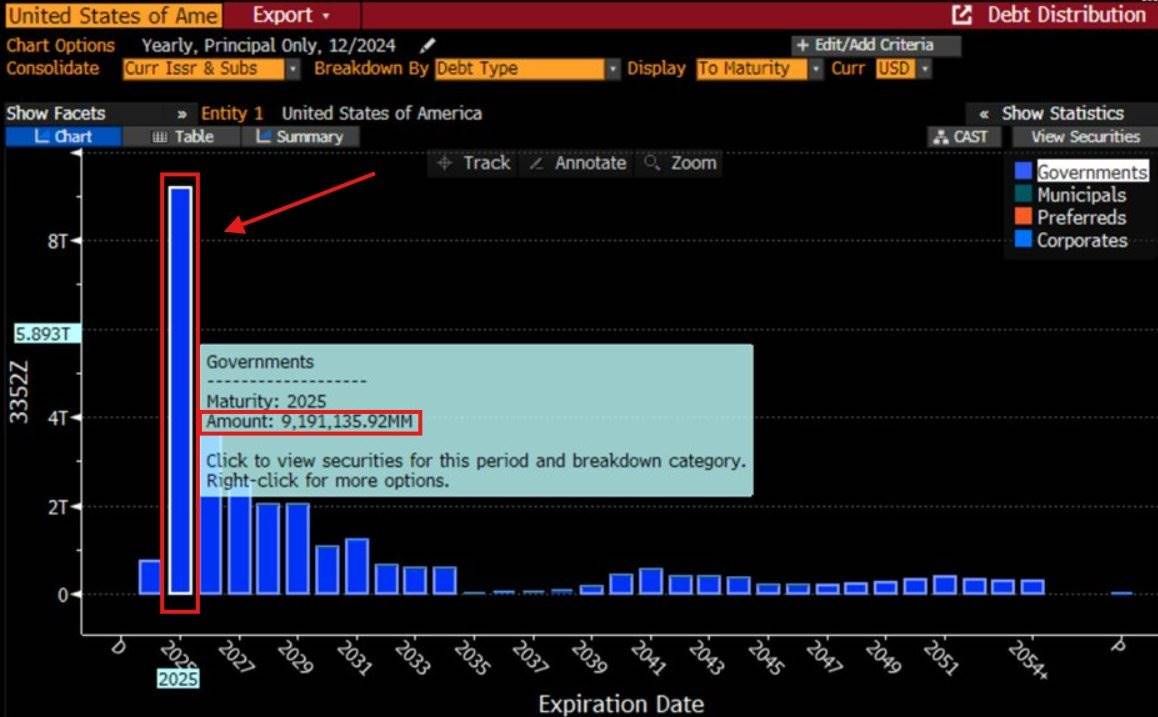

By 2025, the U.S. will have $9.2 trillion in debt maturing or needing refinancing. In the face of this massive refinancing, the quickest way to lower interest rates may be to trigger an economic recession.

But can the U.S. benefit from a market crash?

In the past two months, the yield on 10-year Treasury bonds has fallen by about 60 basis points. This is partly due to market expectations of cuts in deficit spending by government efficiency departments. However, it is also related to increased uncertainty and the rising likelihood of a U.S. economic recession.

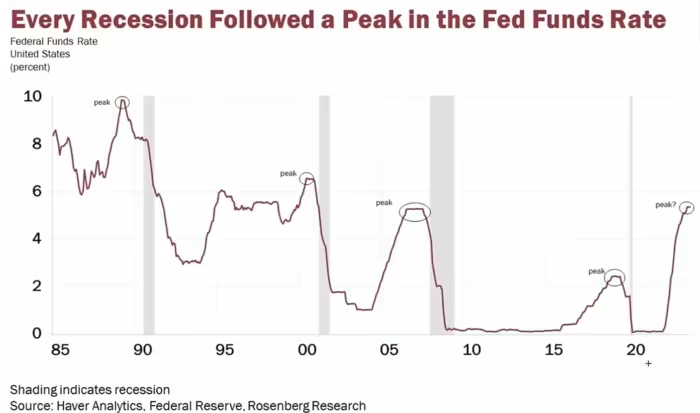

A recession almost guarantees a rate cut.

But why does a recession represent a decrease in interest rates?

Since the 1980s, every U.S. economic recession has occurred after the federal funds rate peaked. When economic growth stagnates, the Federal Reserve responds by "stimulating" the economy. This means lowering interest rates to reduce the cost of capital and promote consumption.

Since the trade war began, U.S. economic growth expectations have significantly declined. Meanwhile, oil prices have also dropped to a new six-month low. Interestingly, President Trump has repeatedly stated that he hopes to reduce inflationary pressures by lowering oil prices.

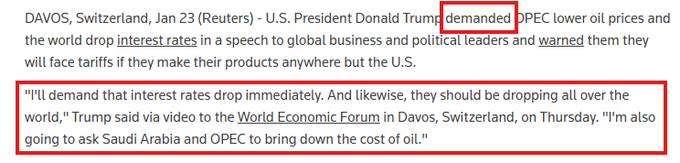

On January 25, President Trump claimed he had a solution to the Federal Reserve's fight against inflation that has lasted over three years. He called for the Organization of the Petroleum Exporting Countries (OPEC) to lower oil prices and urged global interest rate cuts.

However, the quickest way to lower oil prices is likely through an economic recession that reduces demand.

In a recent interview with Fox News, President Trump discussed making interest rate cuts a priority.

He stated, "Interest rates are going down… I also want to see energy prices go down." This remark comes from a report by @amitisinvesting.

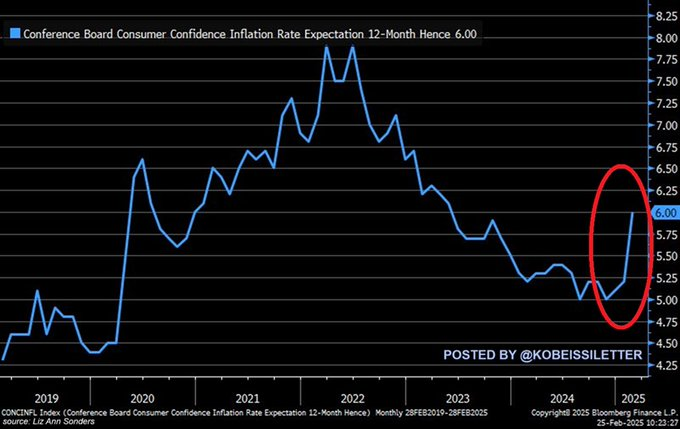

Next, let's take a look at inflation data.

U.S. consumers believe that the inflation rate will rise to +6.0% over the next 12 months, the highest level since May 2023. This marks the third consecutive month of rising inflation expectations.

Inflation is rising, rate cuts are being delayed, but interest rates are falling.

The market is pricing in a recession.

In the context of soaring inflation during the trade war, significantly lowering interest rates is almost impossible without triggering a recession. Furthermore, President Trump stated on March 6 that he is not paying attention to the stock market. The fact is, as we saw during his first term, Trump has always been focused on the market.

President Trump's statement of "not focusing on the market" is quite significant.

In light of his apparent focus on the market, this is actually a signal he is sending to Wall Street, indicating his willingness to lower interest rates and reduce the trade deficit at all costs, even if it means potentially triggering an economic recession.

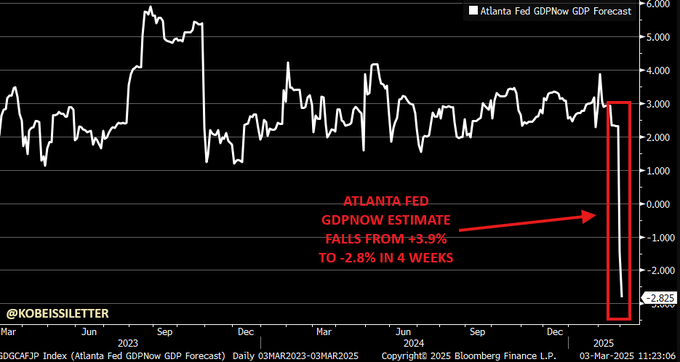

Amid the chaos of the trade war, we have seen a significant decline in economic growth expectations. The Atlanta Fed last week lowered its GDP growth forecast for the first quarter of 2025 to as low as -2.8%. Therefore, we saw a sharp increase in market expectations for rate cuts last week.

Is this intentional?

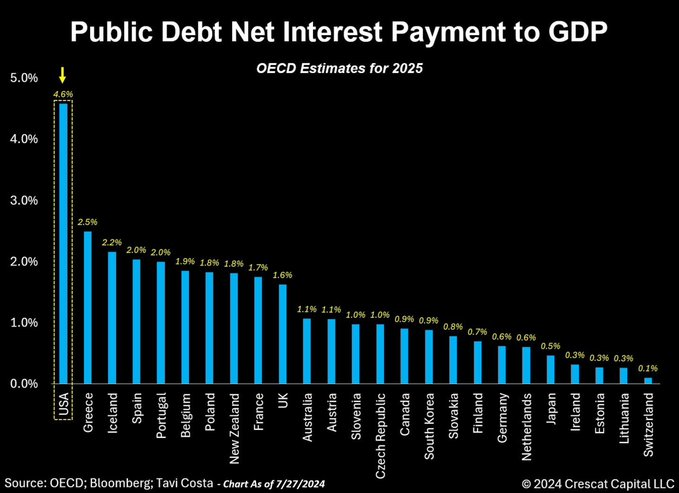

High interest rates are the biggest problem facing the U.S. government.

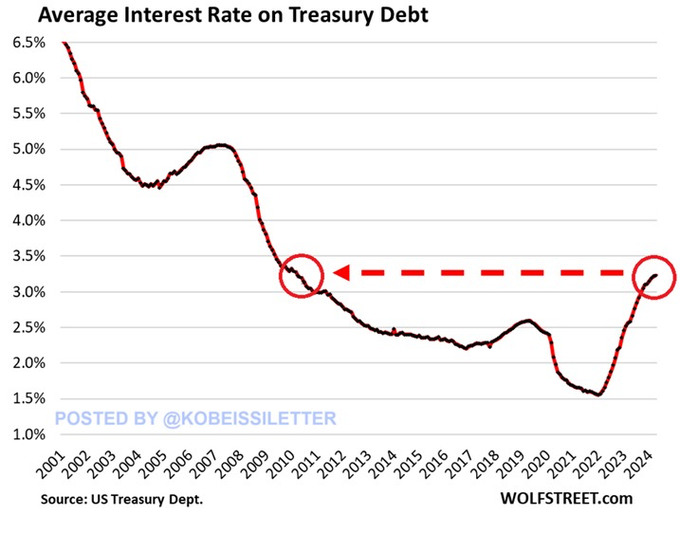

As interest rates soar, the cost of debt interest has significantly increased. Currently, the average interest rate on the U.S. $36.2 trillion national debt is 3.2%, the highest level since 2010. The U.S. government needs rate cuts more than anyone else.

Moreover, rate cuts are imminent:

The $9.2 trillion in U.S. debt maturing is primarily concentrated in the first half of 2025, with 70% of the debt needing refinancing between January and June 2025.

The average interest rate on this debt is expected to rise by about 1 percentage point.

Additionally, the U.S. efforts to cut deficit spending will not happen overnight.

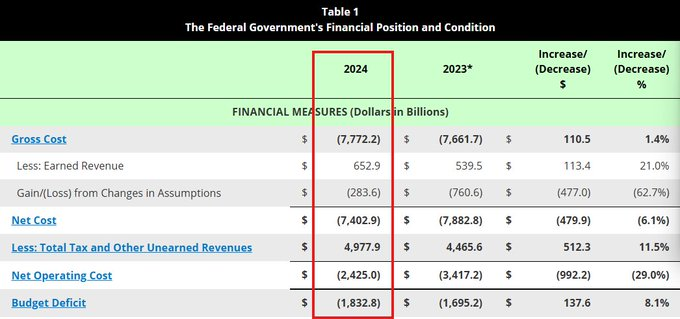

In fiscal year 2024, U.S. spending is projected to reach $7.8 trillion, while revenue is only about $5.0 trillion. This means that for every dollar of revenue generated, there is a cost of $1.56. The shadow of a debt crisis will loom over the U.S. for a long time.

These significant changes in the macroeconomic backdrop will have widespread implications for the entire market, and we are capturing opportunities from this and will continue to do so.

Want to know how we trade the market? Click the link below to subscribe to our premium analysis and alert service:

https://www.thekobeissiletter.com/pricing

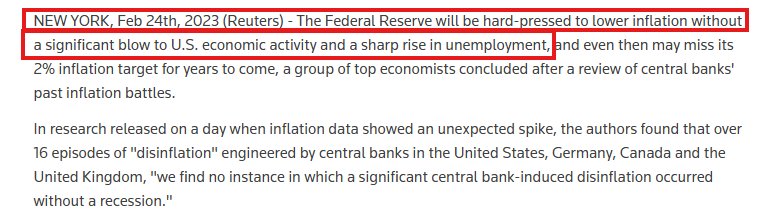

Finally, let's return to 2023, when the Federal Reserve was almost calling for an economic recession to lower inflation.

In February 2023, many studies indicated that a recession might be the only solution. Subsequently, the Federal Reserve shifted to a "soft landing" narrative, but this strategy has yet to successfully lower interest rates.

The reality is that the U.S. debt crisis is the most serious yet most overlooked crisis currently. While President Trump has recognized this, it may be too late. A recession may be the only solution to lower interest rates.

Follow us @KobeissiLetter for real-time analysis updates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。