Source: Cointelegraph Original: "{title}"

Yuga Labs' Vice President of Blockchain warned that during a prolonged bear market, the price of Ethereum could drop to as low as $200, a 90% decline from current prices.

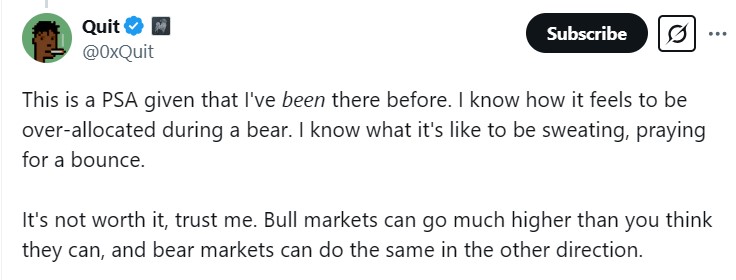

In a post on social platform X on March 11, the executive named Quit refuted some analysts' views that the potential bottom price for Ethereum (ETH) is $1500. Instead, Quit believes that in a true bear market, the price of ETH could fall significantly, similar to previous market cycles.

"If the bear market has just begun, the true bear market target price will be around $200 to $400. This means an 80% drop from the current price, with an overall decline of 90%—which aligns with past bear market situations."

The executive stated that he is in a "safe" position if things worsen. Quit told fans that if they feel uneasy about asset price declines, they might consider selling their held Ethereum.

Source: Quit

ETH holders discuss potential price trends

Quit's post sparked varied reactions within the cryptocurrency community. Some investors agreed with the view that ETH prices could fall further, while others stated that such a scenario would require a significant systemic collapse.

One X user set $1800 as the bottom price. However, when the price dropped to $1800, they began to wonder if it would fall to $1200. This ETH holder agreed with Quit's prediction, stating, "If Bitcoin's price drops to $66,000, ETH is likely to go lower."

Meanwhile, another X user disagreed with this prediction, stating that such a situation could only occur in the event of a systemic collapse similar to that of 2018. This ETH investor noted that unlike previous cycles, Ethereum has been adopted by institutions and has a maturing ecosystem.

"Being prepared for both scenarios is something every smart investor should do, but being overly bearish at the wrong time can be as costly as being overly bullish," they wrote.

ETH whales scramble to avoid liquidation threats

As Quit made these remarks, ETH whales were frantically trying to avoid liquidations caused by a potential drop in Ethereum prices. On March 11, cryptocurrency data platform CoinGecko reported that the price of ETH fell to a low of $1791, down 22% over the past week.

Due to the sharp price fluctuations, ETH whales transferred millions of dollars worth of ETH to protect their positions and avoid potential liquidation risks.

Blockchain analytics firm Lookonchain noted that one ETH whale sold off $47.8 million worth of ETH to avoid a $32 million loss from liquidation. This whale still holds over $64 million in assets on the lending protocol Aave, with a liquidation price of $1316.

Another ETH investor had previously utilized over $5 million in assets to lower their liquidation price to $1836 but is now facing liquidation. Lookonchain reported that as the price fell below $1800, this whale's $121 million asset balance is being liquidated.

There is also a whale account suspected to be associated with the Ethereum Foundation that utilized $56 million worth of ETH during the price drop to avoid liquidation. This address deposited over 30,000 ETH into the Sky insurance vault, lowering its liquidation price to $1127.14. However, this account was later determined to have no connection to the Ethereum Foundation.

Related: Developers claim the Ethereum Foundation is not behind the $56 million Sky deposit.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。