We just need to start doing different things.

Written by: Kyle

Compiled by: Luffy, Foresight News

The biggest problem in the cryptocurrency space is neither a shortage of talent nor a lack of funding, but simply a lack of first-principles thinking. This culture urgently needs to change, and the top 1% of the community needs to lead the field forward.

If you follow my Twitter, you will find that I have been strongly advocating for attention to those seemingly accessible opportunities with high leverage, which appear extremely simple, yet no one seems to truly "understand" or execute well.

In this article, I will specifically explore several topics, including:

Compound assets, industry culture, short-termism

General-purpose Layer 1 blockchains are dead and need reform

The relationship between liquidity tokens and investments

Buybacks and burns are merely the least bad options, not the best solutions

I titled this article "First Principles" because when I think with common sense about how to change this industry currently, all these points come to mind.

The reasoning is not that profound. The definition of madness is doing the same thing repeatedly while expecting different results. Over three market cycles, we have been doing the same thing over and over: essentially creating illusory, non-value-accumulating, highly exploitative tokens and applications, because for some foolish reason, we believe that every four years, this "casino" will open in a frenzied manner, attracting funds from around the world for everyone to gamble together.

Guess what? After three market cycles, or ten years, people have finally woken up and realized that the dealers, scammers, fraudsters, manipulators, and those selling overpriced food and drinks at the casino are taking all your money. After months of effort, all you can show is a history on-chain of how you lost everything. An industry where everyone thinks "I come in, make money, and then leave" cannot nurture any long-term compound assets.

This field once had a beautiful side; it was a place of genuine financial innovation and cool technology. We were once excited about novel and interesting applications, new technologies, and "changing the future of finance."

However, due to some extreme short-termism, a highly exploitative culture, and a lack of integrity, we have fallen into this cycle of persistent financial nihilism, which is collectively caused by everyone thinking that blindly buying tokens issued by scammers is a good idea, reasoning that "I will exit before the scam collapses."

You could say I lack entrepreneurial experience, and that is indeed true. This field is not large, and it has not existed for long. I have worked in this field for four years, collaborating with some of the best and brightest funds, which has allowed me to understand what practices work and what do not.

I reiterate: madness is doing the same thing repeatedly while expecting different results. As an industry, we go through the same thing year after year: when prices inevitably crash, we all feel that nihilism, thinking everything is worthless. I felt this when the NFT market crashed; now, after the recent Memecoin chaos, people feel this too; during the ICO era, people felt the same way.

The solution is actually quite simple: we just need to start doing different things.

1. Compound Assets, Industry Culture, Short-termism

Compound assets, simply put, are assets that appreciate over time, such as Amazon, Coca-Cola, Google, etc. Companies that own compound assets have the potential for sustainable long-term growth.

Why haven't we seen compound assets in the crypto space?

The answer is complex, but the root cause is extreme short-termism and misaligned incentives. Kun made a very good point here:

"This is also why most things are quickly reasonably valued or even overvalued after growing several times, because they are traded at valuations typical of growth tech stocks in traditional finance, but they are just getting started, and most startups cannot successfully go public. But here (in the crypto space), every failed project can still issue tokens based solely on a promise."

https://x.com/0xKun/status/1898599628448387482_

Indeed, there are many issues with how incentives are structured, and Cobie's article articulates this well. I won't delve into it deeply, as the focus of this article is on what we as individuals can do right now.

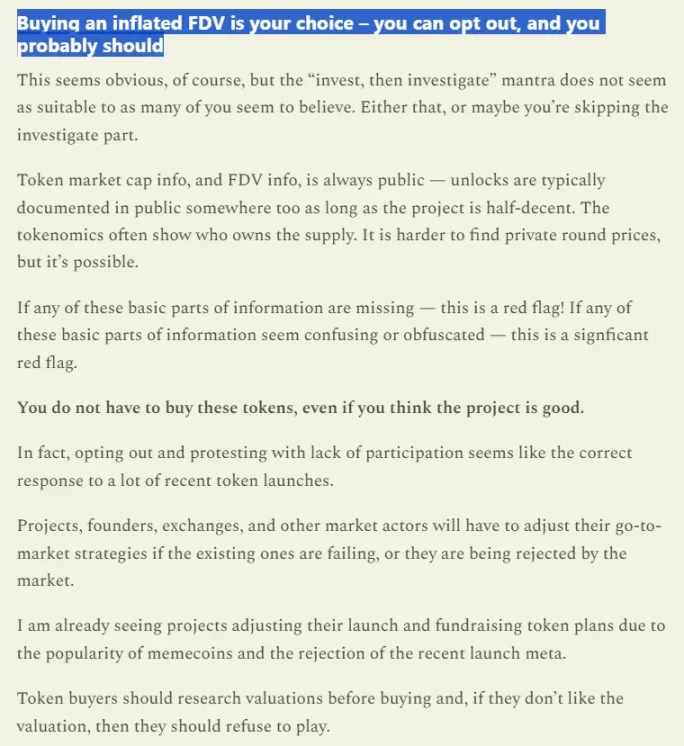

For investors, the answer is clear. Cobie pointed out in the article: you can choose to exit (and you probably should).

Indeed, people have chosen to exit. In this cycle, we have seen the decline of "centralized exchange (CEX) tokens" because retail investors are no longer buying these tokens. While individuals may not have the power to change this systemic issue, the good news is that financial markets are quite efficient: people want to make money, and when existing mechanisms fail to achieve this, they will not invest, making the whole process unprofitable, thus forcing a change in the mechanism.

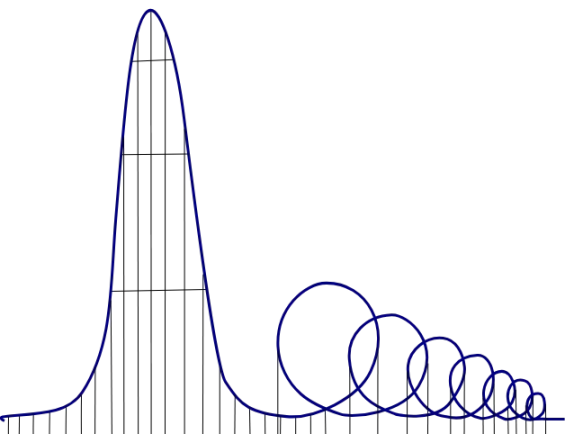

However, this is just the first step in the process. To truly build compound assets, companies need to start instilling long-term thinking in this field. The problem is not just that "private market capture" is bad, but that the entire chain of thinking that led us to this point is flawed. Like a self-fulfilling prophecy, founders seem to collectively believe "I want to make money and then leave," and no one is genuinely interested in long-term building, which means the charts always show a McDonald's "M" pattern.

The most critical point that must change is: a company's quality depends on its leaders. The reason most projects fail is not a lack of developers, but because the higher-ups decide it's time to leave. This industry must start to view the top 1% of founders with high integrity, strong action, and long-term thinking as role models for effort, rather than idealizing those founders who "pump and dump" in the short term.

The average quality of founders in the crypto space is not high, and this is no news. After all, calling those who hype up air tokens "developers" is not a high bar. As long as you have a long-term vision in the first two months after a token launch, you are already ahead of others.

I also believe the market will begin to economically incentivize long-termism, and we are already starting to see this trend. Despite the recent sell-off, Hyperliquid's price has still increased fourfold from its initial issuance price, a feat that few projects can boast in this cycle. When you know that the founder's long-term growth goals align with the product, it becomes easier to convince yourself to "hold this project long-term."

The natural conclusion drawn from this is that founders with high integrity and strong action will begin to capture the largest market share, because frankly, when everyone is tired of scams, they just want to work for someone with a vision who won't exit fraudulently, and such people are indeed very few.

In addition to having an excellent leader, building compound assets also depends on whether the product itself is excellent. In my view, this issue is easier to solve than finding a great founder. One reason there are so many "air token" projects in the crypto space is that the people creating these "air tokens" also have the same "make money and leave" mentality, so they choose not to solve new problems but to copy popular projects in an attempt to profit from them.

However, this industry does reward such illusory ideas, such as the AI agent craze in Q4 2024. In this case, once the craze subsides, we will see the common McDonald's "M" pattern. Therefore, companies must also start focusing on developing products that can be profitable.

No profit pathway = No long-term believers/holders = No asset buyers, because there is no future to bet on

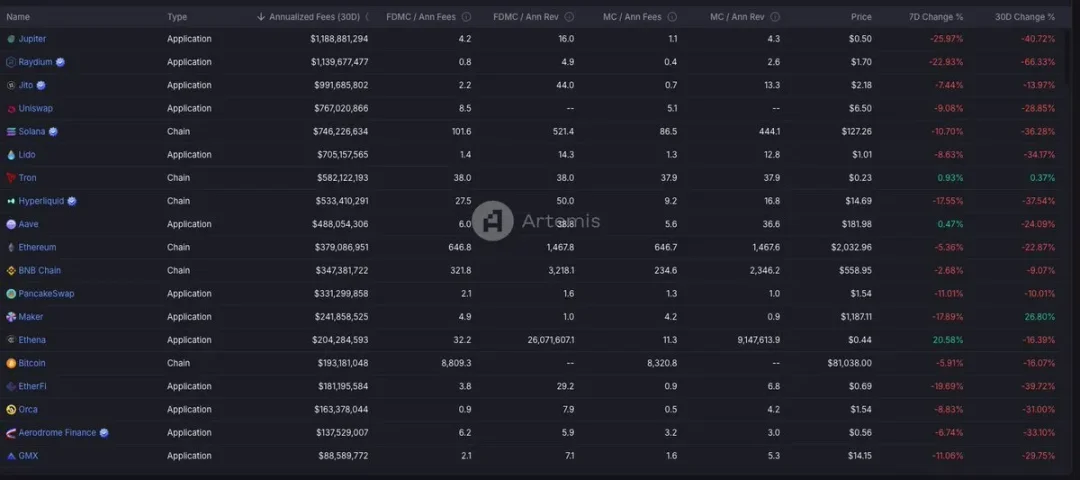

This is not an impossible task; companies in the crypto space can indeed achieve profitability. Jito's annual revenue is $900 million, Uniswap's is $700 million, Hyperliquid's is $500 million, and Aave's is $488 million, and they continue to be profitable even in a bear market (just not as much).

Looking ahead, I believe that fleeting, narrative-driven speculative bubbles will become smaller and smaller. We have already seen this trend. In 2021, the valuations of gaming and NFTs reached hundreds of billions of dollars, but in this cycle, the highest valuations for Memecoins and AI agents are only in the tens of billions.

I believe everyone should be free to invest in the projects they want to invest in. But I also believe people want their investments to yield returns. When this game becomes so obvious, turning into a game of "this is a hot potato, I must get rid of it before it goes to zero," the roller coaster will get faster, and as people choose to exit or lose all their money, the market size will shrink.

Profitability can solve this problem. For investors, it helps you understand that people are willing to pay for this product, thus achieving long-term growth to some extent. When a project has no profit pathway, it is almost uninvestable in the long run. On the other hand, a profit pathway brings growth pathways, attracting buyers willing to bet on the continued growth of the asset.

In summary, building compound assets requires:

Leaders with long-term thinking

Focus on developing profitable products

2. General-purpose Layer 1 is dead, reform is urgently needed

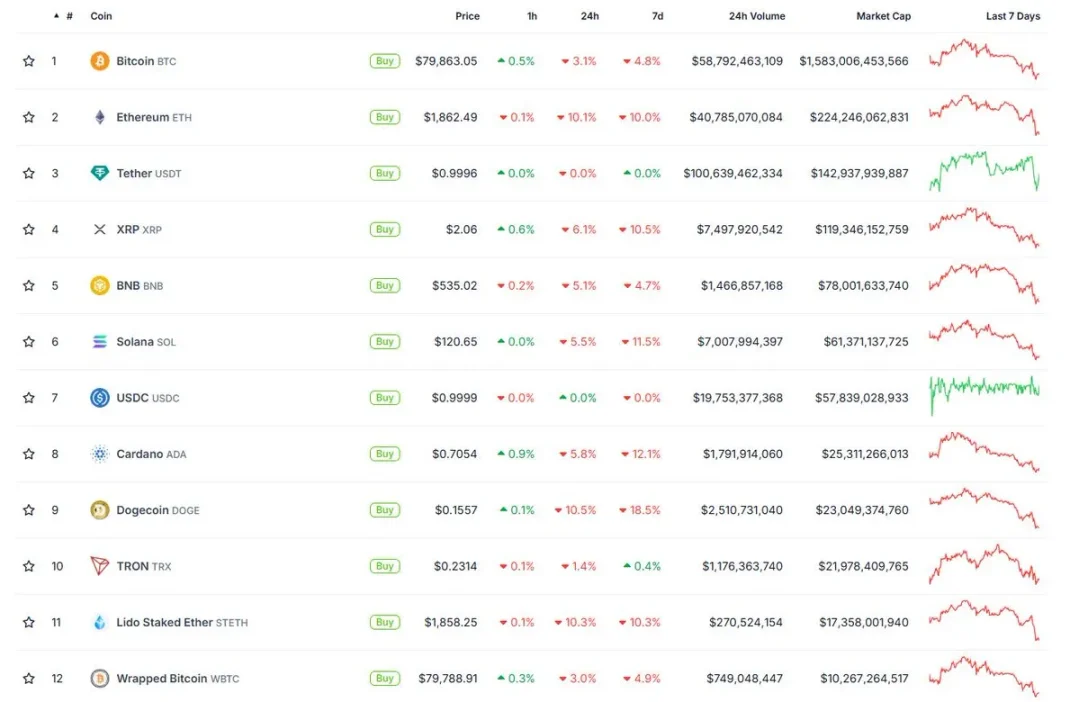

If you sort the homepage of CoinGecko by market capitalization, you will find that Layer 1 blockchain projects occupy more than half of the share. Aside from stablecoins, Layer 1 holds significant value in the crypto industry.

However, the price chart of Ethereum, the second-largest cryptocurrency after Bitcoin, looks like this:

If you bought Bitcoin in July 2023, your return would be 163% at the current price.

If you bought Ethereum in July 2023, your return would be 0%.

This is not the worst-case scenario. The "everything bubble" of 2021 sparked a wave of "Ethereum killers." Some new Layer 1 blockchain projects attempted to surpass Ethereum in certain technical aspects, mainly focusing on speed, developer languages, block space, and so on. However, despite the constant hype and significant funding, the results have not met expectations.

Now, four years after 2021, we are still facing the impacts of that wave. There are already 752 smart contract platforms that have issued tokens on CoinGecko, and there may be more platforms that have not issued tokens.

Not surprisingly, most of their price charts look like this, while Ethereum's chart still looks decent in comparison:

So, despite four years of effort and billions of dollars invested, with over 700 different blockchain projects emerging, only a few Layer 1s have decent activity, and even those projects have not reached the "breakthrough user adoption levels" that everyone expected four years ago.

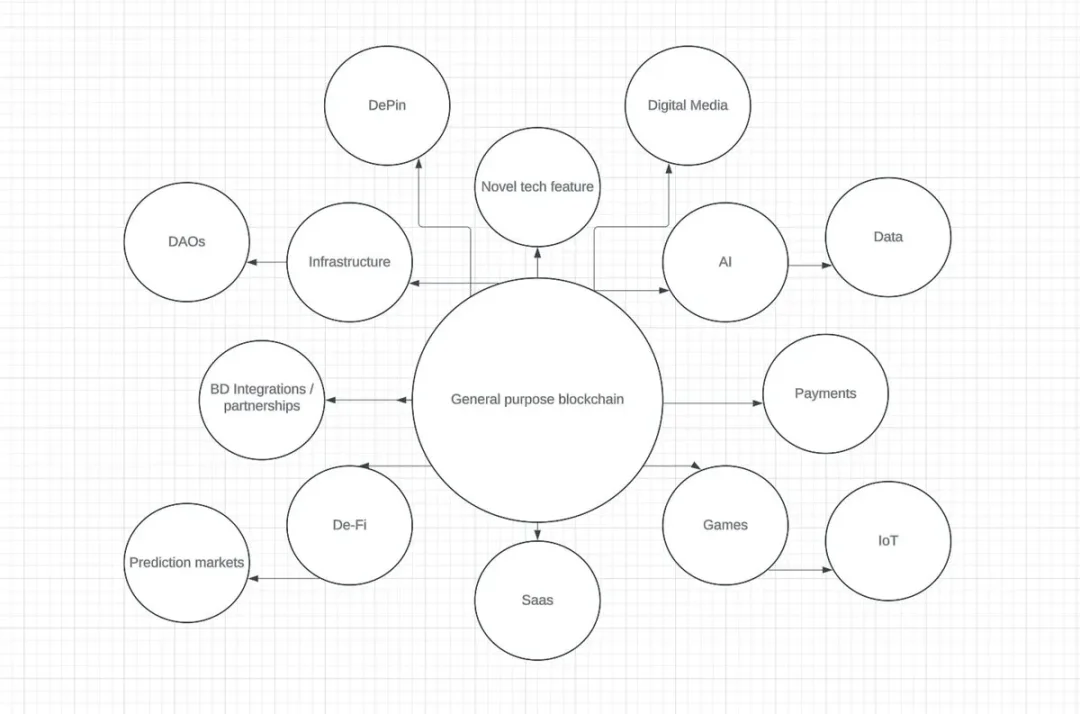

Why is that? Because the construction philosophy of most of these projects is flawed. As Luca Netz pointed out in his article "What is Consumer Crypto," many blockchains today adopt a general-purpose model, with each project dreaming of being able to "carry the internet economy."

But this requires tremendous effort and ultimately leads to market fragmentation, as a product that tries to do everything usually does nothing well. It is a task that consumes both a lot of money and a lot of time. Frankly, many blockchains even struggle to answer a simple question: "Why should we develop on your blockchain instead of the 60th blockchain?"

The current state of Layer 1 is another example of everyone following the same model while expecting different results. They compete for the same limited developer resources, trying to outdo each other in funding programs, hackathons, developer studios, and so on, while it seems we are now trying to develop a mobile phone (?).

Assuming a Layer 1 project succeeds. In every cycle, there are always some Layer 1 projects that achieve breakthroughs. But will this success last? The success story of this cycle is Solana. However, here is a viewpoint that many may not like: What if Solana becomes the next Ethereum?

In the last cycle, many people were so convinced that Ethereum would succeed that they invested most of their net worth into Ethereum. Ethereum still holds the highest total value locked (TVL) among blockchains, and now there is even an Ethereum exchange-traded fund (ETF), yet its price has stagnated. In this cycle, the same people are expressing the same views, believing Solana is the future of blockchain and looking forward to the launch of the Solana ETF, among other things.

If history serves as a reference, the real question is: Can today's success guarantee tomorrow's importance?

Rethinking Layer 1

My point is simple: Rather than building a general-purpose blockchain, it is much wiser for Layer 1 to build around a core focus. A blockchain does not need to meet everyone's needs; it just needs to excel in a specific area. I believe the future of blockchain will be independent of the underlying blockchain; people will only expect it to perform well, and the technical details will not matter as much.

Today, developers have shown signs of this: For founders building decentralized applications, the main concern is no longer how fast the blockchain runs, but rather the user distribution of the blockchain and the usage by end users. Does your blockchain have users? Does it have the user distribution necessary to make the product attractive?

44% of web traffic comes from WordPress, yet its parent company Automattic is valued at only $7.5 billion. 4% of web traffic comes from Shopify, but its valuation has reached $120 billion, 16 times that of Automattic! I believe Layer 1 will also reach a similar final state, where its value will accumulate in the applications built on the blockchain.

Therefore, I think Layer 1 should boldly build its own ecosystem. If we use cities as an analogy for blockchains, we can see that the rise of cities is due to their specific advantages, making them viable economic and social centers. Over time, these cities will specialize in a dominant industry or function:

Silicon Valley → Technology

New York → Finance

Las Vegas → Entertainment and Hospitality

Hong Kong and Singapore → Trade-focused Financial Centers

Shenzhen → China's Hardware Manufacturing and Tech Innovation Center

Paris → Fashion, Art, and Luxury Goods

Seoul → K-pop, Entertainment, and Beauty Industry

Layer 1 is no different; demand is driven by the appeal and activity they provide. Therefore, teams must begin to focus more on excelling in a vertical field, carefully crafting attractions that draw people into their ecosystem, rather than haphazardly building various different projects.

Once you can attract people into your ecosystem, you can then build the entire ecosystem around that attraction. Similarly, Hyperliquid is a great example; they have done well in this regard and iterated based on first principles. They first built their native perpetual decentralized exchange (perp-DEX) order book, spot decentralized exchange, staking mechanism, oracle, multi-signature, and all internal components before expanding to HyperEVM, a smart contract platform for people to build on.

Here is a simple analysis of why it succeeded:

First, focus on "building attraction": By first creating perpetual trading products, Hyperliquid attracted traders and liquidity before scaling.

Control the entire ecosystem architecture: Having key infrastructure (oracles, staking mechanisms) can reduce vulnerabilities and create competitive advantages.

Ecosystem synergy: HyperEVM has now become a permissionless development platform for developers, leveraging Hyperliquid's existing user base and liquidity.

This "build attraction first, then build the ecosystem" model is similar to successful Web2 platforms (for example, Amazon started by selling books and then expanded into all other areas). Solve a problem excellently, and then let the ecosystem organically expand from that core value point.

Thus, I believe blockchains should start integrating their products, creating their own attractions, and controlling the entire ecosystem architecture. As the captain of this "ship," you are the visionary, which allows your blockchain to align with the grander, long-term vision you hold for Layer 1; and it ensures that the project will not be abandoned when on-chain activities begin to decline, as everything is built internally.

Most importantly, this process will give your token monetary properties. If we compare a blockchain to a city, the token is the currency people use for transactions, and this value is conferred through usage. People need to buy your token to do interesting things on your chain. This gives your currency value and provides people with a reason to hold it.

But also remember: Just because you focus on a certain area does not mean there is market demand. Another hard pill to swallow is that Layer 1 must dig for the right opportunities at the right time and in the right way. Blockchains must commit to developing products that people want. Sometimes, people do not really want "Web3 games" or "more data availability."

3. The Relationship Between Liquidity Tokens and Investments

The next topic discusses how liquidity token projects should develop in the crypto space. Simply put, liquidity token projects need to start establishing investor relations positions and publishing quarterly reports so that investors, whether retail or professional, can clearly understand what the company is doing. This position is neither new nor revolutionary, but it is extremely lacking in this field.

Nevertheless, there has been almost no progress in investor relations in this area. Multiple business development heads from different projects have told me that if you have some "regular calls to pitch your liquidity token to funds," you are doing more than 99% of the projects in this field.

Business development is certainly good for attracting developers and ecosystem funding, but having an investor relations position that can explain the token situation to the public is even better. If you are a project looking to attract buyers, you need to market yourself; and the way you market yourself is not by renting the largest booth at a conference or advertising at the airport, but by pitching yourself to buyers with funds.

By publishing quarterly growth updates, you begin to show investors that the product is legitimate and capable of accumulating value, thereby instilling confidence in investors regarding the product's potential for good performance in the long term.

As for how you should do this, here is a good checklist:

Publish reports on your blog/website, sharing quarterly expenses/income, protocol upgrades, relevant data, but not involving significant non-public information.

Communicate monthly with liquidity fund managers to introduce your product.

Hold more online Q&A sessions (AMAs).

4. Buybacks and Burns Are Just a Decent Option, Not the Best Solution

The last point I want to make is about buybacks and burns. My view is that I think buybacks and burns are a decent way if there are no better uses for the funds. In my opinion, the crypto space has not yet developed to a scale where companies can rest on their laurels; there is still much to be done in terms of growth.

The primary and foremost use of revenue should always be for product expansion, technological upgrades, and entering new markets. This aligns with driving long-term growth and building competitive advantages; a good example in this regard is Jupiter's acquisition spree, where they have been using cash to acquire some projects to gain products and key talent in this field.

While I know some people like buybacks and burns and will shout for dividends, my point is that the operational model of most crypto projects is similar to that of tech stocks, because the types of investor groups are similar: they are all investors seeking high returns and expecting asymmetric gains.

Therefore, it does not make much sense for companies to return value directly to token holders through dividends; they can do so, but if they use their cash reserves to build a stronger competitive advantage, it will greatly benefit the product in the next 5 to 10 years.

The crypto space is now beginning to move towards the mainstream. Therefore, slowing down the pace of development now is unwise; instead, funds should flood in to ensure that the next winner maintains a leading position over a longer time span, because even though prices are falling, institutional layouts in the crypto space have never been as solid as they are now: the adoption of stablecoins, blockchain technology, tokenization, and so on.

Thus, while buybacks and burns are much better than running away with the money, considering that there is still a lot of work to be done, it is still not the most effective use of funds.

Summary

This downturn has begun to make people realize that developing products that can generate revenue is a necessary path to profitability, and it inevitably requires establishing formal investor relations positions to showcase the latest developments of your token. There is still much work to be done in this field. I remain optimistic about the future of the crypto space.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。