Source: Cointelegraph Original: "{title}"

The U.S. Securities and Exchange Commission (SEC) has delayed its decision on the approval of several ETFs for Ripple (XRP), Solana, Litecoin, and Dogecoin.

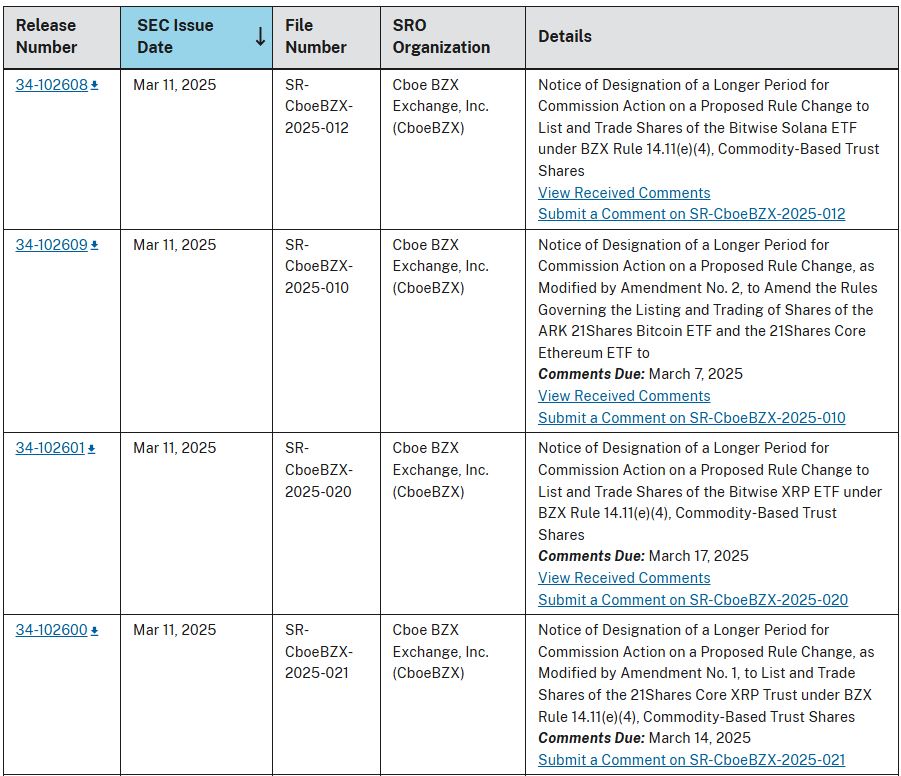

In a series of documents submitted on March 11, the agency stated that it has "designated a longer period" to decide whether to approve the relevant rule change proposals that would allow these ETFs to move forward.

The affected ETFs include Grayscale's Ripple ETF application and Cboe BZX Exchange's Solana spot ETF application, with decisions on these applications postponed until May.

The SEC has delayed its approval decision on several altcoin ETFs. Source: SEC

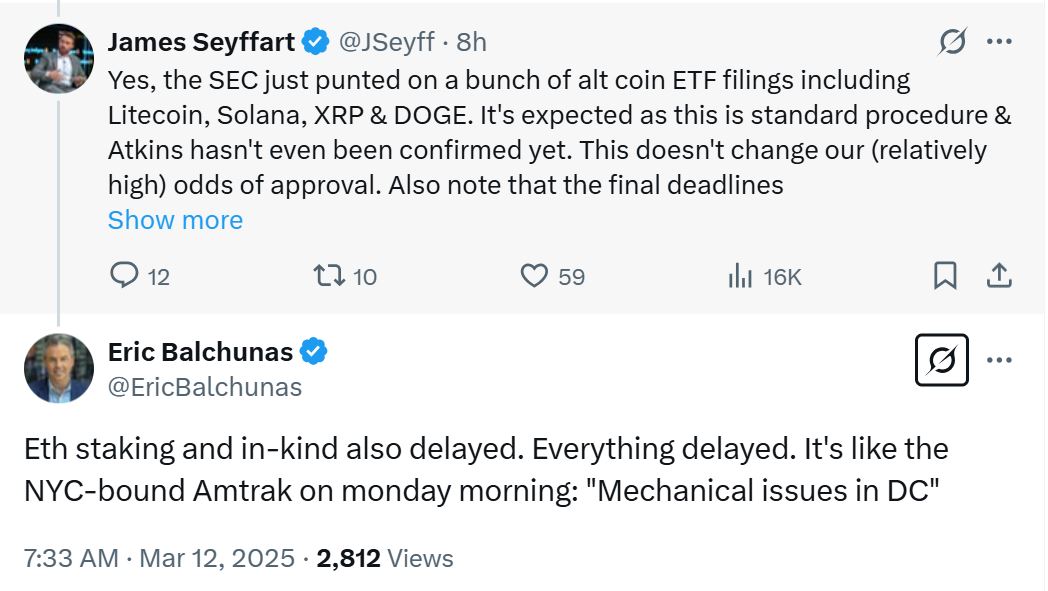

Bloomberg ETF analyst James Seyffart posted on social platform X on March 11, stating that while the SEC has just "delayed a bunch of altcoin ETF application reviews," he believes there is no cause for concern. "This was expected as it is standard procedure."

He added that SEC Chairman Paul Atkins, nominated by President Trump, "has not even been confirmed yet."

Seyffart stated, "This does not change our (relatively high) chances of approval. Also, keep in mind that the final deadline is in October."

Source: Samuel Maverick

Another Bloomberg ETF analyst, Eric Balchunas, also shared his views, saying "everything has been delayed," including ETFs involving Ethereum staking and physical redemptions.

In early December last year, Trump selected pro-cryptocurrency businessman and former SEC commissioner Atkins to be the next chairman of the agency. However, a confirmation hearing in Congress has yet to be scheduled.

This is not the first time the SEC has extended the deadline for ETF decisions. On February 28, it extended the deadline for Cboe Exchange's application regarding options linked to Ethereum ETFs.

Previously, following President Trump's election and the resignation of former SEC Chairman Gary Gensler, the SEC received a large number of altcoin ETF applications.

During Gensler's tenure at the SEC, the cryptocurrency industry believed he took an aggressive regulatory stance. During his time from 2021 until his resignation on January 20, he undertook 100 regulatory actions related to cryptocurrency.

Since Gensler's departure, an increasing number of companies that previously faced SEC enforcement actions have had their cases dismissed, including cryptocurrency exchange Gemini on February 26 and cryptocurrency trading firm Cumberland DRW on March 4.

Meanwhile, SEC acting chairman Mark Uyeda has also proposed to abandon certain rule change provisions that would have expanded the regulation of alternative trading systems to cover cryptocurrency companies.

Related: SEC plans to abandon the requirement for cryptocurrency companies to register as exchanges.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。