Fu Shaoqing, SatoshiLab, Everything Island BTC Studio

1. Introduction

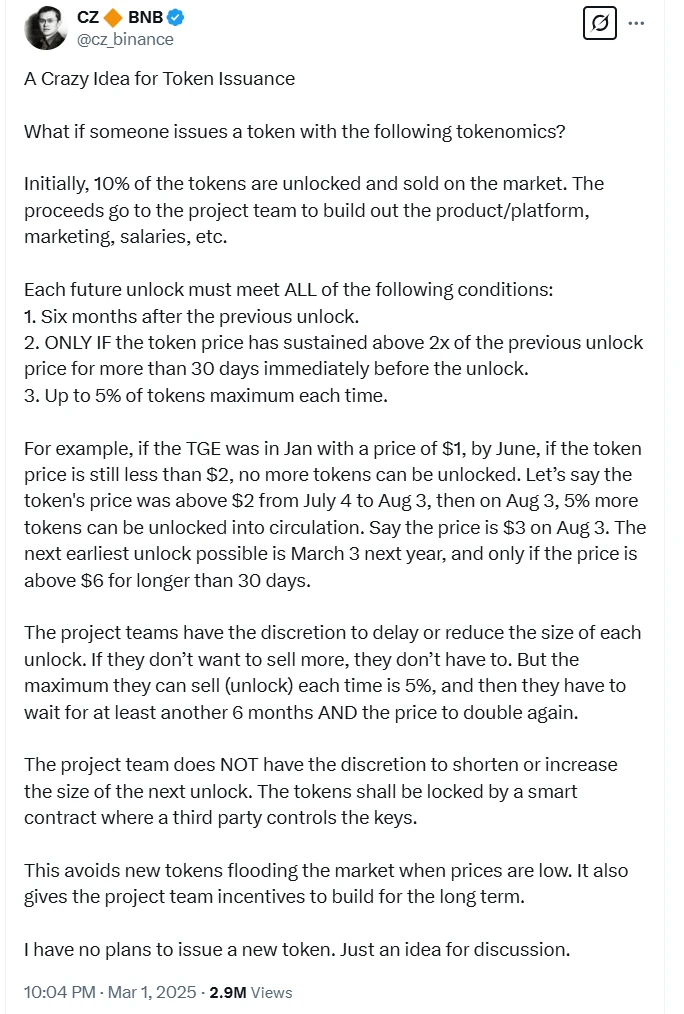

Not only have the phenomena of VC coins and meme coins prompted more reflection, but many well-known figures in the industry have also raised similar questions, all striving to find solutions. For example, during He Yi's response to the Twitter Space event about the Girlfriend Coin, Jason (Chen Jian) raised the question of whether the tokens listed on Binance have mechanisms to address the issue of project teams selling coins and then lying flat. Recently, CZ's article "A Crazy Idea for Token Issuance" has also been attempting to find solutions to related issues.

I believe that all teams genuinely working on projects hope the market rewards true contributors, rather than allowing Ponzi schemes, scammers, and speculators to take the industry's dividends and disrupt its development.

Since VC coins and meme coins have good case analysis value, this article will analyze from these two phenomena.

2. The Past and Present of VC Coins

VC coins did not emerge out of thin air; their appearance has historical reasons. Although VC coins may seem imperfect now, they played a significant role at the time, and important projects in the industry had VC participation.

2.1. The Chaos of ICOs in 2017 - A Dance of Demons

2017 was a pivotal year for the explosion of Initial Coin Offerings (ICOs) in the blockchain field, with statistics showing that the financing amount for ICOs exceeded $5 billion that year. In addition to the classic ICO projects introduced below, I also participated in some small projects' ICOs, fully experiencing the madness of that time, which can be aptly described as a dance of demons. At that time, as long as a project's token was going to conduct an ICO, if someone endorsed it, and the white paper was well-written, it would be snatched up immediately in various groups. People were irrationally crazy. To exaggerate, even if someone threw a pile of dung into a group, it would still be frantically grabbed. If you don't believe it, search for the token situation of MLGB (Ma Le Ge Coin). (This also reflects the powerful influence of ICOs.)

Regarding the reasons for the explosion, I summarize as follows through discussions with DeepSeek and ChatGPT, as well as my own understanding:

(1) Mature token issuance technology: The launch of Ethereum, in particular, enabled developers to easily create smart contracts and decentralized applications (DApps), promoting the rise of ICOs.

(2) Other reasons include market demand, the initial acceptance of the concept of decentralization, the promise of a bright future, and low-threshold investments.

Several classic cases emerged during this period:

(1) Ethereum: Although Ethereum's ICO took place in 2014, its smart contract platform was widely used for many new projects' ICOs in 2017, and this project was also conducted through an ICO. Overall, this project is quite good, having grown to become the second largest in the crypto world today.

(2) EOS: EOS raised nearly $4.3 billion through a year-long, phased ICO in 2017, becoming one of the largest ICOs of that year. This project has now almost disappeared, partly due to not following the right technical path and partly due to insufficient market demand control.

(3) TRON: TRON's ICO in 2017 also raised a significant amount of funds, during which there were widespread rumors of token swaps and plagiarism with other projects, but it developed rapidly afterward, attracting much attention. From this perspective, compared to those projects that ran away, isn't Sun Yuchen doing quite well? His grasp of market demand is still very precise, such as the income from Tron stablecoins. The contrast between Tron’s technical implementation and market demand control with EOS is stark. The development achievements of Tron are quite good; if the HSR (Hshare, humorously referred to as "braised pork") that was swapped for Tron had retained its share, the returns would have been higher than his own project.

(4) Filecoin: Filecoin successfully raised over $250 million in 2017, and its concept of distributed storage received widespread attention, with a relatively luxurious founding team including Juan Benet. It cannot be said whether this project is a success or failure, but whether it can develop healthily is questionable.

Personally, I feel that there are many more non-classic cases, and their impact is greater, which is also a significant historical reason for the emergence of VC coins.

Exposed Issues:

(1) Lack of regulation: Due to the rapid development of the ICO market, many projects lack regulation or have none at all, leading investors to face high risks. There are many scams and Ponzi schemes, with almost 99% of projects exhibiting exaggeration and fraudulent behavior.

(2) Market bubble: A large number of projects raised huge amounts of funds in a short period (these funds were poorly managed), but many of these projects lacked actual value or the described scenarios were completely unachievable, which caused even projects that did not intend to scam to cash out and run away or fail.

(3) Insufficient investor education, making it difficult to judge: Many ordinary investors lack understanding of blockchain and cryptocurrencies, making them easily misled, leading to poor investment decisions. In other words, investors have no way to measure projects or supervise their progress afterward.

2.2. The Entry of VCs and Credibility Endorsement

From the above description, we see the chaos following ICOs, at which point venture capital (VC) first stepped in to solve the problems. VCs provided more reliable support for projects through their own credibility and resources, helping to reduce many issues brought about by early ICOs. An additional effect was that it helped filter projects for a wide range of users.

The Role of VCs

(1) Replacing the grassroots financing flaws of ICOs

Reducing fraud risk: VCs filter out "air projects" through "strict due diligence" (team background, technical feasibility, economic model), avoiding the rampant forgery of white papers during the ICO era.

Standardizing fund management: Using phased funding (milestone-based disbursement) and token lock-up clauses to prevent teams from cashing out and running away.

Long-term value binding: VCs typically hold equity in projects or long-term locked tokens, deeply binding with project development, reducing short-term speculation.

(2) Empowering project ecosystems

Resource integration: Connecting projects with key resources such as exchanges, developer communities, and compliance advisors (e.g., Coinbase Ventures assisting projects in listing).

Strategic guidance: Assisting in designing token economic models (e.g., token release mechanisms) and governance structures to avoid economic system collapse.

Credibility endorsement: The brand effect of well-known VCs (e.g., a16z, Paradigm) can enhance market trust in projects.

(3) Promoting industry compliance

VCs encourage projects to proactively comply with securities laws (e.g., the U.S. Howey Test) and adopt compliant financing frameworks such as SAFT (Simple Agreement for Future Tokens), reducing legal risks.

The involvement of VCs is a direct solution to the problems of the early ICO model. Overall, VCs play a crucial role in the success of Web3 projects, helping them overcome many challenges faced during early ICOs through funding, resources, credibility, and strategic guidance, while also indirectly assisting the public in completing initial filtering.

2.3. Issues with VC Coins

The emergence of new things is always to solve some old problems, but when this new thing develops to a certain stage, it begins to present a series of issues itself. VC coins are such a case, and later they exhibited many limitations.

Mainly reflected in:

(1) Conflicts of interest

VCs are investment institutions that profit through investments. They may push projects towards excessive tokenization (e.g., high unlock pressure) or prioritize serving their own investment portfolios (e.g., exchanges favoring "biological child" projects).

(2) Inability to solve subsequent project development issues.

(3) Colluding with project parties to deceive retail investors (some project parties and VCs operate this way, while larger brand VCs are relatively better).

VC institutions only complete the early investment and profit exit stages, and they have no obligation, capability, or willingness to assist in the later development of projects. (Would it be better if the long lock-up periods for VCs were restricted?)

The main problem with VC coins is that once the project's tokens are listed, there is a lack of motivation for continuous development. Both VCs and project parties often cash out and run away after the tokens are listed. This phenomenon makes retail investors resent VC coins, but the essential reason still lies in the lack of effective supervision and management of the projects, especially in matching funds and outcomes.

3. The Fair Launch of Inscriptions and the Memecoin Phenomenon

The explosion of inscriptions and Fair Launch in 2023, along with the pump-and-dump model of memecoins in 2024, reveals some phenomena and exposes some issues.

3.1. The Explosion of Inscriptions and Fair Launch

In 2023, two significant trends emerged in the blockchain field: the explosion of Inscriptions technology and the popularization of the Fair Launch model. Both phenomena stem from reflections on early financing models (such as ICOs and VC monopolies). In the field of inscriptions, most VCs generally reported having no opportunity to participate in the primary market, and even in the secondary market, they were hesitant to invest heavily. This reflects the pursuit of decentralization and fairness by users and communities.

Inscriptions first exploded on the Bitcoin blockchain, represented by BRC20, producing important inscriptions like ORDI and SATS. The explosion of inscriptions has several reasons: the need for innovation in the Bitcoin ecosystem; users' demand for censorship resistance and decentralization; low thresholds and wealth effects; resistance to VC coins; and the appeal of fair launches.

Inscriptions have also produced some issues:

Pseudo-fairness: Many participating addresses may actually be disguised by a few institutions or large holders;

Liquidity challenges: Inscriptions on the Bitcoin mainnet incur significant transaction and time costs;

Value loss: The huge fees generated by creating inscriptions are taken by miners (anchored assets are lost), and do not empower the ecological closed loop of this token;

Application scenario issues: Inscriptions do not solve the problem of a token's sustainable development; these inscriptions lack "useful" application scenarios.

3.2. The Explosion of Pumpfun and the Memecoin Phenomenon

The origin of memes is quite early, initially a cultural phenomenon. In the real world, the concept of NFTs proposed by Hal Finney in 1993 is considered the earliest origin. The emergence of NFTs was driven by Counterparty, founded in 2014, which created Rare Pepes to turn the popular meme Sad Frog into an NFT application. Meme is translated as "meme," equivalent to an emoji, a phrase, or even a video or GIF.

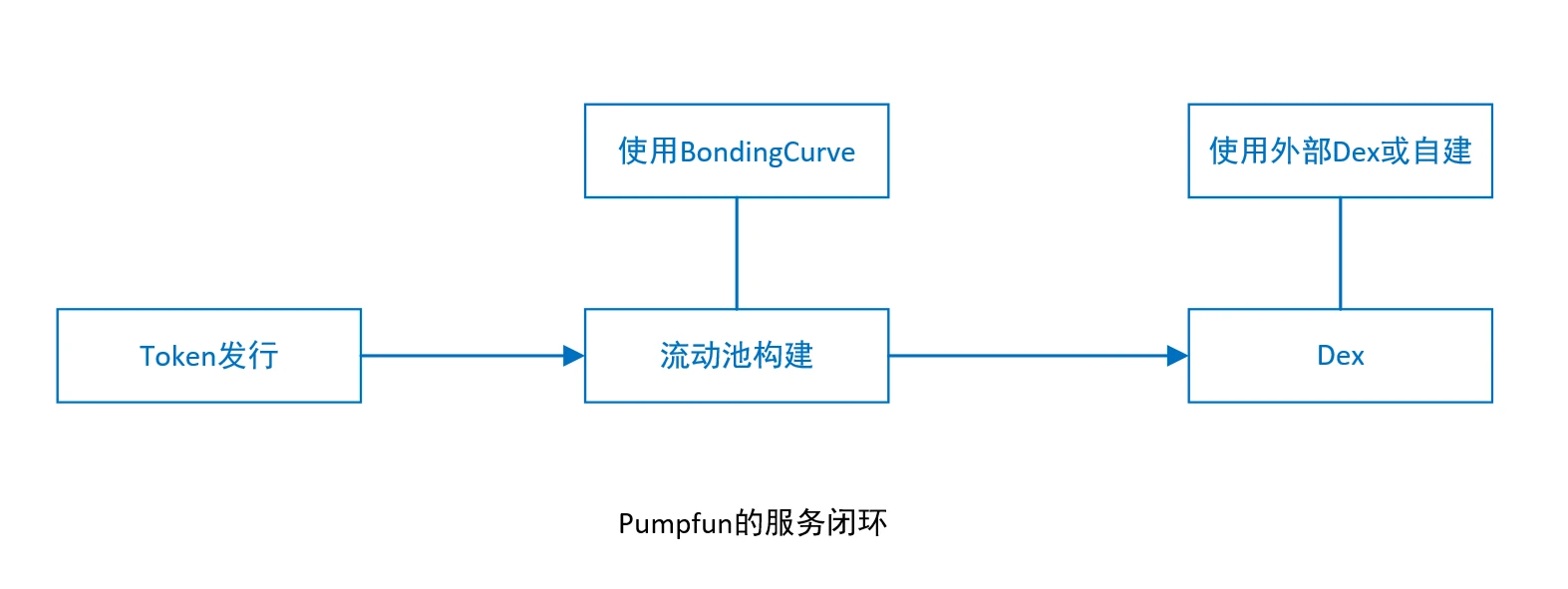

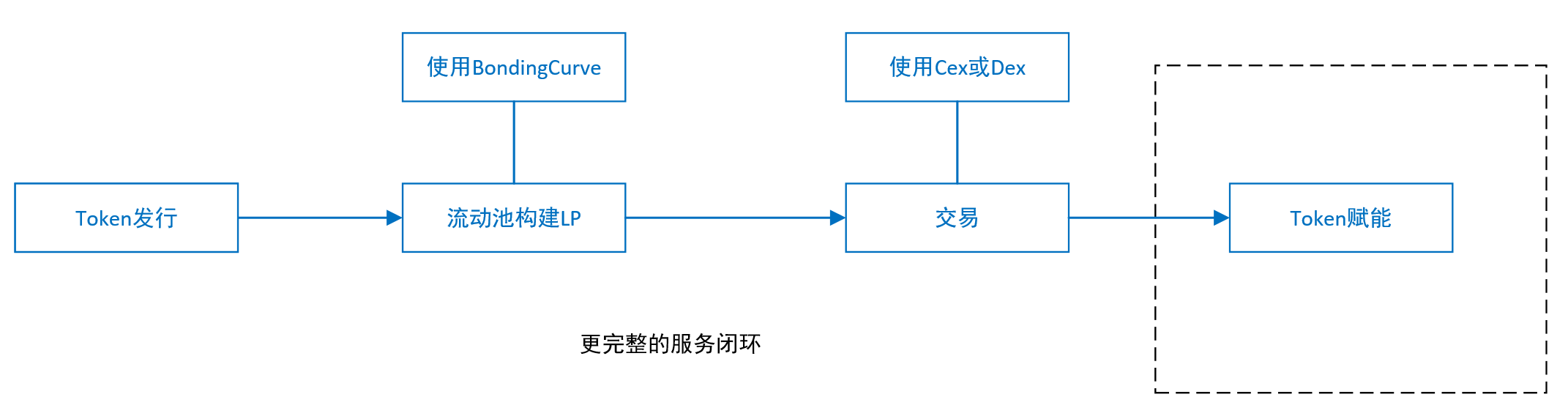

As memes have already risen in the NFT field, and with the maturation of some technologies, memecoins began to form. In 2024, the Pump.fun platform based on the Solana chain rapidly emerged as a core battlefield for memecoin issuance. This platform, through a simple and complete token service process (ICO + LP + DEX) and speculative trading mechanisms, caused memecoins to have a significant impact in 2024. I believe Pumpfun's important contribution is that the platform combines three separate services into a complete closed loop: Token issuance, building liquidity pools, and decentralized exchanges (DEX).

In the early days, the proportion of tokens on Pumpfun that made it to DEX (commonly referred to as the graduation rate in the industry) was very low, only 2%-3%. This also indicates that the entertainment function was prioritized over the trading function, which aligns with the characteristics of memes. However, during the peak period, the token graduation rate often exceeded 20%, turning into a pure speculation machine.

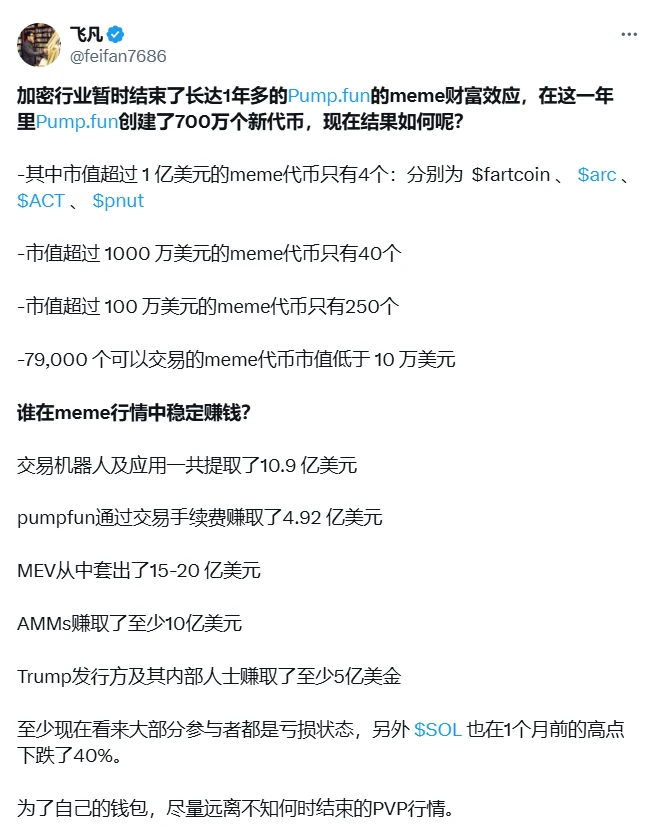

An analysis on Twitter illustrates the issues with the memecoin model well. (I have not verified the reliability of this data.)

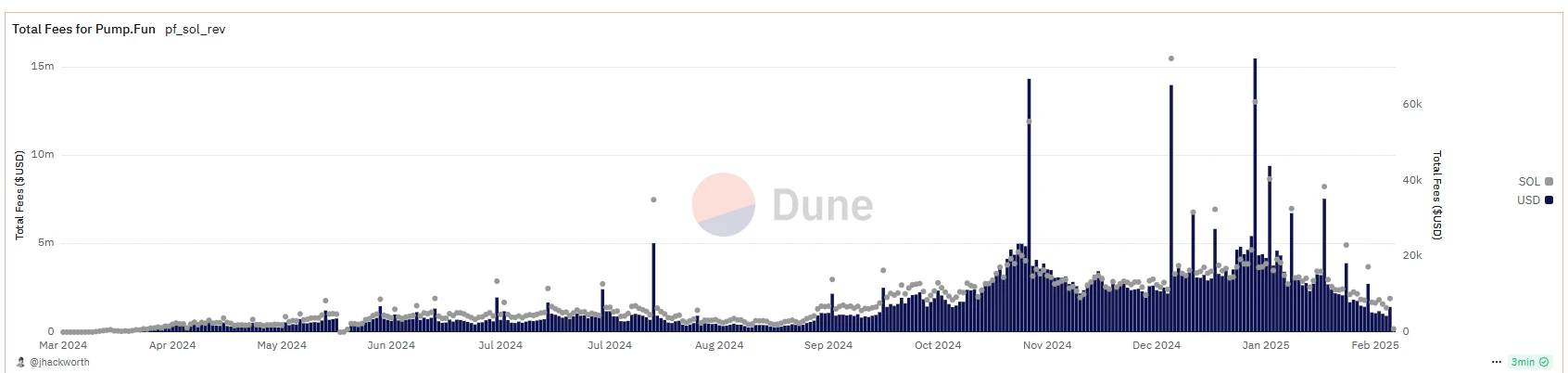

Pumpfun's total revenue approached $600 million, to the extent that U.S. President Trump and his family also issued their own tokens, highlighting the explosion and peak of memecoins. According to analysis from Dune, memecoins are also experiencing a cycle of emergence, growth, and explosion.

Main Issues with Memecoins

(1) Systemic fraud and trust collapse: According to Dune data, about 85% of tokens on Pump.fun are scams, with founders cashing out in an average of just 2 hours.

(2) Rampant false advertising: Project teams forge KOL endorsements and fake trading volumes (through wash trading bots). For example, the token MOON claimed to have Elon Musk's endorsement, which was actually a PS fabrication.

(3) Distorted market ecology: The liquidity siphoning effect, where memecoins occupy a large amount of on-chain resources, squeezes the development space for normal projects (e.g., the TVL of DeFi protocols on the Solana chain decreased by 30%). This leads to the expulsion of real users, and ordinary investors gradually exit the market as they cannot compete against bots and insider trading. Some project teams even consider using the investment funds obtained to manipulate a memecoin and run away with the profits.

Memecoins have evolved from early entertainment functions to mid-late stage PVP (Player versus Player), and later to PVB (Player versus Bot), becoming tools for a few experts to harvest retail investors. The lack of effective value injection into memecoins is a serious issue; if this problem is not resolved, memecoins will ultimately decline.

4. What Kind of Projects Do Users or the Market Want?

By reviewing the development history of Web3 projects, we understand the historical reasons for the emergence of VC coins and their pros and cons, while also briefly analyzing inscriptions and the memecoin phenomenon driven by Pumpfun. They are all products of the industry's development, and through this analysis, we see that there are still some key issues in the current development of Web3 projects.

Note: Do VC coins and memecoins reveal all the problems? Or do they reveal the current main issues?

4.1. Summary of Existing Problems

From the previous content, we summarize the current issues with Web3 projects:

1. Projects must have sustained motivation for development; no one should receive too much money too early. Token holders and those involved in future development should receive continuous rewards, rather than being undermined and deceived.

2. Eliminate or reduce PVP; to a large extent, this means being fairer and reducing manipulation by market makers. Therefore, truly fair launches are more valued, but once on DEX, it still becomes a race to run faster, as the value of the pool is fixed, and those who get in early benefit more.

How to solve the above problems:

1. Project management issues: Do not allow project teams or VCs to access large amounts of funds too early, or use funds under regulated conditions, or allocate funds to teams that contribute and build.

2. Sustainable external value injection: This can solve the PVP issue and reward medium to long-term token holders and builders. Continuous external value injection can provide financial support to projects that genuinely want to build, give token holders medium to long-term growth expectations, and reduce the problem of early cashing out and running away.

This simple conclusion does not easily clarify the issues. For project management problems, it is necessary to analyze the stakeholders in a project's ecosystem and dynamically analyze potential issues from different stages of the project (issuance, circulation, governance).

4.2. Different Stakeholders in Projects and Management Issues at Different Stages

1. Different Stakeholders

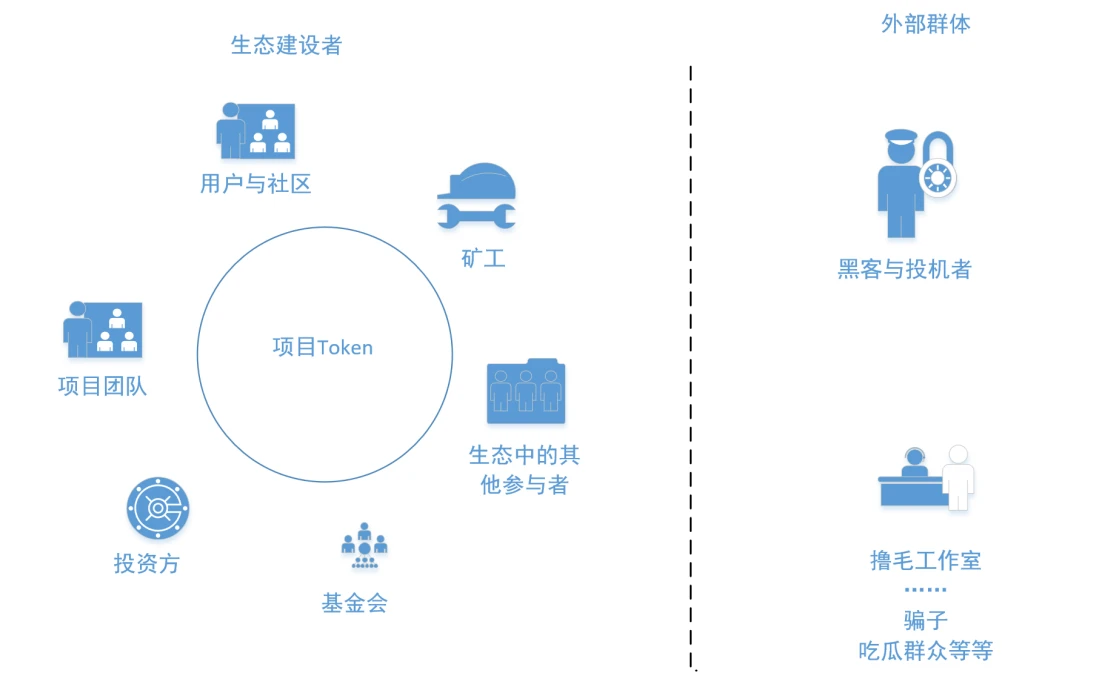

The most relevant part of Web3 projects concerning interests is their economic model design. Stakeholders in a project generally include project teams, investors, foundations, users and communities, miners, exchanges, market makers, or participants from other project ecosystems. It is necessary to use the economic model to plan token distribution and contribution incentives for different stakeholders at various stages. The economic model generally includes the proportion of tokens allocated to stakeholders, token release rules, incentive methods, etc. The specific proportions and release rules will be determined based on the actual situation of each project and the contribution levels of each stakeholder, with no fixed values. There is also a group of onlookers (speculators, yield farmers, scammers, etc.).

Among different interest groups, it is essential to prevent any stakeholder within the ecosystem from taking too much benefit, such as in VC coin projects where project teams and investors took most of the token value, leading to a lack of sustained development motivation. It is also necessary to prevent external groups from taking undue benefits, such as speculators in memecoins.

2. Analyzing Issues from Issuance, Circulation, Governance, and Other Stages

(1) Token Issuance

Digital currencies have various issuance methods. In addition to mining based on PoW, there are ICOs, STOs, IBOs, and various airdrop methods like Ripple. Regardless of the method used, the primary purposes of digital currency issuance are twofold: first, to raise funds; second, to distribute digital currency to users, allowing more people to use it.

(2) Token Circulation and Management

Compared to the early stages of Web3 projects, there are now multiple ways to issue tokens, resulting in a large amount of digital currency entering the circulation field. In the circulation of tokens, due to insufficient demand and limited means of managing token liquidity, many issues arise in the token circulation field. Token management is often achieved through various applications. For example, trading functions of tokens, staking, entry thresholds for members (token quantity or NFT holdings), and consumption within applications (gas fees for public chains, registration and renewal fees for ENS, etc.).

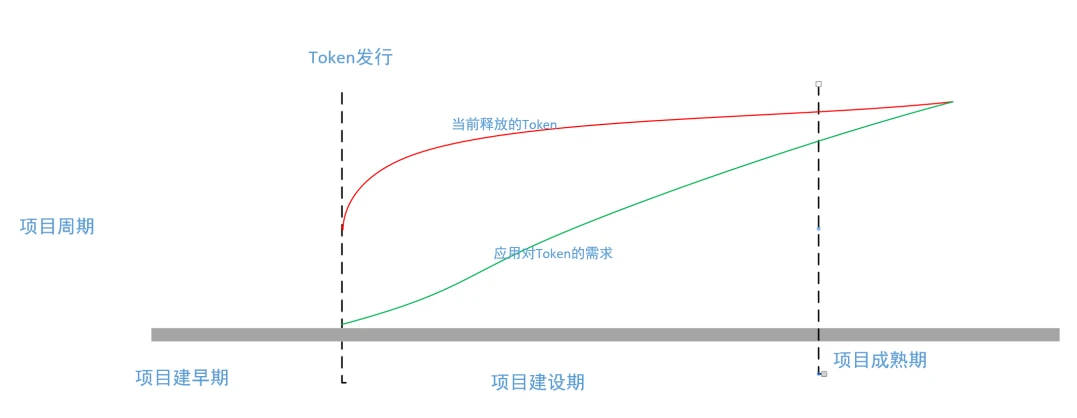

Tokens released too early in the project, which lie between the red line and the green line, need to use liquidity locking functions to prevent any stakeholder from taking them prematurely. The management of these locked tokens and the project's progress during the construction period involves management issues.

3. Project Governance Issues

In Web3 projects, the most direct control is achieved through the design of consensus mechanisms and economic models. Tokens in the economic model are used to control the supply and consumption of resources. The design of the economic model plays a significant role in Web3 projects, but its scope of influence is limited. When the economic model cannot fulfill this function, other means are needed to supplement it. Community governance mechanisms serve as a functional supplement in areas where the economic model is not proficient.

Due to the decentralized nature of the blockchain world and the network infrastructure that operates on programmed rules, DAO and DAC community organizations have emerged, which can be compared to traditional companies and corporate governance in centralized structures in the real world.

This management part, combining DAO and foundation models, can better accomplish fund and ecosystem management while providing sufficient flexibility and transparency. DAO management members must meet certain conditions and should quickly include key stakeholders and third-party institutions. If exchanges for token listings are considered a third party, could this situation adopt Jason's suggestion, where exchanges have certain supervisory and notarization rights and roles? In fact, during the recent market manipulation incident involving GoPlus and Myshell, Binance played such a role.

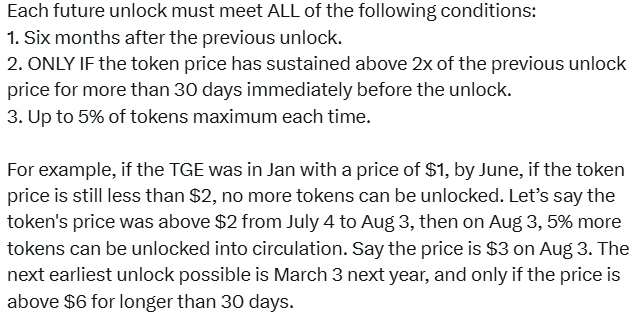

Could this management structure also better implement the model proposed by CZ in "A Crazy Idea for Token Issuance"? We analyze this management concept from CZ's article as follows:

(1) Initially, 10% of the tokens are unlocked and sold on the market. The proceeds will be used for the project team's product/platform development, marketing, salaries, etc. (This design is good; who will manage and supervise this? Would it be better to assign this work to the project's DAO organization, using treasury and third-party supervision?)

(2) Several conditions must be met for future unlocks (this design addresses the ongoing work and later token liquidity management after the initial period; if managed by DAO, the effect would also be better.)

(3) The project team has the right to postpone or reduce the scale of each unlock. If they do not want to sell more, they do not have to. However, they can sell (unlock) a maximum of 5% each time, and then they must wait at least 6 months for the price to double again. (This design must involve a third-party institution like DAO to decide, changing the authority from the team to DAO. Since the project team is also an important member of the DAO, it should not produce excessive side effects.)

(4) The project team has no authority to shorten or increase the scale of the next unlock. Tokens should be locked by a smart contract controlled by a third party. This avoids new tokens flooding the market during price downturns and incentivizes the project team to engage in long-term development. (This design further emphasizes the need for a third-party institution, which would provide better controllability and manageability than a smart contract. In fact, CZ has subconsciously proposed the concept of DAO.)

Of course, this is just a case illustration. Real project governance encompasses many aspects, and I believe that as Web3 develops to this day, the implementation of such solutions will gradually improve and expand, continuously correcting issues and finding better specific methods in practice.

4.3. How to Achieve Long-term Project Development (Value Capture and Value Injection)

Without the cooperation of technological and application innovations, the various projects in the current industry relying on hype models cannot sustain for long. Ultimately, the issues of VC coins and meme coins will resurface. In fact, Pumpfun provides a reference framework; its explosion and subsequent decline were due to the lack of an important link: token empowerment (also known as value capture and value injection). As shown in the figure below:

Based on the above figure, we can see that after VC coins are listed on exchanges, the project teams receive substantial returns, which diminishes their motivation for further development. This is because later-stage development carries significant risks and lacks sufficient returns, making it easier to take a passive approach. However, some idealistic and capable teams will continue to build, but such teams are few. The memecoin model of Pumpfun itself lacks subsequent token empowerment, so everyone is just racing to run faster. Why can memecoins like Dogecoin continue to rise? I believe there are multiple reasons, which I will elaborate on in the future.

How can there be long-term value injection? What are the ways to empower?

Looking back at previous Web3 project cases, for example, how DeFi protocols capture value through liquidity mining, how NFT projects inject external value through royalty mechanisms, or how DAOs accumulate value through community contributions. As Web3 technology matures, more "application scenarios" will emerge, leading to an increasing number of value intersection points.

Value capture and external value injection are the two pillars of the Web3 economic model, with the former focusing on retention and the latter on introduction. More popular terms like "value accumulation" and "flywheel effect" better reflect the dynamic combination of the two, while "token empowerment" and "positive externalities" approach from a functional design perspective.

The core challenge lies in balancing short-term incentives with long-term value, avoiding the pitfalls of "paper models" and Ponzi schemes.

5. Analysis of the Previous Two Crypto Bull Markets and the Possibility of the Next Explosion

The previous content analyzed the issues surrounding VC coins and meme coins that are currently of concern in the industry. Will solving these problems drive the next bull market? Let's first review the two bull markets of 2017 and 2021.

Note: The following content is based on information gathered online, insights from discussions with DeepSeek and ChatGPT, as well as my personal experiences during the bull markets of 2017 and 2021. Additionally, our team is currently developing products related to the Bitcoin ecosystem, so I have included some of my own feelings and judgments in the article.

5.1. The ICO Craze of 2017

The bull market in the blockchain field in 2017 was the result of multiple factors working together, including technological breakthroughs, ecological development, and external environmental factors. According to professional analyses and classic literature in the industry, the reasons can be summarized as follows:

(1) The ICO (Initial Coin Offering) Boom

The ERC-20 standard of Ethereum lowered the threshold for issuing tokens, allowing a large number of projects to raise funds through ICOs (over $5 billion raised throughout the year).

(2) Bitcoin Forks and Scaling Controversies

Disagreements within the Bitcoin community over scaling solutions (SegWit vs. large blocks) led to forks. The Bitcoin Cash (BCH) fork in August 2017 sparked market attention on Bitcoin's scarcity and technological evolution. The price of BTC rose from $1,000 at the beginning of the year to a historical high of $19,783 in December.

(3) The Rise of Ethereum's Smart Contract Ecosystem

The maturity of smart contracts and DApp development tools attracted developers. The concept of decentralized finance (DeFi) began to take shape, with early DApps like CryptoKitties igniting user participation.

(4) Global Liquidity Easing and Regulatory Gaps

The global low-interest-rate policy in 2017 led funds to seek high-risk, high-return assets. Regulations on ICOs and cryptocurrencies were still underdeveloped in various countries, allowing speculative activities to flourish without constraints.

The 2017 bull market laid the infrastructure for the industry (such as wallets and exchanges), attracted technical talent, and brought in more new users, but it also exposed issues like ICO fraud and regulatory deficiencies, prompting the industry to shift towards compliance and technological innovation (such as DeFi and NFTs) after 2018.

5.2. The DeFi Summer of 2021

The bull market in the blockchain field in 2021 was the result of a resonance of multiple factors, including industry ecology, macroeconomics, technological innovation, and institutional participation. According to professional analyses and classic literature in the industry, the reasons can be summarized as follows:

(1) The Explosion and Maturity of DeFi (Decentralized Finance)

The maturity of Ethereum's smart contracts and the testing and launch of Layer 2 scaling solutions (such as Optimism and Arbitrum) reduced transaction costs and delays. This led to an explosion of applications: the total value locked (TVL) in DeFi protocols like Uniswap V3, Aave, and Compound increased from $1.8 billion at the beginning of the year to $25 billion by the end, attracting a large influx of funds and developers.

Yield Farming: High annual percentage yields (APY) attracted retail and institutional arbitrage funds. At that time, YF (yield finance, colloquially known as "Auntie") was once priced higher than BTC.

(2) The Breakthrough and Mainstreaming of NFTs (Non-Fungible Tokens)

Beeple's NFT artwork "Everydays: The First 5000 Days" sold for $69 million at Christie's auction. NFT projects like CryptoPunks and Bored Ape Yacht Club (BAYC) saw their market values exceed $10 billion. NFT trading platforms like Opensea emerged.

(3) Large-scale Institutional Capital Influx

Tesla announced the purchase of $1.5 billion in Bitcoin and began accepting BTC payments.

MicroStrategy continued to increase its Bitcoin holdings (holding 124,000 BTC by the end of 2021).

Canada approved the first Bitcoin ETF (Purpose Bitcoin ETF, February 2021).

Coinbase went public on Nasdaq (valued at $86 billion).

(4) Global Macroeconomic and Monetary Policies

Liquidity Flood: The Federal Reserve maintained a zero-interest-rate and quantitative easing policy, leading to a surge of funds into high-risk assets.

Inflation Expectations: The U.S. CPI year-on-year increase exceeded 7%, with Bitcoin viewed by some investors as "digital gold" to hedge against inflation.

(5) Increased Acceptance in Mainstream Society

Expanded Payment Scenarios: PayPal supported users buying and selling cryptocurrencies, and Visa allowed settlements using USDC.

El Salvador designated Bitcoin as legal tender (September 2021).

Celebrity Effect: Public figures like Elon Musk and Snoop Dogg frequently mentioned cryptocurrencies and NFTs.

(6) Multi-chain Ecological Competition and Innovation

Emergence of New Public Chains: High-performance chains like Solana, Avalanche, and Polygon attracted users and developers due to low fees and high TPS.

Cross-chain Technology Breakthroughs: Cross-chain protocols from Cosmos and Polkadot promoted asset interoperability.

(7) Meme Coins and Community Culture

Phenomenal Projects: Dogecoin (DOGE) and Shiba Inu (SHIB) surged due to social media hype (DOGE's annual increase exceeded 12,000%).

Retail Frenzy: The Reddit forum WallStreetBets (WSB) and TikTok drove retail investors to enter the market.

Impact on Subsequent Markets

The 2021 bull market propelled the institutionalization, compliance, and technological diversification of cryptocurrencies, but it also exposed issues like DeFi hacking attacks and NFT bubbles. Subsequently, the industry's focus shifted towards:

Regulatory Compliance: The U.S. SEC strengthened scrutiny of stablecoins and tokenized securities.

Sustainable Development: Ethereum transitioned to PoS (merger plan), and Bitcoin mining explored clean energy.

Web3 Narrative: Concepts like the metaverse and DAOs (Decentralized Autonomous Organizations) became new focal points.

5.3. When Will the Next Bull Market Occur? 2025? What Will Be the Theme?

The following is a predictive analysis of potential driving factors for a bull market in the cryptocurrency market in 2025, combining current industry trends, technological innovations, and macroeconomic backgrounds. According to professional analyses and classic literature in the industry, the reasons can be summarized as follows:

(1) Large-scale Applications of Web3 and the Rise of User Sovereignty

Scenario Implementation: Decentralized social networks (such as Nostr and Lens Protocol), on-chain games (AAA-level GameFi), and decentralized identities (DID) become mainstream, disrupting traditional internet models of user data ownership and revenue distribution.

Key Events: Giants like Meta and Google integrate blockchain technology, enabling cross-platform migration of user data.

Related Technologies: Maturity of zero-knowledge proofs (ZKP) and fully homomorphic encryption (FHE) to ensure privacy and compliance.

(2) Deep Integration of AI and Blockchain

Decentralized AI Networks: Blockchain-based computing power markets (such as Render Network) and AI model training data rights (such as Ocean Protocol) address the monopoly issues of centralized AI.

Autonomous Agent Economy: AI-driven DAOs (such as AutoGPT) automatically execute on-chain transactions and governance, enhancing efficiency and creating new economic models.

(3) Global Central Bank Digital Currencies (CBDCs) and Stablecoin Interoperability

Policy Promotion: Major economies launch CBDCs (such as digital euro and digital dollar), forming a mixed payment network with compliant stablecoins (such as USDC and EUROe).

Cross-chain Settlement: The Bank for International Settlements (BIS) leads the establishment of CBDC interoperability protocols, with cryptocurrencies becoming key components of cross-border payment channels.

(4) Revival of the Bitcoin Ecosystem and Layer 2 Innovations

Bitcoin Layer 2 Explosion: The Lightning Network's capacity continues to reach new highs, and the emergence of the TaprootAssets protocol supports asset issuance on the Bitcoin chain, while the Stacks ecosystem introduces smart contract functionality.

Institutional Custody Upgrades: BlackRock and Fidelity launch Bitcoin ETF options and collateralized lending services, unlocking the financial instrument attributes of Bitcoin.

(5) Clear Regulatory Frameworks and Comprehensive Institutional Participation

Global Compliance: The U.S. and Europe pass regulations similar to the "Markets in Crypto-Assets" (MiCA) act, clarifying token classifications and exchange licensing systems.

Integration with Traditional Finance: JPMorgan and Goldman Sachs launch crypto derivatives and structured products, with pension funds allocating over 2% of their portfolios to cryptocurrencies.

(6) Geopolitical Conflicts and De-dollarization Narratives

Safe-Haven Demand: Geopolitical risks such as the Russia-Ukraine conflict and the Taiwan Strait situation escalate, making cryptocurrencies a neutral settlement tool.

Diversification of Reserve Assets: BRICS countries jointly issue blockchain-based trade settlement tokens, with some national bonds priced in Bitcoin.

(7) Meme Culture 3.0 and Community DAOization

Next Generation Meme Coins: Meme projects combining AI-generated content (AIGC) and dynamic NFTs (such as AI-driven "Immortal Dog" characters) allow communities to vote through DAOs to determine the direction of IP development.

Fan Economy Chain Reform: Top stars like Taylor Swift and BTS issue fan tokens, unlocking exclusive content and participating in revenue sharing.

Note: To avoid leaving out relevant possibilities, the above analysis retains a lot of information.

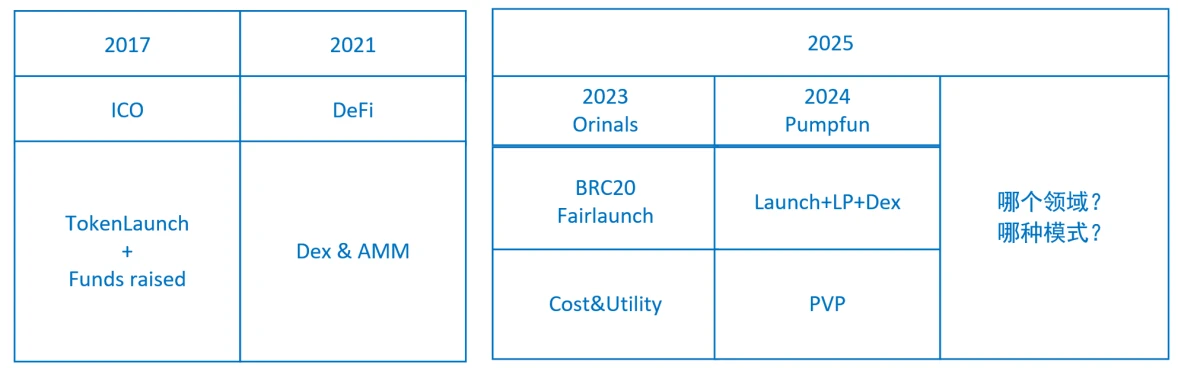

By summarizing the bull markets of 2017 and 2021, as well as analyzing the possibilities for 2025, we can make some judgments based on the figure below.

Regarding the Model:

The inscriptions of 2023 and the Pumpfun phenomenon of 2024 are signs that a bull market may erupt. If the issues with inscriptions and Pumpfun can be resolved, and a more complete model emerges, it could potentially trigger a bull market in certain areas. It is likely still related to asset issuance and asset trading.

Regarding the Fields:

There are roughly two fields that may emerge: (1) Pure Web3 field; (2) The combination of AI and Web3.

Specific Analysis:

For (1) the large-scale application of Web3 and the rise of user sovereignty, I personally judge that the infrastructure is still not mature enough, and the wealth effect is not strong enough, making it difficult to become the main factor or field of a bull market on its own, or it may not be the main factor of this bull market.

For (2) the deep integration of AI and Web3, the power of AI has been experienced by almost everyone. Will this field produce supporting factors for a bull market? It is indeed hard to judge… I personally lean towards it being a bit early. However, this field is hard to say; phenomena like DeepSeek and Manus that can rapidly explode are not entirely new in the AI field. How will DeFi empowered by AI perform?

For (4) the revival of the Bitcoin ecosystem and Layer 2 innovations, Bitcoin has shown good price performance in both the 2017 and 2021 bull markets. Currently, Bitcoin's market capitalization occupies 60% of the crypto market, and the wealth effect is strong enough. If there are good models and good technological implementations in this field, the probability of a bull market will be very high.

For (7) Meme Culture 3.0 and Community DAOization, if meme culture solves the PVP problem and has continuous external value injection, could it become a driving factor for a bull market? Judging from the wealth effect, it is quite difficult.

Other factors (3), (5), and (6) should accelerate changes and will play a supplementary role in the bull market, but they do not have strong enough direct factors to independently generate a bull market.

If 2025 is a bull market, it is most likely to be:

Bitcoin ecosystem and Layer 2 innovations, new models generated from new asset issuance and trading

The combination of AI and Web3, AI-enabled trading models

In addition to judgments about fields and models, the timing of the bull market's eruption will also depend on external environmental factors.

The above judgments are purely personal thoughts and do not constitute any investment advice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。