Source: Cointelegraph Original: "{title}"

Asset management company Bitwise announced on March 11 that it has launched an ETF that holds stocks of companies with significant Bitcoin (BTC) reserves.

Bitwise stated that the Bitwise Bitcoin Strategy Company ETF (OWNB) "aims to track the Bitwise Bitcoin Strategy Company Index, a new stock index that includes companies with at least 1,000 Bitcoins in their reserves."

This ETF is the latest in a series of new investment products designed to give investors the opportunity to invest in companies with substantial Bitcoin reserves.

Bitwise Chief Investment Officer Matt Hougan said in a statement, "Many people are wondering: why do companies buy and hold Bitcoin? The answer is simple: the reasons are exactly the same as for individuals holding Bitcoin."

"These companies view Bitcoin as a highly liquid and scarce strategic reserve asset, and it is not subject to arbitrary decisions or printing actions by any government."

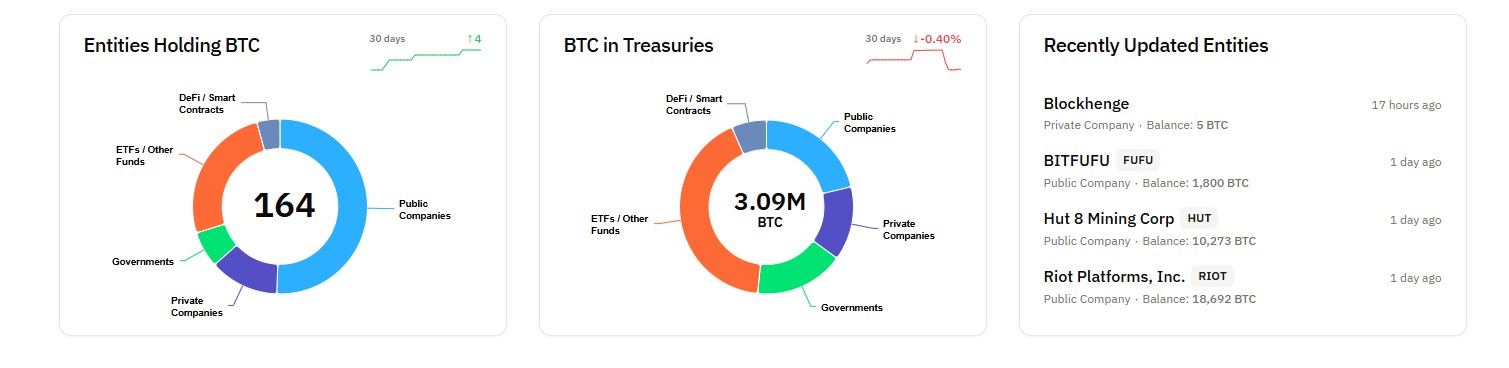

Public companies are among the largest institutional holders of Bitcoin. Source: BitcoinTreasuries.NET

Bitcoin Purchasing Company Index

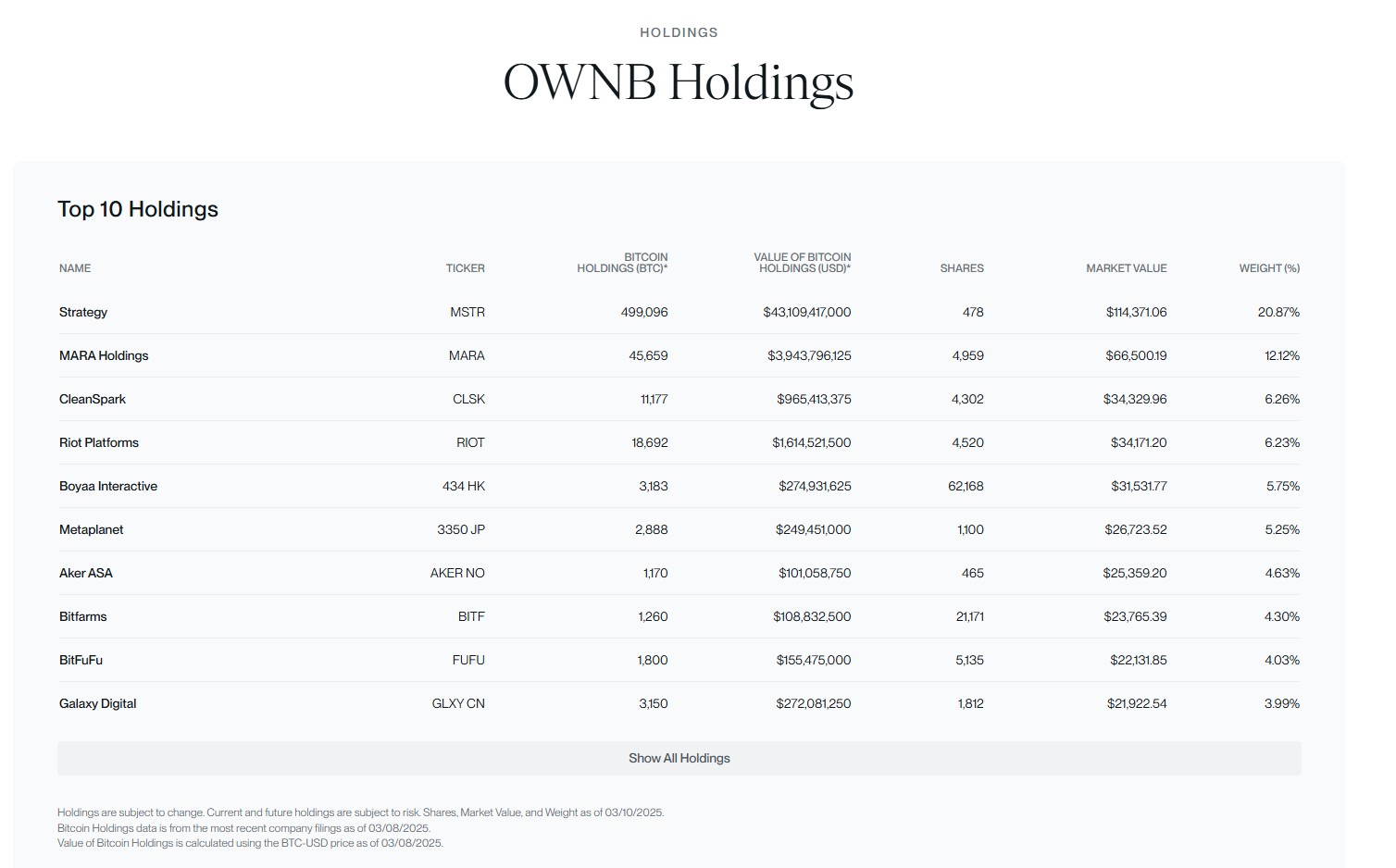

As of March 11, the ETF's largest holdings include Strategy (MSTR) — essentially Michael Saylor's Bitcoin fund — as well as Bitcoin mining companies like MARA Holdings (MARA), CleanSpark (CLSK), and Riot Platforms (RIOT).

It also includes stocks from companies such as gaming company Boyaa Interactive and investment management company Galaxy Digital (GLXY).

Bitwise stated that the index is weighted based on the amount of Bitcoin held, with a maximum holding cap of 20%.

Maximum holdings of OWNB. Source: Bitwise

Rise of Corporate Bitcoin Reserves

According to FinanceCharts, the rise in Bitcoin prices in 2024 has caused Strategy's stock price to soar over 350%. This move has prompted dozens of other companies to begin accumulating Bitcoin reserves. According to BitcoinTreasuries.NET, as of March 11, corporate holdings of Bitcoin are valued at over $54 billion.

Data shows that Strategy remains the largest corporate Bitcoin holder, with Bitcoin reserves valued at over $41 billion.

Even the U.S. government has created a strategic Bitcoin reserve, initially consisting solely of Bitcoins seized by law enforcement.

Other asset management companies are also launching investment products similar to Bitwise. In December of last year, asset management company Strive, founded by former U.S. presidential candidate Vivek Ramaswamy, applied to U.S. regulators for permission to launch an ETF that invests in convertible bonds issued by Strategy and other corporate Bitcoin purchasers.

According to the submitted documents, this ETF aims to give investors the opportunity to invest in "Bitcoin bonds," which are described as "convertible securities" issued by companies that plan to "use all or a significant portion of the raised funds to purchase Bitcoin."

Asset management company REX Shares also announced on March 10 that it is preparing to launch a Bitcoin corporate reserve ETF.

Related: Bitwise applies to launch a spot Aptos ETF — the 36th largest cryptocurrency by market capitalization.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。