A few days ago, the first White House cryptocurrency summit concluded, and its impact is just beginning…

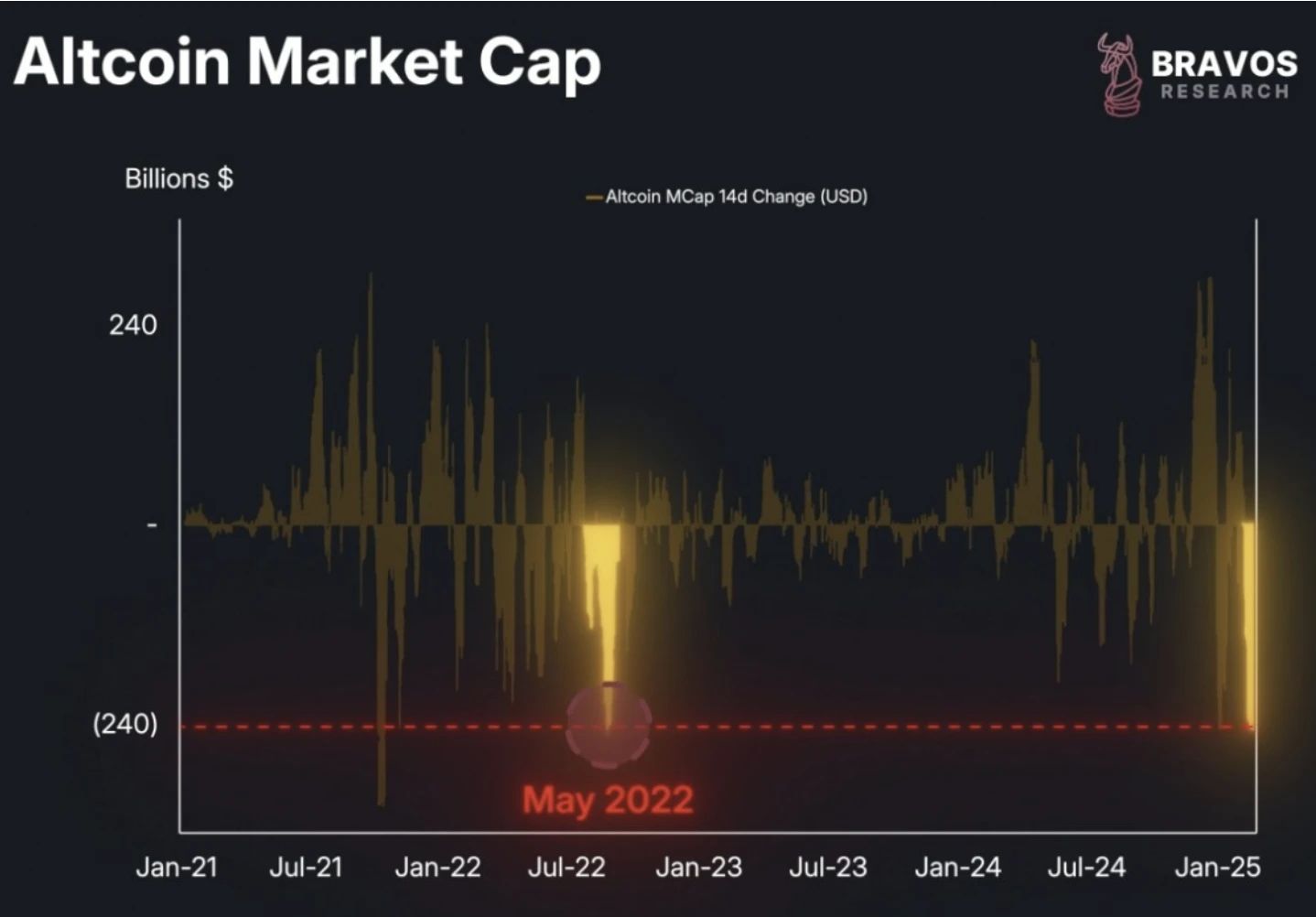

The price of BTC has fallen below $80,000. The crypto market is facing the largest liquidation since the LUNA collapse. Investors' sensitivity to risk has significantly increased, with funds accelerating towards projects that have anti-dip properties. Meanwhile, investors are scrutinizing token economic models more rigorously, raising a key question: Is there a token model that can withstand market fluctuations and traverse bull and bear cycles?

Source: Bravos Research

The Temptation and Cost of Inflation

Most tokens choosing an inflation model do so for a reason. By increasing supply, they reward developers, the community, and early investors, thus quickly launching the ecosystem. However, when market sentiment is low, the expansion of circulation combined with shrinking demand can easily lead to a downward price spiral. Ethereum is a typical example. Its early design did not set a total supply, leading to long-term inflation issues and causing user anxiety. It wasn't until the EIP-1559 proposal introduced a burning mechanism that selling pressure was effectively alleviated, which had a profound impact on Ethereum's economic model and market performance.

But the question is: If inflation is the fuel for launching an ecosystem, can deflation become the brake against cycles?

The Logic of Deflationary Scarcity

In stark contrast to Ethereum's struggles is Bitcoin's four-year halving cycle. After each halving, the rate of new coin production is halved, and scarcity drives the price into an upward channel—this mechanism allows Bitcoin to maintain its deflationary property through multiple bear markets, becoming the only "digital gold" that transcends cycles in the crypto market.

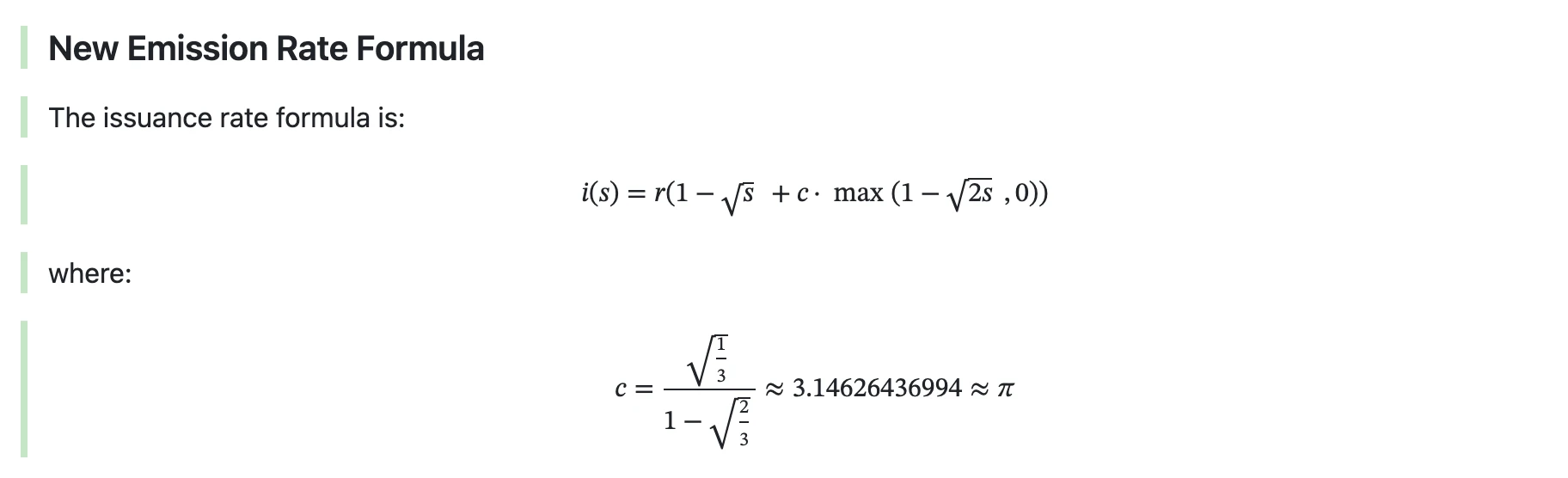

This logic is being emulated by more projects. For example, the Solana ecosystem, which has gained popularity in this cycle, is attempting to balance ecological incentives and value storage through the dynamic adjustment of inflation rates in the proposal for SIMD-0228. This proposal, put forward by Tushar Jain of Multicoin Capital and others, has a core mechanism: when the staking rate of SOL exceeds 50%, the issuance is reduced to curb inflation; when it is below 50%, issuance is increased to incentivize staking. This "elastic inflation" design reveals a key principle—deflation is not a complete denial of inflation but a balancing tool in a dynamic game with it.

Source: SIMD-0228 Proposal

Even during market downturns, the number of token holders for many projects has not decreased but rather increased, perhaps this is the most effective proof of the deflationary token model in facing downward trends.

The Triple Value of Deflationary Mechanisms

In the current counter-cyclical environment, the value of deflationary mechanisms is becoming increasingly prominent, with breakthroughs occurring on three levels:

First, scarcity premium. When the growth rate of circulation is lower than the growth rate of demand, the value of the token naturally rises.

Second, anti-inflation properties. In the context of fiat currency over-issuance and regulatory shocks, deflationary tokens become a safe haven for funds.

Finally, strengthening community consensus. Transparent burning actions directed at the community convey the project party's long-term commitment, attracting value investors rather than short-term speculators.

However, to realize these values, specific tools are needed for support. Current mainstream deflationary mechanisms include:

Token burning: This involves transferring a portion of circulating tokens to a black hole address, such as BONK's daily on-chain burn.

Staking lock-up: This incentivizes long-term holding through rewards, such as Solana's dynamic adjustment mechanism in the SIMD-0228 proposal.

Ecosystem consumption: This uses tokens as gas fees or collateral, forming a positive cycle of use and destruction.

Micro Samples of Deflationary Design

$BONK has performed relatively stably in this round of wild market fluctuations. My research found that it possesses a multi-layered deflationary model. The core of this model is a transparent on-chain burning mechanism, including automatic destruction during ecological interactions and event-driven large-scale burns, continuously reducing its circulation in the turbulent market, achieving a deflationary economy. To some extent, it has realized "rising with the market, not falling with it."

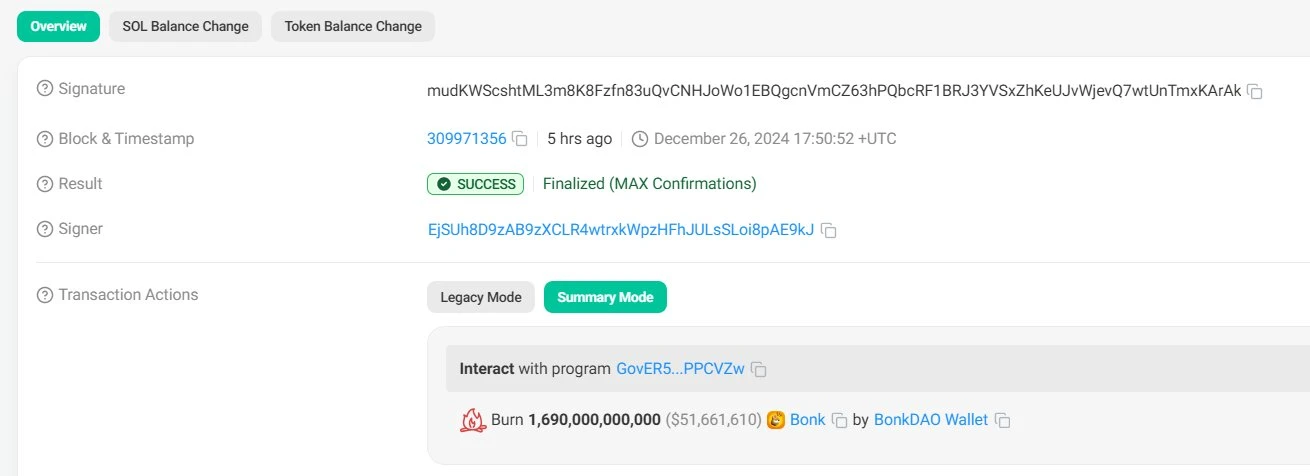

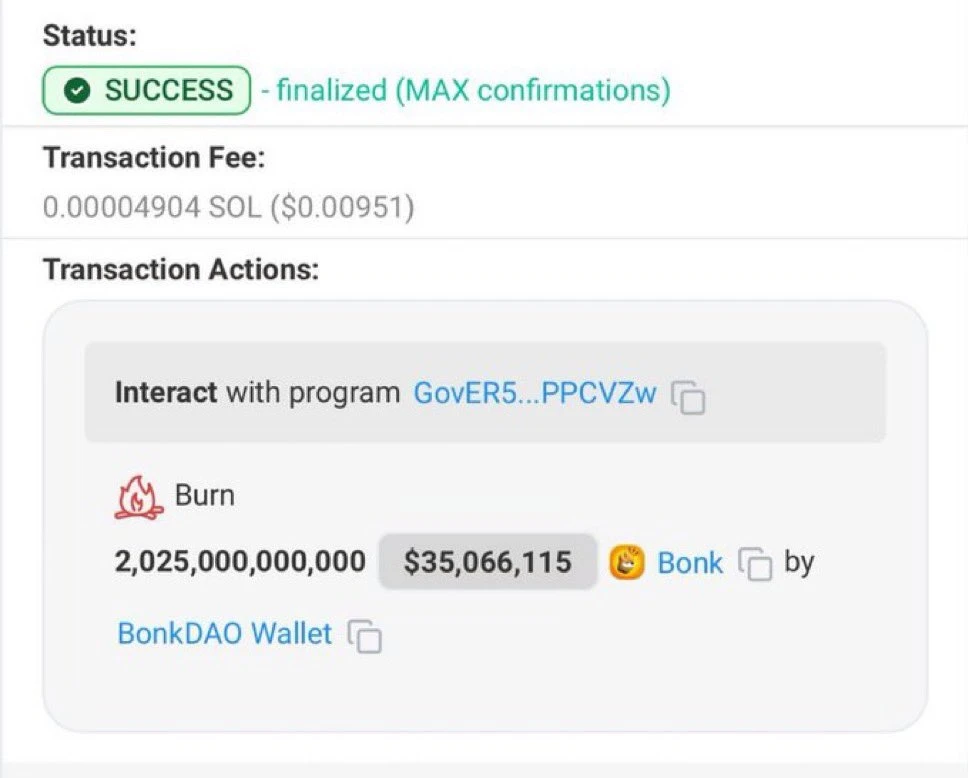

The daily burning mechanism is integrated into all of Bonk's ecological applications, with the amount of destruction continuously increasing. Additionally, the BONK community regularly initiates event-driven large-scale burning activities, such as last December's "BURNmas" plan, which burned 16.9 trillion BONK (approximately $54.52 million), accounting for nearly 1.8% of the total supply of BONK (approximately 92.7 trillion). In February of this year, another 20.25 trillion BONK (approximately $36.96 million) was burned. These burning measures not only enhance investor confidence but also provide price support by reducing selling pressure.

Source: Solscan

These measures produce a triple effect:

First is the reconstruction of scarcity. As the supply of tokens in circulation decreases, the recognition of their value increases, which may exert upward pressure on the token's price.

Second is the establishment of community trust: Burning tokens also sends a positive signal to the community. It indicates that project governance is committed to the long-term growth and sustainability of the token, allowing the community to see a "real monetary" commitment.

Third is the potential for exponential growth: The price stagnation caused by continuous burning creates greater growth potential for the token. For traders seeking high-risk investments with high return potential, this is an attractive point.

In a highly volatile market environment, the value of token economics is gradually beginning to emerge; it is no longer an abstract formula in a white paper but a survival skill that determines the life and death of a project. Using burning to combat inflation, when SOL balances staking and scarcity through the SIMD proposal, we see that deflationary mechanisms are shifting from optional strategies to essential survival needs. In some moments of the crypto market, the design of token economic models can determine survival more than marketing narratives.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。