Source: Cointelegraph Original: "{title}"

According to a filing dated March 11, the Chicago Board Options Exchange BZX (Cboe BZX) is seeking approval from U.S. regulators to incorporate staking features into Fidelity's Ethereum ETF.

This filing marks Cboe's latest attempt to provide staking support for its Ethereum (ETH) fund traded on U.S. exchanges.

The filing states that the proposed rule change by Cboe would allow the Fidelity Ethereum Fund (FETH) to "stake all or a portion of the Ethereum held in the trust through one or more trusted staking service providers, or facilitate its staking."

According to VettaFi data, the Fidelity Ethereum Fund is one of the most popular Ethereum ETFs, managing nearly $1 billion in assets.

In February of this year, Cboe applied for permission to add staking features to another Ethereum ETF—the 21Shares Core Ethereum ETF.

Staking Ethereum can enhance returns by providing Ethereum as collateral to validators in exchange for rewards.

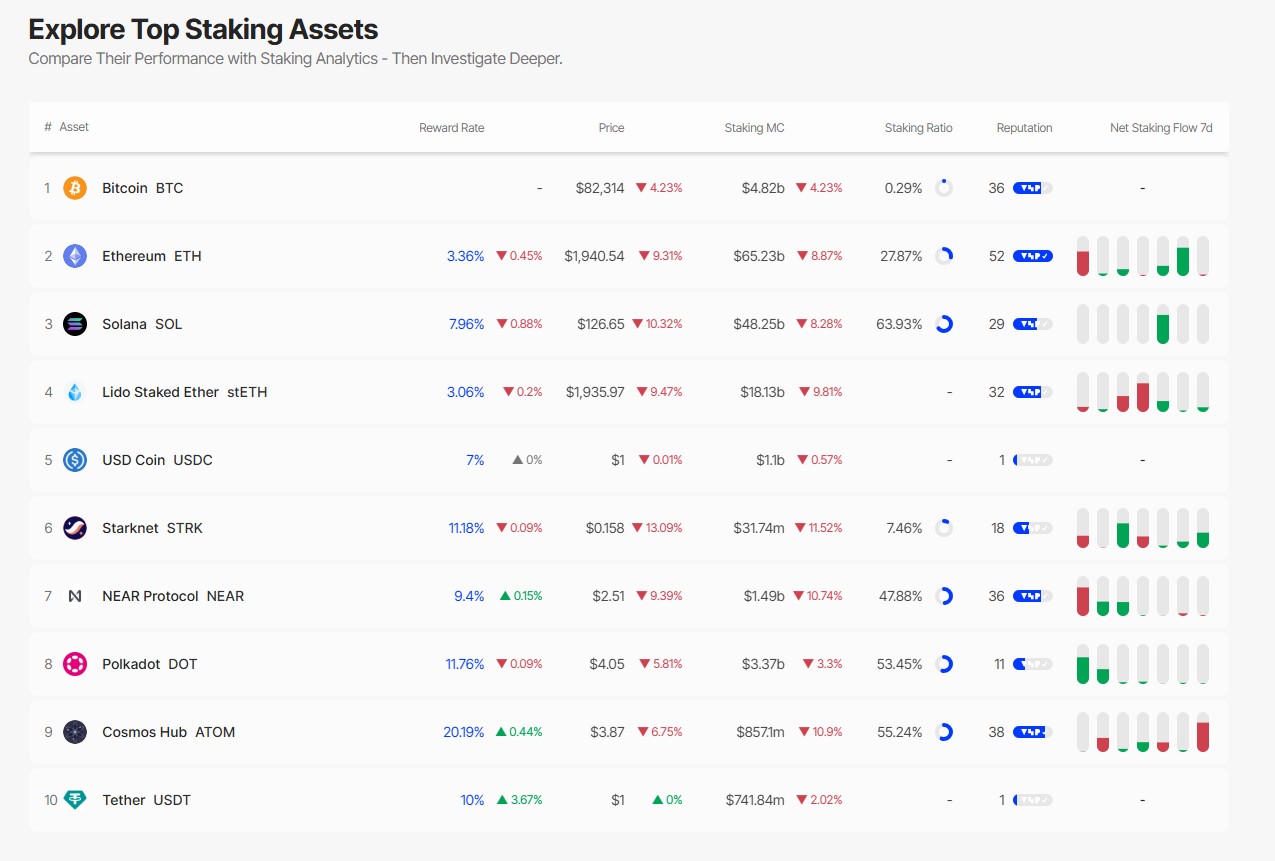

According to Staking Rewards, as of March 11, the annualized yield for staking Ethereum is approximately 3.3%.

Other popular cryptocurrencies, including Solana (SOL), also have staking mechanisms.

Staking rewards by asset type. Source: Staking Rewards

Proposed Rule Changes

The staking feature cannot be initiated until the U.S. Securities and Exchange Commission (SEC) approves Cboe's proposed rule changes.

According to records, in February, the SEC confirmed receipt of over a dozen exchange filings related to cryptocurrency ETFs.

This confirmation from the SEC highlights a softening of the agency's stance on cryptocurrencies since U.S. President Trump began his second term on January 20.

In addition to staking, these filings submitted by Cboe and other exchanges also involve proposed rule changes regarding options, physical redemption, and new altcoin funds.

Cboe has also applied for permission to list the proposed Ripple (XRP) ETFs from Canary and WisdomTree, and to provide physical creation and redemption support for Fidelity's Bitcoin and Ethereum ETFs, along with other proposed changes.

Related: Farside data indicates that U.S. Bitcoin reserves triggered a $370 million ETF outflow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。