Recent market volatility presents ongoing mining opportunities.

Recently, Bitcoin's price has fluctuated between 80,000 and 90,000. Every statement or action from Trump has significantly influenced market trends. Recently, Trump officially signed the U.S. Bitcoin Strategic Reserve, which logically should lead to a wave of bullish expectations. However, Bitcoin quickly dropped by 3% in a short time. The reason is that the U.S. is listing previously seized Bitcoin as reserves rather than purchasing Bitcoin on the secondary market, which did not align with market expectations. The strong discrepancy, combined with the exhaustion of positive news, led to a market collapse that could not be predicted by any indicators or K-line technical analysis.

The future market is difficult to predict, whether in secondary market trading or primary market new listings. The current stage faces hellish difficulty, and perhaps simply mining is a good choice. There are still stablecoin yield opportunities of over 10% in the current market, so let WOO X Research show you what opportunities are available. (Not financial advice, users should conduct their own research)

Ethena USD Yield

This pool generates yield from staked USDe, supported by a delta-neutral position that balances a basket of staked ETH derivatives and ETH shorts on centralized exchanges. The yield is achieved by combining native ETH staking rewards and the positive financing rate paid to shorts.

Project introduction:

- Ethena: A synthetic dollar protocol based on Ethereum. It offers USDe and sUSDe. Ethena's synthetic dollar USDe delta hedges against Bitcoin, Ethereum, and Solana spot assets using perpetual deliverable futures contracts. Staking USDe can earn sUSDe.

Yield source: Users stake USDe, with an exit period of T+7, and an annualized interest rate of 10.69% (continuously changing, yield is sUSDe, compounded weekly).

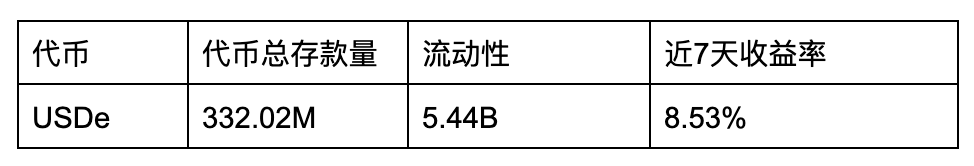

Current data situation:

Data source:

MEV Capital Usual USDC

The Morpho Vaults on Ethereum that stake USDC, supported by MEV Capital, are a collaborative product of Morpho and Usual, thus providing additional incentives from Usual.

Project introduction:

Morpho: A lending protocol. The platform has various asset-combined Vaults, each with its own manager and customizable lending requirements (such as lock-up time, management fees, rewards, etc.).

MEV Capital introduction: An institutional digital asset management company focused on DeFi.

Usual introduction: A stablecoin protocol that launched USD, a stablecoin backed 1:1 by RWA. USUAL is its governance token, which also includes two products: USD0 and USD0++. Pill is a point system that users earn through various activities within the Usual protocol, with points related to the share of USUAL airdrops.

USD0: USD0 is a stablecoin pegged 1:1 to the dollar, supported by various bonds (such as short-term government bonds).

USD0++: A liquid staking token that locks USD0 as principal, using USUAL and USD0 as incentives. During the lock-up period, the locked funds will be used to invest in government bond products.

Yield source: Users stake USDC, with an exit period of T+3, and an annualized interest rate of 9.18% (continuously changing, yield is USDC + MORPHO + points).

【8.61% (native yield) + 1.42% (platform reward yield MORPHO) - 0.86% (performance fee 10%) + Resolv points x 1 time】

Note: The performance fee for this product is 10%.

Regarding the performance fee of Morpho Vaults: The Morpho Vaults protocol itself has no governance, but individual Vaults are managed by the corresponding smart contract owner (who can also designate managers, guardians, and allocators to help manage the Vault). The owner can set performance fees for their corresponding Morpho Vault (as governance, operational, etc. fees), calculated as a percentage of the interest generated by the Vault. (The maximum performance fee can be set at 50%.)

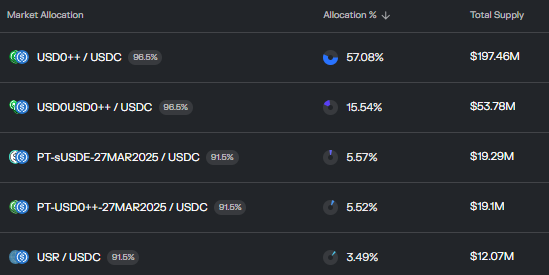

Market configuration situation:

Source: https://app.morpho.org/ethereum/vault/0xd63070114470f685b75B74D60EEc7c1113d33a3D/mev-capital-usual-usdc

Risk: Due to the large proportion of USD0++/USDC in its market configuration. Note: After the new exchange rate mechanism for USD0++/USD0 appears in January 2025, a large outflow of USD0 withdrawals may lead to an imbalance in the USD0++/USD0 pool on Curve (the main source of USD0 liquidity in the market), breaking the 1:1 peg and dropping to a low of $0.90 within a few hours. Subsequently, MEV Capital deployed USD0++ naked vaults, allowing borrowers to adjust and transfer positions without repaying debts, significantly reducing borrowing rates and the associated costs of holding positions. Additionally, the fees charged by curators (performance fees) were suspended.

The main market supply for this product is USD0++/USDC and USD0USD0++/USDC. Given the previous imbalance, investors should assess the risk situation when investing in this product.

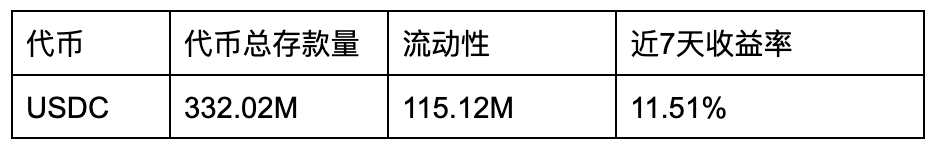

Current data situation:

Data source: https://app.morpho.org/ethereum/vault/0xd63070114470f685b75B74D60EEc7c1113d33a3D/mev-capital-usual-usdc

Smokehouse USDC

Via Morpho, supported by Steakhouse Financial.

Project introduction:

- Steakhouse Financial introduction: Provides financial reporting and analysis for DAOs (MakerDAO, LidoDAO, ENS) and crypto enterprises. Acts as a strategic advisor for Morpho and operates Morpho Vaults that include real-world assets (RWA).

Yield source: Users stake USDC, with an exit period of T+3, and an annualized interest rate of 8.75% (continuously changing, yield is USDC + MORPHO + Points (Resolv) x 1).

【7.70% (native yield) + 1.40% (platform reward yield MORPHO) - 0.38% (performance fee 5%) + Resolv points x 1 time】

Note: The performance fee for this product is 5%. The explanation regarding the performance fee of Morpho Vaults has been mentioned above and will not be repeated.

Current product data situation:

Data source: https://app.morpho.org/ethereum/vault/0xBEeFFF209270748ddd194831b3fa287a5386f5bC/smokehouse-usdc

Supercharger USDT

WOOFi collaborates with Mantle to provide returns. This strategy lends assets to WOOFi sPMMLP based on interest rates.

Project introduction:

Mantle: A high-performance Ethereum Layer 2 network, a product of BitDAO, managed by the $BIT community.

WOOFi: A cross-chain decentralized exchange in the WOO ecosystem, supporting token trading, staking, and swaps.

Yield source: Users stake USDT and can receive weUSDT (as proof). Staking weUSDT can earn WOO and WMNT rewards. Instant withdrawals are available (10% of Vault TVL can be used for instant withdrawals, with a fee of 1%, and the limit for instant withdrawals resets every Monday).

The annualized interest rate is 18.63% (continuously changing, yield is USDT + WMNT).

【0.45% (native yield) + 18.17% (platform reward yield WMNT)】

Additionally, as part of the collaboration, participants can share in the corresponding proportion of MNT, and users depositing in WOOFi can participate in a lottery for MNT (worth $5,000).

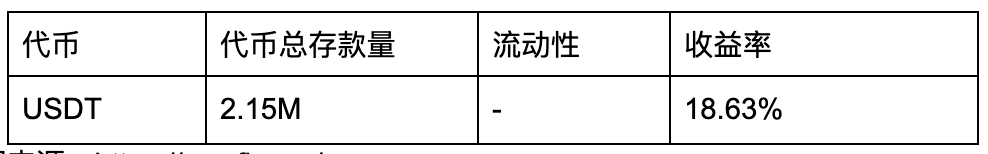

Current product data situation:

Data source: https://woofi.com/earn

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。